Mandate-based Health Care Reform and Business Activity: Evidence from Massachusetts

advertisement

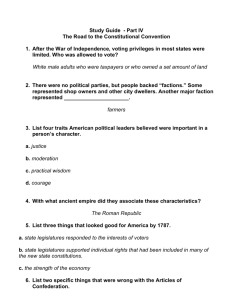

Mandate-based Health Care Reform and Business Activity: Evidence from Massachusetts Nadia Greenhalgh-Stanley Department of Economics, Kent State University 466 College of Business Kent, OH 44242 ngreenha@kent.edu Shawn Rohlin Department of Economics, Kent State University 454 College of Business Kent, OH 44224 srohlin@kent.edu 1 Abstract Recently mandate-based health care reform has been one of the most hotly debated public policy issues. Debates on the merits of health care reform weight the benefits of universal health care coverage with the costs associated with providing such coverage. There is particular concern that businesses bear the burden of such policies and may respond by reducing employment or change their decision to stay in business. Much of this discussion has focused on the federal Affordable Care Act which is commonly known as “Obamacare.” The federal program is difficult to study because the policy affected the whole United States making it difficult to determine what would have happened absent the policy, while cross-country analysis is difficult because countries vary so widely in their health care policies and economic environments. An alternative to studying the Affordable Care Act is to study Massachusetts’ health care reform because it only affected Massachusetts providing counterfactual areas. This study examines the effect of mandate-based health care reform in Massachusetts on new, existing and total businesses. As of April 12, 2006, firms with eleven employees or more were required to offer employer health insurance or pay a fine, which can be used as a natural experiment. Using the Dun and Bradstreet data and a difference-in-differences methodology augmented by a border approach which looks at business activity one and ten miles from the Massachusetts state border, we find the reform did distort incentives for new firms. More specifically, we find a shorter term decrease of 1.5% of new businesses activity for firms with 11-24 employees in Massachusetts versus the adjacent border counterfactual area, followed by a longer term increase of 6.1% in businesses with 10 or less employees. We find no evidence of impacts on the survival rate or employment in existing and total business. Overall, our findings suggest that new entrepreneurs are adversely affected but not enough to affect the overall business environment. Instead we find there is movement around the 11 employee cutoff which doesn’t impact the total business activity in Massachusetts. 2 1. Introduction Mandate-based health care reform, particularly related to the federal Affordable Care Act (ACA), has been one of the most hotly debated public policy issues in recent memory. Discussion regarding the merits of mandate-based health care reform often weighs the benefits of expanded coverage with the costs, particularly related to how potentially detrimental such reform is to job and business creation. While the previous literature has focused on the benefits of expanding coverage in the United States (Currie and Gruber, 1996; Finkelstein, 2007; Finkelstein et. al., 2012), this research project will shed light on the costs associated with such policy and in particular, its effect on new business start-ups, existing business survival rates, and their respective employment decisions. Although, the federal ACA has garnered much attention, it is challenging to study because all states are affected concurrently making it difficult to estimate what would have happened absent the program. However, Massachusetts provides a unique opportunity to investigate the impact of mandate-based health care costs on business creation, business survival, and job creation because it only affects one state, as the surrounding areas did not adopt similar policies. Additionally, the Massachusetts reform can offer some insight into the impact of the national health care reform because many of the key features of the Massachusetts legislation were used as a model for national reform. Massachusetts passed reform on April 12, 2006 with the purpose of expanding access to health care for its residents. 1 Reform affected businesses differentially depending on size. Establishments with 11 or more employees were required to provide a cafeteria-style health plan with the ability to use pretax earnings and to make a “reasonable” premium contribution to their 1 There were earlier attempts to institute the mandated-based health care reform however they were repealed due to economic and budgetary concerns as well as turnover of their political leaders. The uncertainly of its passing is cited as support for plausible exogenity. 3 employees’ health care costs. On the other hand, businesses with 10 or fewer employees were exempt from this requirement allowing employees to take responsibility and purchase insurance on the individual insurance market.In order to insure compliance the reform penalizes both employers and individuals, including: $295 “fair share” assessment if employers don’t make a “fair and reasonable” premium contribution and a free-rider surcharge to firms that do not help contribute to employees’ health insurance. Additionally, firms with 11 or more full-time employees that use at least $50,000 in free health care in one year may be responsible for 10 to 100 percent of the costs. Clearly all of these additional costs could affect incentives to hire additional workers as well as affect entrepreneurs’ decisions to locate in Massachusetts. This paper studies the location and employment decisions of new businesses (businesses with one year or less in years of service), the survival or death rate of existing businesses (those with four or more years of service) and their employment decisions, as well as the total effect on all businesses for both employment and number of establishments. Studying business location decisions poses a number of challenges because location/area attributes, in addition to the policy environment, play vital roles in a business’s decision of where to locate. Undoubtedly, many of these attributes are unobserved no matter the extensiveness of one’s data set; therefore we utilize a difference-in-differences methodology in conjunction with a border approach, utilizing the features of the policy to further control for unobserved factors. Specifically, we study new, existing, and total establishment activity (number of firms and employment) along the Massachusetts state border (extending 1 and 10 miles away) before and after Massachusetts’ health care reform. The differencing methodology helps to control for timeinvariant and time-varying area characteristics that affect both the treatment and counterfactual areas the same. 4 By focusing at the border we minimize unobserved heterogeneous area changes between the treatment and counterfactual areas. Additionally, these adjacent counterfactual areas share local labor markets, customer bases, and natural advantages with the adjacent area in Massachusetts, making them an ideal comparison as they are close in geography and agglomeration economies, however after 2006 they differ in their employer mandate for health insurance. Because firms with 10 or less employees are exempt, weestimate the effect on these two groups of businesses separately, providing a “third level” of differencing. This type of analysis requires establishment data with very precise location information as well as information on the establishment’s employment, age, and size which we attain using the Dun and Bradstreet Marketplace (D&B) data set. We measure both shorter-term (1 year) and longer-term (3 year) effects of the health care reform on these organizations. In addition to providing new information on the entrepreneurship landscape in Massachusetts, our study also allows policy makers to draw the best conclusions possibly about the potential future effects of the Affordable Care Act. On October 30, 2013 President Obama stated “Your law was the model for the nation’s law” when addressing Faneuil Hall in Boston, MA. This suggests our findings will provide insight on the potential effects of ACA on entrepreneurship in the United States. Furthermore, the results of this study are even more valuable considering national health care reform is essentially unprecedented and policy makers must rely on existing programs to learn about the potential impact of the ACA. We find that mandate-based health care reform distorts incentives for new businesses affecting their location