Antitrust Enforcement During the Great Depression Jenny R. Hawkins May 2014

advertisement

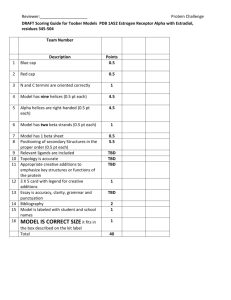

Antitrust Enforcement During the Great Depression Jenny R. Hawkins∗ Preliminary and Incomplete - Please Do Not Circulate May 2014 Abstract: We offer an empirical study of antitrust enforcement by the Department of Justice (DOJ) and Federal Trade Commission (FTC) during the New Deal. The goal of this research is to address arguments that antitrust policies during the Great Depression were harmfully lax or even “suspended”. These arguments stem from the National Industrial Recovery Act (NIRA), lasting from 1933 to 1935, that allowed industries to collude in specific ways under specific rules. Therefore, on the surface, the NIRA indicates antitrust policies were nonexistent during this period. Other non-legislative antitrust actions by regulators and the courts also affected antitrust policy. However, changes in antitrust policy do not imply no enforcement of competition law during this period. We seek to resolve this growing assumption in the literature by creating a detailed dataset, and then carefully examining federal antitrust cases from 1925-1939. Resolving this growing assumption of nonexistent antitrust enforcement is important because some base conclusions on the extent of the Great Depression and output on an assumption of suspended antitrust policy. Such policy implications during this period have been paralleled to potential policy changes in today’s economic environment. Our analysis provides a detailed look at the industries and alleged violations investigated and prosecuted by the DOJ and FTC, as well as other non-legislative antitrust policies in place, the size of the regulatory agencies, the resulting remedies, and length of cases. We examine the years 1925-1939 due to vacillating antitrust enforcement perspectives of the government between these years, as well as to compare to periods outside of the NIRA. Complementing our case data with specifics of the NIRA Codes of Fair Competition (rules of collusion for each industry), as well as data on other non-legislative antitrust policy, we determine factors that explain antitrust enforcement, thereby providing a clearer picture of exactly how antitrust enforcement responded to changes in antitrust policy during this fragile period. As of the date of this draft, data is still being entered and we have not examined any data in detail. ∗ Case Western Reserve University, Department of Economics. I thank Price Fishback and Omar Farooque for helpful discussions and suggestions. I also thank Christopher Danis for assistance entering data. 1 Introduction In June 1933, the National Industrial Recovery Act (NIRA) was passed under emergency legislation in an effort to fight the rapid decline in prices and wages in the early years of the Great Depression. While the NIRA was limited to two years (with intent of renewal), the goals of the legislation went beyond the Great Depression in a permanent way. In the words of President Franklin D. Roosevelt, “it represents a supreme effort to stabilize for all time the many factors which make for the prosperity of the nation and the preservation of American standards.” (Dearing, Homan, Lorwin, and Lyon (1934)). Not only was the goal grand, but too were the provisions of the NIRA. In simple terms, Title I of the NIRA allowed trade practices that aimed to encourage production and employment to return to “normal” levels (Nathan (1935)). Under specific terms, it allowed for government-supported collusion of firms within approved industries. Before the NIRA could be renewed, in May 1935, the United States Supreme Court (“Court”) declared it unconstitutional. The two years of the NIRA, coupled with (i) government encouragement of trade associations and industry codes and (ii) the Court’s ruling in the price fixing case Appalachian Coals, Inc. v. United States (1933) 1 certainly changed antitrust policy in the United States during this period (Bittlingmayer (1995)). One important question, and the relevancy to today’s economic situation, is whether, contrary to the government’s intentions, these changes in antitrust policy during this period negatively affected economic recovery. Cole and Ohanian (2004) and Eggertsson (2012) both address this question in considering a dynamic general equilibrium model of the NIRA. Cole and Ohanian (2004) conclude that under the assumption of monopoly pricing during the Great Depression, the contraction lasted seven years longer than it may have otherwise.2 While both of the Cole and Ohanian (2004) and Eggertsson (2012) models hinge on an 1 The Court’s decision in Appalachian Coals changed the per se rule in price fixing to a rule of reason. The per se rule was reinstated in 1940 in U.S. v. Socony-Vacuum Oil (310 U.S. 150 [1940]. 2 This conclusion of Cole and Ohanian (2004) was popularized in the media amidst several discussions of their research, including articles such as “How Government Prolonged the Depression” February 2, 2009, The Wall Street Journal Opinion page: http://online.wsj.com/article/SB123353276749137485.html#. 