DOES FINANCIAL LIBERALIZATION IMPROVE THE ALLOCATION OF INVESTMENT?

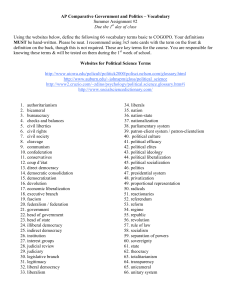

advertisement