This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License. Your use of this

material constitutes acceptance of that license and the conditions of use of materials on this site.

Copyright 2007, The Johns Hopkins University and Jonathan Weiner. All rights reserved. Use of these materials

permitted only in accordance with license rights granted. Materials provided “AS IS”; no representations or

warranties provided. User assumes all responsibility for use, and all liability related thereto, and must independently

review all materials for accuracy and efficacy. May contain materials owned by others. User is responsible for

obtaining permissions for use from third parties as needed.

Session 1

Overview of Health Insurance

& Managed Care Principles

& History

Jonathan P. Weiner, Dr. P.H.

Professor or Health Policy & Management

Goals of Session

• To introduce some basic principles of

health insurance and managed care.

• To provide a brief history and

overview of health insurance and

managed care in the US.

• To identify some key trends

3

Growth in US Health Care Spending:

1962-2007

2000

1800

Dollars (billions)

1600

1400

1200

1000

800

600

400

200

0

1962 1966 1970 1974 1978 1982 1986 1990 1995 1998 2000 2007

Source: HCFA, CMS

Year

4

Paying for Health Care: Alternative

Approaches

• Government employed providers

• Government “social insurance”

– Mandatory buy-in

– Entitlement for special populations

• As “benefit” of employment

– Insurance

– Direct care or access to contract providers

•

•

•

•

Union/worker collectives

Private “indemnity” health insurance

Out of pocket

Charity care

5

Definition of Insurance

• A social device where a group of persons

transfers risk to an insuring entity in order to

combine loss experience.

• This theoretically permits the ability to

actuarially predict these “losses” and to

calculate the premium payments that will need

to be contributed by all members of the risk

pool.

6

Some characteristics of an “ideal”

private insurance market

• Large risk pool

• Predictable, but “random” event

• Potential high cost of insurable event

• Event not controllable by parties

– “moral hazard”

• Market economically feasible

7

Approaches for Sharing and Bearing

Insurance “Risk”

• Consumers

– Premiums,cost sharing (deductibles,co-pays,co-insurance,

coverage threshold)

• “Intermediary” (Insurance/managed care entity)

– Inclusions/exclusions, thresholds, re-insurance

• Providers

- Capitation, risk-sharing arrangements,employment

• Employers

– Premiums, self-insurance, re-insurance

8

Patient Cost, Use, and Insurance

Coverage

Patient Cost of Care

Total Cost for

Uninsured Patient

Out-of-pocket cost for

insured patient, net of

insurance premium

Co-insurance

applies

Use of Care

Deductible

Out-of-Pocket

Limit

External Plan

Maximum

Adapted from Chollet DJ. Mapping Insurance Markets. State Coverage Initiatives, AcademyHealth, 1997.

9

Why Employer’s Got Involved In Health

Care

• Healthy employees are productive employees

• European immigrant / Union expectations

• Vacuum existed in the 1930-50’s, now “stuck” in

this role.

• Tax advantage

• Attracts good employees

• “Self Insurance” (ERISA) is now big factor

10

US Health Insurance: Some Historical

Footnotes

• 1930’s -- Blue-Cross/ Blue Shield and Hospital

Association.

• 1930’s – Prepaid-Group Practices (PGPs) and

Union/Employers

• 1950’s – Commercial insurers get into the act

• 1960’s -- Federal “great society” – Medicare and

Medicaid

• 1970’s - The “Health Maintenance Organization” (HMO)

Act (the unholy alliance of AMA sponsored IPAs and

PGPs)

11

Proportion of Americans with Health

Insurance: 1940-2005

100

90

70

60

50

40

30

20

05

20

00

20

95

19

90

19

80

19

75

19

70

19

65

19

60

19

55

19

50

19

45

19

40

10

0

19

% Insured

80

Year

12

Health Care Financing and Coverage

(Approx) in the US

Private Ins.

Population

67%

Payment

44%

Medicare

10

16

Medicaid

9

14

14

-

16

10

Uninsured

Out-of -Pocket

Other

13

Who Pays for Health Care 1965-2001

Public Total

Private Insurance

Private Other

Private Out-of-Pocket

100%

90%

29%

80%

60%

23%

25%

35%

5%

6%

6%

5%

42%

41%

46%

45%

1975

1985

1995

2001

6%

20%

10%

33%

30%

50%

30%

14%

44%

70%

40%

15%

22%

25%

0%

1965

CMS Office of the Actuary, National Health Statistics Group. Figures may not

add due to rounding.

14

The “Actuarial Cycle” -Cost / premium see-saw

Image from CMS Health Care Industry Market Update. March 24, 2003.

15

Insurance premiums vs. earnings and

inflation

Health Insurance Premiums

Overall Inflation

Workers' Earnings

20%

18%

18.0%

16%

14%

14.0%

13.9%

12.9%

12%

12.0%

11.2%

10.9%

10%

9.2%

8.5%

8%

8.2%

6%

5.3%

4%

2%

0.8%

0%

1988

1989

1990

1993

1996

1999

2000

2001

2002

2003

2004

2005

Kaiser/HRET Survey of Employer-Sponsored Health Benefits: 1999-2005; KPMG Survey of Employer-Sponsored Health

Benefits: 1993, 1996; The Health Insurance Association of America (HIAA), 1988, 1989, 1990; Bureau of Labor Statistics,

Consumer Price Index, U.S. City Average of Annual Inflation (April to April), 1988-2005; Bureau of Labor Statistics, Seasonally

Adjusted Data from the Current Employment Statistics Survey (April to April), 1988-2005.

16

The Late 1980’s: medical inflation is out

of control

• The bankrollers of the system

said enough was enough, and

the era of “managed care”

was born. HMOs and their

techniques served as the

model.

17

Managed Care’s Approximate Share of the

Health Insurance Market in 1988 & 2007

MCO

FFS

120%

100%

15%

80%

60%

75%

85%

40%

20%

25%

0%

1988

2007

18

The Key “Ingredients” of Managed Care

• Care “management”

– aka, utilization/disease management

• Vertical integration / coordination

• Financial risk sharing with providers

• Attempts at instilling a market

19

Definition of Managed Care

An integrated system that manages

health services for an enrolled

population rather than simply

providing or paying for them.

Services are usually delivered by

providers who are under contract to, or

employed by the plan.

20

The Health Insurance Models

• Traditional (Fee-for-Service) Indemnity

• “Managed” Indemnity Plan

• Preferred Provider Organization (PPO)

• Health Maintenance Organization (HMO)

21

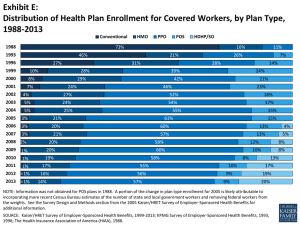

Shift in Employment-Based Plan Type

1988 - 2002

HMO

POS

PPO

100%

14%

90%

9%

8%

38%

41%

25%

22%

7%

5%

48%

52%

22%

18%

23%

26%

2001

2002

27%

80%

46%

70%

60%

Indemnity

35%

73%

28%

50%

26%

40%

14%

24%

31%

27%

28%

29%

1996

1998

1999

2000

30%

20%

10%

11%

16%

7%

21%

0%

1988

1993

Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2002

22

Managed Care Is Mainstream

Managed Care = US Health Care

23

INGREDIENTS SIMMERING IN TODAY’S

PRESSURE COOKER

• Health care cost spiral is inevitable.

• “We”consumers and providers want it “all.”

• Uninsured likely to grow, government not able

(willing?) to tackle head-on.

• Other than MCOs, no party is willing (able?) to

come to grips with resource limitations.

24