Income Inequality, Tax Policy, and Economic Growth ∗ Siddhartha Biswas Indraneel Chakraborty

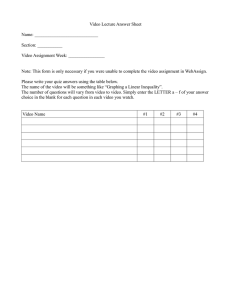

advertisement