Document 11259576

advertisement

Digitized by the Internet Archive

in

2011 with funding from

MIT

Libraries

http://www.archive.org/details/onefficiencyofke258mask

working paper

department

of economics

ON THE EFFICIENCY OF KEYNES IAN EQUILIBRIUM

by

Eric Maskin

Jean Tirole

Number 258

June 1980

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

ON THE EFFICIENCY OF KEYNESIAN EQUILIBRIUM

by

Eric Maskin

Jean Tirole

Number 258

June 1980

Introduction

Theorems characterizing equilibrium in economics that fail to

satisfy some of the strictures of the Arrow-Debreu model have recently

abounded.

In particular,

Grossman and Hart

[8],

papers by

Grossman [7],

and Hahn [10] have studied the efficiency

properties of equilibrium with incomplete market structures and have

established analogues of the two principal theorems of welfare economics.

In this paper we undertake a study of the efficiency of a model with

a

More precisely, we

different kind of imperfection, fixed prices.

start by showing (Proposition 2) that Grandmont's

[5]

notion of

K-equilibrium in fixed-price models, which embraces both the Dreze

and Benassy

[1]

[3]

equilibrium concepts, is equivalent to a kind of

Social Nash Optimum

2

,

in which optimization is incompletely coordinated

across markets and where the control variables are quantity constraints.

Viewing K-equilibria as Social Nash Optima, we believe, permits a

better understanding of the structure of the set of equilibria (see Froposition 3)

K-equilibria possess two important properties:

order (the requirement

that at most one side of the market can be quantity-constrained) and

voluntary exchange (no one trades more of any good than he wants to)

After studying K-equilibria, we examine order and voluntary exchange

and their connection with the two principal concepts of optimality

in a fixed-price economy:

constrained Pareto optimality (optimality

relative to trades that are feasible at the fixed prices! and implementable

Pareto optimality (optimality relative to feasible trades that satisfy

voluntary exchange).

We show first (Proposition

definition of order (c.f., Hahn

[9]

4)

that the usual

and Grandmont [5]), in fact,

-2-

implies that exchange is voluntary (assuming that preferences are convex

and dif f erent iable)

.

We,

therefore, introduce a less demanding notion

of order, weak order, which is distinct from voluntary exchange.

(Corollary

6)

that, with convexity and differentiability, order is equivalent

to the conjunction of implementability (voluntary exchange)

We then demonstrate (Proposition

although

x>7eakly

7)

and weak order.

that constrained Pareto optima,

orderly, are, except by accident, non-implementable and, hence,

Furthermore,

non-orderly.

We prove

(Proposition

8)

implementable Pareto optima

need not even be weakly orderly (although in an interesting special case

absence of "spillover" effects

In section

1

— they

— the

will be)

we introduce the notation

and

definitions.

2

treats the existence and characterization of K-equilibria.

3

studies

Section

Section

the relationships among order, weak order and voluntary exchange.

We consider optimality in section 4.

Finally, in section 5, we compute

the dimension of the various sets of optima.

1.

Notation and Definitions

Consider an economy of m +

1

goods indexed by h(h = 0,1,..., m)_, whose

price vector p is fixed (p„ = 1), and n traders indexed by i(i = l,...,n)

where trader

X

i

has a feasible net trade set X

c= R

.

We assume that

is convex and contains the origin (so that trading nothing is possible)

and that trader i's preferences (denoted

strictly convex on this set.

dif ferentiable as well.

by>.) are continuous

We will at times require preferences' to be

Following Grandmont [5],

for such an economy as follows:

and

we define an equilibrium

-3-

Definition

1

A K-equilibrium is a vector of net trades (t ,...,t

:

associated with the vector of quantity constraints

(with Z

1

1

1

Z

0,

<_

1

>_

Z

0,

=

and ZT =

-°°,

1

is feasible at prices p:

(b)

quantity constraints are observed

(c)

exchange is voluntary:

),..., (Z

,

Z

))

^

.

'vl

t

^_

=0}

|p-t

f) it

<_

Z,

:

is the

t

= X

X

e

t

t

Z

,

such that, for all i,

+°°)

(a)

((Z_

)

Z

maximal element among

-

net trades satisfying (a) and (b)

(d)

exchange is orderly:

l

1

>

t

t

and t

j

>

t

j

1

Y

h

(Z,Z)

-

= {t

1

X

e

then (t^ - zj)

h

h

,

'

i

1

1

IZ

'—k

aggregate feasibility:

(e)

for some commodity h, (t

if,

<

-

k

<

-

St

—h

n

1

1

t,

(t{ - zj)

>

—

0,

)ey^(Z_,Z)y-y^(Z,Z)

t

,

where

Vk^O.h}.

