F I S C

advertisement

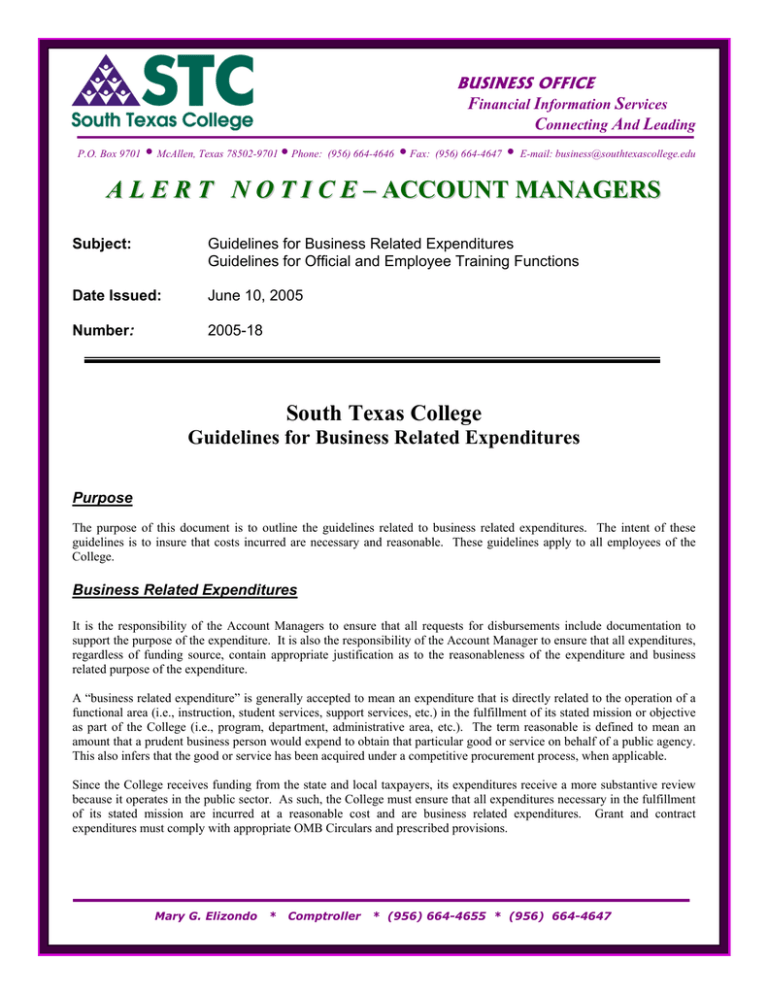

BUSINESS OFFICE Financial Information Services Connecting And Leading P.O. Box 9701 McAllen, Texas 78502-9701 Phone: (956) 664-4646 Fax: (956) 664-4647 E-mail: business@southtexascollege.edu A L E R T N O T I C E – ACCOUNT MANAGERS Subject: Guidelines for Business Related Expenditures Guidelines for Official and Employee Training Functions Date Issued: June 10, 2005 Number: 2005-18 South Texas College Guidelines for Business Related Expenditures Purpose The purpose of this document is to outline the guidelines related to business related expenditures. The intent of these guidelines is to insure that costs incurred are necessary and reasonable. These guidelines apply to all employees of the College. Business Related Expenditures It is the responsibility of the Account Managers to ensure that all requests for disbursements include documentation to support the purpose of the expenditure. It is also the responsibility of the Account Manager to ensure that all expenditures, regardless of funding source, contain appropriate justification as to the reasonableness of the expenditure and business related purpose of the expenditure. A “business related expenditure” is generally accepted to mean an expenditure that is directly related to the operation of a functional area (i.e., instruction, student services, support services, etc.) in the fulfillment of its stated mission or objective as part of the College (i.e., program, department, administrative area, etc.). The term reasonable is defined to mean an amount that a prudent business person would expend to obtain that particular good or service on behalf of a public agency. This also infers that the good or service has been acquired under a competitive procurement process, when applicable. Since the College receives funding from the state and local taxpayers, its expenditures receive a more substantive review because it operates in the public sector. As such, the College must ensure that all expenditures necessary in the fulfillment of its stated mission are incurred at a reasonable cost and are business related expenditures. Grant and contract expenditures must comply with appropriate OMB Circulars and prescribed provisions. Mary G. Elizondo * Comptroller * (956) 664-4655 * (956) 664-4647 Alert Notice 2005-18 Guidelines for Business Related Expenditures Guidelines for Official and Employee Training Functions Examples of allowable business related expenditures are: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Purchase of equipment and supplies for office use. Memberships in professional organizations when the membership will result in a direct benefit to the institution. Retirement receptions after length of service at STC of five years or more (auxiliary funds only). Receptions, entertainment, coffee with a clearly defined business purpose (auxiliary funds only). Dedications and College sponsored events. Athletic events and cultural events are included only when a clear business can be established, such as fund raising or entertainments of guests of the College. Office plants (live or artificial) when they aid in the professional appearance of the office or building and must be located in common/public areas. Subscription to news journals, periodicals and magazines where such subscription is necessary to fulfill ones professional responsibility and must be mailed to a STC office. Funeral attendance travel expenses for one employee selected by the President or designee. Flowers for either bereavement or College sponsored events, such as dedications. The purchase of flowers requires President’s or Vice President’s approval, the occasion indicated, the recipient identified and the business purpose clearly stated (auxiliary funds only). Bottled water dispenser (auxiliary funds only). Framed pictures when they aid in the professional appearance of the office or building and must be located in common/public areas. Examples of unallowable expenditures are: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. Interest on personal credit cards. Gifts, flowers and balloons (Christmas, “Thank