FLIGHT TRANSPORTATION LABORATORY REPORT R 90-4

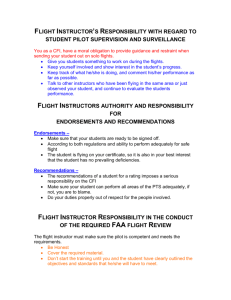

advertisement