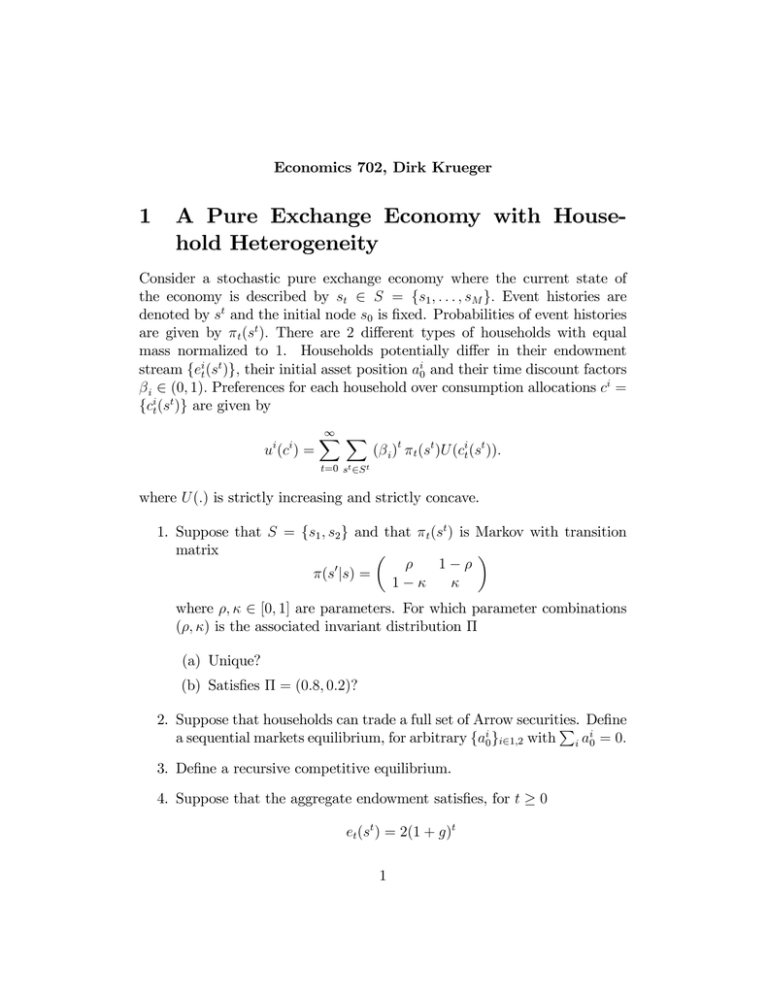

1 A Pure Exchange Economy with House- hold Heterogeneity

advertisement

Economics 702, Dirk Krueger 1 A Pure Exchange Economy with Household Heterogeneity Consider a stochastic pure exchange economy where the current state of the economy is described by st 2 S = fs1 ; : : : ; sM g: Event histories are denoted by st and the initial node s0 is …xed. Probabilities of event histories are given by t (st ): There are 2 di¤erent types of households with equal mass normalized to 1. Households potentially di¤er in their endowment stream feit (st )g; their initial asset position ai0 and their time discount factors i i 2 (0; 1): Preferences for each household over consumption allocations c = i t fct (s )g are given by i i u (c ) = 1 X X ( i )t t (s t )U (cit (st )): t=0 st 2S t where U (:) is strictly increasing and strictly concave. 1. Suppose that S = fs1 ; s2 g and that matrix t (s t ) is Markov with transition 1 (s0 js) = 1 where ; 2 [0; 1] are parameters. For which parameter combinations ( ; ) is the associated invariant distribution (a) Unique? (b) Satis…es = (0:8; 0:2)? 2. Suppose that households can trade a full set of Arrow securities. P De…ne a sequential markets equilibrium, for arbitrary fai0 gi21;2 with i ai0 = 0: 3. De…ne a recursive competitive equilibrium. 4. Suppose that the aggregate endowment satis…es, for t et (st ) = 2(1 + g)t 1 0 with g > 0; and that 1 = 2 as well as U (c) = c1 1 1 : The individual endowments satisfy eit (st ) > 0 for all i; t; st ; but no further assumptions are given, of course apart from 2 X eit (st ) = et (st ) = 2(1 + g)t : i=1 Characterize as fully as possible the sequential market equilibrium consumption allocations and the prices of Arrow securities. 5. Compute the risk-free interest rate in this economy. 6. Now suppose that households cannot borrow, that is, impose ait+1 (st+1 ) 0 and also assume that 1 > 1 > 2 and a10 = a20 = 0 and eit (st ) = (1 + g)t for both i = 1; 2: Repeat questions 4. and 5. 2