Reconciling to Banner September 26, 2013

advertisement

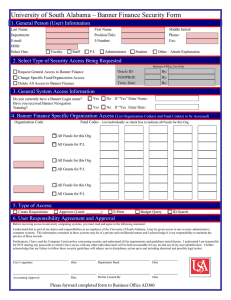

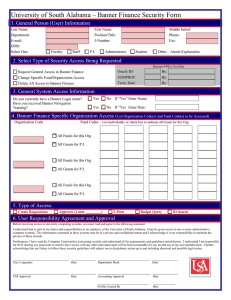

Reconciling to Banner September 26, 2013 Reconciliation Purpose Ensure proper accounting records are maintained Confirm correct accounting transactions were posted to your account Verify accuracy of amounts paid Identify outstanding transactions (encumbrances pending to liquidation) Obtain accurate account status What is a Reconciliation? Match two sets of records to ensure figures are in agreement Example: Match your records of requisitions prepared to the expense and encumbrance transactions posted to the Banner system Identify differences between the two sets of records. Reasons for difference might be: Posting errors Valid changes to the original amount requested Timing differences which will clear with time Reconciliation Benefits Discover erroneous transactions Provide reliable status of your budget Allow better decision making May increase an organization’s available budget by clearing outstanding transactions Banner Transactions Types On Banner, the Field column on FGITRND can help you determine the type of transaction OBD – Budget transaction RSV – Encumbrance transaction from a Requisition ENC – Encumbrance transaction from a Purchase Order YTD – Expense transaction from an Invoice, Journal Entry or Feeds from other Banner systems (Student, Human Resources) “I” documents are Invoices “J” documents are Journal Entries “F” documents are Feed transactions Tracking Encumbrances All encumbrances should eventually clear when payment (invoice) is made. On Banner, form FGIOENC provides you a list of all open encumbrances for an organization. If you identify an encumbrance that should not be open, you need to contact the Purchasing department to request the drop of the Encumbrance How to Get Started? 1. Obtain access to your department’s organizations a. Download Banner Finance Access Request Form from Business Office website (http://www.southtexascollege.edu/businessof fice/index.html) How to Get Started? 2. Become familiar with useful forms in Banner a. b. c. d. e. FGIBDST – Summary of total adjusted budget, expenses, commitments and available balances by account code FGITRND – Detail transactions FGIOENC – List of open encumbrances FGIENCD – Detail of transactions posted against an encumbrance (original encumbrance, adjustments, payments) FOIDOCH – Document history and detail of all documents associated to a specified document Who to contact with Questions? On Encumbrances (Requisitions or Purchase Orders)- Purchasing department (872-4681) On Payments (Invoices) – Accounts Payable department (872-4609) On Journal Entries – General Accounting department (872-4638 or 872-4650) Exercise – Step #1 Update "Department Expense Log" with Purchase Order and Invoice document number if available. Banner form FOIDOCH allows you to find all document history related to a document requested. For example, if you enter a requisition number and click on next block, the form will display all the POs and Invoices issued for the Requisition entered. South Texas College Department Expense Log Step #1 Organization: 123456 STC Orgn Name Operating Vendor Purchase Order Supplies A00004444 P0000003 09/15/07 Computers A00001234 P0000005 I0000009 R0000010 09/18/07 Printers A00058946 4 R0000012 09/30/07 Journal Subscription A00002255 P0000011 125.00 5 R0000014 10/04/07 Equipment rental A00008958 P0000022 55.00 6 R0000022 10/13/07 Temporary staff A00055889 P0000025 I0000053 7 R0000025 10/22/07 Advertising at The Monitor A00001146 P0000035 8 R0000028 11/02/07 Sprint PCS charges A00002540 P0000018 I0000012 84.00 9 R0000033 11/15/07 Books A00001308 P0000044 I0000025 323.00 Requisition # Date 1 R0000001 09/05/07 2 R0000005 3 Description Invoice Original Amount 500.00 1,525.00 633.00 899.00 62.00 Adjustment Revised Amount Exercise – Step #2 Identify changes to amount on original requisition and update "Department Expense Log" with necessary changes. Note: Items identified as corrections needed on the "Department Expense Log" will be updated on this worksheet. Items identified as corrections needed to be made on the Banner system (such as Requisitions or POs that need to be dropped) will be identified on the Reconciling Items section of the "Reconciliation Worksheet". South Texas College Step #2 Department Expense Log Organization: 123456 STC Orgn Name Operating Description Vendor Purchase Order Invoice Original Amount Date 1 R0000001 09/05/07 Supplies A00004444 P0000003 2 R0000005 09/15/07 Computers A00001234 3 R0000010 09/18/07 Printers A00058946 633.00 633.00 4 R0000012 09/30/07 Journal Subscription A00002255 P0000011 125.00 125.00 5 R0000014 10/04/07 Equipment rental A00008958 P0000022 55.00 6 R0000022 10/13/07 Temporary staff A00055889 7 R0000025 10/22/07 Advertising at The Monitor 8 R0000028 11/02/07 9 R0000033 11/15/07 P0000005 I0000009 P0000025 I0000053 Adjustment Revised Amount Requisition # 500.00 (50.00) 450.00 1,525.00 25.00 1,550.00 10.00 65.00 899.00 899.00 A00001146 P0000035 62.00 62.00 Sprint PCS