-

-

-

-

The Importance of Teaching Accounting Ethics

An Honors Thesis (HONRS 499) by

Jennifer 1. Leslie

Thesis Advisor

Dr. Gwendolen B. White

Ball State University

Muncie, Indiana

March 24, 2003

Expected Date of Graduation

May 3, 2003

-

-

-

Abstract

This examination focuses on the importance of the education of accounting ethics at the undergraduate level. In order to understand the importance of ethics education the history of accounting ethics and philosophy's contribution to ethics in accounting is examined. Cases depicting a lack of ethics by an accountant are reviewed to establish the need for more education of ethics. Ethical codes are looked at to understand how regulatory agencies react to the need for ethics education in accounting. Undergraduate students should be taught accounting ethics to bolster the technical aspects of their education. Ethics education at the undergraduate level will help accountants determine how to act ethically when addressing accounting issues.

Acknowledgments

Thank you, Dr. Gwendolen White, for volunteering your time to take on the role as my thesis advisor. Your guidance and editorial advice helped shape this paper. Again, thank you for all of the effort and time you put into helping me with this project.

Leslie-l

Recent accounting scandals have heightened the public's awareness of the importance of ethics in business and the accounting profession. The current ethical debate in the accounting profession centers on the idea of independence and moral values. Independence is a character of a Certified Public Accountant (CPA) as well as a cornerstone of the profession (Previts 1985, 85). In order for an accountant to understand independence, they must first be taught the importance of upholding ethical and moral values as a professional. All business is created from human social interactions, thus establishing a need for a moral code. In order to understand the importance of ethics education, one must first understand the history of accounting ethics. One must also look at philosophy's description of how a person's moral reasoning develops. Undergraduate students should be taught accounting ethics to bolster the technical aspects of their education. Students must be taught strategies to anticipate ethically compromising situations and how to deal with them effectively (Albrecht 1992,6). Ethics education at the undergraduate level will help accountants determine how to act ethically when addressing accounting issues.

The History of Accounting Ethics

Ethics and independence have played an important role in accounting throughout the profession's history. The accounting profession in the United States is closely linked to the profession in the United Kingdom. The idea of independence was slow to develop in the United Kingdom, where chartered accountants are self-regulated (Previts, 1985

12). The United States requires individual state licensure for its CPAs. The idea of independence is most often associated with the accountant's role as an auditor. Auditors act as the intermediary between shareholders and management. Their role is to detect

Leslie-2 fraud and other accounting errors. The Joint Stock Companies Act of 1844 specified that companies had to have their accounting records audited by shareholder appointed auditors in Britain (Chatfield 1996, 238). Chartered Accountants believed an auditor would be more diligent if they had an economic interest in the enterprise; therefore, auditors were selected because of their role as a stockholder in the company being audited (Previts 1985, 12). Chartered Accountants in Britain are similar to Certified

Public Accountants (CPA) in the United States. British auditors of the 1800s obtained technical expertise through public accountants outside of the company, creating the audit function that is now commonplace in public accounting in both the United States and

Britain. The Industrial Revolution of the 18 th century brought about a growth in the number of auditors. This was in response to the increase in corporate forms of business.

The growth of the public accounting profession in Britain and the United States brought about the issue of independence (Previts 1985,34). Independence can mean integrity, honesty, and objectivity. It can also be referred to as freedom from the control of those whose records are being reviewed. Independence can also be viewed as a state of mind and a matter of character (Chatfield and Vangermeersch 1996,322). Many believed that independence was a cultural ought, rather than a notion limited by a set of rules (Previts 1985, 55). In 1849, the British House of Lords proclaimed that an independent individual not interested in giving the accounts a favorable appearance is a better candidate for auditor (Previts 1985, 30). An editorial in Accountant, a British publication, in 1889 stated that for an audit to be upheld, professional solidarity must exist and "self-restraint as a moral force in the face of a transgressing investment community" must be practiced (Previts 1985, 28). These statements rejected the earlier

Leslie-3 beliefs held by the auditing community. These ideas were confirmed with the U.S. stock market crash of the 1920s. This represented the end of the free market era of public accounting and the beginning of a regulated profession.

Numerous laws have been passed by the United States Congress, which have had both a direct and indirect impact on auditors' independence. The Federal Securities Acts of 1933 and 1934 specified that audits at a federal level in the United States must be performed by an "independent public accountant" (Previts 1985, 6). The statute also mandated audits for major publicly held companies. The Securities and Exchange

Commission (SEC) further defined the term independence with its issuance of

Accounting Series Release (ASR) No.2 "Independence of Accountants: Relationship to

Registrant" in 1937. This rule stated that an accountant could not be independent if he or she has been an officer or director during the period under review of the enterprise being reviewed or ifhe or she holds interest in the enterprise with respect to its capital or the accountant's personal future. The SEC again amended the rule in 1950 to eliminate the word substantial from the phrase "any substantial interest" (Chatfield and Vangermeersch

1996,323). The SEC added Ethical Rule 13 in 1950 imposing the independence restriction (Previts 1985,67).

