W Th e cradle of ObamaCare

advertisement

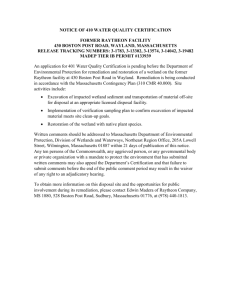

ViewPoint BOSTON BUSINESS JOURNAL | October 4-10, 2013 ———| Editorial |——— The cradle of ObamaCare CONNECT WITH US | ————————————| Business Pulse |———————————— THE QUESTION: Who do you like for Boston’s new mayor? 21% 11% Undecided at this point. W 48% John Connolly. His education message resonates. ial erc mm for co VOTES CAST: 380 Marty Walsh. He has the unions behind him. -N ot 20% als NEXT WEEK’S QUESTION: What’s your reaction to the U.S. government shutdown? Go to: boston.bizjournals.com urn ————————————| Business View |———————————— ine M ss Jo Opening the floodgates for the water industry Am eri c an C ity Bu s assachusetts has historically fully embraced different sectors of the economy to rapidly expand employment and business opportunities in the state and beyond. One only needs to look to the health care and life science industry in the state to recognize the impact state-funded initiatives have on burgeoning industries. The next wave of innovation and entrepreneurship, at least according to many key policymakers in the state, will be found in the water industry. It was only a little more than one year ago that the Massachusetts Executive Office of Energy and Environmental Affairs began its efforts to centralize the discussion on water technology and engineering by organizing the Symposium on Water Innovation in Massachusetts, an event that is likely to become an annual occurrence. The goal of the symposium was to bring business, academia and government to the table to discuss how Massachusetts can position itself as an international leader in the ever-expanding water industry. As a result of the event in 2012, organizers identified hundreds of companies and organizations in the water industry that were either based in Massachusetts or somehow contributed to the industry in the state. Once these entities were identified, it became evident that a commonality existed and a need arose to develop a water cluster in Massachusetts. © ith much consternation, confusion, political agitation and excitement, the Affordable Care Act has arrived at an online health exchange near you. ObamaCare, as it’s commonly called, derives from many of the core principles of the 2006 Massachusetts health care reform effort, famously championed by then Gov. Mitt Romney. Some of its fundamental in-state flaws will soon be writ large across the nation. A program that a relatively wealthy state like Massachusetts has been able to absorb, at considerable cost, already promises to be a whopping drain on the national economy. Our complaint with universal health care, as manifested by the Massachusetts plan and now trumped by ObamaCare, is not that it isn’t desirable for every man, woman and child to have health insurance. And especially, to be able to buy health insurance affordably with preexisting health conditions. However, we’ve looked in vain for an honest assessment of its costs, and the inevitable impact on the average middle-class family. There are trade-offs here, and let’s be candid about them. The Massachusetts example is instructive. When it was enacted here over seven years ago, it was supposed to pay for itself and also put a damper on ever-rising health care costs. It did neither. The state’s additional spending on its reform is pegged at about 1.4 percent of the budget, or upwards of $550 million. But the same political mythology is at work with ObamaCare. Insure everyone, provide better primary care, (and cut Medicare abuse) and you’ll save big money at the tail end of the health care system, when costs are the highest. Massachusetts claims success with its program all the same, for now approximately 98 percent of its residents are insured. Its insurance exchanges have run fairly well. There wasn’t a revolt against the individual mandate. Nor has there been political backlash against the incremental cost to taxpayers. But that is Massachusetts, which began its reform with 94 percent of its residents with health insurance. The task on a national level will be massive, and cost far more than most have anticipated. The initial tax targets, medical device companies (a 2.4 percent tax), “the rich” and fees on health insurers to the tune of $60 billion next year, will not be enough. Many of those taxes and fees will filter down to the average Joe, for an entitlement this large can’t be borne by corporations and the rich alone. Casting a write-in vote for Menino. us e 34 Fast forward to the present day when legislative leaders are poised to take the next step in encouraging the development of businesses and others involved in the water industry. It is expected that the Legislature will consider legislation this fall designed to pump funding into municipal and state projects, including wastewater and infrastructure needs. This initiative will likely be implemented in conjunction with the Massachusetts Clean Energy Center, a quasigovernmental agency that has prioritized the development of a Massachusetts-based water technology cluster. Other states — like Colorado, North Carolina and Ohio — and countries around the world have taken steps to recognize the importance of the water industry by developing their own water clusters of environmental and economic activity. Although it is somewhat unclear how Massachusetts will measure its success in developing a water cluster, there is no doubt that the state is ready to make a significant investment in water-related companies and projects. It will be crucial for water industry leaders to take advantage of the opportunities that will be presented through the bond legislation and, in particular, the funding that will be authorized by this initiative. Steven A. Baddour & Daniel J. Connelly ———| Feedback |——— Raising the bar for entrepreneurs C ongratulations to the team that successfully opened Boston’s first Ice Bar, Frost, last month. The project is unique for its brand equity and planning approaches. Frost is a de facto expansion of the Boston Duck Tours franchise, where cross-selling opportunities from its existing tourism brand, along with its new entertainment venue, will collectively expand the overall customer base. John Donne wrote in 1624 that “no man is an island.” Teamwork is quintessential for startups, but often Lecturer at Boston College more to capitalize on operational scale economies than for business planning. By the time formal preparatory processes are concluded, the idea risks being obsolete, or other “me-too” type products (or direct substitutes), might have already garnered precious market share. Beleaguered firms then must use 20/20 hindsight to catch up. In a perfect world, nascent ventures should begin testing promising technologies or new ideas well before they need to be launched. Frost’s team first did this in 2009 and successfully learned like others have, that returns from analytical rigor and prospective investor feedback are often on par with actual financial returns. Frost’s team also bucked the current trend by putting most of its planning work in writing. I still believe a written document forces more precise planning, not necessarily possible with executive summaries or creatively formatted PPTs. The additional degree of detail makes pivoting easier when, not if, market conditions change. For each of the past 13 years, I’ve used old-fashioned networking, and recently, original content on print, TV and radio, in order to develop a universe of diverse entrepreneurs needing planning assistance. After being vetted and selected, 20 entrepreneurs a year work with graduate business and law students, faculty, and industry mentors at Boston College in a competitive format. Frost is just one of several of the program’s successful alums. No business can be created in a vacuum and, for every one successful launch, I know most ideas never come to fruition. But it’s exciting to see a team use an academic institution not only to test a concept or a technology, and then to launch an actual business using its results. Greg Stoller Steven A. Baddour is a partner and Daniel J. Connelly is legislative counsel at McDermott Greg Stoller is a lecturer and helps build Will & Emery. business programs at Boston College. entrepreneurship and international MBA