The Benefits of Electric Transmission: July 2013

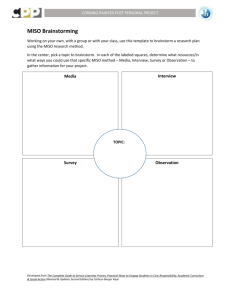

advertisement