School of Enqineerino A Report of the Massachusetts Institute

advertisement

IMPACTS

OF

NEW ENERGY

TECHNlOLOGY,

GENERALIZED INPUT-OUTPUT

USINlG

ANALYSIS

by

James

E.

Just

February,

1973

A Report of the

ENERGY

ANALYSIS

AND PLANNING

GROUP

School of Enqineerino

Massachusetts Institute

of Technoloqy

Cambridqe, Massachusetts

REPOPT r!o.

73-1

The Massachusetts Institute of Technoloay has undertaken a program

of research

on Enerqy

The overall goals of this program

information,

and demand,

and Planning.

Analysis

are to develop

concepts,

and analyticadl tools that relate enerqy

the economy

ful to managers

and the environment

and policy makers

energy industries.

in

sunply

in a manner

overnment

use-

and the

The work reported here is the second

formal output of this effort.

Further

elopinq

research

other models

at refining

relating

this model and also dev-

to the overall goals of the

program is underway.

David C.

Ford Professor

hite

of

noineerin

2

IMPACTS OF NEW ENERGY TECHNOLOGY - USING GENERALIZED INPUTOUTPUT ANALYSIS

BY

Jares Edward

Just

Submitted to the Department

17

January

Degree

in partial

of Electrical Engineerinn on 1973,

fulfullment of the requirements for the

of Doctor of Philosophy

APSTRACT

Traditional input-output analysis was modified to include air

pollution emissions, employment, and other accessory variables.

Engineering studies of high and low DTU coal gasification and

the gas turbine topping cycle were then utilized to incorporate these new technologies into the 1980 input-output table

These

that was projected by the Bureau of Labor Statistics.

two techniques are shown to be able to correct many previous

objections to input-output analysis and to have applicability

to a wide variety of practical problems.

of 1985 projections featurin h igh , medium and low

growth of energy consumption (both with andI without the new

Economic and environmental impacts

technologies) we re also made.

were then calcul ated for these alternati ve futures. The major

A series

conclusions

1.

are:

Total

investment

in general

and capital good

indus-

tries in particular (primarily turbogenerator

manufacturers, boiler makers, and construction

equipment manufacturers) are quite sensitive to

energy use growth rates (especially electricity).

2.

Introduction of high

aggravate the demand

tu coal gasification will

for investment funds and

introduction of the second generation gas turbine

cycle

topping

(with or without

low Btu coal qasif-

ication) will decrease the demand.

These technol-

ogies will have their major impacts on the industries listed above.

3.

Sliaht

changes

in the overall

growth

rates of total

personal consumption expenditures and government

spending

result in large fluctuations

investment.

in total

4.

If high energy qrowth continues and if investment

is to remain within its historical limits as a per

centage of GNP, energy investment will become a

laraer and larqer part of total investment.

5.

While

interest

rates are assumed

to be the balancino

mechanism between supply of and demand for investment

funds, the very act of saving more money (which is

induced by hiqher interest rates) means that less can

This in turn lessens

be spend on consumption goods.

the demand for investment funds because the qrowth

rates of consumption sectors are lovwer. This

indirect effect of interest rates on investment has

been little studied but may be quite important.

The policy implications

THESIS SUPERVISOR:

TITLE:

of these results

David C. White

of Engineerinq

Ford Professor

are also discussed.

4

ACK''OWLE GErlE!TS

I

like to expres s my sincere thanks

would

David White for

this research and to Prof.

supervising

Robert Soloow and Prof.

and assistance.

to Prof

Fred Schweppe

Both professionally

for their

and nersonallv,

have enjoyed my association with them.

have helped me that it is impossible

uidance

I

So many other people

to thank them individually.

However I must express my appreciation of the special assistance

niven

to me by Miss

Istvan,

Samual

ancy Stauffer,

Dolinar,

Pr. Anne Carter,

and the members

Pudvard

of the staff of the

Office of Business Economics (now the Bureau of Economic

Analysis), and Interaqency Growth Project and the Institute

of Gas Technoloqy.