2 assumption that firms collude3 , Eggertsson (2012) finds that output actually increases, in favor of these policies. However, despite changes in antitrust policy, it remains to be determined the correctness of the assumption made by both Cole and Ohanian (2004) and Eggertsson (2012) that collusion was allowed to run rampant and antitrust policies were essentially non existent during the New Deal. In other words, a change in antitrust policy towards more lenient measures does not necessarily imply antitrust enforcement during this period was lax or nonexistent. The assumptions made by Cole and Ohanian (2004) and Eggertsson (2012) are not uncommon in the literature; others claim that antitrust policies were not enforced during the New Deal. While Bittlingmayer (1995) offers a thoughtful look at the effects of the NIRA on recovery, he refers to the NIRA as “suspension of antitrust”. However, his work indicates this statement to be a misleading generalization, common in the literature. He continues to indicate that only several major industries participated in the NIRA by governmentapproved restriction of output or capacity, collusion on pricing or costs information, of prohibition of sales below costs, as is evident in studies of the NIRA. Regardless, even if only a small subset of industries participated in government-sponsored collusion, it is unclear whether these industries still behaved in non-government-approved anticompetitive behavior probed by regulators. Cox (1981) states, “Even though there was little evidence of an increase in monopoly [during the Great Depression], the belief was widely held,” and he provides an example from Berle and Means (1932) who argue that industries had become highly concentrated, yet their evidence does not support this claim. In an effort to clear up the enforcement of antitrust policies during the New Deal, this research addresses (i) the extent to which antitrust policies during the New Deal affected antitrust enforcement during the Great Depression and (ii) whether, outside the limitations of the NIRA and Appalachian Coals, antitrust regulators were otherwise lax in enforcement. The first goal of this research is to carefully investigate antitrust enforcement during the New Deal to understand exactly how antitrust policies affected enforcement. Most of 3 Eggertsson (2012) states that “The NIRA declared a temporary “emergency” that suspended antitrust laws...”. 3 the literature focuses on evaluation of the NIRA and its codes to examine collusion (see, e.g., Nathan (1935), Taylor (2007), Alexander (1997) and Alexander and Libecab (2000)). Posner (1970) is the only work to take a substantial look at antitrust enforcement, though his focus is not on the Great Depression, and his analysis does not consider the NIRA codes nor does he present a yearly analysis of the industries and goods/services for which regulators enforced antitrust policy. In the spirit of Posner (1970), we look at DOJ and the FTC cases between the years 1925-1939 to examine which industries, goods/services and antitrust violations were the focus of regulators during these years to gain a better understanding of antitrust enforcement under Franklin D. Roosevelt’s leadership. We also consider the length of cases, sanctions and remedies, types of violators (firms versus individuals), DOJ and FTC antitrust appropriations, and civil versus criminal pursuit of enforcement to clear up the picture of antitrust policy beyond the NIRA. Then, incorporating (i) the industries and codes of collusion using data from the NIRA’s Codes of Fair Competition and (ii) non-legislative data regarding influential Supreme Court antitrust cases during this time and the FTC’s encouragement and sponsorship of industry codes and trade association conferences , we hope to combine our DOJ and FTC case information to more carefully examine enforcement of the antitrust policies during this period, even when government policies allowed for some violations of antitrust laws. 2 Antitrust policy through the mid 1930s With fairly young antitrust policy in place at this time, part of our investigation of antitrust enforcement during the New Deal includes a more detailed look at the policies and the regulators dictating the law, outlined in Table 1, below. Antitrust policy was led primarily by the Sherman Act of 1890 and the Clayton Act of 1914 (along with its amendment, the Robinson-Patman Act of 1936). After passage of the Sherman Act in 1890 and up to 1933, the Assistant to the Attorney General dealt with antitrust matters. In 1933 the Antitrust Division of the Department 4 of Justice was established under Franklin D. Roosevelt, with Harold M. Stevens appointed as the first Assistant Attorney General of the Antitrust Division. Along with the DOJ’s Antitrust Division, the FTC (as part of the Federal Trade Commission Act of 1914) also regulates competition law in the United States. The Robinson-Patman Act, which focuses on price discrimination, is enforced primarily by the FTC and not the DOJ. A closer look at the focus of various antitrust regulators also can reveal the relative enforcement of antitrust policies. Following Theodore Roosevelt’s strict enforcement of antitrust, during the teens and through the 1920s, antitrust policies were somewhat lax through the allowance of trade associations and even sponsored “Trade Practice Conferences” by the FTC beginning in 1925. As a regulator, Herbert Hoover supported trade associations; however, as President, he was a strict enforcer of antitrust policies and rejected any proposals to relaxed enforcement. On October 25, 1929, the Hoover administration took a public stance by declaring strict enforcement of antitrust policy. This stemmed from the argument that lax antitrust policies had created an unhealthy boom in mergers and the stock market during the 1920s (Bittlingmayer (1995)). Once Franklin D. Roosevelt took office and signed the NIRA in 1933, he had loosened the policies of Hoover back to the aims of the Coolidge administration for promoting exchange of information on prices, costs and production through trade associations (also known as the “Open Price Movement”). However, Roosevelt’s administration was not particular to lax antitrust enforcement. In 1938, President Franklin D. Roosevelt appointed Thurman Arnold as head of the Antitrust Division of the DOJ. Arnold became known as one of the staunchest antitrust enforcers to date. As Hawley (1966) points out, this alternating enforcement of antitrust laws began with the Sherman Act and continued through the Great Depression as different administrations fought what they believed was “cutthroat competition”. However despite this seesawing policy, it appears that regardless of the administration in office, the FTC was constant in its support of first, trade associations, then trade association conferences, and finally proposed industry codes of industry behavior. These industry