The Watergate scandal of the 1970s changed the political mood of the United

States. The burglary of the Democratic Party's Watergate headquarters put the ethics of the President ofthe United States under question. A newfound interest in ethics was formulated throughout the country. From 1976-1982 many hearings took place regarding corporate accountability between several regulatory agencies and the U.S. House of

Representatives Subcommittee on Oversight and Investigations (Previts 1985, 120). The

Leslie-4

American Institute of Certified Public Accountants (AICPA) began focusing on accounting firms rather than the individual during this time period. The AICP A provides authoritative guidance for financial accounting, auditing, ethics, and education. The

AICPA standardized tax practice, management advisory services, continuing professional education, accountants' services on prospective financial statements, and attestation engagements (Chatfield and Vangermeersch 1996, 41). Through collaboration with the

SEC and the Federal Trade Commission (FTC), the AICPA also developed professional ethics standards for the U.S. accounting profession (Chatfield and Vangermeersch 1996,

42). The AICP A is also involved with defining collegiate accounting curricula. In the

1960s state-licensing boards began requiring a bachelors degree with a concentration in business and accounting subjects to take the CPA exam (Previts 1985,75).

The Sarbanes-Oxley Act of2002 came about as a result of the Emon, a publicly traded energy company, and Arthur Andersen accounting scandal. Emon was hiding debt through the creation of separate partnerships; therefore, the debt would be depicted in the partnership's financial statements rather than those of Em on. Auditor, Arthur Andersen, was signing off on financial statements that provided a false representation of the financial stability of Emon. This case has brought to light many weaknesses that exist within the cun-ent organization ofthe accounting profession. The Sarbanes-Oxley Act is an attempt to remedy these problems. The act has instituted a committee to oversee compliance with the new regulations. The Act further defines independence as not receiving, other than for service on the board, any consulting, advisory, or other compensatory fees from the issuer, and as not being an affiliated person ofthe issuer, or any subsidiary thereof. The Act goes on to state that the Chief Executive Officer,

Leslie-5

Controller, Chief Financial Officer, Chief Accounting Officer or person in an equivalent position cannot have been employed by the company's audit firm during the one-year period proceeding the audit. To further ensure the independence of auditors, the act states that the lead audit or coordinating partner and the reviewing partner must rotate off the audit every 5 years (AICPA 2002).

Consulting, professional advice to a client on accounting and business issues, had been a major revenue source for accounting firms before the audit function gained importance. Consulting and tax functions are economically attractive ways to balance the workload between the peak season surrounding year-end audits and the off-season. The

American Institute of Certified Public Accountants (AICP A) encouraged the performance of these services. In 1953, the AICPA formed the committee on management services by

CPAs to encourage local accounting firms to explore extending their practices into other areas (Previts 1985, 88). In 1963 the AICPA issued Opinion No. 12 stating that there was no likelihood of a conflict of interest arising from the offering of consulting and tax services (Chatfield and Vangermeersch 1996,324). Through these actions and statements the AICP A was pronouncing that it was ethical to offer such services.

The offering of consulting services to an audit client has been an issue in many court cases. The Westec case in 1985 brought up the issue of consulting services and independence again. Ernest M. Hall, president of Westec, was accused of inflating the price of his company's shares by making speculative purchases and sales ofWestec securities and by choosing accounting methods that maximized current income (Chatfield and Vangermeersch 1996, 100). This case suggested that audit independence was compromised by the consulting services rendered by the accounting firm (Previts 1985,

Leslie-6

129). The outcome of this case suggests that auditors may be held liable for choosing accounting methods to achieve a desired outcome and certifying the misleading financial statements (Chatfield and Vangermeersch 1996, 100). The SEC responded to the issue of consulting services offered to audit clients with the release of ASR 250, which requires companies to disclose fees for nonaudit services if the sum is more than three percent of audit fees (Previts 1985, 133). The Sarbanes-Oxley Act of 2002 adds to this rule stating that non-audit services may be issued without prior approval if the aggregate amount of all such non-audit services provided to the issuer constitutes less than 5% of the total amount of revenues paid by the issuer to its auditor. The bill goes on to discuss services outside the scope of practice for auditors. The Act prohibits the offering of the following non-audit services: (l) bookkeeping or other services related to the accounting records or financial statements of the audit client; (2) financial information systems design and implementation; (3) appraisal or valuation services, fairness opinions, or contribution-inkind reports; (4) actuarial services; (5) internal audit outsourcing services; (6) management fllnctions or human resources; (7) broker or dealer, investment adviser, or investment banking services; (8) legal services and expert services unrelated to the audit;

(9) any other service that the Board determines, by regulation, is impermissible. The bill allows a firm to engage in any non-audit service not listed above, including tax services.

The bill also provides for the pre-approval of other non-audit services (AICP A 2002).

A close relationship exists between public accounting and the businesses they audit. The apparent financial dependence of accountants on business entities creates this connection. The closeness of this association creates a need for ethics in accounting.

Leslie-7

Auditors not only have a responsibility to their client, but also an "important social responsibility" to the public (Gaa 1994, 111).