Pam Sullivan

Special

for the lon

My research

thanks should

also no to Mrs.

job of typino this report.

has been supported

by the MITPE Corporation,

the National Science Foundation (Contract #GI-34936) and

Massachusetts Institute of Technoloay Ford Professorial Funds.

Their support was

I would

reatly appreciated.

like to dedicate

this report to my mother who

has patiently waited many years for her son to finish his

education.

5

TABLE OF CONTENTS

Paqe

Abstract

2

Acknowledgements

4

Table of Contents

5

List of Finures

8

Conventions

Chapter

Chapter

1

2

13

Summary and Orqanization

15

1.1

Introduction

15

1.2

Generalized Input-Output Theory

17

1.3

Summary

30

1.4

Conclusions

47

1.5

Organization

50

of

esults

Methodoloqy: New Technologies and Generalized Input-Output Analysis

57

2.1

What is Input-Output Analysis?

57

2.2

Technoloqical Coefficients

60

2.3

Capital

68

2.4

Uses of the Coefficients

2.5

Overview

Coefficients

73

of the Generalized

Input-

74

Output Model

Chapter

3

2.6

Methodology

2.7

Output Model

New Technology Coefficients

Impacts of Capital

in the Generalized

Expenditures

Input-

79

87

for New Ene rqv 95

Technologies

3.1

Summary

3.2

Impacts of Capital Expenditures

PTU Coal Gasification

3.3

Low BTU Coal Gasification

3.4

The Gas Turbine

3.5

Cvcle

Nuclear

of the Impacts

Tonpinq

team Generation

95

for t ioh 115

122

Cycle (COGAS

123

129

6

Chapter

4

Impacts of the Technology Plant Operations

and Energy

Chapter

Chapter

5

6

133

Price Rises

4.1

Overview of Chapter

4.2

Impacts of New Technolony

4.3

Price

133

Operations

Changes

134

147

1985 Projections

159

5.1

Scope

159

5.2

Procedure

159

5.3

Issues

169

5.4

Projections

171

5.5

Sensitivity

of Investment

173

Conclusions and Recommendations

184

6.1

Conclusions

184

6.2

6.3

Implications for Energy Policy

Further Pesearch Suqgestions

6.4

Suqggestions for Policy Studies

1,97

187

190

Reference5

194

Appendix A Data Sources

200

Appendix B Some flew Energy Technologies

203

B.1

Gas from Coal

203

B.2

HIygas-Electrothermal

205

B.3

Low

B.4

The Gas Turbine Toppina

TIU Coal Gasification

Appendix C Derivation of HYGPS Capital

Coefficients

211

Cycle

214

Investment

221

Appendix D Derivation of HyQas Technical Coefficients

of Capital Coefficients for

Second Generation Texaco Low BTU Coal

Appendix E Derivation

Gasi fi cati on

244

253

Process

Appendix F Derivation of Second Generation Low PTU!

Coefficients

Coal Gasification Technical

260

of Capital Coefficients for the

266

Appendix G Derivation

Second Generation Gas Turbine Toppin Cycle

7

Appendix

H

Derivation of Technical Coefficients for

the Second Generation Has Turbine Toppino

279

Cycle

Appendix

I

Appendix J

Biographical

Analytical Convergence Procedure

Projections

or 19P5

2P3

Detailed Figures

Notes

299

8

LIST

Figure No.

OF

FIGURES

Pane

Title

1.1

1.2

Basic Input-Output Relationships

19

Two-Period Dynamic Input-Output Model

23

1.3

Quasi-Dynamic Projection Model

25

1.4

Energy-Oriented Generalized Input-Output

Model

26

1.5

few Technologies Investiqated

32

1.6

Major Iso-Energy Impacts of new Technoloqies

(Capital Investment)

34

1.7

Major Iso-Energy Impacts of new Technologies

(Operation)

36i

1.8

Effects of Fuel Price Changes

4n

1.9

1.10

1.11

1.12

1.13

2.1

1980-1985 Modifications

42

1985

43

ew Technolooy Modifications

Balanced 1985 Projections

46

Generalized Input-Output Model Sectors

52

Final Demand Sectors

56

Eiqht Sector Input-Output Table for 1958

58.

