OUTH

advertisement

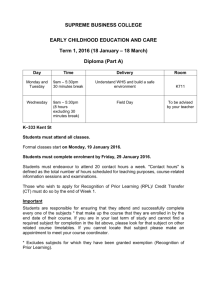

OUTH E X C H A N G E University of South Alabama Federal Credit Union 103 Hillcrest Rd. Mobile, AL 36608 Board of Directors: President, Polly Stokley Vice President, Pam Henderson Secretary, Scherita Mixon Treasurer, Ben Tipton Board Members Wayne Davis Chuck Warnol John Smith Management and Staff: Manager Felicia McKee Assistant Manager Jessica Dickson Bookkeeper Michele Allen Loan Officers Sandra Bolden Kristin Blackerby Compliance Specialist Stacy Barnhill Tellers Brenda Walker Angela Garrick Khyrstal Brown Debbie Allen Phone: (251) 706-0255 Fax: (251) 706-0299 Main (Campus) Lobby Hours: Monday – Friday 8:00 a.m. till 5:00 p.m. Drive-Up Hours: Monday - Thursday 7:30 a.m. till 5:00 p.m. Friday 7:30 a.m. till 5:30 p.m. USAMC Branch Office Hours: Monday, Wednesday, Friday 8:00 a.m. till 12:30 p.m. 1:00 p.m. till 4:00 p.m. Children’s & Women’s Hospital Branch Hours: Thursday 8:30 a.m. till 12:30 p.m. 1:00 p.m. till 4:00 p.m. HOLIDAY CLOSINGS, 2016 Friday, January 1, 2016....................................New Year’s Day Monday, January 18, 2016... Martin Luther King, Jr. Birthday Tuesday, February 9, 2016............................. Mardi Gras Day Monday, May 30, 2016.................................... Memorial Day Monday, July 4, 2016 for............................Independence Day Monday, September 5, 2016.................................. Labor Day Thursday, November 24, 2016.....................Thanksgiving Day Monday, December 26, 2016...........................Christmas Day Current Loan Rates New Auto Rates .…36 months… 1.74% APR ….48 months… 1.94% APR ….60 months.... 2.24% APR ….72 months… 2.84% APR Other Loan Rates Unsecured Loans ..up to 36 months…as low as 10.4 % APR Get-Away Loans ..up to 48 months…as low as 7.40% APR VISA Credit Cards ….8.9% APR/No Annual Fee All loan rates quoted as Annual Percentage Rates and are subject to change without notice. Loans available to qualified borrowers and are subject to existing credit policies. Equal Opportunity Lender. EQUAL HOUSING LENDER PLEASE NOTIFY US If you have any changes in your information, please remember to notify us. • For your protection, please notify us immediately if you are moving or have had a recent change of address. • Please remember to also let us know if you have any change in phone numbers or email addresses. MEETING WINTER 2015 EDITION 2 0 1 6 Annual Save the Date: March 15, 2016 Attention Credit Union Shareholders (ahem: that’s you)! The credit union’s annual meeting is coming up, and you’re invited to join us. That’s because as a member/owner of the credit union, you’re a shareholder. That’s one of the key differences between your credit union and the bank down the street. The bank has stockholders and exists to make them a profit. As a not-for-profit financial cooperative, your credit union exists to serve you. So make plans now to attend the annual meeting. Hear about how we fared in 2015 and what’s on tap for 2016. Meet the board of directors - the people you’ve elected to represent your best interests. Enjoy refreshments and visit with fellow members. The annual meeting is a credit union tradition. We hope you’ll be able to participate. Nomination Procedures for the 2016 Annual Meeting, March 15, 2016 The Nominating Committee for the 2016 Credit Union Annual Meeting was appointed in October 2015. The Committee filed its nominations with the secretary of the credit union on December 11, 2015. A brief statement of qualifications was included for each nominee submitted by the Nominating Committee. Nominations for vacancies may also be made by petition signed by 1% of the members. Each nominee by petition must submit a similar statement of qualifications with the petition Nominations by petition must be filed with the secretary of the credit union at least 40 days before the annual meeting. There will be no nominations from the floor. STATEMENT OF FINANCIAL CONDITION As of October 31, 2015 ASSETS: Total Net Loans & VISAs Net Investments Fixed Assets Land and Building Other Assets TOTAL ASSETS Liabilities & Equity: Liabilities (Payables) Member Deposits: Certificates of Deposit Share Drafts (Checking) IRAs Christmas & Youth Clubs Regular Shares Equity Regular Reserves Undivided Earnings TOTAL LIABILITIES & EQUITY 10,645,255.77 28,306,474.84 58,330.24 653,248.48 91,141.73 $39,754,451.06 85,580.16 2,581,556.11 4,519,723.94 1,300,017.14 671,667.79 26,556,861.88 336,491.99 3,702,552.05 $39,754,451.06 Relax This Holiday Season with Skip-A-Payment You know the tune: It’s the “most wonderful time of the year.” Yet for many of us, those holiday expenses, on top of the extra cooking, baking, entertaining, decorating, shopping, wrapping and more, can make it the most “stressful” time of the year. We can’t help you complete those holiday chores, but we can give your budget a break with Skip-A-Payment. Skip-A-Payment allows you to defer payment on certain consumer loans. Help yourself to some extra spending money when you take advantage of this option. Borrowers in good standing with qualified loans may defer their loan payments. So this holiday season, take the break you deserve. Contact the credit union about how you can Skip-a-Payment. Then relax. It really can be the most wonderful time of the year to spend with your family and friends. Nearly 30,000 ATMs. Over 5,000 Branches. Just look for the CO-OP logo. SAME ATMS AND BRANCHES. SAME NATIONWIDE ACCESS. THE NEW CO-OP LOGOS MAKE THEM EASY TO FIND. We make it easy to access your accounts wherever you are. Our members can take advantage of convenient locations nationwide. Find one near you using one of any of our locator tools including mobile app, allco-op.org, or call 1-888-SITE-CO-OP. Join Our Christmas Savings Program If your 2015 holiday expenses caught you off-guard, here’s a way to be better prepared for the 2016 holiday season: Sign up for the Christmas Savings Program at the credit union. By joining, you’re earmarking funds that will help you take those extra holiday expenses in stride. Even tucking away a small amount adds up. For example, saving $15 a week for 48 weeks means you’ll have $720 when December rolls around. Save $25 a week for 48 weeks and collect $1,200 - yours to spend on gifts, decorations, entertaining, traveling, whatever holiday expenses come your way. Make things easier when you put your Christmas Savings Program on autopilot. Sign up for an automatic transfer or payroll deduction. It’s absolutely true that what you don’t see, you don’t miss. Contact the credit union to get started today. As we close the books on 2015 and look forward to 2016, we would be remiss if we didn’t take a moment to say “Thank You Members!” We truly appreciate your being a part of the credit union family. Without our valued member/owners, we would not exist. You’re putting into action what Roy Bergengren, one of the founders of the U.S. credit union movement, described when he called credit unions a demonstration of “the practicality of the brotherhood of man.” As a financial cooperative, your credit union relies on savers to provide the funds for borrowers. When you participate in all the benefits of belonging, you help make the credit union stronger. Thanks for being a member and for your business. We wish you a prosperous, happy, and healthy 2016. The Last Word The happiest people don’t necessarily have the best of everything; they just make the most of everything that comes their way.