A Decline in Ethics

There are many explanations for the decline in the ethical practice of professionals. Economic critical theory states that the inherent contradictions within capitalism cause ethical conflicts (Ponemon et al. 1999, 126). Corporations tend to suffer from short sightedness, due to their constant drive toward profit (Donaldson and Werhane

1999, 158). A balanced mix of motives, both profit and social, must be reached to avoid conflicts of interest (Donaldson and Werhane 1999, 164). The existence of competition makes the similarities between business and game ethics evident. Economic ethics have a cause-and-etIect association (Ponemon et al. 1999, 121). Donaldson stated that

"everyone is constantly searching for the most advantageous way to achieve the capital they want, which naturally leads to what is most advantageous to society" (Donaldson and Werhane 1999, 142).

Many large regional firms are merging to form larger firms. This leads to a limited number oflarge firms, creating instability within the profession. Information and power asymmetry occurs, which leads to a lack of professional solidarity (Gaa 1994,

3/29). Firms then begin to compete for a contract with a company and they lower their ethical standards to obtain the contract. The Sarbanes-Oxley Act of 2002 states that a study by the GAO will be conducted regarding the consolidation of public accounting firms since 1983. The study will include the present and future of the consolidation and solutions to any problems discovered (AICPA 2002).

Leslie-8

Critics claim a break down has occurred in the ethical standards and behavior of members of the accounting profession (Gaa 1994, 112). Sixty eight percent oflarge and small companies surveyed by Forbes in 1999 agreed, "there is a problem because of the lack of ethics in our society" (Calhoun et a1.l999, 84). See Appendix 2-3. One critic states, "The accounting function has long been established. What we've witnessed has been an erosion ofthe willingness to adhere to that function" (The Post and Courier

2002). In a 1999 survey conducted by Calhoun, Oliverio, and Wolitzer, professionals were asked if they had ever been requested by a superior to do something they considered unethical. Sixty nine percent of the forty-two accounting societies surveyed said yes

(Calhoun et al. 1999,86).

The accounting profession is constantly striving to enhance professionalism while reducing the extent and effect of legal liability. A common problem is the failure of audit team members to report discrepancies with audit work or findings to management.

Generally accepted auditing standards, GAAS states that auditors should report all problems to management (Ponemon et al. 1998, 126). Taking the higher or ethical road is often associated with higher costs, but firms are better able to solve commitment problems with employees when choosing the ethical path. As a result the firm will benefit from increased revenue due to a more effective and efficient work environment

(Donaldson and Werhane 1999, 173). A business cannot have responsibilities, because it is an artificial person, creating a need for ethical standards for professionals (Donaldson and Werhane 1999, 154).

-

Leslie-9

Philosophy's Contribution to Ethics in Accounting

In order for professionals to behave ethically they must first understand the meaning of the word "ethics." The terms "morals" and "values" can be used interchangeably with the word ethics. Derived from the Greek and Latin word for

"custom," me:ming settled or basic, ethics are basic customs of moral reasoning, or human behavior, as it ought to be (Donaldson and Werhane 1999,40). Psychologically, ethics consist of attitudes, beliefs, values, and personality, which are all part of human behavior. Ethics can also be defined using the theory of ethical egoism, "everyone ought always act in his or her perceived self-interest" (Gaa 1994,4/58). This theory states that an act is moral when it promotes the individual's best long-term interest (Armstrong

1993,4). Society and professional accountants would find it in their best interest, though difficult, to negotiate an agreement on responsibilities and autonomy of the profession

(Gaa 1994, 3/29).

The study of ethics in a philosophical context centers on questions concerning what is morally good or bad (Ponemon et al. 1999, 117). In order for people to understand what is morally good or bad they must be taught the differences between the two. As a person progresses through life they develop their own beliefs of what is or right or wrong. Many factors come into play in a persons belief system, "deeply held and enduring beliefs about preferred end-states of existence" (Ponemon et al. 1998, 202).

One such factor relates to a persons upbringing. Basic moral reasoning is learned in childhood.

Lawrence Kohlberg, an American psychologist, pioneered the study of moral development in the late 1950s. Kohlberg's theory of moral reasoning involves six stages

-

Leslie-l0 through which each person passes in order, without skipping a stage or reversing their order. His theory states that not all people progress through all six stages. The first stage of Lawrence Kohlberg's stages of moral development discusses the moral maturity of preadolescent children. In stage one, children view the orders of authority figures as the law and determine what is good or bad based on the physical consequences of their actions (Armstrong 1993, 19). As a child grows and develops, their value system matures as well. Ethics are learned through social interaction, education, and professional relationships. Situational characteristics have a secondary effect on moral judgments, by establishing models of acceptable behavior (Ponemon et al. 1999,3). In

Kohlberg's stage two, people begin to recognize the needs and interests of others

(Armstrong 1993, 19). This often takes place as social interaction in a persons life increase. Most social interaction takes place in an educational setting during the first 18 years of a person's life. In stage three, people become concerned with meeting others' expectations (Armstrong 1993, 22). Children often look to their parents, teachers, and peers for approval of their actions. Professionals often look to professional organizations, peers, and standards. Stage four takes place after high school when people look to external sources to define right and wrong, like laws, company policy, or a religious organization (Armstrong 1993, 23). In order to develop a definition of right a wrong a person must understand the rules and the consequences of acting unethically regarding these rules. Stage five involves becoming aware of others' value systems and respecting and understanding their relevance within the group. Many people never reach this level of maturity (Armstrong 1993,24). Once a person reaches stage six, they follow abstract self-chosen ethical principles (Armstrong 1993, 20-1).