codes were supported by the 5 FTC under the belief it was their obligation to determine and then sanction such behavior. Yet, arguably these conferences and codes masked collusion by firms. The DOJ and U.S. Supreme Court also exhibited some decisions in the 1920s that indicate some lax enforcement of antitrust policy during those years. With the appointment of William Donovan as Assistant to the Attorney General, and therefore head of antitrust, the DOJ appeared to advise trade associations, though it is unclear to what extent and in what capacity. Several important Supreme Court cases also loosened the precedent on mergers, first in U.S. vs U.S. Steel (1920), where U.S. Steel gained 90 percent of the steel industry’s market share, and then in U.S. vs International Harvester (1927). However, by the Hoover administration, the DOJ was strictly enforcing antitrust laws against trade associations that had formed industry codes supported by the FTC (and possibly the DOJ itself) in the mid-1920s. It also required a change in the FTC’s Trade Practice Conferences and the types of codes created therewith (Bittlingmayer (1995)). Besides the Open Price Movement and its continued promotion through Trade Practice Conferences, the NIRA was the other major antitrust policy during this period. As mentioned above, the NIRA was passed in June 1933 for a two year period, but before it could be renewed, the Supreme Court declared it unconstitutional in 1935. In an attempt to combat the collapse in output during 1929-1933, the National Recovery Administration (NRA), the regulatory agency created to oversee the NIRA, approved “Codes of Fair Competition” proposed by trade associations. With approval, the codes held for the entire industry pertaining to those codes. All of the codes were exempt from antitrust law. The President was given the power to prescribe new codes, as well as cancel or modify any previously established codes. The legislation further allowed for “agreements” between people in the industry, trade associations, and labor associations that also were exempt from antitrust laws (Nathan (1935). Thus far, we have no evidence of the extent of such agreements. The NIRA also provided for collective bargaining and the freedom to join unions, as well as requiring employers to adhere to restrictions on minimum pay and maximum hours 6 (Bittlingmayer (1995)).4 During the years the NIRA was in effect, almost 800 industry codes were passed. Among those industries not participating were agricultural, steam railroads, nonprofit institutions, and professional services (Alexander (1997)). According to Taylor (2007), larger industries were favored in faster and possibly more lenient approval of codes. Bittlingmayer (1995) offers evidence that while some major industry codes were detailed and clearly anticompetitive in the usual sense, other major industries did not focus on price collusion. For example, the automobile code focused on labor issues. In our analysis, a closer look at the industries for which regulators prosecuted firms and the codes existing for those industries may reveal more information about antitrust enforcement. Additionally, following the NIRA, some industries still adhered to previously signed codes. One would expect tougher antitrust authorities to therefore begin tighter regulation on such industries openly continuing to collude. Our goal is to take the known changes in antitrust policy, specifically FTC Trade Practice Conferences and initial creation of industry codes, the NIRA, and changed precedence in mergers and price fixing through Supreme Court decisions to then examine the anticompetitive violations of firms prosecuted by the DOJ and FTC in order to determine how antitrust enforcement ensued during this turbulent period. Antitrust policy following the NIRA is less clear. As indicated above, at least some industries continued to collude, and enforcement of antitrust policies within firms in these industries is to be determined in our examination. 3 Related Literature As mentioned above, Cole and Ohanian (2004), Eggertsson (2012), and Bittlingmayer (1995) seek to answer whether output increased or decreased due to the passage of the NIRA. While this is not our focus, these questions point out the important question of 4 These regulations covered Title I of the NIRA, with Title II addressing public works/construction projects and Title III addressing provision related to amendments of the Emergency Relief and Construction Act. 7 Date 1890 1901-1909 1910-1920 1914 1920 1923-1929 1924 1925 1927 1929-1933 1929 1929 (Oct 25) 1929 (Oct 29) 1933 (March) 1933 (June) 1933 (July 16) 1933 (July 19-Aug 31) 1934 1935 (May 27) 1935 (summer) 1936 1938 Table 1: Timeline of relevant events Event Sherman Antitrust Act Strict antitrust enforcement under Theodore Roosevelt Open Price Movement where trade associations sought to exchange information freely Clayton Act Leniency by SCOTUS in mergers: U.S. vs U.S. Steel (1920) decided Lenient antitrust enforcement under Calvin Coolidge (promotion of trade associations) Continued leniency under William J. Donovan, appointed DOJ Assistant to the Attorney General FTC begins sponsoring “Trade Practice Conferences” Leniency by SCOTUS in mergers: U.S. vs International Harvester (1927) decided Strict antitrust enforcement under Herbert Hoover Numerous industries have adopted “codes” under FTC guidance Hoover declares strict enforcement of antitrust Black Tuesday Appalachian Coals, Inc. vs United States decided by SCOTUS making price fixing easier NIRA Passed FDR signs first code (for cotton textiles) President’s Reemployment Agreement (“blanket code”) signed for labor issues Compliance Crisis NIRA declared unconstitutional (via Schechter Poultry Corp. vs U.S. 90 percent of cotton textile firms still adhering to industry codes (though not legally enforceable) Robinson-Patman Act on price discrimination Thurman Arnold appointed Assistant Attorney General of the Antitrust Division 8 how strict antitrust enforcement was during the New