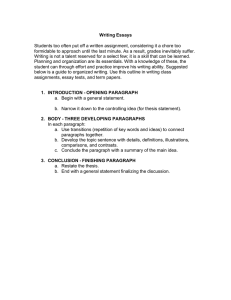

IflS

advertisement