-

Leslie-II

Ethical principles are essential for accountants. All accountants must possess moral sensibility, "the capacity to impose ethical order on a situation and to identify aspects of the situation that have ethical importance" (Ponemon et al. 1999,235). Values are affected directly by previous ethical instruction and exposure to respected professional role models (Ponemon et al. 1999,3). A person's value system is learned through social and professional interaction, much of which takes place in an educational setting. The usage of case studies in business courses will help an accountant's moral development. By applying ethics to real life situations accountants will better be suited to choose the ethical path when in a professional setting.

Ethics are of great importance in accounting as an auditor's commodity in trade is truth. When making a decision the auditor must determine whose interests are relevant.

Conflicting interests may cause a breach of moral code. A value judgment must sometimes be made to arrive at a conclusion (Gaa 1994,4/63). The auditor'S job is to determine that financial statements are properly reported and communicate the information to the stakeholders (Ratliff et al. 2002). When conflicts occur, professional rules can be used to determine whose interests take precedence (Gaa 1994, 6/106).

Auditors must have obj ectivity and independence when making these decisions. The general pronouncements also state the auditor must obtain independence. Independence is an abstract concept (Gaa 1994, 7/111). For this reason, auditors must not only be accounting experts, but also moral experts (Gaa 1994, 5/90). Long-term success for individuals, businesses and the economy depends on consistent ethical business practices

(PR Newswire 2002).

-

Leslie-12

In order for accounting to be considered a profession, it must have an ethical obligation to the rest of society. The profession must be valuable to society, include expertise, regulate itself, and have professional associations (Gaa 1994,2111). The accounting profession is not only valuable to stakeholders of a company, but to society as a whole. The U.S. stock market crash of the 1920s depicts the consequences of society losing faith in the economic stability oftheir country. The public trusts the truthfulness ofthe financial statements, and a breach of this trust can cause great economic instability.

The expertise of accountants allows them to have professional judgment. Public accounting has gained credibility in the U.S., because accountants internalize the responsibility to the public (Calhoun et al. 1999,21). Many professional accounting associations perform self-regulation for the profession.

In order to provide ethically sound services, an accountant must find honor in their commitment to ethical behavior. Independent public accountants need to obtain the following critical skills: knowledge of business functions, knowledge of rules and regulations for multiple industries, and knowledge of professional responsibilities

(Calhoun et al. 1999,23). In addition, accountants must strive to be nonjudgmental and find ethical issues engaging and challenging (Calhoun et al. 1999,31). In a 1999 survey conducted by Calhoun a list of proposals to deter unethical behavior were presented to business professionals. Monitoring or "tone at the top" was seen as the most effective method, while peer pressure and parental guidance came in as a close second (Calhoun et al. 1999,89). See Appendix 1.

Leslie-13

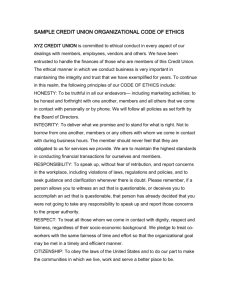

Ethical Codes for Accountants

The accounting profession has many standards and rules governed by different organizations. The accounting ethics codes of these organization often include independence, integrity, objectivity, and due care as rules. Objectivity is a certain state of mind, independence deals with relationships, and due care is a quest for excellence

(Calhoun et al. 1999, 25). General standards and accounting principles state the accountant's responsibilities to clients (Calhoun et al. 1999, 110-1). The AICPA code covers topics on the responsibilities of CP As, the public interest, integrity, objectivity and independence, due care, and the scope and nature of services (Donaldson and Werhane

1999,73). The AICPA, which currently has approximately 300,000 members, is the national professional organization of CP As (AICP A 2002). Financial accounting, auditing, ethics, education, and practice governance are the most important dimensions of the contemporary AICP A program (Chatfield and Vangermeersch 1996). Standards of

Ethical Conduct for Management Accountants, which includes topics covering, competency, confidentiality, integrity, and objectivity, are another source of ethical codes

(Donaldson and Werhane 1999, 79). This code relates to management accountants and their obligation to the organization, their profession, the public, and themselves

(Armstrong 1993, 119). Members of the Financial Executives Institute adhere to the

Code of Ethics of Financial Executives Institute (Armstrong 1993, 123). Internal auditors follow the Institute of Internal Auditors Code of Ethics and the Standards for the

Professional Practice ofInternal Auditing (Armstrong 1993, 123-5). The Association of

Government Accountants Code of Ethics is in place for government accountants

(Armstrong 1993, 126). In order for these codes to be valuable to society, clients, and

-

Leslie-14

CPAs, some form of monitoring must exist. The AICP A, state societies of CPAs, and state boards of accountancy are responsible for policing and enforcing the ethics rules for different organizations (Armstrong 1993,73). Peer review serves as an effective form of ethics monitoring as well. Peer reviews in public accounting consist of one firm providing assurance that another firm is meeting professional standards (Armstrong 1993,

75).

