The Mobile Economy Center for Real Estate Studies

advertisement

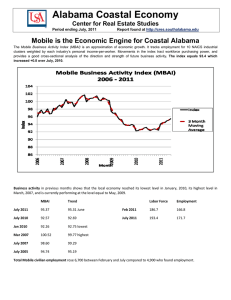

The Mobile Economy Center for Real Estate Studies http://cres.southalabama.edu Period ending May, 2010 The Mobile Business Activity Index (MBAI) The Mobile Business Activity Index is a good indicator of Mobile business activity. It includes employment for 10 employment clusters weighted by each industry’s personal income-per-worker. It measures the ability of the local worker to buy local goods and services. Shown below is current selected data from the local residential market. Residential investment should follow the direction of the MBAI as the worker must have good family income to buy housing. MBAI through May, 2010 Analysis: The May MABI shows that the economy is performing at a level comparable to August, 2004. The local workforce grew by 1000 workers from April to May which caused an increase of .47 percent in the Index. The employment clusters are ranked by size of the workforce to show their relative importance to the metro economy. The top six clusters account for 81 percent of the 172.0 total May employees. Four of the top six declined in May from the same month, 2009. Education and Health Services remained the same, Leisure and Hospitality showed a modest increase of +1.3 percent. The Financial Activities cluster showed the largest decline of - 9.5 percent followed by Professional and Business Service with -4.7 percent followed by Manufacturing, and Mining, Logging, and Construction. Mobile 10 Employment Clusters Rank Mobile Employment Clusters % 1 2 3 4 5 6 Trade, Trans, & Utilities Government Education & Health Service Prof & Business Service Leisure & Hospitality Manufacturing Sub-Total Mining, Logging, Construction Other Services Financial Activities Information Total 21.9% 16.0% 13.5% 12.0% 9.2% 8.4% 81.0% 7.5% 5.2% 5.0% 1.3% 100.0% 7 8 9 10 May Employees (000’s) 37.8 27.6 23.0 20.3 16.0 14.4 139.1 13.0 9.0 8.6 2.3 172.0 % Change vs. 12 Months - 1.6 - 0.4 0.0 - 4.7 1.3 - 2.7 - 2.3 - 2.2 - 9.5 0.0 Residential Investment: The residential market serves as an important indicator of consumer attitudes, expectations about the future economy, and job stability. Selected indicators provide a good cross-sectional view of residential capital investment in Mobile, May Number Actual Sales Month’s Inventory Residential for Sale Single Family Permits New Construction Sales Sales Under $200,000 366 10.3 months 3766 listings 8 (April) 56 258 Direction + Good - Good + Increase - Decline - Decline Analysis: Actual sales showed an increase in May. The number of month’s to sell the existing inventory of listings, 3766, dropped to 10.3 months which is movement in the right direction. Single family permits remains low, and sales of new construction is a healthy 56. The predominant market of under $200,000 dropped slightly, but remains steady. These indicators follow the MBAI. This primary price range remains under $200,000, sales need to increase, permits need to increase, and the existing inventory of properties for sale needs to be lowered. For additional information, contact: Dr. Don Epley, Director, Center for Real Estate Studies, Mitchell College of Business, University of South Alabama, Office: 251.460.6735, E-mail: depley@usouthal.edu University of South Alabama takes reasonable measures to ensure the quality of the data and other information produced. However, USA makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy, correctness, or completeness of any information, nor represents that its use would not infringe on privately owned rights. Reference to any specific commercial product, process, or service does not constitute an endorsement, recommendation, or favoring by USA.