charges A00002540 P0000018 I0000012 84.00 84.00 Books A00001308 P0000044 I0000025 323.00 323.00 Exercise – Step #3 Make sure totals on "Department Expense Log" are updated. South Texas College Department Expense Log Organization: 123456 STC Orgn Name Operating Vendor Purchase Order Supplies A00004444 P0000003 09/15/07 Computers A00001234 P0000005 I0000009 R0000010 09/18/07 Printers A00058946 4 R0000012 09/30/07 Journal Subscription A00002255 5 R0000014 10/04/07 Equipment rental 6 R0000022 10/13/07 7 R0000025 8 9 Requisition # Date 1 R0000001 09/05/07 2 R0000005 3 Description Invoice Original Amount Adjustment Revised Amount 500.00 (50.00) 450.00 1,525.00 25.00 1,550.00 633.00 633.00 P0000011 125.00 125.00 A00008958 P0000022 55.00 Temporary staff A00055889 P0000025 I0000053 10/22/07 Advertising at The Monitor A00001146 P0000035 R0000028 11/02/07 Sprint PCS charges A00002540 P0000018 R0000033 11/15/07 Books A00001308 10.00 65.00 899.00 899.00 62.00 62.00 I0000012 84.00 84.00 P0000044 I0000025 323.00 323.00 10 - Total for all Requisitions 4,206.00 Step #3 (15.00) 4,191.00 Exercise – Step #4 On "Reconciliation Worksheet", update Banner Totals with transactions downloaded from FGITRND Adjusted Budget – total for transactions where field is OBD YTD Activity – total for transactions where field is YTD Commitments – total for transactions where field is ENC and RSV Available Balance – will be calculated as follows Adjusted Budget - YTD Activity - Commitments South Texas College Step #4 Reconciliation Worksheet Organization: 123456 STC Orgn Name Operating Banner FGITRND Data Extract Banner Totals Adjusted Budget (Field = OBD) YTD Activity (Field = YTD) 10,000.00 2,833.00 Commitments (Field = RSV & ENC) Department Expense Log Revised Amount Total for all Requisitions Available Balance as per Department Expense Log Difference 1,567.00 Available Balance 5,600.00 Exercise – Step #5 On "Reconciliation Worksheet", update Revised Amount Total for all Requisitions from "Department Expense Log" worksheet. The amount for Available Balance as per Department Expense Log is calculated as follows: Available Balance as per Department Expense Log = Adjusted Budget total from Banner - Revised Amount Total for all Requisitions South Texas College Reconciliation Worksheet Step #5 Organization: 123456 STC Orgn Name Operating Banner FGITRND Data Extract Adjusted Budget Banner Totals 10,000.00 YTD Activity Commitments 2,833.00 1,567.00 Available Balance 5,600.00 Department Expense Log Difference Revised Amount Total for all Requisitions 4,191.00 Available Balance as per Department Expense Log 5,809.00 Exercise – Step #6 The Difference amount should be automatically updated once all the previous figures are updated. It is calculated as follows: Difference = Banner Total Available Balance - Available Balance as per Department Expense Log South Texas College Reconciliation Worksheet Organization: 123456 STC Orgn Name Operating Banner FGITRND Data Extract Adjusted Budget Banner Totals 10,000.00 YTD Activity Commitments 2,833.00 1,567.00 Available Balance 5,600.00 Department Expense Log Revised Amount Total for all Requisitions 4,191.00 Available Balance as per Department Expense Log 5,809.00 Difference (209.00) Step #6 Exercise – Step #7 List all the items identified as corrections needed to be made on the Banner system on the Reconciling Items section of the "Reconciliation Worksheet". You can use the data extracted from FGITRND to compare documents to the Department Expense Log to identify discrepancies South Texas College Reconciliation Worksheet Organization: 123456 STC Orgn Name Operating Banner FGITRND Data Extract Adjusted Budget (Field = OBD) Banner Totals 10,000.00 YTD Activity (Field = YTD) Commitments (Field = RSV & ENC) 2,833.00 1,567.00 Available Balance 5,600.00 Department Expense Log Revised Amount Total for all Requisitions 4,191.00 Available Balance as per Department Expense Log 5,809.00 Difference (209.00) Step #7 Reconciling Items (Corrections needed to be made on the Banner system) Document # Action Needed Original Amt Revised Amt R0000012 Drop Requisition (125.00) 125.00 P0000018 Drop PO (84.00) 84.00 Total Reconciling Items 209.00 Exercise – Step #8 Once all the Reconciling Items are identified the Reconciled Difference should be zero. You can use the data extracted from FGITRND to compare documents to the Department Expense Log to identify discrepancies South Texas College Reconciliation Worksheet Organization: 123456 STC Orgn Name Operating Banner FGITRND Data Extract Banner Totals Adjusted Budget (Field = OBD) YTD Activity (Field = YTD) 10,000.00 2,833.00 Commitments (Field = RSV & ENC) 1,567.00 Available Balance 5,600.00 Department Expense Log Revised Amount Total for all Requisitions 4,191.00 Available Balance as per Department Expense Log 5,809.00 Difference (209.00) Reconciling Items (Corrections needed to be made on the Banner system) Document # Action Needed R0000012 Drop Requisition (125.00) 125.00 P0000018 Drop PO (84.00) 84.00 - Step #8 Original Amt Revised Amt Total Reconciling Items Reconciled Difference 209.00 - Questions?