Despite all of the professional organizations for accountants and their efforts to promote ethical behavior, unethical conduct continues. For example, firms where fraud is prevalent tend to have an old and vague code of conduct, little enforcement, and bad training programs (Ponemon et al. 1999,91). Good training is vital in helping people to understand how to put the rules of the code into effect. Accountants must be able to understand the code before they can apply it to their work. If a code is outdated, it may lack credibility. If parts ofthe code no longer apply, people are more likely to dismiss the entire codf'. Another important item to remember is that a company's decree does not always reflect the reality of the entity (Calhoun et al. 1999,3). The norm in a company may be to disregard the code. Another overriding problem with ethics is hypocrisy

(Calhoun et aL 1999, 40). The code may simply be a formality, and the rules are not actually followed. To gain credibility, a firm must follow the cliche "practice what you preach" (Calhoun et al. 1999, 10 1). Top management must set an example and follow through on a code of ethics in order for it to be successful. Many business professionals believe this is a singular solution to unethical behavior (Calhoun et al. 1999,91). A firm's code should reflect customer and employee moral values, which can, at times, be conflicting and compete with one another (Donaldson and Werhane 1999, 168). Ifparts

-

Leslie-15 of the code conflict, the credibility of the code declines, and it becomes more likely that the code will not be followed in its entirety. A survey conducted by Calhoun, Oliverio, and Wolitzer in 1999 revealed that often fraud occurred in public accounting firms that did not have an established code of ethics (see Appendix 3).

Accounting Ethics in Education

Training and education is an integral part of any ethics program. Many business professionals believe ethics training or counseling on the job is one possible solution to reducing unethical behavior (Calhoun et al. 1999,91). The training session could be held onsite. The leader of the training session must be knowledgeable in the field of ethics and have actual working experience in order to be effective. Quality class materials and good presentation skills make a training session more engaging and fruitful (Calhoun et al. 1999, 134). Reviewing existing ethical programs in successful businesses can provide a benchmark when building the framework for your company's code (Calhoun et al.

1999, 137). Benchmarking involves viewing other ethical programs for ideas on improving the code of ethics in place or creating a new code.

One ofthe most important ways to reassure the public that accountants will act in an ethical manner is to properly educate accounting students. Many business professionals feel that proper education of ethics will help deter unethical behavior

(Calhoun et al. 1999,91). Bob Rutland, the chairman and CEO of Allied Holdings Inc. in Atlanta, said, "If they don't have those values coming up, they've got to learn them"

(The Post and Courier 2002). Business schools, President George W. Bush said, must be

"principled teachers of right and wrong and not surrender to moral confusion and relativism" (Singer 2002).

Leslie-I 6

The teaching of ethics increases a student's awareness of significant dimensions in decisions they will have to make (Ponemon et al. 1998, 35). Auditors' thinking and reasoning processes are some of their most valuable tools. The ability to accept or reject arguments based on their believability and their relationship to the premise should be a defining characteristic of a competent auditor (Ratliff et al. 2002). Recognizing an issue's ethical dimensions stems from the combination of an individual's sensitivity towards the moral intensity and the ethics involved (Ponemon et al. 1998,35).

Sensitivity toward moral issues is learned early in a person's life, but it grows through life experiences and education. Students become more sensitive to ethical issues once they are aware of the consequences of certain accounting problems. A 1998 study performed by Patricia Casey Douglas and Bill N. Schwartz found that teaching ethics throughout an accounting curriculum increased students' principle reasoning skills.

Finding educational material that includes information and guidelines on accounting ethics can be a challenge. One ofthe first places to look for educational materials is a textbook. Unfortunately, not all accounting texts include a chapter on accounting ethics. The opportunity cost of teaching ethics in lieu of more "significant" business topics causes the importance of teaching ethics to be downgraded (Ascribe

Newswire 2002). Most accounting information texts do not cover the importance of ethics (Ponemon et al. 1998, 267). Publishers and authors need to address this most importance aspect of the profession. If the demand for textbooks covering the topic of ethics increased, the publishing industry would respond to this demand by providing more texts that cover accounting ethics within their respective areas. When textbooks do not cover ethics, the responsibility lies with the faculty to teach this topic to students. In

-

Leslie-17 order for a program to be successful, it must have faculty support (Ponemon et al. 1998,

107). The "tone at the top" affects the ethics of the people below. When professors truly believe in the importance of the topic they are teaching, students will attach that importance to what they learn.

Students must have the knowledge to recognize issues in accounting that have ethical implications. Then, they must develop a sense of moral obligation or responsibility relating to the issue. By learning to deal with the uncertainties of the accounting profession, students can develop the abilities needed to deal with ethical conflicts or dilemmas. Proper education can set the stage for a change in ethical behavior. Students will appreciate and understand the history and composition of all aspects of ethics and their relationship to the general field of accounting (Ponemon et al.

