THIS D O C U M E N T ... S G O V E R N M E...

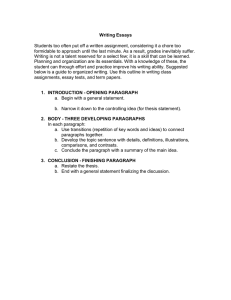

advertisement