rm:\'cri::, BY INJlrlN,{

advertisement

BY

rm:\'cri::,

INJlrlN,{

CCNTENTS

I.

II.

Introcmc tien

,:,urvey of Literatere

A.

B.

III.

FASB

A.

B.

DI.

B.

1/8

•

A.

p

....,.

•

2

•

#P

•

•

• •

•

•

,->

:;

c'

:;;

7

7

7

•

•

•

l(,

11

11

11

II

14

15

•

•

• •

15

•

•

16

IE.

17

17

17

•

le

18

•

19

•

Gt:rrE·nt 2L:..tus of FASE liP:

other Closing Remarks • •

o

• •

•

•

:::urrent Rate ;!eU:cd •

•

•

1. No r~stcrtion of Relationships

2. t'-a Xisrr:atch1.r.g Eevent:.e and Expense

3. 1-.. 'liard of Caution.

Immediate Hecognition with Disclosure

1. Disclosure of the Types of Exchcmge

Gains and Losses

Disclosure ir:c;ta temer. ts

J. Disclosure in Footrctes

•

2

•

•

The Eequirements of :3tate!7lent No. 8

• •

The Lesponse to F.I';SB No. P • •

•

1. \'ore Disclosure of ~xcrlarge Gair./Loss

c.. Realized ~.~a ins and Losses

t. Unrealized Gains and Lesses •

c. Translation Gains and Losses

2. ~-:cre Disclosu!'e of Yxchange Gain/Loss

Before and Aft.er Tax!?s

.3. Hore Disclosure of Gross VarGin Distorticn

Bibliography

1

•

8

The F'u!'pose of Statement No.

Ccnclusion

• •

• •

I'ram-'lat ion ~'~E,U,ods •

•

•

1. Current-t·:orcnrrent ~'~e thod

•

,::. ~Jone tary-Honmone tary ;rethcd. • • • • • •

•

3. Temporal r~ethod •

•• •

•••

L. Curren"'::, Rate :~ethod •

5. ';:'ransl3.ti.cn Yethocis CO!Ti:Jared and Contrasted

Exchange Gair: and Loss Treatment

••

1. Immediate Reeogni tion

2. Defer Gain--Recq;nize Loss

3. Defer Gain and Less •

1.. Hodge-Podge I-'ethods

•

The :~o':;'t:. tien to FASE

A.

v.

•

• •

•

• •

•

•

•

• • •

19

19

• •

•

• • •

•

22

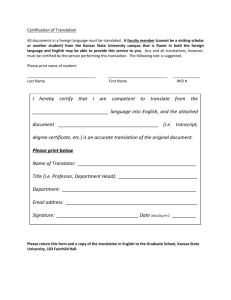

ILLUSTRATIONS

Exhibit

1.

1979 Income Statement

• • • • • • • • • • • • • • • • • • • •

12

2.

1979 Balance Sheet, 1978 Balance Sheet • • • • • • • • • • • •

13

3.

Computation of Translation Gain

• • • • • • • • • • • • • ••

14

Comprehensive Review • • • • • • • • • • • • • • • • • • • • • • ••

20

TABLES

1.

Summary of Translation Methods • • • • • • • • • • • • • • • • •

6

2.

Rates Used to Translate Assets

and Liabilities • • • • • • • •

9

•

• • • • • • • • • • • • • •

Intr0.:iuc:ti C!!

if

th~

AmericCiD :::ulVrat,iond::' ('irmc; ... ul~:"d ccnVert their

from the i'creign cUlTencJ tc TTni ted St""tes

r

enE: currency ,;n it f0r c.nc :,Jl,: r, the

forei;:;!] entities.

TLis is

·~h;:!jr

had teen

;1'''1:::

~,ract'

7'Ht

e'lEn state:l,er:ts are transJd.ted.

as thollgrl

.!'

do11a~":-;.

'IJ"u1c 1

th~

~;nd

phy:::ica~1;)'

liabilj ti.es

c):chanprG

the exac t, J1e t "ort.h of the i r

cal, so at the erect

The p;rpose of

r~ea,:ur,"d

~:n(:w

3y

aSSE,'t:::

:::>~'

clc:.ch pd'icd the ':or-

translaticn is to ch'=.nge the

and recorcir;c: in dollars l1nder' fiClerican cencI'dlly

acce;: t.ea acccl:nting :JI'inc iple;:;.

individual currenc',-ps

dollar.

liMited.

(-lb.S

"-:;':presse~i

:en

tfr~s

of gold and "PE€:becJ'f to a convertible

Foreign curr:::nc'es could crl;- ::hct\:3.te ty 1% up or down u[ainst the dol-

In the early 1970's U:e sy3tem of fixed exchanp, rate,' Was ren13,c;n.d Ly

tt,€; :1oating rate systerr,.

wi th m ,m·ifor""ity.

l'~C'W

the vuricus transL" tien ",etLcds char:,,::e consideraLly

For In:3tance, under de7a1uat:ir,n, t.he c;.;.rrcnt-rcncerrent o.r;d

the current ra t.e :'lc":,t;ods cf translati('n prodece exch;mgc,

103::,(:,5 \.. h~ 1,:0

the :r.onet:lry-

fessicn ar~ues that these losses a~d [a~ns are produced 1::J co~vc~t'~n~l lr~ns1~tio~

"':ethcQs

econcm~c

th,~t

stress

rT'lct~ca1

::1eas'.;re:':'12nt and dL;clcsl:re practice.: ;nstead of

real~ty.