Z,

k

=0.

i

For any trade

"canonical" rations

then

if t} >

h

—

*

Z^t 1 )

h

by trader i, we may confine our attention to the

t

_Z(t

)

and Z(t ), associated with that trade:

= tj and Z^Ct

h

—h

1

=

)

0;

if

'

<

—

t""

h

0,'

then

zV

1

)

for h 4 0,

=

and

zNt

—h

Voluntary exchange implies that agents are not forced to trade

more of any good than they want to.

An allocation characterized by

voluntary exchange is said to be implemen table.

Definition

(t

,...,t

2

)

:

Formally, we have

An implementable allocation is a vector of net trades

satisfying conditions (a),

(b)

,

(c)

,

and (e) for the canonical

rations associated with these trades.

A market is orderly if buyers and sellers are not both constrained

on that market.

The next two definitions represent alternative attempts

to capture the idea of order.

First we introduce property (d'), which is

equivalent to (see Proposition

1)

but somewhat easier to work with than (d)

1

)

= t^

h

(d'):

A vector of net trades (t ,...,t

)

satisfies property (d') if,

for all markets h, there exists no alternative vector (t

lly,

and

(Z(t ),Z(t ))

1

I

1

t,

= 0.

such that

£

t

,

...,t )e

(with at least one strict preference)

t

3

h

The following definition is standard:

Definition

3

An orderly allocation is a vector of net trades (t

:

satisfying (a),

(b)

,

(d'), and (e)

,

...,t

)

for the canonical rations associated

with those trades.

The problem with the above definition of an orderly allocation, if

one is attempting to distinguish between the notions of order and

voluntary exchange, is that it itself embodies elements of voluntary

Indeed, we will show below (Proposition 4) that, with

exchange.

differentiability, the above concept of order implies

Heuristically, this is because, under the definition of order,

exchange.

the trade

voluntary

in Y,(Z(t ), Z(t )) could be preferred to t

t

forced trading on

on market h.

a

market k 4 h and not because

t

simply because

involves

t

relaxes a constraint

Therefore, we propose a new notion of order that

is free from the taint of voluntary exchange.

We first define property (d")

(d")

:

A vector of net trades (t ,..,,t

)

satisfies property (d") if, for

~1

~n

all markets h, there exists no alternative vector (t ,...,t )

...

such that, for each i,

and

E

i

tj =

0.,

t

where yJCtVft

.

e

—i

11

Y,

(with at least one strict preference)

t

1

P

i=l

.

>

e

X

1

|

tj = tj, k f 0, h

}

i

(t

)

-5-

Notice that properties (d') and (d") are identical except that the latter

requires that alternative net trade vectors be identical to the original

trades in all markets other than h and 0.

Definition

,...,t

(t

4

A weakly orderly allocation is a vector of net trades

;

satisfying property (a),

)

(b)

(d")

,

,

and (e) for the canonical

rations associated with the trades.

An orderly allocation is obviously weakly orderly.

Below we shall be interested in the Pareto-maximal elements in the

sets of K-equilibria, implementahle allocations, orderly allocations

and weakly orderly allocations, which will be called K-Pareto optima

(KPO)

implementable Pareto optima (IPO), orderly Pareto optima (0P0)

,

and weakly orderly Pareto optima (WPO)

respectively.

,

A still stronger

notion of optimality, selecting Pareto-maximal elements in the set of

all feasible allocations, is constrained Pareto optimality:

Definition

5

A constrained Pareto optimum (CPO) is a Pareto optimum of the

:

economy for feasible consumption sets X

= X f\ {t

p*t

= 0)

I.e., it

.

solves the program

max

1

subject to

1

and Y.t~ = 0,

i=l

for some choice of non-negative A 's, where the u 's are utility functions

(*)

Z

X

u

(t

)

t e

X

representing preferences over net trades.

Characterization and Existence of K -equilibrium

We first check the consistency of the definitions:

P roposition 1

{K-equilibrium allocations} = {Implementable allocations} C\

2.

:

{Orderly allocations}.