and employment decisions. Specifically, our results suggest that Massachusetts initially (1 year after the reform) experienced a reduction of 1.5 percent in establishments with 11-24 employees. However, in the longer term (3 years after the reform), 5 we find an increase of 6.1 percent in new businesses with 1-10 employees, suggesting that the law does distort decisions by incentivizing firms to hire fewer workers and open as smaller businesses. We also find the same pattern with the change in employment: there is a decrease of 5.9 percent in the shorter run for new business employment in firm with 11-24 employees and an increase in the longer term of employment of 8.9 percent at businesses with 0-10 employees for new and total establishments. Our analysis indicates little to no effect on existing businesses or “total” (all aged) businesses (which makes sense given existing businesses comprise the majority of all businesses), even for businesses around the cutoff, suggesting perhaps that many existing firms already provided health care for their employees or that the additional costs from the reform were not sufficient to dissuade existing firm from hiring employees above the cutoff or force existing firms to relocate. Additionally, despite the adverse effect on new business formation, the business environment overall (all ages and sizes) in Massachusetts does not seem to be affected. Robustness checks indicate no anticipatory effects of the law change nor differences in trends in the treatment and counterfactual areas. The rest of the paper will be structured with the second section describing the Massachusetts health care reform and existing literature. The third discusses data and methodology, while the fourth section presents the results and robustness checks and is followed by a brief conclusion. 2. Massachusetts’ Mandate-based Health Care Reform In 2005, Massachusetts had the highest per capita health care spending of any state in the nation, with spending 30% higher than the national average, and over 8% of their population not 6 covered by any type of health insurance. 2 As a result, in 2006, Massachusetts adopted An Act Providing Access to Affordable, Quality, Accountable Health Care, otherwise known as, the Massachusetts Health Care Reform Act (MHCRA). While the act introduced widespread reform throughout the Massachusetts health care market with aims to increase their insured population, the two biggest changes were the individual and firm mandates. The individual mandate required all adults to either pay a financial penalty or buy health insurance, however, households with income below 300% of the federal poverty line were eligible for subsidies to help pay for their coverage. In addition, Medicaid was expanded to cover more low income children and adults. The employer provision mandated all employers with at least 11 employees provide coverage or else face a fine, while firms with 10 or less employees were exempt from the provision or contribution to employee health insurance. The effects of MHCRA have been studied across many different outcomes including rates of uninsured (Kolstad and Kowalski, 2012; Long, 2008), adverse selection (Hackmann, Kolstad, and Kowalski, 2014), health care use and health (Kolstad and Kowalski, 2012; Miller, 2012), wage compensation (Kolstad and Kowalski, 2014), and financial distress (Mazumder and Miller, 2014). However, the focus of this paper is how the MHCRA impacted business location decisions, including where new businesses/entrepreneurs locate, whether survival/death rates of existing firms are affected, and employment in both new and existing businesses. The MHCRA mandated all businesses with 11 or more employees had to either pay a maximum per employee fine of $295 or offer a health insurance plan in which employees can buy into it with pre-tax dollars. (They also have to contribute some of the costs of the health insurance premiums or pay a free rider surcharge). 2 The District of Columbia had the highest per-capita spending at $8,644, while Massachusetts spending was the highest of any state at $7,436 and the national average was $5,726. http://kff.org/other/state-indicator/healthspending-per-capita/. Authors calculation of 30% change from (7,436-5,726)/5,726. 7 The way the law is structured provides a natural experiment to compare the behavior of firms. Our methodology will compare businesses on either side of the Massachusetts border with business with less than 11 employees, those exempt from MHCRA mandates, and those with 11 or more employees which had to comply with the health insurance reform. We can test whether the MHCRA makes doing business in Massachusetts less attractive and results in businesses choosing to locate on the other side of the border, which allows them to retain the same labor pool and access to any natural advantages, while at the same time avoiding the expensive cost of providing health insurance to their employees (or paying a fine). In addition to providing new information on the entrepreneurship landscape in Massachusetts, this study also allows us to draw the best conclusions possible about the potential future effects of the Affordable Care Act (ACA). While there are similarities and differences between the Massachusetts Health Reform and Affordable Care Act, on October 30, 2013 President Obama stated “Your law was the model for the nation’s law” when addressing Faneuil Hall in Boston, MA. Suggesting that our findings from the Massachusetts health care reform will provide insight on the potential effects of ACA on entrepreneurship in the U.S. and is particularly helpful given national health care reform is essentially unprecedented and as a result, we must learn as much from existing programs to help shape our ideas of what the ACA will do for entrepreneurship in the U.S. While there are many similarities between the Massachusetts Health Care Reform and the Affordable Care Act, including but not limited to the individual mandate, expansion of Medicaid, employer rules, state-based exchanges, and subsidies available to low income families, there are many key differences as well. The most relevant to our study is that the ACA only puts requirements on employers with 50 or more employees, while the MHCA mandates all firms 8 with 11 or more employees pay a fee or provide health insurance to its’ employees. In addition, the MHCA only affected one state, which allowed entrepreneurs to avoid the policy by locating on the other side of the state border, while for the ACA companies cannot avoid the policy by locating in an alternate part of the United States. The size of the ACA will obviously be much larger as it affects 50 different and diverse states and the entire United States population. Other differences include but are not limited to the income requirement to be eligible for a subsidy to help pay for insurance, the Medicaid expansion policy, and the requirement of co-pays for preventative care services which was allowed by Mass Care Reform but not by ACA standards. Massachusetts will have to make several changes to their existing health insurance program because some of the Affordable Care Act statutes either contradict or are inconsistent with the current regulations in place in Massachusetts (for instance the population eligible to receive a subsidy is less generous under the Massachusetts law compared to the national law). As a result, we use third quarter 2009 as our latest data because the results using any data after that time period would be confounded by potential business decisions in response to the ACA implementation rather than just the MHCA. 3. Data and Empirical Methodology 3.1 Establishment Data To separately study new and existing establishments across different employment sizes, we need an establishment dataset that has information on the location, size and age of the business. Our source for establishment data comes from the Dun and Bradstreet (D&B) Marketplace database, which includes the ZIP code where the businesses reside, their employment, years of service, some information on their sales and their two-digit standard 9 industrial code (SIC). New businesses are defined as having 1 year or less of service, while existing establishments are defined as having 4 or more years of service. Because the law was adopted on April 12, 2006 with the latest effective date for several of the provisions being July 1, 2007, we use 2005 3rd quarter D&B as our pre-period data, and 2007 3rd quarter D&B data to get a sense of the immediate response to the policy and 2009 3rd quarter data for a more longer-term effect. We stop at 2009 3rd quarter because uncertainty from the federal mandate-based health care program likely starts to affect entrepreneurs’ decisions as early as 2010 and we do not want to confound our results. Additionally, as a robustness check we run the analysis before the policy in 2006 therefore uses data from 2002 to 2005 to see if there are any pre-existing trends. The border approach requires comparing two adjacent areas on opposite sides of the state border. Difficulty occurs because ZIP codes are often highly irregularly shaped and in some cases, such as large firms or schools, can be as small as a parcel of land. Although comparing differently shaped areas is not necessarily a problem due to our methodology that differences over time, ideally these adjacent areas would be somewhat similarly shaped particularly with respect to their distance from the border. We use geographic information systems (GIS) software to create 1 and 10 mile buffer zones segments along the Massachusetts border. 