Deal, holding constant the change in antitrust policy. Others look at the NIRA and industry codes to examine how industries actually responded to the NIRA (see e.g., Taylor (2007), Alexander and Libecab (2000), and Alexander (1997)). Cox (1981) is the only known work that attempts to investigate monopoly behavior before, during and after the Great Depression. However, his focus is not on the effects of antitrust policy and antitrust enforcement, but the ex post realization of monopolies. Posner (1970) not only enumerates DOJ (and certain, but not all FTC) antitrust cases from 1890-1969, but groups them in years of five by violation. This enumeration, while useful in a grand scheme, is not as useful for a detailed analysis of antitrust policies during the New Deal. Therefore, in the spirit of Posner, we look at DOJ and FTC antitrust cases during 1925-1939 on a yearly basis and break them down by violation and industry, as well as look at other factors neglected by Posner (1970) such as budget appropriations and FTC trade conferences. Additionally, Posner does not offer a detailed statistical analysis; he provides no statistical tests nor the relationships between variables. Posner (1970) provides some theoretical discussion regarding what determines antitrust enforcement. With respect to an economic downturn, there’s more incentive to violate antitrust laws during downturns, but there may be fewer resources to reveal and investigate such violations. Therefore, does the observation of fewer investigations indicate fewer violations or less enforcement? Posner (1970) suggests two hypotheses related to economic activity: (i) Level of economic activity and antitrust enforcement are positively correlated, as during upturns, there are more resources for enforcement, even if there is less incentive to violate antitrust laws. (ii) Level of economic activity and antitrust enforcement are negatively correlated. During economic contractions, the government may be harsher on anticompetitive behavior, seeking violations more vigorously. As Gallo, Dau-Schmidt, Craycraft, and Parker (2000) indicate, this follows the theory of regulation by Peltzman (1976) where“regulation will tend to be more heavily weighted toward ‘producer protection’ in depressions and toward ‘consumer protection’ in expansion”. This theory might seem to apply during the 9 Great Depression and with respect to the NIRA, as firms have more incentive to seek protection from the government during downturns due to increased competition resulting from excess capacity experienced during a contraction. Gallo, Dau-Schmidt, Craycraft, and Parker (2000) suggest this behavior was observed during the 1930s, but does evidence show the government was less stringent on firms during the Great Depression, when controlling for the size of the DOJ and FTC and other factors? Posner (1970) finds a positive correlation between the number of DOJ antitrust cases and real GNP for the years 1890-1940, generally. From his Figure 1, we see that pre-Great Depression, correlation is unclear; as GNP slowly increases, cases widely fluctuated and decrease at a point of an increased growth rate between 1925-1030. During the Great Depression, the trend in cases appears to follow the trend in GNP. Posner’s analysis for the years 1940-1970 reveals that even though real GNP rose, the number of antitrust cases did not increase significantly. Gallo, Dau-Schmidt, Craycraft, and Parker (2000) find similar results from 1955-1972 and an even stronger case against the positive correlation theory in the 1980s, as they find that the number of cases decrease significantly with growth in real GNP. Therefore, for our period of examination, once we include all DOJ and FTC antitrust cases, it is unclear which hypothesis presented by Posner (1970) will hold. During the Great Depression, we expect Posner’s hypothesis (i), above, to hold; however, this may be due to industry codes formed before the NIRA and during the NIRA and not necessarily the contraction itself. In other words, a decrease in cases may be due to the possible change in regulators’ budgets and other contractionary effects, or it may be due to the relaxation of competition law. However, prior to the Great Depression, when industry codes were in effect, though collusion through such codes was not formally government-supported, the correlation between cases and GNP is unclear. If we are to argue that industry codes that allowed collusion, whether formally or not, led to a suspension of antitrust enforcement, we would expect antitrust cases to decline during the period the FTC supports and sponsored trade associations and the formation of industry codes. 10 Posner (1970) and Gallo, Dau-Schmidt, Craycraft, and Parker (2000) analyze another metric for enforcement: a civil or criminal remedy. While both remedies involve sanction, clearly a criminal remedy is of higher magnitude and higher economic costs. Several have investigated the deterrent effects of a civil versus criminal remedy. Calkins (1997) finds that civil fines have a smaller deterrent effect than a criminal fine. Therefore, one might hypothesize that a criminal remedy as opposed to civil remedy indicates greater antitrust enforcement. On a first look, Gallo, Dau-Schmidt, Craycraft, and Parker (2000) find that from 1925-1934, the DOJ pursued twice as many civil cases as criminal cases. They also find that of those imprisoned for antitrust violations, none were imprisoned not only because of price-fixing charges, but in addition to findings of intimidation, threats or violence. From 1935-1939, they find that for 57 DOJ antitrust cases, 53 per cent were civil. Therefore, criminal cases clearly are not uncommon. We want to examine civil versus criminal cases in more detail, as the remedy and the type of case can reveal stricter enforcement of antitrust policy. 