AERONAUTICS ASTRONAUTICS DEPARTMENT OF MASSACHUSETTS INSTITUTE OF TECHNOLOGY

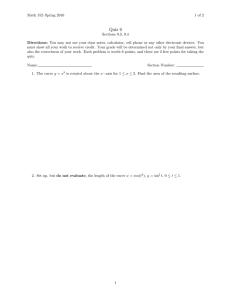

advertisement