Proof:

is not satisfied for

(d')

n

X

(t

?

We need just check that (d) and (d') are equivalent.

.

.

.

,t

)e n

1=1

Y^UCt

h

1

)

(t

^(t

,...,t

1

))

)",

4

If

there exist h and

such that

(t

,...,t

n

)

Pareto-dominates

(t

,...,t

n

)

-6-

Because

(t

...,t

,

)

maintains equilibrium on market h, we can infer that

at least one agent is demand-constrained and one supply-constrained in

(t

,...,t ), which contradicts (d)

satisfied by

such that

,...,t ), there exist h,

(t

(t\

t

j

t

,

EY^CZCt^ZCt

)

1

(t

on the other hand,

If,

.

J

)

1

))

x

Y

Pareto-dominates

J

h

i,

j

,

(d)

is not

and

J

(Z(t j ), Z(t ))

(t

1

t

,

J

and

)

(t^"

1

-

t,

h

h

)

(t^

h

- t?

)

<

h

0.

Therefore, if the constraints on market h are relaxed by the amount

min

{|t?" -

t^"

|

,

|t^ - t^|},

Q.E.D.

property (d') is contradicted.

We now turn to the characterization of K-equilibria in terms of

social Nash optima.

As indicated above, the idea behind a social

Nash optimum is to consider m uncoordinated planners, one for each

market h (h^O)

,

who choose quantity constraints to maximize a weighted

sum of consumers' utilities, subject to keeping equilibrium on their

own market and given the rations chosen by the other planners.

A

social Nash optimum is then defined as a Nash equilibrium of that "game."

Formally:

Definition

6

:

For each i, let

t

(p

Z_

,

,

Z

)

solve trader i's preference

maximization problem, given prices p and rations

i

the indirect utility function V (p,

—i

i

Z_

,

Z

i

)

i

Z_

°

= u (t

x

is a utility function representing i's preferences.

for fixed positive weights

{\

}

,

—

Z

—

and Z

i —

(p,Z_ ,Z

Define

.

)),

where u

Suppose that,

the manager of market h chooses Z^ and

n

i

i

i

—

A

I

V (p, Z , Z ) subject only to

for each i so as to maximize

—

.

h

n

i= 1

°i

i

—

the constraint £ t

Z ) =

and taking as given the rations

(p, Z_

i=1

i

-i

Z

and Z in each market k 4 h, Q.

The allocation corresponding to the

h

.

.

.

.

,

"

K.

<

K.

equilibrium of such a "game" is a

social Nash optimum

.

By definition, a social Nash optimum is an implementable allocation.

From the equivalence between (d) and (d'), it is also orderly.

Conversely,

-7-

a K-equilibrium is a social Nash optimum.

We have thus characterized

the set of K-equilibria:

Proposition

2

;

{K-equilibria} = {Social Nash optima}

The set of weakly orderly and orderly allocations can be characterized

similarly.

In particular, a weakly orderly allocation is equivalent

to a social Nash optimum where the instruments of planner h are the

trades {t

}

on his own market.

The characterization of orderly allocations,

although straightforward, is less natural because of the hybrid nature of

these allocations:

an orderly allocation is a social Nash optimum where

each planner chooses trades on his own market given the canonical rations

associated with the allocations chosen by the other planners.

In other

words, each planner assumes that the others have the power only to

choose rations, whereas, in fact, they choose the actual trades.

Under differentiability, Corollary

6

below guarantees that

this kind of social Nash optimum is identical to that of Definition 6.

As a by-product of the character izaton of K-equilibria as social

Nash optima, we obtain a straightforward proof of the existence of

a

K-equilibrium at prices p based on the Social Equilibrium Existence

Theorem of Debreu

Proposition

3

:

[2]

Under the above assumptions, for any vector of positive

prices p and any choice of positive weights {A

Nash optimum

and, hence, a

},

there exists a social

K-equilibrium, associated with those prices

and weights.

Proof

:

We must show that each planner faces a concave, continuous

objective function and that his feasible strategy space is a convex- and

compact-valued correspondence of the strategies of the other planners.

-8-

To see the concavity of the objective function, consider two alternative

((Z 1

choices of constraints,

1

For any a,

a

/

)

, .

.

.

feasible for the constraints (aZ

1

,

7

(Z

,

Z

n -n

.