4 Data We collect data on DOJ antitrust cases from the Annual Report of the Attorney General (Department of Justice (1920-1940)) and FTC antitrust cases from the Annual Report of the Federal Trade Commission (Federal Trade Commission (1920-1944a). These Reports provide very brief summaries of cases, providing at least one defendant name, as well as indications of the violation, good or service, industry, and outcome. Additional DOJ case information and the industries which commit violations is provided in a book summarizing federal antitrust cases Department of Justice (1936); however, not every case initialized in any given year is summarized in these publications. More detailed explanations of DOJ cases are provided in the CCH Trade Regulation Reporter (also known as the CCH Bluebook) (Commerce Clearing House (1932-1939)) and FTC cases in the Federal Trade Commission Decisions (Federal Trade Commission (1920-1944b)). These are the sources used by Posner 11 (1970), which includes only cases finalized in a given year. Though the data analysis becomes more complicated when we include all cases instigated in a particular year, whether finalized or continued, we believe the fact a case was instituted and information about the industry and good for which the case belongs in that given period is revealing information about antitrust enforcement. Therefore, we include these additional cases in our analysis, but must be careful in how we use this information and account for replication when relevant. We complement our data collection from the Attorney General’s Reports and the FTC Reports with these three additional sources of data. We consider the years 1925-1939 because we want to investigate other non-legislative antitrust policies and how the also affect antitrust enforcement during the Great Depression. We also include these years to compare enforcement outside of the NIRA. Furthermore, the fact that prior to the NIRA, the FTC encouraged trade associations and sponsored Trade Practice Conferences for industries to form codes, indicates that the government, to some degree, was exempting aspects of competition law prior to the NIRA. Therefore, to some extent, collusion was permitted in certain industries well before the contraction. We want to understand how the formation of industry codes before the Great Depression affects antitrust enforcement. Finally, we include the years 1925-1939 for comparison to Posner (1970)’s reporting of data in five-year increments. Table 2 is a replication of parts of tables from Posner (1970) of DOJ and FTC total cases for the years 1925-1939. Table 3 lists the total number of cases we find described in the Attorney General Reports. Quick observation reveals Posner’s totals and the totals from these Attorney General Reports do not equate. Posner considers only cases finalized in a given year. We keep record of all cases initialized in a given year, but ultimately have to avoid duplication for the continuance of the cases. The cases listed in Table 3 include all cases pending and initialized in a given year. Therefore, all cases pending in the next year are duplicated in the total for the following year. Also included in Table 3 is the Attorney General report of cases finalized in each year. These totals also do not equate to Posner’s 12 Table 2: Total DOJ and FTC cases reported in Posner (1970) and to be compared; Robinson-Patman Cases and FTC Trade Practice Conferences to be determined. Year DOJ FTC RobinsonFTC Conf Cases Cases Patman Cases 1925 12 21 tbd tbd 1926 9 4 tbd tbd 1927 13 8 tbd tbd 1928 17 10 tbd tbd 1929 8 17 tbd tbd 1930 7 12 tbd 57 1931 3 4 tbd tbd 1932 5 3 tbd tbd 1933 9 4 tbd tbd 1934 6 14 tbd tbd 1935 4 30 tbd tbd 1936 5 33 75 (1936-39) tbd 1937 7 18 tbd tbd 1938 10 28 tbd tbd 1939 31 31 tbd tbd totals. We have yet to resolve the discrepancies. Based on Posner’s totals, we expect a total of 146 DOJ cases and 237 FTC cases to analyze over the period 1925-1939. Table 4 lists the reported number of inquiries and formal complaints by the FTC. Comparing the formal complaints to Posner’s total FTC cases shows an obvious discrepancy for the only year entered, 1930. Of the formal complaints reported by the FTC in each year, various violations are included. However, Posner only reports restraints of trade cases. Tables 5 and 6 provide appropriations to the Antitrust Division and the FTC for each year, with an itemization of salaries and general work for the FTC. Also included for the DOJ (currently unknown for the FTC) is additional remedy information for DOJ cases, including both civil and criminal fines, criminal convictions and total number of months of incarceration. Potential problems with our analysis include dealing with the following. First, as highlighted in Gallo, Dau-Schmidt, Craycraft, and Parker (2000), many cases could result from one initiated case that provided leads to other violations within an industry. Therefore, 13 Table 3: DOJ Antitrust Division total Year Total Civil (pending and init) 1925 59 29 1926 67 32 1927 45 29 1928 48 26 1929 43 26 1930 44 32 1931 39 29 1932 22 18 1933 25 21 1934 22 tbd 1935 tbd tbd 1936 31 18 1937 31 15 1938 tbd tbd 1939 tbd tbd civil and criminal cases (Source: AG Reports) Crim Finally Civil Crim deter- finally finally mined det. det. 30 11 8 3 35 30 18 12 16 23 15 8 22 22 12 10 17 13 8 5 12 9 6 3 10 21 14 6 4 4 2 2 4 6 4 2 tbd 8 tbd tbd tbd tbd tbd tbd 13 10 7 3 16 3 tbd tbd tbd tbd tbd tbd tbd tbd tbd tbd Table 4: FTC total inquiries and formal complaints (Source: FTC Reports) Year Total inquiries Formal Complaints 1925 tbd tbd 1926 tbd tbd 1927 tbd tbd 1928 tbd tbd 1929 tbd tbd 1930 1505 172 1931 tbd tbd 1932 tbd tbd 1933 tbd tbd 1934 tbd tbd 1935 tbd tbd 1936 tbd tbd 1937 tbd tbd 1938 tbd tbd 1939 tbd tbd 14 Table 5: DOJ Antitrust Division appropriated budget, total fines, total convictions and total jail time (Source: AG Reports) Year Budget Civil Fines Crim Fines Convictions Jail time (mo) 1925 $203,930 $67.90 $235,500 2 tbd 1926 $228,000 $297.58 $292,301 4 0 1927 $200,000 tbd $335,850 4 72 1928 $198,000 $1,725 $114,500 5 0 1929 tbd $3,658 $37,000 4 36 1930 $203,600 tbd $46,025 69 240.5 1931 tbd tbd tbd tbd tbd 1932 $204,160 tbd $100,865 100 tbd 1933 $150,000 tbd $222.10 2 tbd 1934 $153,000 tbd $559 15 48 1935 tbd tbd tbd tbd tbd 1936 tbd tbd tbd tbd tbd 1937 tbd tbd tbd tbd tbd 1938 tbd tbd tbd tbd tbd 1939 tbd tbd tbd tbd tbd Table 6: FTC appropriated budget itemized by salaries and general work (Source: FTC Reports) Year Budget Salaries for Commissioners General Work 1925 tbd tbd tbd 1926 tbd tbd tbd 1927 tbd tbd tbd 1928 tbd tbd tbd 1929 tbd tbd tbd 1930 $1,495,821.69 $50,000 $1,390,971.82 1931 tbd tbd tbd 1932 tbd tbd tbd 1933 tbd tbd tbd 1934 tbd tbd tbd 1935 tbd tbd tbd 1936 tbd tbd tbd 1937 tbd tbd tbd 1938 tbd tbd tbd 1939 tbd tbd tbd 15 Variable Date Length Defendant Defendant type Plaintiff name Industry Alleged violation Court Disposition Winner Sanction Remedy Fine Jail time DOJ budget FTC budget Table 7: Variables Explanation year, month and day case initiated and then decided number of months from initiation to final decision (including appeals) names of all defendants, when known dummy variable whether defendant(s) was firm or particular individual in that firm. If individual, what type (director, owner, president, vice president, secretary/treasurer, corporate officer, other) Typically US, but in cases where a private suit was appealed, it may be a previous defendant in detail and by SIC code, broken up by division, major group, industry, and four-digit SIC code in detail and coded under 27 possible violations court where final decision made Defendant’s plea and the court’s decision dummy variable = 1 if US; 0 otherwise. explanation of the sanction in detail dummy variable for civil (injunction, fine or both) or criminal (incarceration, fine or both) amount of fine, if applicable (civil or criminal cases) months of incarceration, if applicable (criminal cases only) appropriated budget for the Antitrust Division appropriated budget for the FTC (can be broken down into salaries and general work) lack of violations in other industries may be just due to lack of information or tradeoff in investigating cases and leads in another industry. Also, controlling for the number of employees is important since fewer employees clearly means fewer cases can be prosecuted, but such data currently is lacking; we will use budgets as a proxy for the time being. 4.1 Variables Table 7 summarizes the variables collected in reading the DOJ and FTC court cases. We use this data as metrics for investigating the degree of antitrust enforcement in the years just prior to and during the Great Depression. Next we present hypotheses with respect to each metric examined, and when possible, offer summaries of findings by Posner. 16 4.1.1 Length of each case The length of each case is determined by the number of months between the initiation and decision or executed remedy date of each case. We expect that the longer the cases, the stricter the antitrust enforcement. However, many cases end with a consent decree (agreement in civil cases) or nolo contendere (no contest plea in criminal cases). In such cases, the government wins, but the case length likely is very short, since both entail out of court settlements and thus no litigation. Therefore, the shorter the case length in which the government loses indicates more lax enforcement. However, we examine how many cases were settled and litigated. Posner (1970) finds that for the 59 DOJ cases between 1925 and 1929, 44 were settled within six months and 15 were litigated (25 per cent). For the 30 DOJ cases between 1930 and 1934, 20 were settled in six months and 10 were litigated (33 per cent). Finally, for the 57 DOJ cases between 1935 and 1939, 21 were settled within six months and 27 were litigated (47 per cent). The percentage of cases litigated appears to increase, and pre-NIRA litigation appears lower than post-NIRA litigation, offering no evidence for more lax enforcement in terms of efforts to try a case. With further analysis, we can examine length for civil versus criminal cases and by industry to determine which types of violations and cases required or expended more effort of the DOJ. Table 8, replicated from Posner (1970), provides a breakdown in years of five of DOJ cases by civil and criminal, indicated the number of consent judgments, and provides the number of cases over lengths of time. We see that in early years, more cases were settled within six months and more consent decrees were issued, indicating settlement agreements with the DOJ. During the Hoover administration of tough enforcement and the beginning for most of the NIRA, at least four cases last over two years. While Posner’s examination is useful, a more detailed analysis of length by year and interacted with other variables will reveal more information about enforcement during this period. 17 Table 8: DOJ cases: length and number (replicated from Posner (1970)) DOJ variables 1925-1929 1930-1934 1935-1939 Civil cases (in mo.) 31 40 62 Criminal cases (in mo.) 32 51 26 No. 12 mo. or less (civil) No. 13-24 mo. (civil) 1 3 No. 25-36 mo. (civil) 3 2 No. 36-48 mo. (civil) 4 1 No. 49-60 mo. (civil) 1 No. 61-72 mo. (civil) 1 1 1 No. 73-84 mo. (civil) No. 85-96 mo. (civil) 2 No. 97-124 mo. (civil) 1 No. 125 mo. or more (civil) 4 No. cases settled w/in 6 mo. 44 20 21 No. Consent judgments (civil) 33 12 17 4.1.2 Defendant type While we often do not have details of every defendant, the number of and types of defendants offer insight into the strictness of the DOJ and FTC in which parties they deem violators. Evidence of individuals, rather than just the firm, being prosecuted might indicate stricter antitrust enforcement. A more intense antitrust enforce would seem to go after not just a firm, but individuals within a firm, as well, if such violation warrants individual sanctions. Therefore, like Gallo, Dau-Schmidt, Craycraft, and Parker (2000) we determine what type of entity the DOJ and FTC pursue. Becker and other theories of punishment argues that firms are the more efficient violator to pursue in terms of deterrence and cost because of the judgment proof problem with individuals and the greater likelihood a firm can pay a fine, so that incentives of the firm are in fact affected, as well as costs of imprisonment are avoided. Others support remedies involving specific individuals in a firm to increase incentives by firm employees to adhere to antitrust policies. 