1998, 107). A study conducted of the 14 schools in the Mid-American Conference depicts the lack of formal ethical education at the undergraduate level (Leslie 2003). Of the ten schools responding to the survey, only one school requires all accounting majors to take a course on ethics. The nine other schools stated that ethics were covered as topics within other courses or the coverage was left to the discretion of the professor (See

Appendix 4). The Association to Advance Collegiate Schools of Business (AACSB) accredits all ten ofthe business schools that responded. AACSB accreditation promotes excellence and continuous improvement in undergraduate and graduate education for business administration and accounting. The standards state that accounting degree programs, in addition to building a substantial knowledge base in accounting and business administration in the context of a professional orientation, should develop communication, intellectual, and interpersonal skills built on a broad, general education

Leslie-18 foundation. The standards suggest placing emphasis on the professional role played by accountants in society providing and ensuring the integrity of financial and other information. This implies the importance of ethics, but does not state the teaching of ethics as a requirement to obtain AACSB accreditation (AACSB 1998).

A student must be taught ethical reasoning in order to determine what an ethical solution would be to problems arising in accounting practice. Teaching the four dimensions of ethical reasoning will help students apply ethics to actual situations: recognize the ethical issue (See Appendix 2), make a moral judgment, create an intention, which leads to a behavior, and the resulting behavior (Ponemon et al. 1998, 29). Another approach when attacking an ethical issue involves seven discussion steps: 1) identify the facts; 2) identify the ethical issues; 3) identify the norms, principles, and values related to case; 5) name alternative courses of action; 6) choose the best action that is consistent with the norms, values, and principles; 7) relate the consequence to the action; and make a decision. If students follow this process in the classroom, they will train themselves to think in this manner when ethical issues arise in the field.

CP As must be able to insightfully analyze a situation, observe astutely, solve problems, identify relevant and valid evidence, and have the ability to learn independently (Calhoun et al. 1999,30). These skills can be taught throughout an accountant's education and reinforced in their day-to-day professional activities. At the earliest level of a student's education they can be taught to observe and learn independently. Ethics education begins in a child's earliest years. In junior high and high school, the teaching of ethics becomes even more relevant. As students begin preparing resumes and college applications in high school, they must understand the

-

Leslie-19 ethical implications of the information they present about themselves. Finding strength and fortitude in putting forth truthful and proper information.

Elementary students are taught the basis of ethical reasoning throughout their early education. In 1999, the Virginia General Assembly approved legislation that requires all Virginia schools to teach character education (Roanoke Times and World

News 2002). The legislation is part of a national movement to restore the teaching of values in schools, in lieu of the fact that many people believe that the nation's moral climate is deteriorating. This legislation sprang from Character Counts, the national program that promotes ethics in education (Roanoke Times and World News 2002).

Advocates of this program believe the program instills civic virtues and positive character traits that will help boost the students' academic education, reduce disciplinary problems, and develop a civic-minded attitude. Schools are now required to teach honesty, responsibility, respect and fairness to diverse social, cultural, and religious groups. Some elementary schools are creating a program in which students seen practicing good character traits are rewarded for their good behavior, while other schools are creating musicals, plays, and skits representing positive character traits. Some schools recite a pledge to be fair, considerate, and responsible every morning. School assemblies and classroom discussions are becoming more centered on ethical education (Roanoke Times and World News 2002). These programs instill the importance of ethics at a young age and continue to educate students on ethical principles throughout their education.

One important area in the education of accounting ethics is tax. The association between the level of moral reasoning and tax compliance decision-making is very strong

(Ponemon et al. 1999, 108). Attempts are often made to serve the short-term economic

-

Leslie-20 interests ofthe professional tax community (Ponemon et al. 1998, 82). Common questionable behaviors among tax preparers, as reported by the IRS in 1998, include: not probing for secondary sources of income, not being cautious about criminal violations when there is a suspicion that income is intentionally understated, signing a return when there is strong suspicion that it understates income, signing a return that has a large undocumented deduction, and showing a deduction in such away as to minimize the chances of being selected for an audit (Ponemon et al. 1998,77). Tax issues often present the most difficult ethical and moral dilemmas, but there is the least education regarding these issues (Ponemon et al. 1998, 73). Introductory tax textbooks rarely include a section on ethics (Ponemon et al. 1998,79). A large amount of technical material exists in tax education and little time is left to discuss moral implications. Tax educators' often lack ethics training or the materials to teach them (Ponemon et al. 1998,

80). Adding a course in tax ethics to the accounting curriculum would help students better understand the moral implications in tax accounting. While other tax classes focus on the technical aspects surrounding taxes, a "tax ethics" course can teach students how to deal with conflicts that may arise in this, most sensitive or public areas. The addition of this course would only serve to broaden a student's knowledge in taxes.