1

2

Are thE accol,.;.ntine practices reflecting or distorting the economic

substance underlying the financial results of foreign operations?

The conven-

tional translation methods are accused of creating an accounting reality which

induces American r.1ultinat:'onal firms to overmanage the risks of foreign currency

translation.

Firms are tempted to reduce exposure to translation adjustments by

increasing the:ir cash borrowings.

The costs incurred to avoid the exposure are

more detrimental to the firms' profits than the exposure, itself.

Under the fixed exchange rate system, there was no need to be concerned

with the management of the exposure to translatjon since it had little impact cn

reporting the results of foreign operations.

The floating exchange rate system

allows the translation exposure to have a significant impact on reported earnings.

Today's shifting economy, created by floating rates, calls for a re-evaluation of

the various translation methods to determine their ability to resolve the problems

of increased international business activity, extensive currency adjustments, and

new accounting procedures.

The intent of this paper is to provide insight to the

different techniques and to select a translation method that will best reflect

today's changing environment.

Survey of Literature

Translation Hethods

Current-Noncl.:.rrent Method

The current-noncurrent method waS acknowledged as the first proper

practice for translating foreign financial statements with the issuance of ARB

No. ~3.

The translation of current assets and current liabilities at the exchange

rate in effect at the balance sheet date was established by Chapter 12 of this

bulletin.

All other assets, liabilities, and equities were to be translated at

the historical rates prevailing when they were incurred.

3

The practice of translating noncurrent items at historical rates served

several purposes. The dollar value of property, plant, and equipment was

not felt U, be diminished by the devaluation as long as operations continued because the devaluation usually reflected severe inflationary conditions locally. Use of historical rates for long-term liabilities held

to the principle of conservatism. Any gain resulting from the rate change

was deferred in this manner until the liquidation of a liability.l

The current-noncurrent mettod treated property, plant, and equipment as having

intrinsic value which did not change witb devaluation.

The accounting profession

felt the failure to treat inventory in this same manner represented a departure

from the historical cost concept; therefore, the monetary-nonmonetary method

evolved.

Monetary-Nonmonetary Method

In

196~),

APB Opin ion No. 6 was issued to provide a me thod to translate

assets and liabilities upon their characteristics, rather than upon their balance sheet classification.

Those assets and liabilities representing claims or

obligations expressed in a fixed monetary amount are translated at the current

exchange rate.

All other assets, liabilities, and owners' equity accounts are

translated at t.he appropriate historical rates.

Under this method, inventory is

translated at ;:1istorical rates since it is a nonmonetary asset.

occurred with noncurrent payables and receivables.

The other change

vJithout specifying the cir-

cumstances, Paragraph 18 of APB Opinion No.6 found translati(n of these accounts

at current rates is appropriate in many instances.

The monetary-nonmonetary method retains the historical concept in foreign

financial statements, which makes accounting standards applied in consolidated or

combined statements more consistent.

Under

~his

method, changes in resources,

obligations, and operating rt:'sults of a foreign subsidiary are stated as though

they occurred in the parent co:npany's currency.

Alth::)Ugh thjs method corrected

IRuth .:<:. Pleak, !IAn Analysis of the FASB' s Treatment of Foreign Currcn::y

Translaticns," Hanagemen '.:, A.ccounting, Vol. 59, September 1977, p. 31.

problems of thp current-noncurrent method, it created a nev,

determination of the

do~inant

prC':~lem

characteristic of some assets and

in the

lia~ilities.

The temr:,oral method evolved to answer the (iuestion.

Temporal Vt,thod

In 1972, Ah3 No. 12 recommended a new methcd of translation which would

be more cor1patible with the tistorical cost framework of accepted accounting

principles.

mettod.

Ttis method is a sligh"

!Tlod~ficaticn

of' the monetary-nonmonetary

It calls for the translation of assets ano liabilities accC'unted for at

present or futt:re prices at the cu{'rent exchange rate, while those assets and

liabilitie:3 carried at past prices are translated at

appl~_c2ble

hLtorical rates.

Euch of the confusion created by the 1"lonetctry-nonrnonetary syster.; was

eliminated.

Trle ncticeatle change" occur in inventory and investm.ents.

The

inventory and inv8st'nent accounts that arE! carried at cost are translated at

historical ratE!s.

The inventcrJ and investment accounts recorded at market

value are tranC31ated at current rates.

Curren t Ita te Ye thod

This method has not teeT' generally accepted by the United States.

The

FASB rejectt::d :Lt in the Proposed Statement of' Fir:ancia1 Accounting Standards on

Foreign Currency TrCinslation in 1974.

from foreign er'.tities.

East of the suprcrt of this method comes

Today, i t is gaining more sUpDort, especially from the

critics of thE othEr translation metr.ods.