Z

,

+ (1-a)

Z_

aZ

1

£L

1

((Z_

~n

),..., (Z

Z

,

+ (1-a) t

)

,

..

and

,Z ))

1

the trade at (p

l,

<_

^ls

Z1

,

1

X

(p,Z_,

+ (1-a)

Z

z"

£ik

Z )).

,

is

)

The

).

concavity of the utility functions then implies the concavity of the

Continuity follows immediately from the

planner's objective function.

The set of feasible strategies for planner

continuity of preferences.

defined by

h is

z£»| j.tjCp,

{((zj, zj;),...,(z£,

and is denoted by

r,

restrict

Z.,

r,

h

(Z

h

,,

—)h('

N

,

(Z.,

Z.,

— )h(.,

.)

Without loss of generality, we can

.

)h(

to canonical quantity

j constraints.

i

.)

)h(

is not empty because it contains

(0,0).

the preferred vector in y (Z\,

Zv

<

—

< max

—

Z,

h

{ t,

0}

,

h

To see that

i

(?£.

for

Zjj))

<

and

a <

CZ_

h

1.

,

If

T

h

Z

h

(Z

—

.,

.

min/t

,

,

0l< Z .

)h(

r

is convex, choose

,.)

)h(

Z.

,

in

)

(Z

Z

h

for example,

t,

n

because constraints are canonical,

and tJ;(p,aZ^ + (1-a) Z

,

h

(Z N

Z.,

,,

—)h('

.

,)

)h(

It is bounded because if t

is

and

<

—i—l

_

°

t.'s.

,)

r,

is closed because of the continuity of the

It

.

,,

5

= o>

z£, zj

h(i z£, zjh( )

Z

fe

)h(

,a Z

J;

)

(p,

t,

n

Z,

—

h

(p,

Z,) =

—h'

,

h>

Z., ,

7 h(

,

Z,

h

,

Z.,

Z,

n

Z.,

; n

,

.,

)h(

Z^)

Z

n

.)

=

Z

,),...

h

Z^

+ (1-a) (Z^,

Z,

then,

n

v.

,

((Z, ,

h'

h

and consider a(Z_

+ U-«) Z*,

Similarly, for the upper constraints.

( Z,

Z.

.

)n{.

,

=

)

—Z,h

;

= aZ^ + (1-a) z£.

That the correspondence

T

is upper

hemi-continuous follows from the continuity and convexity of preferences.

It

is also immediate that

restrict the domain of

be canonical

I\

h

constraints.

bounded and convex.

I\

h

to

is lower hemi-continuous.

only those rations

(Z., ,,

-)h('

Finally,

Z N1 ,)

)hC

we can

which could ever

This domain is obviously closed,

We can thus apply the Social Equilibrium Existence

Theorem to conclude that a social Nash optimum exists.

Q.E.D.

,

Z^

-93

Order and Voluntary Exchange

.

We can now demonstrate that if preferences are differentiable and there

are at least three markets, order implies voluntary exchange.

For convenience,

we shall, from now on, delete the component of trade vectors corresponding to good

Thus

corresponds to trades t.,...,t on markets

m

1

m

on market h.

implicit trade t n = -£ p t

h h

h=l

Proposition 4:

If preferences are differentiable and m>

zero.

t

to m, with an

1

an orderly

2,

allocation is implementable.

Proof

Consider an orderly allocation

:

is not implementable,

in particular,

then,

if

If this allocation

,...,t ).

(t

(t*

...,t*

,

is the vector

)

of feasible, preference-maximizing net trades associated with the canonical

rations for

h

and

(t

.

,

.

.

such that

t,

h

,t

t*

,

)

4

= t,

t,,t.

,t., .)

h

)h(

t

feasible and

is

= 0)

and since

j

or

t

(ii)

and t,, =

t

t

choose h' 4 h.

,

1

t,

•

h

(A)

t

<

h

If

0.

(i)

+

At?"

n

=

t

E

holds, then, since

+ (1-A) t*

By convexity,

=

n

t?"

!

X

1,

(A) X-

F1

)

is not orderly, afterall.

combination of

t,

h

assumption above.

Because (0,

t

,

t Xl ,)

)h(

and

If

t,

h

|t

If

.

>

|

t,

h

= 0,

If

(ii)

then

t,

h

It*

L

(t

h

I

n

,...t ).

h

t,

_±

t

.

,

•

= A t

1

)

X

t

(A)

Therefore

is a convex

which violates our

is not orderly.