You”, birthday, baby shower, Secretary’s Day, Bosses Day, etc.) to College employees or outside individuals other than those given to retiring employees or certain employees leaving the College’s employment (exceptions include for marketing, public relations and employee appreciation or a clearly stated business purpose and requires President’s or Vice President’s approval and the use of auxiliary funds only). Memberships in social organizations (exception requires President’s approval and use of auxiliary funds only after the business purpose is clearly established and documented). Purchase of goods or services for non-College or personal use or for use of an organization other than the College. Cleaning of personal clothing worn on the job. Memberships in organizations when membership will not result in any direct benefit to the institution. Examples would include memberships in health clubs, gymnasiums, and social clubs. Donations or contributions to outside organizations. Picture framing for personal pictures that may hang in a College office, but are not considered STC property. Furniture that will not be retained by the College. Portraits of individuals whether retained by the College or not, unless prior approvals obtained from the President’s or the Vice President administratively responsible for the area. Registration for outside seminars, continuing education programs, and courses at other educational institutions if similar training opportunities are offered at STC. The payment of any type of employee subsidy (i.e., rent, parking, insurance, etc.). Motor vehicle moving violations and parking tickets. External personal legal services. Any expenditure that may constitute a violation of the College’s Purchasing Policy 5210, Purchasing Authority Policy No. 5200, or other administrative regulations. Purchase of alcoholic beverages. Office plants (live or artificial) for employee’s office. 2 Alert Notice 2005-18 Guidelines for Business Related Expenditures Guidelines for Official and Employee Training Functions Food Purchases With the exception of food supplies purchased for travel, educational or laboratory purposes, the only funds which may be expended for food and/or beverage shall be from Auxiliary Fund Accounts. Expenditure of these funds for such purposes must serve a legitimate public purpose or furthers the educational function of the College. The Purchase Requisition must indicate the time and place of the function and must identify the direct beneficiaries of the function and must be approved by an appropriate authorized Account Manager. Business Expenditures Related to Lodging Meals and Travel The College’s Travel Guide includes guidelines for business expenditures related to lodging, meals and travel. Tax Status STC is classified as a non-profit educational institution and, as such, is exempt from the Texas Sales & Use Tax. Authority to Requisition Account Managers are responsible to strictly adhere to their accounts’ budgets. Approving Purchase Requisitions is one method of monitoring the unit’s expenditures. The authority to approve requisitions and requests resides with the Account Manager. Accounting System Budget To successfully complete a purchase, the purchase must be charged to a budget with unencumbered funds available. Encumbrances An encumbrance is created when a Purchase Order is issued and remains in the department’s account until the payment is made to the vendor or the Purchase Order is canceled. The encumbrance system helps the Department in monitoring its budget. The encumbrance system ensures that the account being charged has sufficient funds budgeted to accommodate the purchase. Disencumbering Funds There may be instances when encumbrances are not relieved from an account due to an order being canceled. To request that an encumbrance be cleared, send a memo to the Accounts Payable Accountant explaining why the entire encumbrance should be removed. 