The current rate methed, unlike the

ether techniqla:s, emphCisizes the local cUYTenc;;r aspects of forei[:n subsjdjaries.

It best reflects the actu",l financial po;:)i tion

0:

foreigr cperations.

All ac;;,ets and lialil:ties are translated at the current o:change rate.

Owners 1 ec,ui ty accounts are translo.ted at appropriate hi storical ratAS.

,\

r.

s

minority of accountants beli8ves that the

tra~slation

of owners' equity should

also be at the current rate.

Translation Hethods Compared and Contras ted

In the income statement, depreciation and amortization are translated at

historical rates under the current-noncurrent, monetary-nonmonetary, and temporal

methods.

Cost of goods sold is translated at the appropriate rate used to trans-

late the inventory; this may be either current or historical rates.

Historical

rates are used to translate the remainder of the revenue and expense accounts.

Average rates may be used since it is often difficult and costly to keep record of

these transactinns.

transl~ted

Under the current rate method, all expenses and revenues are

at current rates.

The income statement is treated similarly with respect to all methods.

The methods differ primarily in translatbn of the balance sheet accounts.

Table

1 summarizes the differences of the four methods.

Exchange Gain and Loss Treatment

Under each dU'ferent method, items in the financial sta tements are translated at several rates--current, average, and historical.

The use of these

different rates produces an imbalance of debits and credits.

A balancing figure

labeled as an exchange gain (loss) is produced to reconcile the difference.

This

gain (loss) has been treated in several different manners.

Immediate Recognition

This technique is the simplest.

There is no record keeping of deferrals

of the exchangE! gains or losses since they are entirely recognized in the immediate period.

With the full recognition of the exchange gains and losses, a greater

fluctuation from period to period in ne t income will result.

6

TABLE 1

SUMMARY OF' TRANSLATICN METHODS

}1onetaryNonmonetary

Temporal

C-H

C

C

C

C

C

C

C

• • • •

C

H**

H

C

• • • •

C

H

C

C

·• • • • •·

Market •

·• ···• • •

Fixed Assets

·• • ··• •

Other Assets • • •

·•·•

H

H

H

C

H

H

C

C

H

H

H

C

H

H

H

C

• • • • •

C

C

C

C

····

• • · ·

··• ·

H

C

C

C

H

H

H

H

*

*

*

*

CurrentNoncurrent

Cash

• • • • • • • • • • •

Accounts Receivable • • • •

Current

Rate

Inventory:

·• •• • •

Market

··• ·•

Cost

,

Investments:

Cost • • •

Accounts Payable

Long-term Debt

Common Stock

Retained

• •

• • •

Earni~r.gs

•

*Residual Bala.nce

i:-il-Current Rate (C), Historical Rate (H)

7

Defer Gain--Recognize Loss

This technique is the most compatible with the concept of conservatism.

Therefore, gains are not recorded until they are realized.

Technically, no gain

is realized under translation; it is realized under conversion.

A gain may be

recognized to the extent that it offsets other exchange losses; then the remainder is deferred.

Exchange losses, or the remainder exceeding the gains, are

recognized immediately.

Defer Gain and Loss

Under t.his technique, both gains and losses are deferred.

then amortized over some smooth long-run average basis.

The net is

Fluctuations in net in-

come would dev€!lop primarily from adjustments to the amortization rates, not

from varying currency exchange rates.

This technique is more judgmental than the

others since each entity would determine an amortization rate to be used for the

deferral.

Hodge-Podge Methods

These methods evolved from the combination of the prior techniques.

A

method recommended by Chapter 12 of ARB No. L3 called for the recognition of

exchange losses and realized exchange gains immediately in net income while unrealized exchange gains wo\;ld be deferred to the extent that they offset the

losses.

In 19'71, the APB proposed another method in the exposure draft entitled,

"Translating Foreign Operations".

This technique was compatible with the monetary-

nonmonetary system and required an entity to " •• • defer exchange gains and losses

to the extent t.hat they did not exceed those attributable to long-term debt.

Amounts deferred were to be accounted for in a similar to debt di.scount.,,2

2"Translating Foreign Operati.ons," exposure draft, December 20, 1971,

quoted in "Sta'~ement of Financial Accounting Stan::iards No. B--Accounting for the

Translation of Foreign Currency Transactions and Foreign Currency Financial Statements," The Journal of Accountancy, December 1975, p. A7.

8

FASE #8

The different f1'Ietho:l.s used fo;:" translation of foreign financ:.al statements led to confusion as mere companies became 'nultinationals.

consistency among

state~ents;

there was no basis for

com~arison.

There ,,,as no

In order to

correct this mE,tter, FASE No. £1, "Accounting for the Translation of Forejgn

Currency Transa.cticns and Foreign Currency Financial Statements", was released

in October 197;;.

The Purpose of Statement No.8

Statement No.