>

—

+ (l-A)t*

then, by strict convexity, (0, tv, ,)S-.

,...,t

t,

h

h

there exists

holds, then

= t*

and

1

Furthermore,

satisfies the canonical constraints

we again conclude that

1,

,

I

n

t" (A)

.

satisfies the canonical constraints associated with

1

'

Let

.

>

1

>

—

I

j^i

,...,t

(t

(Z(t ),Z(t )),

,

'h

I

h

h

h

t

1

t,

.

/

(t

ey

t

contradicts the order of

This, in turn, implies that either (i)

.

Then

cannot satisfy the canonical constraints associated

t

scalar Ae[0,l] such that

Then

t?",, t

'

=l

Therefore,

with

t~, =

E

(otherwise,

(ot

t

.

l

satisfies the canonical

If t

.

quantity constraints associated with

r

t

maximizes i's preferences among

by differentiability and coivexity, t

all net trades satisfying p«t

For this i, there exist

for some i.

t

associated with

Thus,

—

t

1

.

-10-

in all cases,

if

(t

,...,t

is not implemen table, we conclude that it is

)

Thus order implies implementability.

not orderly, a contradiction.

Q.E.D.

That there be at least three markets and that preferences be

diff erentiable are hypotheses essential for the validity of the

preceding proposition.

Consider, for example, a two-market economy as

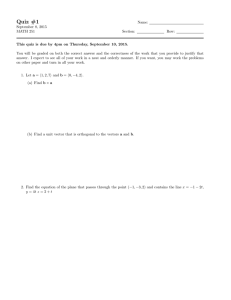

represented in the Edgeworth box in Figure

Point A represents the

1.

initial endowment;

Figure 1

the line through A, prices;

indifference curves.

and the curves tangent to the line,

Any allocation between B and C is clearly

orderly, but not implementable since it involves forced trading by the

agent whose indifference curve is tangent at B.

is crucial,

To see that differentiability

consider a two-person three-good economy where agents have

preferences of the form log min {x

ferences, we can treat goods

1

and

,

2

x

}

+ log x

.

Given these pre-

together as a composite commodity,

since traders will always hold goods 1 and

2

in equal amounts.

economy is, in effect, reduced to two goods, and so Figure

becomes applicable.

1

Thus the

again

-11-

We next show that voluntary exchange and weak order together imply

To do so, we make use of the following:

order.

Definition

trade

6

Agent

:

is said to be constrained on market h for feasible

i

if there exists

t

feasible and

Proposition

(t

5

,

t,

t,

h

V-

,)

.

with It,

h

'

t

>

I

'

such that

t.

h

'

h

is

,)

t-.

,

)h\

.

If preferences are dif ferentiable,

:

(t.

{implementable allocations}!

{Weakly orderly allocations}^: (Orderly allocations}.

Proof

Suppose that (t ,...,t

:

vector of

)

is a weakly orderly and implementable

If it is not orderly, there exists market h

net trades.

and feasible net trades (t ,...,t

)

that Pareto dominate (t ,...,t

)

n

=

I

t,

and, for all i, t e Y. (Z(t

There are

Z(t ) )

)

h

h ,

1=1

two cases, depending on whether all agents i are constrained on market

such that

,

.

.

h for trade

Case

I

t

.

Every agent

:

i

constrained on market h for

t

.

Either everyone is constrained from buying or all are constrained

from selling - a mixture is not possible because of weak order.

Suppose,

without loss of generality, that everyone is constrained from buying.

Then

t.

h

=

for all i, and there exists

all i then (t ,...,t

with

(t ",..., t

),

)

j

J

such that t^ <

h

a contradiction of implementability)

h

(t^,

h

=

t,

for

h

satisfies the canonical constraints associated

constrained from buying on market h, there exists t^ >

is feasible and

(if

t ^

)n

.)

(

Vf j

,

tJ

•

.

Because

j

such that

is

(t,

n

,

t

;

n

)

{

Choose Ae(0,l) such that At J + (l-X)tr' =

h

h

0.

1

-12-

Let

t

J

of

= X (t^

t.^

,

+ (l-A)f3

)

By strict convexity

.

t

,...,t )'s implement ability.

(t

,1

that

,...,t

(t

Case II

n.

,

1

t

/^.

I

J

and therefore £t,

i

such that

,

yet

,

violation

,

t,

h

and |t

j

Let

S

be the

From strict convexity and implementability, we

Thus if tt = t* for all ieS, there exists

h

h

.