3 Alert Notice 2005-18 Guidelines for Business Related Expenditures Guidelines for Official and Employee Training Functions South Texas College Guidelines for Official and Employee Training Functions Purpose The purpose of this document is to outline the procedures related to official and employee training functions. The intent of these guidelines is to insure that costs incurred are necessary and reasonable. These guidelines apply to all employees of the College. Definitions and Rule Official Function – A meeting, conference, meal, or other function, which is hosted by the President, or representative of the College, attended by guests and/or College employees, and held for official college business purposes. Training Function – A meeting, conference, or other function which is hosted by the College, attended by College employees, and held to enhance staff knowledge or to educate College employees, that are affected by the College’s operations or regulations. Training functions should have a written agenda, study materials, and be led by an identified presenter. College Funds – Any monies deposited with the College, which require disbursement by means of a College purchase requisition, but not including agency funds (0-9xxxx). Rule – Official functions and training functions shall be held to achieve College program objectives and shall be limited to reasonable and actual costs. The attendance of College employees at these functions shall include only those individuals directly related to the purpose of the function. Expenditures shall be kept to a minimum as they have the potential of being perceived to be of personal benefit and an abuse of public funds. Official functions shall be hosted by a representative of the College that has been delegated authority by the President or a Vice President to host such functions. Acceptable Official and Employee Training Function Activities The following are examples of acceptable official and employee training function activities. • • • • • • • • • Functions where College personnel host or welcome a non-employee guest or visitor, or group of such persons, for the benefit of the College. Commencement ceremonies and associated receptions and events. Festive office decorations for highly visible departments that are frequently visited by non-employee guests. Employee or student recruitment activities in locations on or off campus, where food and beverages might be served. Events designated to generate alumni, legislative, donor, and business or community support for College programs, where food and beverages might be catered at on or off campus locations. Formal gatherings such as award ceremonies that acknowledge employee achievements or non-employee accomplishments that benefit the College. Retirement receptions after length of service at STC of five years or more (auxiliary funds only). Departmental or divisional retreats. Occasional (not daily, weekly, or monthly) lunch meetings of only employees and/or official guests of the College. The primary purpose of the meeting is to conduct College business and where the specific business purpose is justified. 4 Alert Notice 2005-18 Guidelines for Business Related Expenditures Guidelines for Official and Employee Training Functions Not Acceptable Official and Employee Training Functions Activities The following activities do not qualify as official and employee training functions: • Lunches, dinners, receptions and other gatherings where the primary purpose is for College personnel, (faculty, staff and students), to informally gather for social or personal purposes and not to further specific College program objectives. This includes Christmas parties or receptions, going away receptions for non-retiring employees and similar events. • Gifts and gatherings recognizing occasions of personal importance to employees and non-employees that are not directly related to the conduct of College business or accomplishment of program objectives. This includes birthdays, weddings, engagements, death or birth in an individual's family, illness or hospitalization of an individual, holidays, retirement gifts, or other "special days". These guidelines should not discourage employees or departments from taking up a collection and making unlimited private gifts to colleagues in appreciation for their services or in recognition of events of personal importance. 5