How To Be Fiscally Fit for End of Year Travel Summer

advertisement

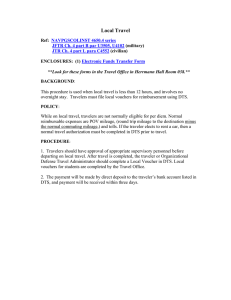

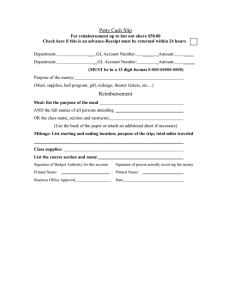

How To Be Fiscally Fit for End of Year Travel June 26, 2015 Summer “Fiscal” Tips 2015 The Travel Office, under the Accounts Payable Department, audits business related travel authorizations, travel vouchers and mileage reimbursement vouchers as well as student travel forms to ensure accuracy, completeness and compliance with the college’s policies and procedures. The goal of the Travel Office is to ensure dependable and timely services to South Texas College faculty, staff and students, with excellent customer service and a commitment to continuous process improvement. Fiscal Tips: • All reimbursement requests for travel that occurred on August 31st or prior must be submitted to the Business Office by September 8th. • Any travel documents received for travel occurring after 09/1/15 will be processed with FY2016 budget. Vanessa Limon, Accounting Assistant Email: vlimon2@southtexascollege.edu Phone: (956) 872-4618 Dalinda Gamboa-Accounting Group Manager Maricarmen Ramirez-Accountant Group Supervisor Vanessa Limon, Accounting Assistant-Travel Patricia Jackson, Accounting Assistant-Travel x4619 x4609 x4618 x4656 • Travel Authorizations with travel dates after August 31, 2015 will be processed in the new fiscal year (FY16). All travel expenses such as per diem, lodging, mileage, airfare, registration, etc. will be charged to the department’s FY16 budget. • The only exceptions will be: • Registration fees with a due date prior to September 30, 2015 which offer a savings to the college for early payment. • Airfare with travel dates prior to September 30, 2015. • These exceptions will be processed and charged to the department’s FY15 budget. • Beginning July 1 through August 31, the Travel Office will be sending out e-mail reminders for missing travel vouchers. The e-mails will go out every two weeks. • The Travel Guidelines state, “a Travel Voucher must be submitted to the Business Office within 15 days after returning from the trip.” The 15 day rule is accelerated for travel happening the last week of August. Please submit the approved vouchers for August travel along with the required documentation as soon as the traveler returns from the trip in order to meet the FY15 deadline of September 8th. • Reminder: IRS requires an "adequate" accounting by the recipient within a reasonable period of time. This means that employees must verify the date, time, place, amount and the business purpose of the expenses. Receipts are required unless the reimbursement is made under a per diem plan. • Mileage reimbursement requests for in-district travel during the month of August are due to the Travel Office by September 8th or prior. • To avoid delays in processing vouchers, please make sure: • To attach all proper documentation (ie. receipts, boarding passes, mileage log, SMM forms, faculty teaching schedules, school calendars –if applicable, etc.) • To verify that the traveler’s address on the voucher matches the address in Banner. • That the Organization Code on the voucher is correct. • All proper approvals are on the voucher forms • Instate- Employee, Immediate Supervisor, Financial Manager • Out of state- Employee, Immediate Supervisor, Financial Manager, Division Vice President • Mileage Log – Employee, Immediate Supervisor, Financial Manager, Division Vice President, if applicable • Standard Mileage Method Form – Employee, Immediate Supervisor, Financial Manager • Make sure to close all open mileage encumbrances for employees that are no longer traveling. To do this: • Send an e-mail (must be from the FM or approved by the FM) to the Travel Office requesting that the encumbrance(s) be closed. Make sure to include the following: • Name of the traveler (employee) • Traveler’s A# • Encumbrance Number • • • • • • • • FTMVEND-Vendor Maintenance FAIVNDH-Vendor Detail History FOIDOCH – Document History FAIINVE-Invoice/Credit Memo Query FGIBAVL-Budget Availability Status FGITRND-Detail Transaction Activity FGIOENC-Organization Encumbrance List FGIENCD-Detail Encumbrance Activity