2.2

2.3

Components

62

Hypothetical Ten-Sector Economy

63

2.4

Components of Pipeline Gas Price-Preliminary

Assiqnment of Sectors

G4

2.5

Components of Pipeline Gas Price-Final Assign- 66

ment of Sectors

2.6

Technoloqical Coefficients for Coal Gasifica-

of Pipeline

Gas Price

67

tion

2.7

2.8

2.9

2.10

2.11

2.12

Investment Breakdown for Pipeline Gas Plant

Pipeline Gas Investment Summary

69

71

Liqnite Grinding & Drying Equipment Summary

72

Energy-Oriented Generalized Input-Output Model 75

Sources

of Input-Output

Data

Outputs of Generalized Input-Output Model and

Data Sources

77

7R

Fiqure No.

Title

Page

3.1

1970 Gross

3.2

New Plant and Equipment

3.3

Electric Construction Expenditures

3.4

Gas Utility Industry Construction Expendi-

National

Product

96

Expenditures

98

99

100

tures

3.5

Plans for Capital Spending

101

3.6

New Technology

103

3.7

Summary of Detailed

3.8a

Comparison

Plant Sizes and Costs

Comparisons

104

of 1980 Total Investment

with

ln6

$10 billion Investments in new Technoloqy

3.8b

Outouts Required to Support Equal Capital

Investments in ew Technology

3.9

Expenditures

BTU/Day

for 5 Trillion

Capacity

109

112

of Each New Technology

3.10

Outputs Required to Support Investment

Equal Capacities of new Technologies

3.11

High BTU Coal Gasification

3.12

Major

3.13

Coal Reserves

3.14

Low BTU Coal Gasification

3.15

Major

3.16

Gas Turbine

3.17

Major

3.18

Nuclear Generation Scenarios

130

3.19

Major Impacts of Nuclear Scenarios

Selected

Fiqures for the Energy Supply Ind-

131

4.1

in

117

Scenarios

Impacts of fligh TU Gas Scenarios

of the United States

Impacts of Low BTl

Topping

113

119

by States

120

Scenarios

124

Gas Scenarios

125

Cycle Scenarios

Impacts of Gas Turbine

127

Scenarios

128

135

ustries

4.2

4.3a

Coast of Electricity

Classification

of Gas Operatina Expenses

137

138

4.3b

4.4

4.5

Composite Gas Income Accounts

Generation Cost vs. Average Customer Cost

$10 Billion

Energy Purchases

139

141

141

4.6

Outputs Required to Support

142

Energy Purchases for

10

illion

ew Technoloqies

of

i

Figure No.

Title

Page

4.7

Outputs Required to Support Purchases of

5 Trillion

BTU/Day

145

4.8

Significant Price Rises Caused by Coal

151

4.9

Significant

152

4.10

Significant Price Rises Caused by Oil

Significant Price Pises Caused by Natural

4.11

Price Pises Caused by Crude Oil

153

154

Gas

4.12

Sirnificant

Price Rises Caused by Electricity

155

4.13

Sinnificant

Fuels

Price Rises Caused by All Fnergy

156

5.1

1980-1985 Modifications

160

5.2

Istvan's Electric Utility Information

161

5.3

1985 Initial

163

5.4

Quasi-Dynamic Projection Model

165

5.5

1985 New Technology Modifications

167

5.6

Balanced 1985 Projection Procedure

168

5.7

Basic Unscaled 1985 Projection

172

5.8

Basic Scaled 1985 Projection

172

5.9

Changes in Pequired Investment

174

5.10

Balanced 1985 Projections

175

5.11

Sensitivity of Total Outputs

Final Demand

to Unit Changes

5.12

Sensitivity of Total Outputs

Chanaes in Final Demands

to Percentage

179

5.13

Investment

to Changes in Final

183

6.1

Enerqy Demand

Model Develonment

Final Demand Projection

Sensitivity

B.1

Dynamic Generalized Input Output Model

Selected Worldwide Natural Gas iqhliahts

B.2

FPC Natural Gas Estimates

B.3

Hyqas Electrothermal Process

Hyqas xyaen Process

Texaco Partial Oxidation Process

6.2

B.4

B.5

in 176

189

191

204

206

207

21n

213

11

Fiqure No.

