JU HU UNIVERSITY OF PENNSYLVANIA

advertisement

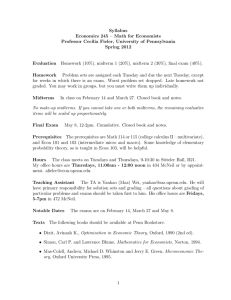

JU HU <https://economics.sas.upenn.edu/graduate-program/candidates/ju-hu> <juhu1@sas.upenn.edu> UNIVERSITY OF PENNSYLVANIA Placement Director: Iourii Manovskii Placement Director: Andrew Postlewaite Graduate Student Coordinator: Kelly Quinn MANOVSKI@ ECON.UPENN.EDU APOSTLEW@ECON.UPENN.EDU KQUINN @ ECON.UPENN.EDU Office Contact Information 328 McNeil Building 3718 Locust Walk Philadelphia, PA 19104 Cell Phone: 267-909-1250 Personal Information: Citizenship: China Date of Birth: April 02, 1985 Gender: Male Undergraduate Studies: B.A., Finance, Fudan University, Shanghai, China, 2007 Masters Level Work: M.A., Finance, Fudan University, Shanghai, China, 2010 Graduate Studies: University of Pennsylvania, 2010 to present Thesis Title: “Essays on Reputations and Dynamic Games” Expected Completion Date: May 2016 Thesis Committee and References: Professor George J. Mailath (Advisor) 432 McNeil Building 3718 Locust Walk Philadelphia, PA 19104 gmailath@econ.upenn.edu 215-898-7908 Professor Rakesh V. Vohra 451 McNeil Building 3718 Locust Walk Philadelphia, PA 19104 rvohra@seas.upenn.edu 215-898-6777 Professor Yuichi Yamamoto 457 McNeil Building 3718 Locust Walk Philadelphia, PA 19104 yyam@sas.upenn.edu 215-898-8761 Teaching and Research Fields: Microeconomic Theory, Game Theory, Dynamic Games 215-898-6880 215-898-7350 215-898-5691 Teaching Experience: Fall, 2011 Fall, 2012 Spring, 2012, 2013 Spring, 2015 Summer, 2012, 2013, 2014 Econ 701 Microeconomic Theory I (graduate level), University of Pennsylvania, Teaching Assistant for Prof. Andrew Postlewaite and Steven Matthews Econ 701 Microeconomic Theory I (graduate level), University of Pennsylvania, Teaching Assistant for Prof. Andrew Postlewaite and Mallesh Pai Econ 212 Game Theory, University of Pennsylvania, Teaching Assistant for Prof. Tymofiy Mylovanov Econ 212 Game Theory, University of Pennsylvania, Teaching Assistant for Prof. Yuichi Yamamoto Econ 897 Graduate Math Camp , University of Pennsylvania, Instructor Professional Activities: Presentations: 2012-2015 Penn Micro Theory Lunch Club, University of Pennsylvania 2015 Micro Theory Seminar, University of Pennsylvania Referee Activities: Theoretic Economics, International Economic Review Other: 2013-2014 Co-organizer, University of Pennsylvania Micro Theory Lunch Club Honors, Scholarships, and Fellowships: 2011-2013 Xinmei Zhang Fellowship, School of Arts and Science, University of Pennsylvania 2013-2014 Sidney Weintraub Memorial Fellowship, University of Pennsylvania Publications: “Reputation in the Presence of Noisy Exogenous Learning”, Journal of Economic Theory, 2014, Volume 153, 64-73. Research Paper: “Biased Learning and Permanent Reputation” (Job Market Paper) Abstract: This paper studies reputation effects between a long-lived seller and different short-lived buyers where the short-lived buyers do not know how long the seller has been in business. Departing from standard assumptions in repeated games, this paper assumes that buyers enter the market at random times and only observe a coarse public signal upon entry. The signal measures the difference between the number of good and bad outcomes in a biased way: a good outcome is more likely to increase the signal than a bad outcome to decrease it. The seller has a short-run incentive to exert low effort, but makes high profits if it were possible to commit to high effort. First, we show if the bias is large, in the complete information game, always exerting low effort is the unique equilibrium. We then introduce incomplete information. There are two types of the seller. One is a commitment type who always exerts high effort and the other is a normal type who behaves strategically to maximize long-run payoff. If there is small but positive chance that the seller is a commitment type, in any equilibrium, the normal seller must exert high effort at some signals to build up his reputation. Moreover, the seller builds up his reputation only to milk it. In any equilibrium, once the seller builds up reputation through reaching a high enough signal, the seller then exploits by exerting low effort. Because all buyers only have limited information, they are unable to distinguish the two types of the seller no matter how long the game has been played. Consequently, the incentives of building reputation never disappear in the long-run. “Reputation in the Presence of Noisy Exogenous Learning” Abstract: This paper studies the reputation effect in which a long-lived player faces a sequence of uninformed short-lived players and the uninformed players receive informative but noisy exogenous signals about the type of the long-lived player. We provide an explicit lower bound on all Nash equilibria payoffs of the long-lived player. The lower bound shows when the exogenous signals are sufficiently noisy and the long-lived player is patient, he can be assured of a payoff strictly higher than his minmax payoff. “Social Learning and Market Experimentation” Abstract: This paper studies optimal dynamic monopoly pricing when a monopolist sells a product with unknown quality to a sequence of short-lived buyers who have private information about the quality. Because past prices and buyers’ purchase behavior convey information about private signals, they jointly determine the public belief about the quality of the monopolist’s product. The monopolist’s is essentially doing experimentation in the market because every price charged generates not only current period profit but also additional information about the quality. We focus on information structures with a continuum of signals. Under a mild regularity condition on information structures, we show in equilibrium, the optimal price is an increasing function of the public beliefs. In addition, we fully characterize information cascade sets in terms of information structure. We find the standard characterization in terms of boundedness of information structure in the social learning literature no longer holds in the presence of a monopoly. In fact, whether herding occurs or not depends more on the values of the conditional densities of the signals at the lowest signal.