Document 11225501

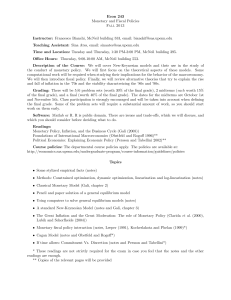

advertisement