P

established standards of financial accounting and report-

ing for foreign currency transactions plus foreign currency financial statements

that 'rlere

comb:~ned

enterprise.

or consolidated with the statement:') of an American reporting

For the purpose of preparing combined or consolidated financial

statements, F'A~>B #8 selected a translation method with the objective of measurf.ng

and expressing .the assets, liabilities, revenue, or expenses, which were !neasured

or denominated in foreign currency, in dollars and in conformity '.>lith U. S.

generally accepted account:ing proced'lres.

The purpose of this statement was to

select a translation metbod that reMeasllred the foreign currency accounts in

dollars wi thOll t altering the measurement bases required by other accounting

principles.

~.

The Requirements of Statement No.

Statement No.

'llodified tempo::-al

e re{juires

m~thod

for

the America.n multinational firms !~o adotJt a

transl~,tion

of foreign financial statements.

2 summarizes the rates to be used in translating the balance sheet items.

Table

The

exchange gains or losses resulting from translation are to be recognized entirely

in the immediate period; there are

:J()

deferrals.

9

TABLE 2

RATES USED TO TRANSLATE ASSETS AND LIABILITIES

Translation Rates

Current

Cash on hand and demand and time deposits

Marketable equity securities

Carried at cost

Carried at current market price

Accounts and notes receivable and related

unearned discount

Allowance for doubtful accounts and notes

receivable

Inventories:

Carried at cost

Carried at current replacement price or

current selling price

Carried at net realizable value

Carried at contract price (produced under

fixed price contracts)

Prepared insurance, advertising, and rent

Refundable deposits

Advances to unconsolidated subsidiaries

Property, plant., and equipment

Accumulated depreciation of property, plant,

and equ ipment

Cash surrender value of life insurance

Patents, trademarks, licenses, and formulas

Goodwill

Other intangible assets

Historical

x

x

x

x

x

x

x

X

X

x

X

X

X

X

X

X

X

X

Liabilities

Accounts and notes payable and overdrafts

Accrued expenses payable

Accrued losses on firm purchase commitments

Refundable deposits

Deferred income

Bonds payable or other long-term debt

Unamortized premium or discount on bonds or

notes payable

Convertible bonds payable

Accrued pension obligations

Obligations under warranties

X

X

X

X

X

X

X

X

X

X

SOURCE: "Statement of Financial Accounting Standards No. 8--Accounting for

the Translation of Foreign Currency Transactions and Foreign Currency Financial

Statements, II The Journal of Accountancy, December 1975, p. 84.

10

The Response to FASB No.8

Overwhelming criticism emerged when this statement was issued.

At first,

the criticism focused on the methods selected to transl"l.te foreign statements

and to report the foreign currency adjustments.

Prior to the statement, only

one out of three American firms used the temroral method.

cent of the

Am~rican

Approximately 70 per-

firms used some form of deferral to prevent erratic

fluct~a-

tions to the income statement caused by translation adjustments.

Today, criticism focuses on

re~uired

disclosure of the statement.

John

K. Shank and Ga.ry S. Shamis expressEd the following opinion in their article on

foreign currency translation.

GAAP requires that disclosures be adequate to ensure a full and fair presentat~on of the financial situation.

A question can be raised as to

whether the required disclosures under statement no. 8 measure up to this

standard. This is a particularly crucial question in an area such as

foreign currency accounting where extensive disagreement on basic objectives

and wo:."ld'dide diversity in accounting practices make full disclosure even

more important than is normally the case. Full disclosure of the impact of

foreign exchange rate swings on the consolidated financial statements enables

the reader to rr:ake whatever adjustllents are deemed necessary in terms Cof the

conceptual framework selected by the user. ,,3

Critics are demanding more disclosure.

that reflect economic reality.

it creating a new reality?

They want disclosure of statements

Does FASB No.8 reflect economic reality or is

The goal of proper accoun"Cing is to reflect actual

results of the business entities.

The profession questions whether this state-

ment reflects reality when it translates foreign operations from a partnt

pany's point of view.

COM-

Translated results and relationships, under this modified

temporal method, differ significantly from these reflected in the foreign

currency statements.

The accounting profession is focusing its attention to

these criticisms.

3John L Shank and Gary S. Shamis, "Reporting Foreign Currer:cy Adjustments:

A Disclosure Perspective," The Journal ef Accountancy, Vol. 147, April 1979, p. 59.

11

Hore Disclosure of Exchange Gain/Loss

Statement No. 8 requires that all foreit;n exchange gains and losses be

reported in the inccme statement imEediately--only the aggregate amount needs to

be disclosed.

This does net seem to present full disclosure.

Jotn K. Shank

notes that there exists three different types of exchange gains and losses having

significantly different implications.

Realized Gains and Losses.

These are gains and losses resulting from a

closed exchange in which a transaction is settled at a rate different from the

rate used to record the carrying value of items.

The transactions are completed.

There is no question as to whether the gain or loss is "real" and should be

recognized.

Unrealized Gains and Lcsses.

These gains and losses result frem an

open exchange ...,hich is a transaction invclving two currencies that has not been

settled at the end of the period.

is completed, :_s unknown.

ized.

The exchange rate, at the time the transaction

Under this open exchange, the gain or loss is not real-

By the time the transaction is closed it may have reversed or increased.

FASE No.8 still requires the immediate recognition of the unrealized gain or loss.