Paqe

Title

...

Gas

B.6

Cost of One Million

BTU of Synthesis

E3.7

Waste Heat Recovery

COGAS System

B .8

C .1

Proposed COGAS Power Systems

Cost Summary for Electric Power Stations

Hygas Investment Summary

C.2

Escalated

C.3

C.13

Plant Utility Supply for Hyoas

Hygas Equipment Summary

Conventional Coal Generation Capital Vector

Expenditures for Pollution Control Equipment

C.14

Breakdown of Pollution Control Equipment

C. 15

Cost Allocation

C.16

D.1

Revised Investment Summary

Hygas Capital Fxpenditure Coefficients

Operatinq Expenses for Hyaas Process

D.2

Labor Requirements for Fyaas Process

D.3

Dy-products

D.4

Summary of Annual Material Requirements

Process and Feedwater Requirements

B .9

C. 4-11

C.12

C.17

D .5

D.6

D.7

E.1

E.2

E.3

Investments

for Hyaas Proc ess

for Various

Equipment

246

Equipment

247

248

249

250

252

254

255

of Low BTI3 Coal Gasification

256

of Hyqas Process

Coolinq ater Summary

Hyqas Technolonical Coefficients

"Add on" Estimation Technique Illustration

Low BTU Gas Process

Comparison

215

217

219

220

223

224

?25

226

235

237

238

240

241

243

245

Processes

E.4

E.5

F.1

F.2

Modal

Allocation

of Transportation

Low BTU Gas Capital

Operatinq

Costs

259

Coefficients

for Low

261

3TU Gas Process

F.3

Comparison of Material Balances

Distribution of Labor Charges

F.4

Breakdown

F.5

Low BTU Coal Gasification

of Total Maintenance

ficients

258

Costs

262

Costs

Technolonical

Coef-

263

263

265

12

Fiqure

No.

Pane

Ti tle

267

G.1-8

COGAS Equipment Summary

G.9

COGAS

G. 10

Labor MarQins

on FPC Capital

G.11

COGAS

Coefficients

H.1

COGAS Technoloqical

.2

Capital

Capital

275

Cost Summary

Accounts

276

27P

2 n

Coefficients

or Combined

Technoloqical Ccefficients

and Low BTU Coal Gasification

COGAS

2°2

3.1

Comparison

of Ulnscaled 1985 Total Final Demands 2,7

J.2

Comparison

of Ralanced

J.3

Comparison

of Ulnscaled 1985 Total Outnuts

291

J.4

J.5

Comparison

of Ealanced

23?

Comparison

of Gross

1985 Total Final nemands2P9

1985 Total

Investment

utputs

and Total

295

Output (1930)

J.6

Comparison of 1980 Investment

with Total Output (1980)

(GPDI) Impacts

297

13

CONVENTIONS

A

- capital

[aij],

letters

(underlined)

[bj], - Matrix

aij

represent

A (or vector

vectors or matrices

B) is composed

of elements

(or bj)

Aij,bj - elements of matrix A (or vector B) are subscripted

lower-case letters

a, ,c - constants are non-subscripted lower-case letters

AT - transpose

A -1 -

of matrix

or vector

inverse of matrix A (assumed

Equation Numbers

and

A

to be square)

1.1, 3.9 - umber before decimal point

refers to chapter number, while number

Figure Numbers

after decimal point indicates senuence

number with chapter.

Footnotes - Within Text - Numbered sequentially throughout

report; used for informational purposes only.

Footnotes - within Figures -

umbered berinninq with 1 with

each figure.