Accounting students build on their own values and ethics through honor codes or exposure to history and philosophy as part of a liberal arts education (The Post and

Courier 2002). Business disciplines such as management, marketing, finance, accounting, and others are taught to students in college and universities as the key fundamentals to business operations. Business ethics are plainly missing from this equation. Business education in the past has focused on maximizing profits with little

-

Leslie-21 focus on ethics (The Post and Courier 2002). Ethics training is often considered a trifling requirement that students should get out of the way as quickly as possible in order to focus on more "important" business issues (Ascribe Newswire 2002). According to a recent survey of 2000 students entering MBA programs, 68 percent stated maximization of shareholder value was their prime responsibility to the corporation. By the end of the first year, 82 percent of the students surveyed stated maximization of shareholder value was their prime responsibility to the corporation (Ascribe Newswire 2002). Ethics should be integrated into the requirements for all business majors like any other business discipline (Calhoun et al. 1999,92). Requiring a course on business ethics will help accounting students understand the ways in which moral values fit into their education and chosen career. Ethics should not only be a stand alone course, it should also be integrated into other courses as well to avoid being perceived as an afterthought, "tacked on" as an additional prerequisite (Ascribe Newswire 2002).

To establish the importance of ethics in our society, one must begin at the basic education level and work their way to business operations in organizations. First, business ethics must be established as part of core curriculums in colleges and universities. Second, business ethics must be made part of testing materials in professional certifications exams and Continuing Professional Education (CPE) programs. As business professionals progress through their career they must continue education on ethics. Accountants are updated on current topics in the profession through

CPE courses. Third, business ethics must be an important part of every organizations decision-making and operational strategy (Calhoun et al. 1999,158).

-

Leslie-22

A class on ethics should introduce principles of ethical thinking and apply them to situations and models for business decision-making. In light of the recent accounting scandals, like Enron and WorldCom, some colleges are beginning to incorporate ethics into their business programs. David Vogel, a professor at the Haas School of Business of

University of California, Berkeley stated, "it is hard to shoehorn ethics into a two-year business curriculum" (Singer 2002). "The curriculum is under so many other pressures to do technology, the Internet, globalization, the environment - (ethics) is competing with so many other things," Vogel said. "The curriculum is finite. You can't put everything in it" (Singer 2002). But Hans Grande, 30, who graduated from Haas in May, worries that if ethics is not made a formal part of the curriculum, attention will fade and his peers will again be caught up in the moneymaking frenzy that fueled the high-tech boom and bust of the late 1990s.

A conceptual and systematic study of corporate ethics in an effort to develop consistent criteria for business ethics decision-making must be provided. The professor can review court cases, case studies, and ethical readings. Topics can include: I) philosophical foundations of ethics; 2) increasing societal diversity and its impact on organizations; 3) human behavior in organizations, primarily human motivation; 4) forces in society and business that have resulted in organizations' establishment of ethics offices; and 5) government regulation (Bentley College 2000).

The recent Enron and WorldCom scandals have created a greater public awareness of business ethics (PR Newswire 2002). The increased attention placed on the ethics of accounting professionals should result in a response from business schools to offer better training of their students in the discipline of ethics. "I would worry that once

Leslie-23 the economy starts revving again, and there are more new technologies, people will get sidetracked," Grande said. Also, these create good stories for examples in the classroom, but education of ethics may not go further than that (Ascribe Newswire 2002). Only eighteen MBA programs nationwide require students to take an ethics course (PR

Newswire 2002). The thinking of many MBA programs is that by the time a student has reached this point in their education their ethics are essentially incorrigible (Ascribe

Newswire 2002). "If we really believe in life-long learning, we should act as if we can change attitudes toward ethical and responsible behavior in positions of organizational leadership" (Ascribe Newswire 2002). Bentley College requires its MBA students to take 3 to 4 ethics courses: Ethical Issues in Corporate Life, Law and Ethics in Business,

Managing Ethi cs in Organizations, and Research in Business Ethics (Bentley College

2000). Rutgers University in New Jersey will be requiring all full-time business students to take an ethics class next year (Singer 2002). The Katz School of Management at the

University of Pittsburgh is considering eliminating ethics as a separate class and integrating ethics into other subjects they are studying, such as accounting or marketing

(Singer 2002). The University of Akron business school is offering a new ethics course in the philosophy department. Their business courses incorporate ethics through case studies. The University of South Carolina's Moore School of Business is adding CEOs to its speaker series to talk about working in an environment where ethical behavior is expected. The Citadel is bringing in speakers to address students on business and leadership issues, which focus on ethics (The Post and Courier 2002).

Ethics should be the legs on which the profession stands. In order for the accounting profession to rise above the recent ethical scandals its newest inductees must

-

-

-

Leslie-24 be properly educated in the arena of ethical values. Accountants are seen as honest individuals, and the importance of this honesty can be instilled in students throughout their business education.

)

Leslie-25

Appendix-l

Respondents' Judgment of Proposals to Deter Unethical Behavior

Businesses

N=76

Proposal

Code of ethics

Written policies and procedures

Monitoring or

"tone at the top"

Co-worker or peer pressure

State or federal law

Ethical training

Parents' guidance

. . . .

Effective

55

62

97

82

18

51

80

Accounting

Societies

N=42

Effective

69

81

88

86

52

83

93

28

1

16

53

33

5

Responses

Businesses

N=76

Accounting

Societies

N=42

(Percentages shown)

Moderate Moderate

22 24

14

7

10

36

12

5

Businesses

N=76

Ineffective

21

28

13

I

9

0

1

Accounting

Societies

N=42

Ineffective

2

5

2

2

12

5

2

-

Calhoun, Charles H., Mary Ellen Oliverio, and Philip Wolitzer. Ethics and the CPA: Building Trust and Value-Added Services. New

York: John Wiley & Sons, Inc., 1999.