Translation Gains and Losses.

This third type of exchange gain or loss

arises when the conversion rates used to translate successive balance sheets of

a foreign entity are different.

The debi ts and credits will net be equal when the

successive balcLnce sheets are translated into equivalent dollars at the different

exchange rates.

A balancing figure is created to account for the difference.

"This figure car. always be rationalized or explained as the product. of the parent's net 'exposure' position to fluctuations in the subsidiarJ's currency multiplied by the percentage change in the exchange rate.,,4

4Ibid. J p. 60.

-

Exami.nation of £Xhjbits 1,

12

EXHIBIT 1

1979 Income Statement

Foreign

Currency

DollarsFASB #8

FC 2000

$1800

600

540

Fe 2600

$2340

Cost of Goods

Sold (FIFO)

800

880

Depreciation

500

600

Depreciation on plant acquired when the exchange

rate was Fe 1 : 1.2.

Selling &

Administration

300

200

Accrued ratably over the year.

Other Expenses

400

360

600

$ 230

300

270

300

$(40)

Sales

Interest Income

Total Revenue

Profit Before 1'axes

Fe

Income Tax

Net Income

Fe

Assumptions

Revenues accrued ratably

over the year - no seasonal

effect.

Represents inventory purchased in equal amounts each

month during 1978.

II

II

II

II

II

Paid monthly.

Exchange Rates

January 1, 197B

January 1, 1979

January 1, 1980

Fe 1

FC 1

FCI

1.2

1.0

.8

Average Rate 1978

Average Rate 1979

FC 1

Fe 1

1.1

.9

2, and 3 shoul(i clarify the definition of translation gains and losses.

In Exhibit 3, a translation gain of $750 was computed, but what is its

significance?

If this foreign subSidiary and the parent company continually

make regular transactions exchanging the foreign currency for dollar3, then the

gain is real.

If the foreign subsidiary conducts all of its transactions locally,

13

EXHIBIT 2

1979 Balance Sheet

Foreign

Currencl

DollarsFASB #8 a

Cash

Accts. Rec.

Inventory (FIFO)

Plant & Equipment

Land

Total Assets

FC

700

1100

1200

6000

2000

FC lJpOO

$

Acets. Pay.

Notes Pay.

Bonds Pay.

Mortgage Pay.

Common Stock

Add. Paid-ln C~p.

Retained Earnin.gs

Total Liab. & Capital

FC

880

960

1680

1360

4200

600

1990

$ 11/670

FC

1100

1200

2100

1700

3500

500

900

l~OOO

$

560

P80

1080b

c

67S0

2400d

u,670

$

1978 Balance Sheet

Cash

Accts. Rec.

Inventory (FIFO)

Plant & Equipment

Land

Total Assets

FC

Accts. Pay.

Notes Pay.

Bonds Pay.

Mortgage Pay.

Common Stock

Add. Paid-In Cap.

Retained Earnings

Total Liab. & Capital

FC

600

1000

800

5000

2000

600

1000

880

6000

2400

$ 10,880

800

1000

2000

1000

3500

600

1000

2000

1000

4200

600

1280

$ 10,880

FC 9 ,1~oo

500

600

FC 9,460'

$

$

aRefer to rates used in Exhibit 1.

blnventory was purchased each month during year.

cPlant & Equipment:

$ 4500

Purchased when rate was FC 1 : 1.2

1500

Purchased equal amounts in each

$ 6000

month when rate was FC 1 : .9

d

Land was purchased when exchange rate was FC 1 : 1.2

EXHIBIT 3

Computation of Translation Gain

Exposurec~

6100

CA 1800

4300

CL

1979 Net Liability Exposure

1978 Net Liability Exposure

Change in Exposure in 1979

41300

1600

3200

4300

3200

ITOo

Translation Gain**

Exposure throughout the year times

full year's devaluation

(3200 x 20%)

640

Change in exposure during year times

one-half year's devaluation

(llOO x 10%)

110

Total Translation Gain

750

OR

1979 Translated Retained Earnings

1978 Translated. Retained Earnings

1979 Net Income (Loss)

1990

1280

710

(40)

--go

Total Translation Gain

*Exposure to t.ranslation gain or loss equals the net of the accounts

tra.."lslateci at current rates.

**Translation gain or loss equals exposure times the percentage of devaluation.

then this gain is meaningless.

It makes no difference how many dollars resulted

from the translation if there is no intercurrency exchanges in the foreseeable

future.

This gain would be unrealized.

More Disclosure of Exchange Gain/Loss

Before and After Taxes

FASB Nc. 8 does net require any disclosure of the effect taxes have on

15

exchange gains and losses.

This iMpact is not always clear according to Shank

and Shamis, who uncovered the following eX<1mples.

In 1975, Tenneco reported an

exchange gain of $2 million before taxes and reported an exchange loss of ;;J1

million after t.axes.

On the other hand, International Paper had an exchange loss

of $1,100,000 tefore taxes and an exchange gain of $200,000 after taxes in 1976.

It seems that more disclosure of the income tax impact on exchange gains and

losses would be necessary.