[39],

[2], etc. refer

Special

Symbols

to books listed under

eferences.

and Letters:

N - number of sectors in economy

A - N X N matrix

of technological

C - N x N matrix

of capital

coefficients

coefficients

Y - " X 11 total final demand vector

Y Z Y

N x 1 investment

component

- N x 1 non-investment

of final demand

component

(GPDI)

of final demand,

includes PCE exports, and government spending

X

MCF

MBTU

MMBTU

-

N

x

1

total

output

vector

- thousands of cubic feet

- thousands of BTU

- millions of BTU

14

e

I

L

P

-

u IC U

LA

nu

J

p

,, i

uI

guras ri , nt,

ducer.s

S

U*

.J

,

r

15

Chapter

Summary and

1

rganization

Introduction

1.1

"The breakdown did not come all at once -- not like the

cataclysmic nightfall that blacked out New York and

most of the Northeast in 1965 -- but it was no less

House lights went out: furnaces sputtered and

eerie.

cooled; auto traffic jammed up at darkened intersections.

Dog races were canceled because the electric rabbits

would no longer run. Factories shifted to a four-day

week,

then a three day week,

laying off 1.6 million

employees. Only the most essential services operated

full time -- hospitals, water and sewage plants -- and

nobody knew how long they could continue."

Time, June 12, 1972.n.

49 [151

describing events during

Britain's two month coal strike.

Americans use nearly twice as much electric power per

capita as the British,

and hence the potential

even greater than that described above.

can help to ward off such consequences,

new technology

to examine

as a cure-all

the impacts

The research

is

Pdvances in technology

but before embracing

for these problems,

it is important

of such technologies.

described

here exp lores only three new tech-

nologi es that could have significant

1985.

for disaster

commercial application

by

These technologies are:

(1)

High Btu coa 1

(2)

Low Btu coal qasification, and

(3)

Gas turbine

gasification,

topping cycle (combined

gas and steam

cycle).

The techni ques developed during the research are applicable

to any possible

new technologies, and provide broad but detailed

looks at the Uni ted States,

15 to 20 years

hence.

The techniques

are based

on a generalized

1

form of input-output

sis and thus can focus on the myriad

many sectors of the projected

As such,

the techniques

interactions

(I/O) analvbetween

the

future economy.

should be a useful

tool for

policy-makers who must decide what actions to take if there is

an "energy crisis". Such possible applications will be discussed at the end of this chapter.

studies

is that engineering

niques

One contribution

can be used to incorporate

Since engineering

into the I/O framework.

new technologies

of the tech-

studies can handle relative price changes and other variables,

this capability

the problem

alleviates

I/O

of simplistic

projections that ignore price changes and facilitates the

development of dynamic economic models in which technology

depends on relative prices, energy availability, etc.

The research

prepared

utilized

by the Interagency

Labor Statistics [481.

a projection

Growth

of the 1980 economy

Project

of the Bureau of

These projections were incorporated

into a mode 1 that contained environmental variables and new

technology representations that had been derived from basic

engineering studies. The research focused on the economic

impacts

nologies

of investing

in these highly

capital

intensive

operation

of such

lants.

an d of day-to-day

techAn

attempt was made to calculate the effects of fuel-switchinn

and conserv ation policies

caused by the hiah prices

of these

new energy sources but the attempt failed because of the lack

of industri al price elasticity data. Finally a dynamic model

was

used to make

a series

of 1985 projections.

These pro.jec-

tions involved different rates of energy use arowth and were

performed with and without the new technologies.

1.

"Generalized"

refers

to the inclusion

of non-economic

variables such as sulfur dioxide emissions or employment within

the I/n framework and t the use of enqineerinr studies to

update projections of the technological structure of the

economy.