18 4.1.3 Industry We break down the good or service for each case by the Standard Industrial Classification (SIC) four-digit codes, as well as the division. Ten divisions (A-J) make up the SIC groupings, then the hierarchy of each four-digit code is broken down in major groups (first two digits), industry group (third digit) and finally, the good or service itself is indicated by the fourth digit. We break down each good and service to compare industries and general types of goods/services with those for which participated in the NIRA. Clearly many large industries were favored by the NIRA, and we want to understand if these industries also were favored in non-NIRA allowed anticompetitive behavior, reflected by fewer antitrust cases in these industries, or whether regulators focused less on the industry and more an specific violations not allowed under the NIRA. Additionally, as mentioned above, evidence suggests some industries continued to follow their industry codes post-NIRA, in which case such behavior would violate antitrust laws. If we see few antitrust cases in industries known to continue following industry codes of collusive behavior (and the specific behaviors in those codes not being prosecuted), then we have some evidence of lax antitrust enforcement. 4.1.4 Alleged violation We categorize six types of antitrust violations, one of which is a violation for threatening behavior (which can lead to criminal prosecution). Between these seven types of violations, we have 29 total possible violations (assigned a value 0-28). These 29 violations were categorized in part by the violations considered in Posner (1970) and Gallo, Dau-Schmidt, Craycraft, and Parker (2000). We will investigate each violation as well as determine the frequency of each type of violation to determine the focus of antitrust authorities. We also will combine this information with the NIRA codes to determine if we find a decline in cases for specific violations and if that decline correlates with industries and the particular codes of collusion allowed by the government, whether informally prior to the NIRA and formally during the two years of the NIRA. As indicated above, post-NIRA, 19 under a hypothesis of strict antitrust enforcement, we expect an increase in prosecutions for violations that were allowed by the NIRA, particularly in those industries that openly continue to adhere to their codes. Table 9 outlines the 29 violations. 4.1.5 Court and/or Location By examining location and the court, we hope to understand if specific courts favored one side or were more lenient (or harsher) for certain alleged violations. 4.1.6 Disposition, Winner, Sanction and Remedy With respect to the type of pleas, we might see a decrease in the number of guilty pleas if the penalties are higher (stricter enforcement) because defendants might want to avoid harsh penalties. This is a theory presented by Snyder (1990) (page 439). We also breakdown cases by civil and criminal. We expect criminal violations to be extreme and hope to get a clear picture of what other antitrust violations are part of the criminal cases, as criminal sanctions are stricter than civil sanction and can be an indicator or tougher enforcement. During this period, the maximum statutory penalty for antitrust violations under the Sherman Act was $5, 000 for firms and individuals, with a maximum one year incarceration (misdemeanor) for individuals. We hypothesize that the closer to these limits the regulator got, the stricter the antitrust enforcement. We would like to investigate aspects of the data such as (i) violations and industries enforced by regulators both during and outside the NIRA; (ii) violations and industries enforced by the courts (wins/losses by violation) both during and outside the NIRA; (iii) which violations were tried under criminal statutes; (iv) trends in remedies, fines and incarceration over time and by industry and violation; (v) types of defendants by violation and industry; (vi) length of cases both during and outside the NIRA; and (vii) if specific courts favor regulators. 20 Table 9: Alleged Violations of Antitrust Law Category 0 - Violence & threats (verbal or physical) including bullying Horizontal (per se) restraints Monopolization Exclusionary practices Vertical restraints Violation 1 - price fixing or agreement to maintain fixed min. prices 2 - colluding on something other than price 3 - fixed output levels (production or sales quota) 4 - trade association or equivalent 5 - policing, fines, audits 6 - territory allocation schemes 7 - customer allocation schemes 8 - bid-rigging with government as a buyer 9 - other bid-rigging 10 - single-firm monopolies 11 - single-firm patents 12 - multiple-firm monopolies 13 - multiple firm patents 14 - cases with dissolution or significant divestiture 15 - price discrimination 16 - boycott 17 - reciprocity 18 - tying arrangements 19 - misuse of patents or threatening patent action 20 - sabotaging competitors 21 - exclusive dealing 22 - single-firm RPM 23 - multiple-firm RPM 24 - restrictive requirements on franchisers or dealers - something other than RPM 25 - Horizontal merger violations Non-horizontal merger violations 26 - product extension merger 27 - conglomerate merger 28 - vertical mergers 21 5 Proposed analysis Beyond the basic statistical evaluation of antitrust cases between 1925-1939, we can also consider what explains whether the United States (DOJ or FTC) wins an antitrust case, looking at factors such as the industry, the violation, the Court, change in budget. Using an event study, we also can examine the effect of the change in antitrust policy to determine if the number of cases statistically change during the NIRA compared to nonevent periods before and after the NIRA. Finally, we hope to combine our case data with industry code data to determine how the DOJ and FTC changed antitrust enforcement in response to the NIRA codes for specific industries and for specific (anticompetitive) behavior. For example, did regulators shift away to industries that not sign industry codes, or did they merely focus more on specific violations not covered by industry codes, but favored no particular industry? We can break down all of these analyses by civil and criminal cases, or include such as an explanatory variable. 