Surviving the S Curve™

advertisement

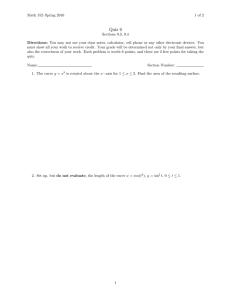

Surviving the S Curve™ Why do most start-up businesses fail within the first five years of opening? The fact that they do is well known, but the answer for why they do is less well known. The answer may seem as simple as just running out of cash, also referred to as under-capitalized. But beneath the surface, there is actually a nearly universal trend in businesses that is easily anticipated, corrected, and overcome—when you know what to look for—that explains the Five Year Fail. At Cathedral, we track the natural cycle of a startup business using a unique tool we call the S Curve.™1 The S Curve™ The S Curve™ hits virtually every startup business in this pattern: begin strong, grow by 15, 20, or even 30% for a period, then sales decline, sometimes by 60 to 80 percent. We attribute this to most businesses reliance on friends and family members of the owners and employees of the company boosting initial sales revenue. Below is an illustration of the S Curve™. Why the S Curve™ Matters for Your Business Many small business owners make the mistake of thinking that they are driving their company’s revenue stream. When businesses first start up, it is not uncommon for them to experience tremendous growth in the first year or two. Again, we attribute this to the “soft” friends-andfamily market. Because revenue appears to be streaming in at a steady rate, business owners project continued upward growth and become anxious about capacity to meet this growth. Because of the higher revenue the owners begin to increase their overhead costs (notice the 1 The S Curve can be thought of as the “Startup Revenue Curve.” Cathedral Consulting Group, LLC Page 1 red dotted arrow on the chart above as it creeps up to intersect with the revenue line) and upgrade—new hardware, new office space, new equipment, etc. But suddenly, business owners discover that the friends-and-family market is maxed out, and there is no more growth in revenue. Instead, revenue falls off. The result is significant negative cash flow. From a capital perspective, the company burned through the startup capital as planned during this “friends and family period.” The plan was to be over break-even, but now there is no capital to fund the continuing and often deepening losses. The Shift to Marketing When the friends-and-family market is exhausted, the only way for a company to stay in business is to shift to an aggressive “true marketing” phase. During this phase, a systematic marketing program must be implemented. The good news is the friends and family time gives the company the needed trade record, market knowledge, and price experience. Once the plan is developed the company needs to shift to a systematic marketing program. This shift must be swift and effective. Many companies cannot make this shift. In short, they die for lack of an effective marketing program. Marketing in this context is about immediate sales, not branding, presence, or other broader marketing ideas. All available resources have to go into this revenue-based marketing effort. Staying Out of the Woods To stay out of the “S Curve™” woods owners should first watch their marketing and customer base. If it is mostly friends and family sourced, then the “S Curve™” is likely. If the customers are referrals or from other marketing sources the “S Curve™” may be avoided. The second is to keep overhead and expansion slow and preserve startup capital. Having reserves in case of an “S Curve™” means potential for survival. Note the dotted blue line on the graph above. This represents the very conservative target overhead expense limit that startup companies should strive for. While it might feel like an unnecessary sacrifice, avoiding a crisis scenario—where the company is all but bankrupt, with no cash reserves—is well worth doing without top quality equipment, a bigger office space, offsite training sessions, etc. Philip Clements is CEO of Cathedral Consulting Group, LLC and a Managing Director in the New York Office. Sharon Nolt is a former Senior Associate in the New York office. For more information, please visit Cathedral Consulting Group LLC online at www.cathedralconsulting.com or contact us at info@cathedralconsulting.com. Cathedral Consulting Group, LLC Page 2