More Disclosure of Gross Margin Distortion

By trar:.slating inventories at historical rates, there is a mismatch of

revenue and expense.

Cost of goods sold contains an element of the realized

gain or loss on foreign inventories sold during the period.

by referring back to Exhibits 1 and 2.

exchange rate was Fe 1 : 1.1.

FC 1 : .9.

Und~r

This can be seen

Inventory was bought for :$800 when the

It was sold in 1979 for $2000 when the rate was

this method, there is a gross margin of $920; yet, part of this

margin resulted from a realized gain of $160 from holding the goods when they

devalued from $1:80 to $720.

There is no disclosure to distinguish results of

operations and results of translation.

The Solution to FASB #8

liThe public expects of financial statements that any loss or gain reported in net i:r1come is identifiable

~vi th

a discernable

economic worth of the company's resources .,,5

correspondi~g

In the past the arguments centered

on shallow explanations used to defend the modified teMporal method.

is accused of using prior labels without studying their full

It is hoped that this proposed,

alt~rnate

change in

imp~ct

FASB #8

on translation.

method can better report the actual

5Marvin Deupree, "Is FASB #8 the Best Approach?," Financial Executive,

Vol. 46, Januar:r 1978, p. 26.

16

operations of foreign entities and clarify those areas where confusion exists.

Current Rate Nethod

Statement No.

e was

Accounting Standards Board.

adopted by six affir!!lative votes of the Financial

Hr. r-1ays, the seventh member, dissented.

He

dissented because he felt the te:tlporal method was inappropriate for translation.

YlI'. Mays suppo:;'ted the current rate !!lethod because he felt it met two requirements

deemed essential:

• • • (1) that the translation process should preserve the essence of the

foreign currency statements in ter!!lS of financial position and results of

operations and (2) that it shOl..;ld produce results that are genera::'ly consistent with the economic effects of exchange rate changes.

By translating financial statements from an ongoing foreign currency perspective,

the current rate maintains the characteristics of the foreign operations.

The tem-

pora::' method misstates actual results by translating assets, liabilities, revenue,

and expenses as though they had individually been transacted and recorded in

dollars.

~1r.

\1ays felt that all assets are equally at risk in the foreign exchange

market, not injividual assnts acquired by the foreign subsidiary.

No Distortion of Relationships

The greatest weakness of the

tem~oral

method and the greatest strength

of the current rate method lies in the relationship of the items in the financial

statements.

By referring back to Exhibi ts 1 and 2, i t is possible to see the

distortion of financial ratios after translation by the temporal method.

ratio of sales to fixed assets before translation is

.25,

while it is .20 after

.15; it is (.02) after

translation.

Net income to net sales before transl8.tion is

translation.

The current rate method maint.ains these ratios.

6"Accounting Standards No.8," p.

83.

The

17

No Mi:3r1atching Revenue and

~pense

CO~lt of goods sold retained a portion of realized gain ($160) by trans-

lating inventory at historical cost.

The Pli,)r1atching arises from translating

inventorie:3 and fixed assets at historical rates while translati.ne: the short- and

long-term debt, used to finance them, at current rates.

It was generally

ac('e~teri

that the temprral method waS superior because it waS the most compatible with the

historical cost. concept.

r~r.

~1ays

stated in his dissenting opin:lon that

It • • •

assets acq'.1irecl for local currency by a foreign subsidiary have no historical

dollar cost; their historical cost exists only in local currency, and translation

at the current rate does not change that baSis."?

By adopting the current rate

method, characteristics of items are maintained without mismatching revenue and

expense.

A tJord of Cau t:~on

There are discrepancies under the current rate mnthod.

The vast majority

of the accounting professic'n translate all items in the balance sheet, except

m·mers' equity, at the current rate.

rates.

Owners' ec;uity is translated at historical

Under this variety of the current rate method, some ratios .... ill rema-Ln

distorted.

A minority of accountants ad'pt the position that owners' equity should

also be translated at the current rate.

only existed

~::1

the local currency.

It was stated before that

h~storical

cost

Therefore, it WQuld seem logical to translate

owners' e;uity at the current rate.

Immediate RecognUion with Disclosure

There is a significant argullent against immediate

ga ins and 10ss9s.

r8cogn:~tion

of exchange

Under the concept of conservatism, all gains and losses '..rould

be recognized, except unrealized gains.

7Ibid., p. fl3.

These w(}uld be

deferred.~tatements

be-

come more judE!r.ental by using deferrals.

If the crange in ratE;s is permanent,

then tte company is delaying the inev:ltable.

By recognizing the entire exchange

gain or loss and then dis(;losing the different aspects of it, the reader is able

to determine the significance of the gain or loss.

rlsclosure of the Types of Exchc.nge

Gains and Losses

It was discussed earlier that tpIee types cf exchange gains and losses

exist--realized, unrealized, and translation.

By using the definition of the

current-r.oncurrent concept, the !'ealized and unrea] ized portions can be detE;rmined.

Since current asset and liability transactions are

one year, t.he

devaluat~on

nor~ally

closed withir

or revaluation of these items is realized.

cr revalnation of the remaining items would be unrealized.