3 The analysis for the 1 mile border area has the sharpest identification because we are comparing business activity that are most similar in levels and trends given that they are a mile away however, leaves the reader to wonder whether these results are generalizable to the rest of the state. Therefore, we also study firms that are 10 miles on either side of the border, which provide a better understanding of how generalizable our results are to the rest of the state. 3 Our results are robust to alternative geographical specifications, including for instance matched ZIP codes, which are available upon request from the authors. 10 The GIS process entails creating the buffer zones on each side of the Massachusetts border and then overlaying a 20-by-20 mile square grid to “cut” the 1 and 10 mile buffers. This process which can be seen in Figure 1 creates border-area pairs along the Massachusetts state border and creates pairs of “border areas” along the state line. We then assign the business activity in ZIP codes to the border areas that they intersect. In the case where a ZIP code intersects more than one border area on their respective side then we assign all the business activity to the border area with the greatest degree of overlap. 4 For more information on the creation of the border-area pairs, see Rohlin (2011) or Rohlin, Rosenthal, & Ross (2014). 3.2 Differencing Methodology at the Border To identify the causal effect of Massachusetts’ mandate-based health care reform on businesses we will need to overcome a number of estimation concerns including accounting for observed and unobserved time-varying and time-invariant area characteristics, determining the optimal counterfactual areas, and accounting for other business-related state policies that simultaneously occurred with the health care policy. Determinants of business location and employment decisions, such as local area characteristics can be organized into three types: time-invariant determinants, time-varying determinants that affect all areas the same and area-specific determinants that change over time. To control for these determinants we utilize a difference-in-differences methodology, which has often been done in the policy evaluation literature, in conjunction with a border approach. Specifically, we estimate changes in/to new and existing business activity before and after the adoption of the health care policy in Massachusetts and compare them to changes in 4 We also tried assigning a proportional amount of the business activity to each border area, meaning if a ZIP code had 10 businesses and was 40% in one border area and 60% in another then we would assume a uniform distribution of businesses and assign 4 businesses and 6 businesses to their respective border areas. Our findings are robust to this approach and are available from the authors upon request. 11 counterfactual areas. This differencing methodology eliminates any time-invariant additively separable confounding determinants but not time-varying factors. To minimize potential bias due to time-varying area characteristics as well as to aid us in choosing ideal counterfactual areas we employ a border approach which focuses the analysis to areas along the Massachusetts border. Comparing adjacent areas on opposite sides of the state border over relatively short distances (1 and 10 miles) maximizes the potential for time-varying factors to affect both the treatment and counterfactual areas which is accounted for by the differencing methodology. When studying business location decisions the border approach is particularly helpful because it allows the treatment and counterfactual areas to have the same customer and labor markets which play vital roles in the decision of where to locate. Additionally, another business determinant that is accounted for using this approach is area natural advantages which also have been known to affect business location decisions. The border approach also minimizes unobserved heterogeneous area-specific factors that only affect one side of the border-area pair by relying on the fact that the spatial correlation of area characteristics, such as changes in the robustness of the local economy, do not change as one moves across state lines. Lastly, if businesses were to “hop” over to the non-Mass side of the border then our counterfactual area are in effect being positively affected by the policy. We view this as a potential strength as it provides us with an upper bound estimate which can be helpful for policy recommendations. We run the difference-in-differences regression provided in equation 1 where ∆Yits is the change (1 or 3 year) in business activity (number of new, existing, and total establishments or employment in those establishments) in border-area, s, in industry, i, in time period t. The parameter β1 accounts for differences between border areas in Massachusetts and non- 12 Massachusetts and controls for any time-invariant factors, while β2 is an after time-period dummy (2007 and 2009 in shorter- and longer-term estimates, respectively) which accounts for any differences in time periods that affected both border-areas. The parameter, β3, is the parameter of interest and measures the effect on businesses in Massachusetts after the reform. Finally, PairFE and IndFE indicate the regression includes border-area pair as well as 2-digit SIC fixed effects. ∆𝑌𝑌𝑖𝑖𝑖𝑖𝑖𝑖 = 𝛽𝛽1 (𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀)𝑠𝑠 + 𝛽𝛽2 (𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴)𝑡𝑡 + 𝛽𝛽3 (𝑀𝑀𝑀𝑀𝑀𝑀𝑀𝑀 × 𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝑟𝑟)𝑖𝑖𝑖𝑖 + 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑝𝑝 + 𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝑖𝑖 + 𝜀𝜀𝑖𝑖𝑖𝑖𝑖𝑖 (1) Despite our approach there could be residual concerns over unobserved heterogeneous Massachusetts-specific time-varying factors confounding our estimates, therefore, we utilize a feature of the health care policy: it only applies to businesses with 11 or more businesses. By separately measuring the effect of the health care policy on businesses with less than 10 employees, who are not directly affected by the policy and on businesses with 11 or more employees, who are influenced by the policy, we can better account for any time-varying factors specific to Massachusetts. 5 Additionally, separately studying businesses by employee size helps in addressing the concern of other state policies as long as they do not disparately affect businesses at the same size cutoff. Our research of other Massachusetts policies during this time period found only one other substantive business-related state policy. In 2006, Massachusetts voted to increase their minimum wage with a two year phase in period for a final new minimum wage of $8.00 with an effective date of January 1, 2008. 6 This minimum wage policy makes it difficult to separately identify the effect it has on entrepreneurs from the health care policy’s impact however, because 5 Businesses with 10 or less employees in Massachusetts could be influenced by the policy if they hope to hire more employees in the future. The results later in the paper will shed some light on this. 6 In 2006 Massachusetts had a minimum wage of $6.75, while the surrounding states had minimum wages of $7.40 in Connecticut, $5.15 in New Hampshire, $6.75 in New York, $6.75 in Rhode Island, and finally $7.25 in Vermont. 