1

t

J

for all i, with strict inequality if and only if

t

1

2l

1

t

a

,

t

Not all agents are constrained on market h.

:

t,

t

.

is orderly.

)

set of all sellers.

I

(A)

Therefore, in this case, we conclude

Suppose, in fact, that the sellers are not constrained.

have

J

satisfies the canonical constraints associated with

(A)

t

(A)

>

0,

<

—

0.

a contradiction.

jg!S

J

such that

Therefore, there exists

<

t,

<

|t

h

h

S

'

Assume, for the moment, that

[}.

1

=

H^tf)

For each k e H,

.

1

1

t

(k)

(such a choice is possible since i is

t

-constrained on market k)

|

>

tjM

|

tjM

convexity, we can choose the

=

i £

J

t,

Define H = {k i is constrained on market k for

and, if

)

h

.

choose t* so that

A(t -t

>

t?

(1-A)

of elements in H.

|h|

t,

(t -t^)

'

s

(tJ\ t.

/

),

t

(k))^-.

so that there exists Ae(0,l)

for all keH, where

|h|

~

~

(1 A) ti5

°

t

By

.

for which

is the number

Define

S

A Z V-Qt)

l± =

+

1

if

,H|

>

rlf

1

t

,

if

|h|

=

is strictly preferred to t

=

By convexity,

t

for all keH.

But by differentiability, convexity, and implementability,

,

and, by construction

t,

t,

-13-

t

is the best trade that i can make if forced to trade

t,

k

on each market

Thus, in this case too we conclude that (t ,...,t

keH, a contradiction.

is orderly.

Corollary

6

Q.E.D.

If m > 2 and preferences are dif ferentiable then

:

{implementable allocations}

allocations}

4.

f)

{Weakly orderly allocations} =

{Orderly

{K-equilibrium allocations}

=

Optimality

We next turn to constrained Pareto optimality.

a

)

We show that although

constrained Pareto optimal allocation is weakly orderly, it is

ordinarily neither implementable nor orderly, at least when preferences

are dif ferentiable.

Proposition

A constrained Pareto optimum (CPO) is

7:

(i)

weakly

orderly (which implies that {Constrained Pareto optimal allocations} =

{weakly orderly Pareto optimal allocations} and

preferences, neither implementable nor (when m

(ii) with diff erentiable

>

2)

orderly, if it is not

a Walrasian equilibrium allocation, if each trader is assigned a

strictly positive weight in the program (*)

,

and if there is some (i.e.,

non-zero) trade on every market.

.

Proof

:

Let (t

n

,

.

.

.

,

)

be a CPO.

If it were not weakly orderly,

then trades could be altered on some

market h, leaving trades on other markets undisturbed, in a Paretoimproving way, a contradiction of optimality.

Therefore,

(i)

is established.

-14-

Suppose that

,...,t

(t

is not a Walrasian equilibrium allocation,

)

that preferences are dif f erentiable, that there is non-zero trade on

every market, and that all traders have positive weight.

establish that

(t

,...,t

is not implementable.

)

We will

Because it is not

Walrasian, there exists at least one market h and one agent

prefer a trade different from

k ^ 0, h.

If,

say, trader i

t,

h

,

,...,t

(t

)

is a net buyer of h, either he would like

follows immediately.

like to buy more.

who would

given his trades on other markets

to buy more or to buy less of good h.

of

i

If less,

the non-implementability

Assume, therefore, that he would

Because, by assumption, there is non-zero trade on

market h, there are traders who sell positive quantities of good h.

among these traders, there exists an agent

j

who would like to sell

less of good h, the proof is, again, complete.

sell more than -t,

than

and h)

,

If

If

j

would like to

units of good h (given his trades on markets other

i and j

can arrange a mutually beneficial trade at

prices p, contradicting constrained Pareto optimality.

that all sellers on market h are unconstrained.

Therefore, assume

From differentiability,

forcing them to sell a bit more of good h does not change their utility

to the first order but does increase i's utility.

allocation assigns positive weight to

trading.

4

Thus

(t

,...,t

)

:

in (*)

,

is not implementable.

implies it is not orderly.

Remark

i

Therefore, if the

it involves forced

If

m

> 2,

Proposition

Q.E.D.