DevaluaUcn

There is no translation

gain or loss wr:.en the current rate is used to translate all items, including owners' equity, ir the financial statements.

Disclosure in :::tatements

The unrealized and reA.ljzed portions of the exchange ga:in or loss should

be disclosed ir:. the body of the inccme statement.

These porticns should be dis-

closed before and after taxes, since income tax can greatly influence the results.

Disclosure in Footnotes

The significance the currency has, with regard to exchange gains and

losses, was not. previously llentioneo before.

These gains and losses can l::;e inter-

preted differertly depending on the currency that generated them.

By gatl:ering

information about the foreign currency, it i3 possiblE to estimate whether unrealized gains and losses will increase or reverse.

Estimation of realized gains and

losses can be obtained with the disclosure of the major currencies.

This di8-

closure reflects ;mother irr:portant economical aspect of exchG.nge gains and losses.

19

To

avo~d

confusion in the bc·dy of the inco:ne stateMent, it is proposed that the

djsclosurE:: of i'oreigr. currency be in footnotes follm.;ing the stateMents.

Conclusion

Curren t Status of Fil.SB

#8

Tht::: Financial Accounting Standards Board is currentl;{ revie·w:inG this

statement.

ThEY are

reco:nmend~.ng

the use of the cUI-r,mt rate method.

exists some diE,crepancy on the treat-r.ent of the exchange gain or loss.

There

There is

the recornmendat.ion that unrealized gains and losses tecome a ncnoperating item

or be a direct charge or credit to retilined earnint:s.

A direct charge or credit

to retained earnings is a departure from the all -:nclusive accourting jn('ome

concept which

E:

ta tes tha tall reverme, expenses, gains, and losses are included

in income, except those resultir.g from c&pital transactirns.

Another recommen-

dation is to defer the unrealized gains and losses and then amortize them (lVer

the carryin£ value of the relatec item.

continl~al=-y be~ng

itell is disposed.

Other Clos ing

Under this app:'cach, if the currency is

devalued over the periods, deferro.l ocellrs until the related

This "'1ethod leads to

post~,oninG

the inevitatle.

l~emarks

No translation method is suitable in all situations.

the current rate

rr.et~od

It is felt that

is superior because it best reflects economic reslity.

It shows the f:.nancial stater:ents from a loea:!. viewpoint, not a p&rent company's

viewpoint.

Diflclosure of the different aspects of the exch,mEe gajns and losses

is strongly recommended uncier any translation mettod selected for use by the ?1-.SB.

The

followi~C

comprehensive review covers points "'1entioned in the paoer.

20

1979 BALANCE SHEET

FOREIGN

CURRENCY

U.S. DOLLAR

CURRENT RATE

Cash

Acets. Ree.

Inventory (FIFO)

Plant & Equipment

Land

Total Assets

FC

700

1100

1200

6000

2000

$

FC llpOO

$

Acets. Pay.

Notes Pay.

Bonds Pay.

Mortgage Pay.

Common Stock

Add. Paid-In Cap.

Retained Earnings

Total Liab. & Owner's Equity

FC

$

1100

1200

2100

1700

3500

500

900

FC lJpOO

"$

U.S. DOLLAR

FASB #8 *

560

880

960

4800

1600

8,800

$

880

960

1680

1360

2800

400

720

8,800

$

600

1000

800

5000

2000

9400

I

$

800

1000

2000

1000

3500

500

600

9,400

$

$

$

560

880

108e

6750

2400

11P70

880

960

1680

1360

4200

600

1990

11,670

1978 BALAN CE SHEET

Cash

Accts. Ree.

Inventory (FIFO)

Plant & EGuipm,ant

Land

Total Assets

F'C

Accts. Pay.

Notes Pay.

Bonds Pay.

Mortgage Pay.

Common Stock

Add. Paid-In Cap.

Retained Earnings

Total Liab. & Owner's Equity

FC

Exchan~e

600

1000

800

5000

2000

9,400

$

800

1000

2000

1000

3500

500

600

FC 9,400

$

FC

$

$

$

:$

600

1000

880

6000

2400

10}380

800

1000

2000

1000

4200

600

1280

1q880

Rates.

January 1, 197'8

January 1, 1979

January 1, 1960

FC 1

FC 1

FC 1

1.2

1.0

.8

Average Rate 1978

Average Rate 1979

FC 1

FC 1

*Refer to Exh1.bits 1,2, and 3 for assumptions used under this method of

translation.

