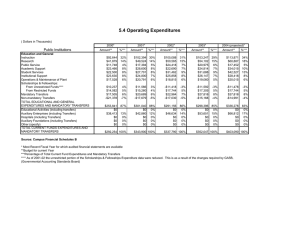

Private Inter-household Transfers in Vietnam in the Early and Late 1990’s

advertisement