13 the minimum wage affects all businesses and does not have a cutoff similar to the health care policy by analyzing the effect on businesses around the health care cutoff we can account for the other Massachusetts policies that occurred at that time. 7 Lastly, difference-in-differences methodology relies on the assumption that both treatment and control areas are trending in similar ways. Although, we use the border approach to mitigate this concern, we explicitly test for trends by running our specification before the policy occurred, using 2002 and 2005 as our pre- and post-periods, respectively. 4. Results 4.1 Establishments The estimates of the effect of the Massachusetts health care reform on the number of new (Panel A), existing (Panel B), and total (all aged) establishments (Panel C) are shown in Table 1. The table shows estimates of the law change in the shorter term (2005-2007) in the first three columns and in the longer term (2005 -2009) in columns 4 to 6. Because the health care reform mandate is directly affecting businesses with 11 or more employees, the analysis is separately conducted to show the effects of the reform on businesses with 0-10 employees (exempt from the reform), and businesses with 11 or more employees (treated by the law change). However, due to the possibility of the reform being particularly costly to firms around the cutoff we analyze businesses with 11-24 employees, as well as for firms with 11+ employees. Tables 1 through 9 focus the analysis on border areas that extend 1 mile into the interior while appendix tables 1 through 4 provide the corresponding results for border areas up to 10 miles into the interior. The 0 to 1 mile analysis provides the best areas in terms of identification by minimizing 7 There is evidence in the minimum wage literature that smaller businesses are particularly sensitive to minimum wage changes (see Rohlin 2011) 14 heterogeneous area-specific changes while the 0 to 10 mile analysis provides insight into how generalizable are the results for the rest of Massachusetts. Results are robust across border size. 8 The first three columns of Panel A in Table 1 displays the estimates for the shorter term (2005 to 2007) effect of the law change on number of new (1 year or less years of service) establishments, which essentially measures the birth of firms before and after the law change. To begin we will look at the 1-10 employee businesses that are exempt from the health care reform but may be influenced by the policy if they hope to increase their employment size above 10 employees in the future. The negative estimate (of -0.191) for the “MASS” variable indicates that Massachusetts has less new businesses (establishment births) relative to neighboring areas on the other side of the state border, however it is not statistically different from zero. The statistically significant positive effect (0.191) on “AFTER” shows that the business environment has improved in general in 2007 compared to 2005. The effect of the law change is the interaction between being in Massachusetts and being after the reform for firms with 1 to 10 employees. The effect is relatively small (-0.024) and statistically insignificant suggesting that small new businesses were not strongly deterred from starting their business in Massachusetts immediately after the reform. Moving to the second column of Panel A of Table 1 examines the effect of the health care reform on employers (those with 11-24 employees) who must now offer health care benefits to their employees because of the reform. We find that being in Massachusetts after the health care reform deters new businesses from locating in that area with a decrease of 0.023 new businesses, statistically significant at the 5% level suggesting that businesses near the cutoff either do not locate in Massachusetts or chose to remain small by having few employees. To 8 Additionally, analysis of the 0 to 5 mile border areas produced similar results as the 0 to 1 and 0 to 10 analysis. Although these results are not shown in the paper they are available upon request. 15 determine the extent of this deterrent effect on firms with 11 or more employees column 3 of Panel A shows the results for all firms with 11 or more employees. We find a smaller (-0.002) and insignificant effect for all firms with more than 11 employees, which may not be surprising considering that large businesses will likely never be under 11 employees and highlights the importance of separately estimating the effect of the number of businesses with 11-24 employees. Columns 4-6 of Panel A estimate the longer term (2005 to 2009) effect of the Massachusetts health care reform on businesses by the same size classifications (1-10, 11-24, 11+) as the shorter term classifications. We see that while all of the longer term effects are statistically insignificant, the effect on 1-10 employees becomes positive with a large magnitude, showing that there is an increase of 0.159 new small firms, although not statistically different from zero. This could be evidence of new firms that were already planning to be relatively small (say less than 20 employees) making a conscientious choice to only hire 10 or less employees to be exempt from the employer mandate. The effect on 11-24 employee firms is still negative but is essentially zero, while the 11+ effect is positive but essentially zero. The longer-term effect seems to be that by 2009 new firms decide to hire less than 11 employees in response to the law change. Panel B examines the effects of existing businesses to measure whether the health care reform is affecting survival or death rates of businesses in Massachusetts. Overall, the interaction term in Panel B of Table 1 does not indicate the health care reform drove existing businesses out of the state or caused them to shutdown relative to the counterfactual areas regardless of the employment size. We find a positive statistically insignificant effect of 0.095 firms for 0-10 employee firms, in addition to finding almost zero estimates for 11-24 firms 16 (0.009) and 11+ firms (0.008) both of which are imprecisely estimated. The longer term findings support the idea that existing businesses did not have disparate closure rates. Results shown in Panel C of Table 1 combine the business activity of new and existing establishments to investigate the reform’s impact on businesses for all businesses regardless of their years of service. We find a larger positive effect for small business (0-10) and small negative effect on firms with 11 to 24 employees in the short term however both are imprecisely estimated. In the longer term there are much larger estimates compared to new and existing establishments but again without precision. However, it is very difficult to interpret the size of these changes in establishments due to our border approach. Therefore, as is more typical in this literature, we move on to estimates of the percent change in the number of establishments. Table 2 has the identical table structure as Table 1 but instead a natural log transformation of the dependent variable has occurred making the interpretation of the coefficients the percent change. Focusing on the difference-in-differences interaction term for new establishments, small firm (1-10 employees) have a positive 1.2 percent estimate, however it is not distinguishable from zero. For the businesses facing potential increased health care costs or fines (11-24), the interaction term shows a decrease in new businesses in Massachusetts after the law change of 1.5%, statistically significant at the 5%. For the longer term effects, there is an additional 6% increase in small businesses, statistically significant at the 1% level, providing evidence that entrepreneurs who plan to operate small businesses still locate in Massachusetts however they purposefully hired less than 11 employees in response to the health care reform. Together these results provide evidence that around the cutoff new businesses are purposefully employing fewer workers to stay under the cutoff. There continues to be no evidence of broad losses of new entrepreneurs for all businesses larger than 11 employees. 