This proposition demonstrates that Hahn's Proposition 2.2

(see [9]), which asserts the existence of a K-equilibrium that is also

constrained Pareto optimal, is false.

-18-

By the absence of spillovers, we mean that a change in a constraint on a market

does not alter net trades in any of the other markets, except the uncon-

strained market.

A sufficient condition to obtain no spillovers is

that traders' utility functions take the form U

= t_

U

+

£ $,

(t,

h

h

)

.

In

the no spillover case, the only change in Figure 3 is that the IPO

set shrinks to coincide with the KPO and 0P0 sets.

Proposition

Proof

:

9

:

In the case of no spillovers,

An IPO must be orderly.

We have

(iPO) =

{KPO} =

{OPO}

Otherwise, slightly relaxing the

constraints in market h for one demand- cons trained and one supply-

constrained agent would be implement able (since it would not disturb

the other markets) and Pareto improving.

Q.E.D.

-15-

The hypothesis of differentiability in Proposition

is,

7

as in

Crucial too is the assumption that all

previous results, essential.

traders have positive weight in the program (*).

To see this, refer

Point B is both constrained Pareto optimal and

again to Figure

1.

implementable.

However, the trader whose indifference curve is tangent

to C has zero weight.

(Note,

incidentally, that all the other CPO's -

the line segment between B and C - are non-implementable.

)

Finally,

the hypothesis of non-zero trade on each market is necessary.

for example, to the Edgeworth box economy of Figure 2.

Figure

Refer,

Initial endowments

2

are given by A, which is also a constrained Pareto optimum relative to

the price line drawn.

Although A does not involve forced trading, it

does not violate the Proposition, as it involves no trade at all.

Although differentiability is a restrictive assumption, the

non-zero weight and trade assumptions rule out only negligibly many

CPO's.

On the basis of Proposition

7,

we may conclude that, with

differentiability, CPO's are generically non-implementable and non-orderly.

-16-

We now consider the set of Pareto optima among implementable

the Implementable Pareto optima.

allocations:

As opposed to a Social

Nash Optimum where an uncoordinated planners choose the rations on their

own market according to their own weights, an IPO is a Pareto optimum

for a unique planner choosing all the rations.

Obvious questions are

whether IPO's are necessarily orderly or even weakly orderly.

The

following proposition demonstrates that this is not the case.

Proposition

8

Implementable Pareto optima need not be weakly orderly,

:

a fortiori

(nor,

Proof

orderly).

,

The proof takes the form of an example.

:

Consider a two-trader,

three-good economy in which trader A derives utility only from good

and has an endowment of one unit each of goods

1

Trader B has

and 2.

a utility function of the form

U(x ,x ,x

Q

1

)

2

=

—x

15

3

+ — x

- 3x

- 3x x

2

2

- x

2

2

+ x

Q

,

where x. is consumption of good i, and an endowment of one unit of good

0.

All prices are fixed at

It can verified that trader B's

1.

unconstrained demands for goods

respectively.

trader

B.

and

1

at these prices are

2

is

3

-rrj-

16

.

and

—

o

This is an IPO in which all the weight is assigned to

In this IPO, trader A is constrained on both markets.

suppose that trader B is constrained from buying more than

of good 1.

—

12

—

13 11

—

r-r-

Now

units

It can be verified that his corresponding demand for good 2

Because

-7-7-

24

+ — 16

>

——

12

-

H

-

—

8

,

trader A obtains more of

.

-17-

of good 3 when B is constrained on market

1

than when unconstrained.

more

Therefore the allocation in which A is constrained from selling

than the vector

good

1

(~

is an IPO.

,-A-

)

and B from buying more than

units of

Furthermore, it is not weakly orderly, because given

a purchase of 3/16 units of good 2,

of good A,

24

trader B would like to buy -^-

units

Q.E.D.

and 5/96 > ~j^~

this

We can summarize the results (with differentiability) to

point in a schematic diagram (Figure

Figure

3)

3

One "unappealing" feature of Figure

3

is the fact that the set of

IPO's is neither completely within nor without the set of weakly orderly

allocations.

With an additional hypothesis often made in the disequilibrim

literature - the absence of spillover effects - this unaesthetic property disappears,

•19-

5

.

Structure of K-Equilibrla, Constrained Pareto Optima and Keynesian

Pareto Optima Sets

.

In this section we undertake a study of the local dimension of

the different sets.

