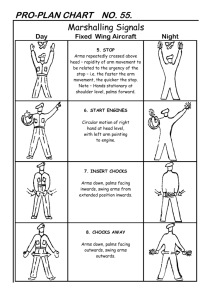

Highlights Military Expenditures Figure 1. World Military Expenditures: 1961-1995

advertisement