) )

Appendix-2

Identify

Issue

Recognize

Ethical

Dimension

Ethical

Sensitivity

Moral

Intensity

Ethical

Issue

Recognition

Make

Moral

Judgment

Establish

Moral

Intent

Figure 1. Model of Ethical Issue Recognition

Act

On

Intent

)

Leshe-26

Ponemon, Lawrence A., Marc J. Epstein, and James Gaa. Research on Accounting Ethics. Vol 4. Stamford: JAr Press Inc., 1998.

Leslie-27

Appendix-3

Knowledge of Unethical Behavior

Knowledge of a business operating fraudulently?

If yes, did the fraud have a material effect on financial statements?

Have you knowledge of a business operating unethically at the senior management level or above?

Did the organization

(where fraud was noted) have a published code of ethics?

Have you been requested by a superior to do something you considered wlethical?

Have you seen intentional misstated financial statements?

Businesses

N-76

Yes

21

13

39

7

22

13

Responses from

Accounting

Societies

Accounting

Businesses Societies

N-42 N-76

(Percentages shown)

N-42

Yes No No

38 79 62

31

40

7

69

19

13

59

32

70

78

7

60

24

24

33

Calhoun, Charles H., Mary Ellen Oliverio, and Philip Wolitzer. Ethics and the CPA:

Building Trust and Value-Added Services. New York: John Wiley & Sons, Inc.,

1999.

Appendix 4

--.. ---==------... _.......- ___

~= ==_..

_I--

How do you incorporate the teaching of ethics in undergraduate

~ourses for Accounting majorsl.. __

- - - - - - - - -

Ethics is covered as a topic in other required courses for Accounting majors, __ _ _ ___ _

Ethics is covered at the discretion of the professo-r.

No formal policy is in place regarding the teaching of ethics.

5

3 7

.,

,

Note: After a second request four the MAC schools did not respond.

Leslie-2B

-

Leslie-29

Works Cited

Albrecht, Steve W. 1992. Ethical Issues in the Practice of Accounting. Cincinnati:

South-Western Publishing Co., 1992.

American Institute of Certified Public Accountants. 2002. Mission Statement. AICP A

<http://www.aicpa.org>

American Institute of Certified Public Accountants. 2002. Summary of Sarbanes-Oxley

Act 2002. AICPA <http://www.aicpa.org>

Armstrong, M. B. 1993. Ethics and Professionalism for CPAs. Cincinnati: South-

Western Publishing Co., 1993.

Ascribe Newswire. 2002. Business Schools, the Rankings, and Their Roles in the Crisis of Corporate Confidence. <http://proxy.bsu.edu:2059/universe/document>

Association to Advance Collegiate Schools of Business. 1998. Accounting Standards

2000. < http://www.aacsb.edu>

Bentley College. 2000. Bentley College Official Web Page.

<http://ecampus.bentley.eduidept/cbe/ethicseducationlmba.html>

Calhoun, C. H., M. E. 0., and P. W. 1999. Ethics and the CPA: Building Trust and

Value-Added Services. New York: John Wiley & Sons, Inc.

Chatfield, M. and R.V. 1996. The History of Accounting: An International

Encyclopedia. New York: Garland Publishing, Inc.

Donaldson, T. and P. H. W. 1999. Ethical Issues in Business: A Philisophica1

Approach. 6 th ed. Upper Saddle River: Prentice-Hall, Inc.

-

-

Leslie-30

Gaa, J. C. 1994. The Ethical Foundations of Public Accounting. Vancouver: CGA-

Canada Research Foundation.

Leslie, J. L. 2003. Undergraduate Ethics Programs in Accountancy.

Ponemon, L. A., M. J. E., and J. G. 1998. Research on Accounting Ethics. Vol 4.

Stamford: JAI Press Inc.

Ponemon, L. A., M. J. E., and J. G. 1999. Research on Accounting Ethics. Vo15.

Stamford: JAI Press Inc.

PR Newswire. 2002. Business Ethics Is New Initiative on 770 College Campuses;

Students in Free Enterprise Year-Long Ethics Campaign Launches National

Business Ethics Month in October. <http://www.pmewswire.com>

Ratliff, R. L., 1. T. N., G. S., and G. M. 2002. Teaching Logic to Auditing Students.

<http://www.usu.eduiaccount/faculty/nelsonilogic.htm>

Roanoke Times and World News. 2002. Aim Of Character Education To Instill Civic

Virtues, Personal Ethics; It Usually Is Integrated Into Daily School Activities And

Classes And Not Treated As An Add-On Program.

<http://proxy.bsu.edu:2059/universe/document>

Singer, P. 2002. Business Schools Adding Course on Ethics. The Seattle Times

Company. <http://seattletimes.nwsource.com>

The Post and Courier. 2002. Corporate scandals show importance of teaching ethics.

<http://proxy.bsu.edu:2059/universe/document>