1.1

.9

21

1979 INCOME STATEMENT

FOREIGN

CURRENCY

U.S. DOLLAR

CURRENT RATE

Sales

Interest IncomE:

Total Revenue

FC

2000

600

2600

$

COGS (FIFO)

Depreciation

Selling &

Administration

Other Expenses

FC

BOO

500

$

Profi t Before Taxes

Fe

FC

$

Income Tax

FC

300

$

640

400

$

480

$

1800

540

2340

$

880

600

270

360

230

$

240

300

Net Income (Loss)

1600

480

2080

240

320

300

400

600

U.S. DOLLAR

FASB # 8

240

$

270

(40)

$

FOOTNOTE DISCLOSURE

FASB #B

CURRENCY

REALIZED

UNREALIZED

Spanish Peso

French Franc

$

40

70

$

80

150

$

320

430

Total

$

110

$

230

$

750

Spanish Peso

French Franc

$

120

(20)

$

(150)

(230)

100

$

(Jeo)

CURRENT RATE

Total

TRANSLATION

22

BIBLICGRAPHY

Ble iberg, Robert, K., "FASB - Catch-22: In the Fore ign Money Game, Nearly

Everyone Loses," Barrons, Vo::L. 56, November 1, 1976, p. 7.

Choi, Frederick D. S. and Mueller, Gerhard G., An Introduction to Multinational

Accounting (Englewood Cliffs: Prentice Hall, Inc., 1978), pp. SE-e.2.

Deupree, Marvin, "Is FASB #8 tte Best hpproach?," Financial Executive, Vol. 46,

January 197f, pp. 2Ll-9.

Evans, Dr. Thomas G., "Some Concerns About Exposure After the FASB I S Statement

No.8," Financial Executive, Vol. Lil, November 1976, pp. 28-30.

Fantle, Irving, "Problems with Currency Translation - A Report on FASB #8,"

Financi.al Executive, Vol. 1.;7, December 1979, pp. 33-6.

Griffin, Paul A., "What Harm has FASB 8 Actually Done? ," Harvard Business

ReView, July/August 1979, p. 8+.

Meigs, Walter E.; Mosich, A. N.; and Larsen, E. John, Modern Advanced Accounting

(New Ycrk: McGraw-Hill, Inc., 1975), pp. 373-381.

Merjos, Anna, "For Better or Worse, FASB - 8 Continues to Play Hob with Corporate

Earnings," Barrons, Vol. 57, August 1977, p. 11+ •

e

Are Rippling Far

• , "Lost in Translation - The Effects of FASB - - - - a n d Wiele," Barrons, Vol. 56, December 1976, p. 11.

Norby,

~illiam

C., "Accounting for Financi al Analys is," Finane ial Analysts

JournaJ:., September /Oc tober 197f, pp. Ie -20 •

• , "Accounting for Financial Analysis," Financial Analysts Journal,

----S'eptember/Octoter 1979, p. If.

_ _ _ _ ., "Accounting for Financial Analysis," Financial Analysts Journal,

January/February 19PO, pp. 16, 32.

Pleak, Ruth E., "An Analysis of the FASB's Treatment of Foreign Currency Transla tions, n Management Accounting, Vol. 59, September 1977, pp. 29-32.

Rodriguez, Rita H., "FASB No. E: What has It Done for Us?," Financial Analysts

Journal, Vol. 33, March/April 1977, pp. 40-7.

P..udnitsky, Howa.rd, "How Companies Cope," Forbes, Vol. 121, January 23,1978,

p. 134.

Shank, John K., "FASB Statement 8 Re,solved Foreign Currency Accounti.ng - Or Did

It? ," .Financial Analysts Journal, July/August 1976, pp. 55-61 •

• j Dillard, Jesse

----,Decision

Makers,"

F.; and Murdock, Richard J., "FASB No.8 and TI1e

Financial Executive, February 19fO, pp. 18-23.

23

• dn,j ':,hamis, :JCiry 'j., "nes,orting l'oreip1 Currency Adjuc;tmfmts:

- - - -Disclosure

?erspective," The JOL.rnal of AccQur.tanc,l, April 1979,

A

pp. 59-65.

"Statement of Financial Accourt:in[ ·'tanc.G.r:i:: Eo. P--AccounUng for t.bo; Tran:"lation '.1' ~ OI'<:!i;.o:;. Surr"ncy Tr'",:lsdctir:ns Cind Foreicn C1lrrency Fir,andal

::taterr:ents," Th,,~ J,urna1 01' Accountancy, December 19"(5, pp. 7e-()?

Teck, Alan, "BEycnd FA(~ [To. P: Definin~: eth'r

Decemb':'r :l.9~'[, pp. 5l-7.

.:::xposl;re~,"

Eanagerr.ent AccoL.ntir:g,

"Trying to OutI'm; Currency Swings," Busi.nes:: .leek, February 14, 1977, p. l'JP.

_,_,lJ_s_'_:n_'_8_s_s_,_Jp__.:--_'.1.r_", ;iuG1JS t 6, 1979,

"Ways Out of H,e Currency Trans1at ien

p. fo.

~-f~h:te,

G2~aJ...d

1

701. JS:, \:arch/.'I.·)r~11979, p~;.

~~

il:"ey,

l\!r.~,!r

1., "ll;,=.;view of J"ASB Stat'SF..8nt

HlJ.~3s-:;11.

Decemt~~

.:.,

It

Jr.

~e

1979, pp.

[\; ns~ c· f ;,' \")

36~;o.

F:na!l·::ldl

1~~~-llj!3~J

t1f'*)u.rnal,

,'(-1.

~: 0.

C.

,

!I

:'~3.na;::l~"11ent. l\~countjnb'

\T::~,.