6 Conclusion We offer an empirical study of antitrust enforcement by the Department of Justice (DOJ) and Federal Trade Commission (FTC) during the New Deal. The goal of this research is to address arguments that antitrust policies during the Great Depression were harmfully lax or even “suspended”. These arguments stem from the National Industrial Recovery Act (NIRA), lasting from 1933 to 1935, that allowed industries to collude in specific ways under specific rules. Therefore, on the surface, the NIRA indicates antitrust policies were nonexistent during this period. Other non-legislative antitrust actions by regulators and the courts also affected antitrust policy. However, changes in antitrust policy do not imply no enforcement of competition law during this period. We seek to resolve this growing assumption in the literature by creating a detailed dataset, and then carefully examining, federal antitrust cases from 1925-1939. Resolving this growing assumption of nonexistent antitrust enforcement is important because some base conclusions on the extent 22 of the Great Depression and output on an assumption of suspended antitrust policy. Such policy implications during this period have been paralleled to potential policy changes in today’s economic environment. Our analysis provides a detailed look at the industries and alleged violations investigated and prosecuted by the DOJ and FTC, as well as other non-legislative antitrust policies in place, the size of the regulatory agencies, the resulting remedies, and length of cases. We examine the years 1925-1939 due to vacillating antitrust enforcement perspectives of the government between these years, as well as to compare to periods outside of the NIRA. Complementing our case data with specifics of the NIRA Codes of Fair Competition (rules of collusion for each industry), as well as data on other nonlegislative antitrust policy, we determine factors that explain antitrust enforcement, thereby providing a clearer picture of exactly how antitrust enforcement responded to changes in antitrust policy during this fragile period. We still are entering data and further analysis will continue in the ways indicated above. 23 References Alexander, B. J. (1997): “Failed Cooperation in Heterogeneous Industries Under the National Recovery Administration,” The Journal of Economic History, 57(2), 322–344. Alexander, B. J., and G. D. Libecab (2000): “The Effect of Cost Heterogeneity in the Success and Failure of the New Deal’s Agricultural and Industrial Programs,” Explorations in Economic History, 37, 370–400. Baker, J. B. (2003): “The Case for Antitrust Enforcement,” The Journal of Economic Perspectives, 17(4), 27–50. Berle, A., and G. C. Means (1932): The Modern Corporation and Private Property. New York: Macmillan. Bittlingmayer, G. (1995): “Output and Stock Prices When Antitrust Is Suspended: The Effects of the NIRA ,” in “The Causes and Consequences of Antitrust: A Public Choice Perspective”, ed. by F. S. McChesney, and W. S. I. (eds.)., chap. 17, pp. 297–318. University of Chicago Press. Calkins, S. (1997): “Corporate Compliance and the Antitrust Agencies’ Bi-Modal Penalties,” Law and Contemporary Problems, 60, 127–167. Cole, H. L., and L. E. Ohanian (2004): “New Deal Policies and the Persistence of the Great Depression: A General Equilibrium Analysis,” Journal of Political Economy, 112(4), 779–816. Commerce Clearing House (1932-1939): Trade Regulation Reporter, United States Antitrust Case Summaries. Cox, C. C. (1981): “Monopoly Explanations of the Great Depression and Public Policies Toward Business,” in The Great Depression Revisisted, ed. by K. B. (ed), chap. 8, pp. 174–207. Springer. Dearing, C. L., P. T. Homan, L. L. Lorwin, and L. S. Lyon (1934): The ABC of the NRA. Washington, D.C., Brookings Institution. Department of Justice (1920-1940): Annual Report of the Attorney General of the United States for the Fiscal Year XXXX. (1936): The Federal Antitrust Laws With Summary Of Cases Instituted By The United States And Lists Of Cases Decided Thereunder ...... Nabu Press. Eggertsson, G. B. (2012): “Was the New Deal Contractionary?,” American Economic Review, 102, 524–555. Federal Trade Commission (1920-1944a): Annual Report of the Federal Trade Commission for the Fiscal Year Ended June 30, XXXX. (1920-1944b): Federal Trade Commission Decisions. 24 Gallo, J. C., K. Dau-Schmidt, J. L. Craycraft, and C. J. Parker (2000): “Department of Justic Antitrust Enforcement 1955-1997: An Empirical Study,” Review of Industrial Organization, 17, 75–133. Hannsgen, G., and D. B. Papadimitriou (2009): “Lessons from the New Deal: Did the New Deal Prolong or Worsen the Great Depression?,” Working Paper No. 581. Hawley, E. W. (1966): The New Deal and the Problem of Monopoly: A Study in Economic Ambivalence. Fordham University Press. Nathan, O. (1935): “The N.I.R.A. and Stabilization,” The American Economic Review, 25(1), 44–58. Peltzman, S. (1976): “Toward a General Theory of Regulation,” Journal of Law and Economics, 19, 211–240. Poole, W. (1981): “Comments on “Monopoly Explanations of the Great Depression and Public Policies Toward Business”,” in The Great Depression Revisisted, ed. by K. B. (ed), chap. 9, pp. 208–219. Springer. Posner, R. A. (1970): “A Statistical Study of Antitrust Enforcement,” Journal of Law and Economics, 13(2), 365–419. Taylor, J. E. (2007): “Cartel Code Attributes and Cartel Perforance: An Industry-Level Analysis of the National Industrial Recovery Act,” Journal of Law and Economics, 50, 597–623. 25