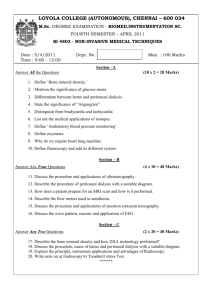

Document 11243628

advertisement