17

results document

The major

capital investment

to changes

and to the adoption

illustrate

of total

the sensitivity

in the energy

of new energy

use growth

technology.

that very small changes

rate

They also

in the overall

growth

rate

of personal consumption or government expenditures can restrain

total investment

age of GNP.

to within

its historical

of these results is that the

The significance

of the U.S. can sustain

people

limits as a percent-

the huge investment

demands

created by rapid energy demand growth by reducing the growth

rate of personal

consumption

and government

spending

than 0.1% per year

through

1985.

remains

because

the sum of the growth

unchanged,

investment

rate

rates in

oods is a constant.

and non-investment

The next section (1.2)

Overall GNP growth

by less

of this chapter briefly describes

the generalized I/O model, while the followinq sections (1.3

and 1.4) summarize

the organization

1.2

The last section

of the report.

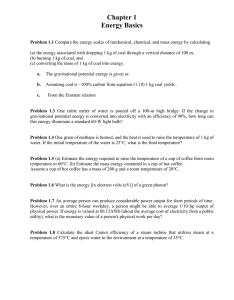

Static Input-Output Models

Input-output

sectors 2

(I/O) analysis

of the economy.

is the study of interrelations

It seeks to answer

tions as "If GNP grows

by 4

each sector grow given

that consumer's

will change?"

To perform

to characterize

per year, how will

such analysis

of

and technology

it is first necessary

the flow of goods and services

periodically

such ques-

the outputs

preferences

This is done with the aid of the interindustry

is prepared

(1.5) outlines

Generalized Input-Output Theory

1.2.1

between

the results.

between

sectors.

flow table that

as part of the governments

Census of

Business.

2

Sectors

can be agricultural,

service groups.

sectors.

industrial,

commercial

or

Households and Government are also considered

A very simple

three sector

example

economy

is presented

the table represents

to sectors

by

se ctor

along

of a flow table f or a hypothetical

the top.

Thus each row i can be read as sales

and each column j

purchases by sector j from other sectors.

3 x3

flow

Final

Demand

m atrix

3

x

1

each sector to private

House holds

1x 3

ti on

of

V =

[vil)

th e Value

components

X

=

The entries

final consumers

a re

both

The entries under Value

fo r each sector.

N1ote that the suim

t o the Gross

This

t rue by definition

is

(the 3 x 1 vector

) are the total sales of each sector either

Demand.

Thus

x

3

=

3

j=l

The objective

Output

X responds

in technology.

of I/O analysis

to changes

(Gl P)

of the account ing

[x

sectors or to Final

under Total Output

ema nd

Product

es.

]

The entries

National

ti fi

i

dded (the

esent purchases of labor, deprecia-

repr

equal

n der

such as

Added componen ts and the sum of the Final

of this econ omy.

i den

and public

changes , and profit

= [dijl by the

tor Y = [yi]) are the sales from

vec

a nd Governments.

vector

can be read as

Let

enclosed in double lines.

(the

Fach entry in

dollars of sales from se ctors on the left

to other sectors

i

in Figure 1 .1.

d

to other

+ v

1j

i

is to predict how Total

in Final Demand

Y or to changes

The first step in this analysis

forms the

technological coefficient matrix A that represents input

purchases

required

is easily

calculated

the flow matrix

per dollar

of output

by dividing

of each sector.

each column

This

of purchases

by the total output of that sector.

in

Thus

d.

A

=

[a.

1 =

13

[

x.

Actual I/O tables include investment purchase, net

For introductory

exports and inventory chanae in Final Demand.

purposes

it is better

to innore

these.

Fi gure

19

1.1

Hypothetical Flow Table ----(in Dollars)

_

I

To

-

From

Sector

_

..

.

I_

2

1

- _

-

Final

3

Demand

Total

Output

Y

X

i

1

Agri culture

4

8

2

Industry

4

4

3

Energy &

Services

I_

8

8

20

2

30

40

2

2 -

10

20

I,_

Va lue Added

16

V 12 20

,(Labor etc.)

!

