International Trends in Work Organization in the Auto Industry:

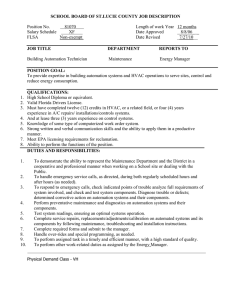

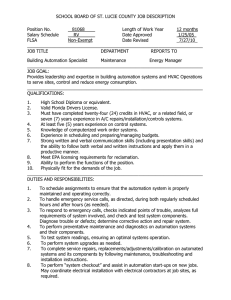

advertisement