17 Moving to existing establishments, Panel B suggests that the new health care reform has not caused firms 4 years or older to have higher closure or relocation rates in either time period. If firms already offer health care benefits to their employees after they are in business for a few years then that may explain the lack of response by businesses with 4 or more years of service. For total establishments, results suggest that businesses were not affected by the reform one year after adoption but were more responsive to the policy by 2009. Specifically, firms with 11 or more employees experienced a relative 7 percent decline in the number of total firms suggesting that the law change may have been detrimental to the businesses activity in Massachusetts. However, as we will discuss later in the paper this detrimental effect seems to be concentrated in the 0 to 1 mile border areas and as we move further away from the border this effect dissipates. Also, it should be noted that the only positive coefficient for the interaction term in the total results was in the 1 to 10 employee sized firms with a 6.63 percent, although barely statistically insignificant. Table 2 provides evidence of two trends: first new businesses in Massachusetts after the law change purposefully choose less than 11 employees to avoid the law change and second total businesses with 11 or more employees choose to locate on the other side of the border. Both cases provide evidence that the law change did deter new business activity in Massachusetts in the 0 to 1 mile border region. 4.2 Employment The effect of the Massachusetts health care reform on businesses in Massachusetts can not only affect the extensive margin of whether or not a firm opens or closes but also the intensive margin of the number of employees they hire. Table 4 estimates equation (1) using employment as the dependent variable and it set up in a similar fashion as Table 2. Panel A shows that there is a decrease of 0.38 employees at new firms with employees with 11 to 24 18 employees, statistically significant at the 5% level. Existing establishments continue to exhibit little evidence of deterrent effects from the reform in either the number of firms as well as their employment decisions. For total establishments, the coefficients on the interaction term between Massachusetts and being after the law change for the treated firms (11-24 and 11+) show imprecisely estimated negative effects, suggesting that the firms on the opposite side of the border hired more employees. Again these effects are very hard to interpret the magnitude, so we turn our analysis to the percent change in employment for firms. Table 4 estimates the percent change in employment in all industries. Consistent with the patterns for establishments shown in Table 2, we see that for new firms there is an almost 6% decrease in employment at firms with 11-24 employees in Massachusetts after the law change, statistically significant at the 5% and that in the longer-term there is an increase in employment of 9% for small firms with less than 11 employees. These results are consistent with the results and patterns seen for establishments shown in Table 2 where we found that there was a shorterterm loss in firms with 11-24 employees and a longer-term gain in small firms with less than 11 employees. Similar to the firm results, we do not find many employment effects at existing establishments. For total establishments, there is an approximately a 9% increase in employment at small firms and a decrease in employment of 20% for firms with 11 or more employees. Similar to the firm results, we will demonstrate that this negative effect is concentrated at the 0 to 1 mile border region. Table 4 again provides evidence that there are adverse entrepreneurial effects from the Massachusetts health care reform. Industry Results 19 Tables 2-5 provide results for all industries, however it is possible that some industries are effected more than others. For instance, a priori we would expect export industries, such as manufacturing, to respond differently than service industries which rely on a customer and employment base. The changes in the number of establishments (Table 5) and employment (Table 6) in the following industries: manufacturing, retail, service, and wholesale. For parsimony, we only show the estimate for the interaction term between being in Massachusetts and after law change. Panel A of Table 5 again shows new establishments and we find an increase of 3.01 percent in number of firms in manufacturing with less than 11 employees, with the effect getting slightly larger in the long-run with both having some statistical significance. It seems the loss of new businesses with 11 to 24 employees in the shorter-term is in the service and wholesale industries with losses of 3.79 percent and 13.6 percent respectively. The longerterm growth in firms with only 1 to 10 employees is driven by the manufacturing and service industries with growth rates of 3.9 percent and 11 percent respectively. The existing establishment results by industry support the findings for all industries that existing firms were not affected by the reform with the exception of the manufacturing industry with 1 to 10 employees in the shorter-term with an estimated loss of 4.37 percent. The total results suggest that the service industry is particularly sensitive to the health care changes with a 7 percent loss of 11 to 24 employee firms in the shorter term. The longer term results show a growth in small sized service firms (1 to 10) of 13.2 percent and a loss of -12.7 percent of firms with 11 plus employees. Table 6 shows the employment effects across industries and show firms were more responsive in their employment decisions than their decisions to stay in business. The evidence suggests that retail, wholesale and particularly the services changed their employment decisions 20 due to the reform. This seems reasonable given the fact that these industries are the least likely to have provided health care benefits to their employees before the reform. 4.3 Placebo Test A weakness of the difference-in-differences approach is the reliance on the assumption of similar pre-trends. Although the border approach attempts to use control areas that are trending most similarly, we can also explicitly test for this by estimating the effect of the reform before the law was enacted. Table 7 presents the placebo effects for establishments and employment between 2002 and 2005. The first three columns display the effect on firm location decisions while the last three columns show the effect on their employment decisions. None of the results are statistically significant and many are small in magnitude suggesting Massachusetts border areas were not trending differently compared to their adjacent control areas prior to the reform. Additionally, most of the estimates on the interaction term for 11-24 employees are actually small and positive rather than the negative effects we measured for the actual law change. 4.4 Effects for 0-10 borders Although the 0 to 1 mile border region offers treatment and control areas that are most similar it leaves one wondering what about areas further away from the border. Therefore, we present the results for 0 to 10 mile border pairs with Table A-1 and A-2 showing the change and percent change in the number of establishments while Table A-3 and A4 showing the change and percent change in the employment in those firms. Overall, the two tables show a consistent story with those from Tables 1 to 4 in that we see a negative effect on new establishments among treated firms with 11-24 employees. However, an important finding from Table A-2 is that the negative effect on total firms in the longer term for businesses with 11 plus employees dissipates. Instead of a statistically significant -0.0705 in the 0 to 1 border region we have an imprecisely 21 estimated -0.036 for the 0 to 10 border region. 9 This suggests that the negative effect on firm location decision for total firms with 11 plus employees is concentrated in 0 to 1 mile border region. However, the employment effect on 11 plus employees is relatively supportive of the finding that employment in 11 or more employee firms was negatively affected. Table A-4 shows that for all-aged firm results in the longer term for 11 plus employees a loss of 11.8 percent and losing its statistical significance compared to the 0 to 1 mile border results in Table 1 of 19.6 percent. However, the shorter term employment estimate in Table A-4 for 11 plus employees for all-aged establishments is higher in the 0 to 10 mile border results, -15.7 percent (statistically significant) than the 0 to 1 mile border estimate of -9.9 percent (not statistically significant). Taken as a whole, the 0 to 10 mile border results support the findings new businesses were hurt by the reform in the shorter term and that employment decisions were negatively affected for firms with 11 or more employees while the location decisions of firm with 11 or more employees may only be affected for near the state border. 