__

Total

=

D

Inputs

=

=

[xi]

Total

xi

A =

[aij]

13J

X

AX

= total

+

Y

m

=

_

dollar sales by sector i

[ -1

sales to Final

dollar

i

]

emand by sector i

Coefficient Matrix

= Technological

Y

or

X

_

20

= Final Demand Vector

[yi]

where

L

G N!P

dollar sales of sector i to sector j

Output Vector

=

d

where

Y =

20 140

------

= Flow Matrix

[di j]

where

X

._

48

Basic Inout-Output

elationship

[ I -A] -ly

_

_

Matrix (in Dollars)

Technological

"------- Coefficient

-Sector

2

3

1

Agriculture

.20

.20

2

Industry

Energy & Services

.20

.10

.10

.20

.10

3

1

1

Economists

often

use

x.i

to

to represent total output .

to be less confusinn.

represent

the

flows and x.

The above not ation was

thouqht

20

coeffi cient matrix

The technological

sector economy

each sector

Final

is also shown in Fiqure

can be expressed

Output

Final

Demand,

This expression

of Final

function

as

is easily

of

matrix

product

A X.

The objective

=

(I

-

Y

(1.1)

)-1

as

if it

has been achieved

1

, which can be derived

year and a particular

GNP

for other yea rs and other Final

applies

Technological

(1.2)

y

(I-A)

from Census data for a particular

and Final Demand,

for Total Output

solved

of I/O analysis

that the inverse

can be assumed

output and

Demand.

X

Demands.

the

the sum of the immediate

is obviously

X= X+

a

The output

vector is known as total immediate output since

The resulting

Total

1.1.

b y other sectors, excluding

that is consumed

Demand,

for the three

chanqe

can be h andled by modifying

the technological coefficient matrix A to correspond

to

the

change.

can also be used to calculate

The I/O framework

ibrium

relative

price

levels for all goods.

euil-

The assumptions

behind this derivation are usually that companies set prices

to cover

the cost of material,

labor, and some nominal

profit

and that the relative

price of labor is equal to one.

added is the economic

term that describes

the labor costs,

taxes, and profits

that make up the

depreciation,

difference

business

between

of materials

the selling

that went

Let V = [v i]

the ith sector.

Value

price of a good and the cost

into it.

where

v

= value added per unit sold of

21

The per unit price pi

as

pi

=

+

vi

ood can be expressed

p

a

N

of the ith

j=1

Changing to vector notation, the per unit price vector

P =

]

[pi

is

=

p

+

V

for prices

Solving

(I

=

P

This equation

term price effects

(1.3)

A'P

-

makes

in terms of value added

AT)

1

(1.4)

V

it very simple

on other commodities

of changes

in the capital

Note that they tell

of any one sector.

or labor requirements

the long

to calculate

nothing about how rapidly these price changes would propagate

the economy,

through

nor do they indicate

other industries might react to such

above equation

be

itself

these price

used

to predict

the

price changes.

or

Thus the

the price sensitivities

in value added, but it cannot

of

response

the

to

system

changes.

1.2.2

There

to changes

industries

of various

by

can be used to explore

how consumers

Dynamic Input-Output Models

a re

many possible formulations of dynamic input-

output models , but the essential

concepts

with a simple two-period

for times to and t1.

example

can be presented

Assume

that the same technological coefficient matrix A applies for

both periods.

Two conceptual changes are required to modify the static

theory of the previous

sectors

First,

total final demand

of yF = final demand purchases

must now consist

and governments

section.

and yI = capital investment

of the economy:

Y

=

F

I

Y

by households

purchases

by all

Second,

the

capital

matrix

[cij] where

cij is the marginal

i by sector

j required

one dollar

period

t

investment

Thus if X1 were

is

C (X1

defined

purchase

from sector

the total output

in period

- X ).

as C =

of sector

the capacity

the total output

required

be

capital

to expand

of output.

and X

C must

By

j by

in

t1, the total new

defining

C in

terms

of marginal capital requirements, difficult problems of defining

capital stocks

and measuring

These

of the model

objective

output

relationships

are avoided.

are summarized

is to find for period

(X1 ) and total final demand

to (X ) and the non-investment

period

(Y1 ).