5 .1

(h =

K-Equilibria

Assume that at a K-equilibrium the m markets

.

l,...,m) comprise at least one binding constraint (a constraint

is binding if the derivative of the indirect utility function with

respect to the constraint is different from zero).

Let us show that,

the number of degrees of freedom is equal to the number

on market h,

of binding constraints

(b

)

,

minus one; for that let us remember that

a K-equilibrium is a Social Nash Optimum.

The first order condition

for a Social Nash Optimum with a binding ration Z

h

yields

1

i

A,

h

3V

=

~-i

u,

h

,

where

u,

h

is the multiplier associated with market

3Z,

1

1

A

h's equilibrium constraint.

Let

A,

h

=

— and

%

F =

—

A,

h

:

1

I

It is easy to see that the jacobian of F is of rank

is a function of

of dimension (b

thus

E

(2b

-1).

)

Z,

[b

variables, the inverse image F

1

(p.z /^

+1].

(0)

1

)

Because F

is a manifold

The local dimension, of the set of K-equilibria is

- 1) = b - m,

(b

1

1

3Z,

where b is the total number of binding constraints,

h

5.2

Constrained Pareto Optima

.

The local dimension of this set is (n-1) since a Constrained Pareto

Optimum is

a

Pareto Optimum of the economy with consumption sets X

induced preferences.

and

-20-

5.3

K eynesian Pareto Optima

.

The only (direct) way to change the

weight between two traders is to change their rations for a market

on which they are. both constrained.

constrained on

Call T = {(i,j)

at least one market}.

the redundant pairs; more precisely,

at most one sequence of pairs:

|

and

i

j

are both

T is obtained from T by eliminating

in T,

(i,j),

starting from

(j ,k)

,

.

.

.

,

(£,i)

i

there can be

leading back

to i.

The local dimension of the set of Keynesian Pareto Optima is

then:

Min

[

I

T

,

|

n - 1]

FOOTNOTES

Benassy's equilibrium is a K-equilibrium if preferences are convex.

2

The term is due to Grossman [7].

Grossman's SNO, however, is related

only in spirit to our own.

3

Grandmont, Laroque, and Younes [6] call property

(d

'

)

market-by-market

efficiency.

4

This equivalence is demonstrated by Grandmont, Laroque, and Younes [6].

If x is an m-dimensional vector,

vector (x

,

.

.

.

,x,

deleting component

,

h.

x,

...... ,x

),

denotes the

the notation x N1

)h(

,

i.e.,

the vector obtained by

REFERENCES

[1]

Benassy, J.P.

"Neo-Keynesian Disequilibrium Theory in a Monetary

,

Economy," Review of Economic Studies

[2]

42,

,

1975.

Debreu, G., "A Social Equilibrium Existence Theorem," Proceedings

of the National Academy of Sciences of the USA

[3]

,

38,

Dreze, J., "Existence of an Equilibrium under Price Rigidity and

Quantity Rationing," International Economic Review

[4]

1952.

Dreze, J. and Miiller, H.

,

,

46,

1975.

"Optimality Properties of Rationing

Schemes," DP7901 Core 1979.

[5]

Grandmont, J.M.

,

"The Logic of the Fixed-Price Method," Scandivanian

Journal of Economics

[6]

Grandmont, J.M.

,

,

1977.

Laroque, G. and Younes, Y.

Allocations and Recontradicting,

[7]

Grossman,

S.

,

"

,

"Disequilibrium

Journal of Economic Theory

"A Characterization of the Optimality of Equilibrium

in Incomplete Markets," Journal of Economic Theory

[8]

Grossman,

S.

Hahn, F.,

45,

[10]

1-18,

Hahn, F.

,

,

15,

1-15, 1977.

and Hart, 0., "A Theory of Competitive Equilibrium in

Stock Market Economies," Econometrica

[9]

.

,

42,

293-330, 1979.

"On Non-Walrasian Equilibria," Review of Economic Studies

1978.

Comment on Grossman-Hart, 1979.

,

APR

3 199f

MAR.

APR.

07

0?

I

'993

AU6.81 W9il

Lib-26-67

-

1

3

DSD D04 415

fl5M

DM 415 Ab2

2±>(

TDflD DQ4

3

47fi

fc.13

9 (/>*3

3

3

TDflD DD4

TOflO DD4

TOfi D

415

415

DDM 415

fi7

flfifl

6

MIT LIBRARIES

3

TDfiD DD4

415 TD4