4.5 How Does this Movement Around the Cutoff Affect the Overall Business Environment? The results presented so far suggest that the Massachusetts health care reform increased new establishments that were considered to be small (0-10 employees) in the longer term while causing a shorter term decrease in the new businesses with 11-24 employees. Additionally, there is evidence that employment in larger (11 or more employees) firms were negatively affected in the longer term. This leads to questions about whether Massachusetts economy overall was affected by these distortions. Therefore, Tables 8 and 9 present the results for number of firms and employment, respectively, when all firms are pooled together in Massachusetts compared to 9 In results not shown, the 0 to 5 mile border region also indicates little to no effect on total firms with 11 plus employees in the longer term with an imprecisely estimated -0.0354. 22 neighboring areas to determine the total effect on firms for new establishments (panel A), existing establishments (panel B), and total establishments (panel C). By using the border analysis, we are finding the upper bound effect because its possible businesses that would have opened in Massachusetts will instead locate on the other side of the border, which decreases Massachusetts and increases the other side of the border (the counterfactual). Since we don’t find an effect, it gives more strength to the argument that the Massachusetts health care program did not have as much of a negative impact as was initially feared. The first and third columns gives the change in the number of establishments (matches to Table 1) in the shorter and longer term, while the second and fourth columns estimate the percent change in establishments (comparison to Table 2). Overall, there are no statistically significant interaction terms for all three types of firms in Table 8. The point estimates are actually positive for new firms while negative for existing and all aged firms. Ignoring statistical significance for a moment, the percent change estimates for the all-aged estimates suggest that massachussets decreased 9.8 percent and 15.5 percent in the shorter and longer term which would suggest that Massachusetts was much worse off after the policy. However, these estimates are quite imprecise and this type of analysis suffers from bias resulting from other state policy changes. A specific policy to be worried about would be that Massachusetts also increased their minimum wage during this time period so the results shown in Tables 8 and 9 are including the minimum wage effect. Nonetheless, our take away from this analysis is that there is little evidence of an effect of the health care reform on the overall business environment. Employment, none of the interaction terms are statistically significant. Best guess is that the percent changes are negative for everything except for the shorter term change for new 23 establishments, showing evidence that our best guess is the negative effect for firms with 11 or more employees outweighs the growth in employment for smaller firms. Conclusion To understand the full economic impact of the Massachusetts Healthcare Reform, it is important to not only weight the benefits, such as increased insured population and increased health outcomes, but also consider potential costs, including those on the entrepreneurship activity in Massachusetts. The healthcare reform instituted near universal coverage by including an individual mandate and also mandated all businesses with more than eleven employees provide health insurance for their employees. This provides a unique quasi-experiment to investigate whether the business mandate decreased establishments and employment in Massachusetts, as opposing policy makers feared. This paper measures the effect of Massachusetts healthcare reform on new, existing, and total entrepreneurship activity by using a difference-in-differences methodology augmented by a border approach, which allows us to control for time-invariant characteristics among other things. We find that the law change decreased establishments and employment among firms with 11-24 employees for which the firm mandate was binding, and increased establishments and employment for businesses with 0-10 employees which were protected from the law change. We find this as evidence that the healthcare reform did distort the decisions of entrepreneurs by encouraging them to open smaller businesses with fewer employees than they likely otherwise would have. However, when considering total employment we do not find big decreases in establishments or employment as had once been fears. 24 This paper gives new evidence on the cost side of the Massachusetts healthcare reform to be considered with the previous literature that measured the benefits to the population of Massachusetts. In addition, as President Obama has repeatedly stated that the federal Affordable Care Act was modeled after Massachusetts healthcare reform, meaning that our paper gives insight into potential costs of the federal healthcare reform. While it will be many years until we know the entrepreneurial costs of federal healthcare reform, in the meantime our paper provides suggestive and helpful evidence on the potential effects of healthcare reform on business activity in the United States. 25 References Courtemanche, Charles and Daniela Zapata. 2014. “Does Universal Coverage Improve Health? The Massachusetts Experience.” NBER Working Paper #17893. Currie, Janet and Jonathan Gruber. 1996. “Health Insurance Eligibility, Utilization of Medical care, and Child Health.” The Quarterly Journal of Economics, 111 (2):431-366. Finkelstein, Amy. “The Aggregate Effects of Health Insurance: Evidence from the Introduction of Medicare.” The Quarterly Journal of Economics, 122(1); 1-37. Finkelstein, Amy, Taubman, Sarah, Wright, Bill, Bernstein, Mira, Gruber, Jonathan, Newhouse, Joseph, Allen, Heidi, Baicker, Katherine, and the Oregon Health Study Group. 2012 “The Oregon Health Insurance Experiment: Evidence from the First year.” The Quarterly Journal of Economics, 127(3): 1057-1106. Hackmann, Martin, Kolstad, Jonathan, and Amanda Kowalski. 2012. “Health Reform, Health Insurance, and Selection: Estimating Selection into Health Insurance Using the Massachusetts Health Reform” American Economic Review: Papers & Proceedings May 2012. Vol. 102, No. 3: 498-501. Kaiser foundation an update 6 years later Kolstad, Jonathon and Amanda Kowalski. 2012. “The Impact of Health Care Reform on Hospital and Preventive Care: Evidence from Massachusetts” Journal of Public Economics. December Vol. 96. 909-929. Kolstad, Jonathon and Amanda Kowalski. 2014 “Mandate-Based Health Reform and the Labor Market: Evidence from the Massachusetts Reform” NBER Working Paper 17933. Latest Version: January 2014. Long, Sharon. 2008. “On the road to universal coverage: impacts of reform in Massachusetts at one year. Health Affairs, 27(4):270->>. Mazumder, Bhashkar and Sarah Miller. 2014. “The Effects of the Massachusetts Health Care Reform on Financial Distress”. FRB of Chicago working paper 2014-01. Miller, Sarah. 2012. “The Impact of the Massachusetts Health Care Reform on Health Care Use among Children”. American Economic Review, 102(3):502-07. Scott 2009 26 27 Figure 1: Example of the Geographic Information Systems software. 28 TABLE 1- The Change in the Number of Establishments in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile MASS x AFTER AFTER MASS Observations Longer term (2005 to 2009) Shorter term (2005 to 2007) # of Employees # of Employees 1 to 10 11 to 24 11+ 1 to 10 11 to 24 11+ (1) (2) (3) (4) (5) (6) Panel A: New Establishments -0.0210 -0.0234** -0.00233 0.159 -0.00264 0.00510 (0.0681) (0.0103) (0.0110) (0.149) (0.00848) (0.0179) 0.191*** 0.0125 -0.00609 0.503*** -0.0124 -0.0249 (0.0673) (0.00958) (0.0108) (0.134) (0.00781) (0.0175) -0.191 0.00211 -0.00642 -0.177 0.000231 -0.00885 (0.173) (0.0132) (0.0225) (0.179) (0.0129) (0.0219) 7,672 4,517 4,913 7,468 3,928 4,337 Panel B: Existing Establishments MASS x AFTER AFTER MASS Observations 0.0952 (0.576) 0.00982 (0.103) 0.00869 (0.166) 0.925 (1.975) 0.0480 (0.0685) 0.0598 (0.0966) -1.158** -0.0710 -0.0936 6.843*** 0.171** 0.236** (0.557) -0.249 (4.877) 7,901 (0.0999) -0.298 (0.912) 7,372 (0.157) -0.481 (1.401) 7,372 (1.717) -0.0173 (5.137) 7,514 (0.0641) -0.294 (0.938) 7,208 (0.0990) -0.480 (1.440) 7,208 Panel C: Total (All Aged Firm) Establishments MASS x AFTER AFTER MASS Observations 0.239 (0.513) -0.0265 (0.120) -0.0384 (0.208) 0.885 (2.012) -0.128 (0.0979) -0.254 (0.175) -1.138** -0.0430 -0.0547 7.493*** 0.337*** 0.539*** (0.492) -1.216 (5.287) 7,753 (0.116) -0.170 (0.952) 7,245 (0.199) -0.173 (1.398) 7,404 (1.846) -1.077 (5.411) 7,637 (0.0965) -0.171 (0.966) 7,138 (0.178) -0.195 (1.428) 7,287 29 TABLE 2- The Percent Change of Establishments in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile MASS x AFTER AFTER MASS Observations Longer term (2005 to 2009) # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments 0.0122 (0.0143) -0.0150** (0.00646) -0.00284 (0.00675) 0.0618*** (0.0208) -0.00347 (0.00559) 0.000403 (0.00927) 0.0494*** 0.00833 -0.00261 0.100*** -0.00574 -0.0135 (0.0127) -0.0468 (0.0442) 7672 (0.00616) 0.00287 (0.00745) 4517 (0.00635) -0.00158 (0.0129) 4913 (0.0217) -0.0452 (0.0441) 7468 (0.00414) 0.00157 (0.00729) 3928 (0.00878) -0.00299 (0.0124) 4337 Panel B: Existing Establishments MASS x AFTER -0.0253 (0.0229) -0.00843 (0.0166) -0.0167 (0.0220) 0.00198 (0.0395) 0.0142 (0.0170) 0.00757 (0.0215) AFTER -0.0329 0.00130 0.00703 0.183*** 0.0204 0.0278 (0.0222) 0.143 (0.139) 7901 (0.0158) 0.0390 (0.101) 7372 (0.0207) 0.0544 (0.120) 7372 (0.0360) 0.157 (0.141) 7514 (0.0155) 0.0346 (0.103) 7208 (0.0203) 0.0486 (0.123) 7208 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER -0.00432 (0.0194) -0.0176 (0.0212) -0.0313 (0.0279) 0.0663 (0.0392) -0.0382 (0.0260) -0.0705* (0.0395) AFTER -0.0428** 0.00915 0.0208 0.129*** 0.0714** 0.105** (0.0167) 0.0649 (0.136) 7753 (0.0206) 0.0778 (0.104) 7245 (0.0272) 0.126 (0.121) 7404 (0.0407) 0.0460 (0.137) 7637 (0.0278) 0.0721 (0.106) 7138 (0.0418) 0.120 (0.124) 7287 MASS Observations 30 TABLE 3- The Change in the Employment in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments Longer term (2005 to 2009) # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) MASS x AFTER -0.0349 (0.114) -0.376** (0.141) 0.463 (0.412) 0.279 (0.294) -0.0665 (0.107) 0.361 (0.707) AFTER 0.242** 0.173 -0.638 0.826*** -0.173 -0.756 (0.101) -0.304 (0.320) 7,672 (0.139) 0.0883 (0.168) 4,517 (0.393) -0.347 (0.647) 4,913 (0.257) -0.276 (0.335) 7,468 (0.108) 0.0536 (0.166) 3,928 (0.618) -0.421 (0.631) 4,337 MASS Observations Panel B: Existing Establishments MASS x AFTER 0.174 (1.445) 0.00982 (0.103) 0.0686 (4.156) 2.275 (4.221) 0.0480 (0.0685) 1.662 (2.342) AFTER -2.608* -0.0710 -1.855 13.89*** 0.171** 5.018* (1.439) -1.310 (14.30) 7,901 (0.0999) -0.298 (0.912) 7,372 (3.824) -13.46 (34.33) 7,372 (3.700) -0.745 (14.91) 7,514 (0.0641) -0.294 (0.938) 7,208 (2.476) -13.45 (35.25) 7,208 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER AFTER MASS Observations 0.946 (1.399) -0.326 (1.801) -0.676 (5.253) 0.885 (2.012) -1.841 (1.429) -6.267 (4.375) -3.181** -0.671 -1.292 7.493*** 4.694*** 12.75*** (1.383) -3.938 (15.36) 7,753 (1.778) -2.185 (13.66) 7,245 (4.946) -5.781 (34.33) 7,404 (1.846) -1.077 (5.411) 7,637 (1.422) -2.224 (13.85) 7,138 (4.482) -6.444 (35.05) 7,287 31 TABLE 4- The Percent Change in the Employment in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile MASS x AFTER AFTER MASS Observations Longer term (2005 to 2009) # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments 0.0167 (0.0175) -0.0589** (0.0235) -0.00327 (0.0290) 0.0894*** (0.0295) -0.0183 (0.0216) 0.00127 (0.0389) 0.0526*** 0.0330 -0.0188 0.119*** -0.0156 -0.0551 (0.0142) -0.0549 (0.0563) 7672 (0.0235) 0.0178 (0.0241) 4517 (0.0260) -0.00442 (0.0520) 4913 (0.0277) -0.0521 (0.0562) 7468 (0.0154) 0.0123 (0.0235) 3928 (0.0357) -0.0103 (0.0501) 4337 Panel B: Existing Establishments MASS x AFTER -0.0380 (0.0350) -0.0160 (0.0444) -0.0666 (0.0606) -0.000978 (0.0547) 0.0458 (0.0460) 0.00102 (0.0572) AFTER -0.0324 0.00581 0.0343 0.186*** 0.0318 0.0646 (0.0339) 0.203 (0.172) 7901 (0.0413) 0.108 (0.194) 7372 (0.0565) 0.175 (0.241) 7372 (0.0503) 0.220 (0.174) 7514 (0.0377) 0.0928 (0.199) 7208 (0.0501) 0.158 (0.247) 7208 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER -0.00227 (0.0258) -0.0381 (0.0569) -0.0993 (0.0758) 0.0880* (0.0516) -0.0835 (0.0681) -0.196* (0.103) AFTER -0.0590** 0.0251 0.0677 0.107* 0.158** 0.264** (0.0225) 0.102 (0.166) 7753 (0.0559) 0.204 (0.203) 7245 (0.0746) 0.354 (0.252) 7404 (0.0524) 0.0735 (0.167) 7637 (0.0722) 0.186 (0.206) 7138 (0.109) 0.339 (0.257) 7287 MASS Observations 32 TABLE 5- The Percent Change in Establishments Across Different Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile Only MASS x AFTER coefficients are Presented Longer term (2005 to 2009) # of Employees Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ 1 to 10 11 to 24 11+ (1) (2) (3) (4) (5) (6) Panel A: New Establishments Manufacturing Retail Service Wholesale 0.0301* (0.0167) -0.00637 (0.0113) -0.00704 (0.00994) 0.0390** (0.0171) -0.00383 (0.0131) -0.0195 (0.0143) 0.0115 -0.0497 -0.0364 0.0475 -0.0194 -0.00592 (0.0429) (0.0291) (0.0229) (0.0506) (0.0334) (0.0336) 0.0342 -0.0379* -0.00324 0.110* -0.0268 0.00229 (0.0458) -0.188 (0.158) (0.0211) -0.136* (0.0748) (0.0155) 0.0227 (0.0391) (0.0564) -0.0154 (0.150) (0.0214) 0.0505 (0.0731) (0.0146) 0.173 (0.106) Panel B: Existing Establishments Manufacturing -0.0437* (0.0236) -0.0107 (0.0188) -0.00774 (0.0231) -0.0166 (0.0335) -0.000216 (0.0200) 0.00738 (0.0251) Retail -0.0103 0.0128 0.0128 -0.0302 0.0270 0.0103 (0.0472) (0.0432) (0.0486) (0.0578) (0.0528) (0.0568) Service -0.00194 -0.0505 -0.0558 0.0277 0.0163 0.0154 Wholesale (0.0439) -0.0326 (0.0857) (0.0351) (0.0368) 0.00493 0.0262 (0.0873) (0.0603) Panel C: Total Establishments (0.0723) -0.0570 (0.0936) (0.0372) -0.0179 (0.0901) (0.0408) -0.0900 (0.0718) -0.0279 (0.0224) -0.00929 (0.0223) -0.0204 (0.0276) 0.0120 (0.0341) -0.0265 (0.0215) -0.0414 (0.0286) 0.0202 -0.0365 -0.0528 0.0511 -0.0764 -0.0803 (0.0512) (0.0764) (0.0504) (0.0602) Manufacturing Retail (0.0451) (0.0461) Service 0.00752 -0.0700* -0.0653 0.132* -0.0780 -0.127* Wholesale (0.0363) 0.0604 (0.0650) (0.0373) 0.00784 (0.0660) (0.0396) -0.00267 (0.0568) (0.0726) 0.128 (0.0886) (0.0465) -0.00953 (0.102) (0.0658) -0.104 (0.0902) 33 TABLE 6- The Percent Change in Employment Across Different Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile Only MASS x AFTER coefficients are Presented Longer term (2005 to 2009) # of Employees Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ 1 to 10 11 to 24 11+ (1) (2) (3) (4) (5) (6) Panel A: New Establishments Manufacturing 0.0539** (0.0258) -0.0239 (0.0424) -0.0314 (0.0520) 0.0685** (0.0275) -0.00915 (0.0508) -0.119 (0.0777) Retail 0.00184 -0.190* -0.130 0.0960 -0.104 -0.0155 (0.0669) (0.105) (0.0983) (0.0843) (0.112) (0.126) 0.0431 -0.210** 0.00943 0.138* -0.201* 0.0585 (0.0545) -0.244 (0.219) (0.0902) -0.474* (0.255) (0.0734) 0.240 (0.241) (0.0691) 0.0713 (0.202) (0.115) 0.177 (0.291) (0.0586) 0.736* (0.429) -0.0175 (0.0489) 0.0238 (0.0598) -0.000716 (0.0721) Service Wholesale Panel B: Existing Establishments Manufacturing Retail Service Wholesale Manufacturing Retail Service Wholesale -0.0672* (0.0373) -0.00813 (0.0604) -0.0325 (0.0711) -0.0121 -0.0103 0.00355 -0.0302 0.0163 -0.0154 (0.0598) (0.112) (0.136) (0.0742) (0.141) (0.151) 0.0166 -0.160* -0.143 0.0380 -0.00676 0.00101 (0.0597) -0.0658 (0.111) (0.0866) (0.104) 0.141 0.0823 (0.194) (0.155) Panel C: Total Establishments (0.0966) -0.106 (0.149) (0.0855) -0.0704 (0.243) (0.0976) -0.368* (0.199) -0.0456 (0.0380) -0.0170 (0.0735) -0.0682 (0.0838) 0.0148 (0.0564) -0.0669 (0.0712) -0.152 (0.0968) 0.0390 -0.103 -0.139 0.0658 -0.234* -0.211 (0.0674) (0.128) (0.141) (0.0954) (0.124) (0.150) 0.0329 -0.210** -0.198* 0.172* -0.201* -0.321** (0.0477) 0.0442 (0.0854) (0.0902) 0.100 (0.192) (0.101) -0.0133 (0.162) (0.0891) 0.183 (0.114) (0.115) -0.0432 (0.265) (0.149) -0.389* (0.216) 34 TABLE 7- Robustness Check: The Change in the Establishments and Employment in All Industries Before the Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile MASS x AFTER AFTER MASS Observations Establishment Effects from 2002 to 2005 # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments Employment Effects from 2002 to 2005 # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) 0.00776 (0.0172) 0.00502 (0.00441) -0.00002 (0.00750) 0.0154 (0.0243) 0.0194 (0.0168) -0.0145 (0.0354) 0.0232 -0.00718* -0.00381 0.0110 -0.0299** -0.00550 (0.0178) -0.0478 (0.0438) 7453 (0.00383) -0.00143 (0.00953) 4588 (0.00601) 0.000164 (0.0127) 4949 (0.0265) -0.0612 (0.0626) 7453 (0.0142) 0.000343 (0.0345) 4588 (0.0260) 0.0162 (0.0501) 4949 Panel B: Existing Establishments MASS x AFTER 0.0278 (0.0220) -0.00223 (0.0156) 0.000233 (0.0194) 0.0384 (0.0334) -0.0241 (0.0437) 0.00685 (0.0564) AFTER -0.0395* -0.00404 -0.00576 -0.0703** -0.0109 -0.0302 (0.0209) 0.127 (0.135) 7514 (0.0148) 0.0427 (0.0988) 7206 (0.0188) 0.0552 (0.115) 7206 (0.0322) 0.183 (0.167) 7514 (0.0408) 0.136 (0.190) 7206 (0.0514) 0.179 (0.223) 7206 -0.00650 (0.0378) 0.0444 (0.0660) MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER AFTER MASS Observations -0.0663 (0.0534) 0.00763 (0.0140) 0.0229 (0.0232) -0.0966 (0.0736) 0.0575 -0.0146 -0.0306 0.0675 -0.0301 -0.0772 (0.0516) 0.171 (0.149) 7534 (0.0120) 0.0766 (0.104) 7046 (0.0211) 0.114 (0.120) 7104 (0.0699) 0.254 (0.188) 7534 (0.0304) 0.224 (0.206) 7046 (0.0569) 0.340 (0.238) 7104 35 TABLE 8- The Change in Total (All Sizes) Establishments in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile MASS x AFTER AFTER MASS Observations Shorter term Longer term (2005 to 2007) (2005 to 2009) Establishments Establishments Change in Percent Change in Percent Number Change Number Change (1) (2) (3) (4) Panel A: New Establishments -0.0370 (0.122) -0.0322 (0.0890) Pre-term (2002 to 2005) Establishments Placebo In Levels (5) 0.0173 (0.0346) -0.152 (0.379) 0.0936 (0.117) 0.215** 0.0456* 1.045*** 0.229** 0.0620 (0.0873) -0.167 (0.240) 5,733 (0.0227) -0.0361 (0.0636) 5,733 (0.302) -0.233 (0.244) 4,889 (0.0876) -0.0512 (0.0643) 4,889 (0.0755) -0.304 (0.236) 5,402 Panel B: Existing Establishments MASS x AFTER 0.112 (0.747) -0.0132 (0.0363) 1.636 (1.814) -0.0228 (0.0307) -0.145 (0.360) AFTER -1.260* -0.0423 6.427*** 0.195*** 0.173 (0.715) -0.634 (6.044) 8,065 (0.0359) 0.157 (0.167) 8,065 (1.613) -0.477 (6.307) 7,808 (0.0274) 0.201 (0.167) 7,808 (0.354) -0.575 (6.089) 7,752 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER -0.269 (0.885) -0.0454 (0.0702) 2.116 (1.944) -0.0112 (0.0911) 0.337 (0.294) AFTER -0.724 0.0181 6.547*** 0.193** -0.246 (0.849) -0.440 (6.183) 8,056 (0.0653) 0.212 (0.177) 8,056 (1.771) -0.449 (6.360) 8,150 (0.0884) 0.238 (0.182) 8,150 (0.305) -0.771 (6.596) 7,705 MASS Observations 36 TABLE 9- The Change in Total (All Sizes) Employment in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 1 Mile MASS x AFTER AFTER MASS Observations Shorter term Longer term (2005 to 2007) (2005 to 2009) Establishments Establishments Change in Percent Change in Percent Number Change Number Change (1) (2) (3) (4) Panel A: New Establishments 0.431 (0.391) 0.0426 (0.0554) 0.950 (1.675) Pre-term (2002 to 2005) Establishments Placebo In Levels (5) 0.00192 (0.141) -0.0214 (0.538) -0.447 0.0115 1.072 0.241* -0.00609 (0.309) -0.641 (0.923) 5733 (0.0387) -0.0526 (0.103) 5733 (0.738) -0.729 (0.938) 4889 (0.125) -0.0684 (0.104) 4889 (0.356) -0.592 (1.011) 5402 Panel B: Existing Establishments MASS x AFTER 0.855 (5.100) -0.0138 (0.0633) 6.299 (4.711) -0.0586 (0.0623) -2.389 (2.650) AFTER -5.076 -0.0622 16.55*** 0.208*** 1.518 (4.767) -12.57 (44.61) 8065 (0.0604) 0.287 (0.248) 8065 (4.339) -12.19 (45.77) 7808 (0.0533) 0.347 (0.247) 7808 (2.774) -11.60 (45.00) 7752 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER AFTER MASS Observations -5.713 (8.514) -0.0980 (0.127) -0.744 (6.193) -0.155 (0.146) 4.092 (3.496) 1.510 0.0883 24.41*** 0.323** -5.219 (8.399) -5.065 (44.96) 8056 (0.122) 0.413 (0.260) 8056 (6.302) -5.021 (45.44) 8150 (0.146) 0.460* (0.268) 8150 (3.425) -9.339 (48.30) 7705 37 APPENDIX TABLE 1- The Change in the Number of Establishments in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 10 Mile Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments Longer term (2005 to 2009) # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) MASS x AFTER 0.0500 (0.0789) -0.0291* (0.0151) -0.0200 (0.0164) 0.474 (0.318) -0.00214 (0.0159) 0.00541 (0.0207) AFTER 0.263*** 0.0128 0.00337 0.682*** -0.0180 -0.0299 (0.0937) 0.167 (0.288) 7,580 (0.0132) 0.0241 (0.0226) 5,505 (0.0166) 0.0296 (0.0348) 5,734 (0.185) 0.251 (0.314) 7,323 (0.0140) 0.0236 (0.0221) 4,981 (0.0221) 0.0287 (0.0341) 5,347 MASS Observations Panel B: Existing Establishments MASS x AFTER -0.779 (0.560) -0.0170 (0.0795) -0.0720 (0.125) 6.127 (4.113) 0.217 (0.170) 0.269 (0.230) AFTER -1.044* -0.0700 -0.0818 8.109*** 0.220* 0.312* (0.536) 10.79 (8.035) 7,956 (0.0763) 1.549 (1.416) 7,795 (0.116) 2.451 (2.164) 7,795 (2.730) 11.42 (8.436) 7,667 (0.123) 1.545 (1.416) 7,747 (0.180) 2.446 (2.164) 7,747 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER -0.524 (0.634) -0.165 (0.135) -0.297 (0.220) 3.982 (4.606) 0.168 (0.150) -0.0305 (0.324) AFTER -0.986 0.0642 0.127 11.39*** 0.253* 0.591* (0.597) 11.64 (8.791) 7,649 (0.133) 1.567 (1.464) 7,791 (0.209) 2.482 (2.235) 7,775 (3.215) 12.79 (9.173) 7,436 (0.135) 1.607 (1.454) 7,790 (0.325) 2.566 (2.206) 7,898 MASS Observations 38 APPENDIX TABLE 2- The Percent Change in the Number of Establishments in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 10 Mile MASS x AFTER AFTER MASS Observations Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments Longer term (2005 to 2009) # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) 0.0197 (0.0162) -0.0179** (0.00784) -0.0132 (0.00819) 0.0447 (0.0358) -0.00106 (0.00787) 0.000667 (0.0108) 0.0527*** 0.00863 0.00257 0.125*** -0.00910 -0.0166 (0.0134) 0.0598 (0.0677) 7580 (0.00756) 0.0153 (0.0106) 5505 (0.00764) 0.0166 (0.0155) 5734 (0.0245) 0.0660 (0.0696) 7323 (0.00695) 0.0153 (0.0105) 4981 (0.0109) 0.0163 (0.0153) 5347 Panel B: Existing Establishments MASS x AFTER -0.0357* (0.0204) -0.00543 (0.0172) -0.0155 (0.0199) 0.0165 (0.0414) 0.0262 (0.0214) 0.0147 (0.0249) AFTER -0.0278 -0.00561 -0.00272 0.170*** 0.0138 0.0188 (0.0199) 0.413* (0.218) 7956 (0.0158) 0.237* (0.135) 7795 (0.0193) 0.298* (0.163) 7795 (0.0379) 0.421* (0.222) 7667 (0.0183) 0.230* (0.135) 7747 (0.0230) 0.290* (0.162) 7747 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER 0.0124 (0.0455) -0.0365 (0.0297) -0.0553 (0.0369) -0.0892 (0.0691) 0.0164 (0.0257) -0.0360 (0.0531) AFTER -0.0661 0.0234 0.0357 0.284*** 0.0216 0.0678 (0.0439) 0.418* (0.229) 7649 (0.0300) 0.236 (0.139) 7791 (0.0378) 0.300* (0.168) 7775 (0.0655) 0.434* (0.231) 7436 (0.0244) 0.239* (0.137) 7790 (0.0532) 0.308* (0.165) 7898 MASS Observations 39 APPENDIX TABLE 3- The Change in the Number of Employment in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 10 Mile Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments Longer term (2005 to 2009) # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) MASS x AFTER 0.0519 (0.122) -0.417** (0.195) -0.333 (0.492) 0.809 (0.523) -0.0949 (0.211) 0.149 (0.652) AFTER 0.320** 0.171 -0.227 1.069*** -0.210 -0.744 (0.136) 0.441 (0.583) 7580 (0.167) 0.388 (0.307) 5505 (0.426) 0.815 (1.002) 5734 (0.338) 0.584 (0.630) 7323 (0.187) 0.384 (0.302) 4981 (0.612) 0.828 (0.990) 5347 MASS Observations Panel B: Existing Establishments MASS x AFTER -1.967 (1.438) -0.240 (1.175) -3.059 (3.323) 13.19 (8.976) 3.027 (2.387) 5.358 (5.307) AFTER -2.237 -1.118 -1.181 16.72*** 2.874* 7.122 (1.448) 31.50 (23.61) 7956 (1.159) 22.54 (20.36) 7795 (2.945) 60.98 (52.89) 7795 (6.050) 33.13 (24.55) 7667 (1.664) 22.48 (20.36) 7747 (4.397) 60.97 (52.86) 7747 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER -1.284 (1.755) -2.344 (1.972) -8.507 (5.596) 7.831 (10.05) 2.232 (2.127) -1.821 (7.816) AFTER -2.548 0.777 3.748 23.92*** 3.431* 13.78* (1.687) 33.85 (25.63) 7649 (1.985) 22.91 (21.05) 7791 (5.130) 62.04 (54.67) 7775 (7.262) 36.58 (26.42) 7436 (1.915) 23.42 (20.91) 7790 (7.897) 64.10 (53.94) 7898 MASS Observations 40 APPENDIX TABLE 4- The Percent Change in the Number of Employment in All Industries from Massachusetts Healthcare Reform using Difference-and-Difference Estimation. Border: 0 to 10 Mile MASS x AFTER AFTER MASS Observations Shorter term (2005 to 2007) # of Employees 1 to 10 11 to 24 11+ (1) (2) (3) Panel A: New Establishments Longer term (2005 to 2009) # of Employees 1 to 10 11 to 24 11+ (4) (5) (6) 0.0245 (0.0193) -0.0672** (0.0263) -0.0536 (0.0323) 0.0595 (0.0442) -0.00869 (0.0282) -0.00760 (0.0444) 0.0539*** 0.0324 0.00461 0.144*** -0.0267 -0.0667 (0.0148) 0.0914 (0.0903) 7580 (0.0258) 0.0614* (0.0329) 5505 (0.0251) 0.0711 (0.0571) 5734 (0.0311) 0.0984 (0.0925) 7323 (0.0218) 0.0621* (0.0329) 4981 (0.0405) 0.0705 (0.0561) 5347 Panel B: Existing Establishments MASS x AFTER -0.0470 (0.0322) -0.0218 (0.0436) -0.0691 (0.0543) -0.000355 (0.0515) 0.0616 (0.0593) 0.0125 (0.0668) AFTER -0.0323 -0.0135 0.00582 0.180*** 0.00775 0.0211 (0.0302) 0.550* (0.273) 7946 (0.0407) 0.509* (0.266) 7795 (0.0534) 0.679* (0.343) 7795 (0.0480) 0.560* (0.277) 7667 (0.0490) 0.490* (0.265) 7747 (0.0605) 0.655* (0.340) 7747 MASS Observations Panel C: Total (All Aged Firm) Establishments MASS x AFTER 0.0194 (0.0625) -0.0866 (0.0709) -0.157* (0.0894) -0.127 (0.0885) 0.0326 (0.0650) -0.118 (0.124) AFTER -0.0921 0.0465 0.0918 0.314*** 0.0318 0.150 (0.0605) 0.549* (0.285) 7649 (0.0714) 0.509* (0.277) 7791 (0.0925) 0.691* (0.353) 7775 (0.0862) 0.571* (0.287) 7436 (0.0597) 0.511* (0.273) 7790 (0.125) 0.700* (0.348) 7898 MASS Observations 41