The model

investment.4

=

The basic

= C

I~~-

YI

A) - 1

(I

assumes

so that output

at 100% capacity

(X

(I-A)- 1

=

The

'e total

t

final demand

that sectors

in

always operate

by capital

can only be increased

equations

Y1

1.2.

(Y1 ) given the total output

in period

t1

in Finure

for this model are:

(Y1

+ Y1

)

(1.5)

(1.6)

-x)

-O

These equations can easily be solved for total output

and total final

X1

-1

=

(I

demand

- A

1

These equations

on investment

rates

1

(Y1 F

C X)

(1.7)

(1.8)

are easily

used to calcu late the effect

yI and total output X of changes

of individual

available

(Y1):

- C)-

--1

to assure

(X-1

1 )

components

of Y

Various

in the qrowth

methods are

that total GP

4

Slack variables can be used to modify this assumption

but such considerations

are not important at this stage.

23

Two-Period Dynamic Input-Output Model

Given:

= [x io

X

period

F

xio = total output

where

of sector

i in

to

final

by households

demand purchases

ment in period

and

overn-

t1

purchases

capital

C = [c. ij = marginal

from sector

i

by sector j required to increase sector j's output

by one dollar.

A = technical

and

Find:

for both periods

matrix

coefficient

t

Y1

F

I

Y-1 + YI

total final demand

ment purchases in period t1

Solve:

X1

= total

X

=

YI

(I-A)

C

output

in period

1 Y1

(I-A)-

(X

=

t1

(YF

X-

Resul ts:

X1

1

to

: (I-A-C)

--

-1

X

(yF-1 C -o

1 + C (X1

F

I

- Xo

)

G

U

R

E

1.2

+

y

where Y

I

invest-

24

where

Gri P

5

F

I

+

YI

Y1

I =j Y11

Y

1

i=1

and N = numbers

does not exceed

certain

in later chapters.

of sectors

in model.

limits, but these will be discussed

It should

also be noted

that, whereas

the technical coefficient matrix (A) was derived from basic

the capital matrix

Census data,

capital

(C) must be estimated

flow data or from engineering

with both sources

data.

There are problems

of data that do not arise with

coefficient calculations.

from

technical

These will be discussed in later

chapters.

The model

tions utilizes

the further

the two period

constraint

(1958 dollars).

1.3.

Given

with

used for the 1985 Proiec-

anal ysis described above with

that the 19 85 GNP equal $1.34 trillion

The model is pict;orially described

an initial

one iterates

obtained

that was actually

around

projection

in Figure

of the 1985 final demand,

the loop until a final demand

the proper GNP.

6

Con vergence

vector is

can be guaranteed

by modifying the scaling factor.

1.2.3

Generalized Input-Output Model

The generalized input-output

illustrated in Figure 1.4.

It is

model

referred

used in this

study

is

to as "qeneralized"

because

5

The magnitude signs represent the vector norm formed

by arithmetic addition of the vector elements. They do not

represent absolute value signs

6

This GNP represents a 4.47 per year

rowth rate from the

BLS projection of the 1980 GNP.

It was calculated by excluding

any contribution from BEA sectors 84, 85, and 86 (Government

Industry, Rest of the World Industry, and the Household Industry

respectively). These dummy sectors were excluded because they

do not interact

with other sectors;

they only contribute

to GNP.

2 5r

oo o

I

a)

0o

0

O

I

0

xl

L -I

12

O

OIa,- 0:,

I

o,--

xl

o

CL

0

) axl

.0

xl

0

40

I:

.m

U)

Li-

E

0

0

0

0C}

O .-

0).

o

.

,,

0L

(n U

Yl

I

-

L.

C-1

.

L-%R

ul

0

IiUU

pq

r~~~~~~~~

I

E

> Q) n

-

ii

45

zZ

Z Oc

(3

c

)C.-I<

> ) n4 E

c

1-4

oo

C

>-

0

--

C

T

o

o

'Z

.l

t

4-

a-

/

I

%

JI

I

c

.2

0o

-

*

-

N

v0

U

l

c

o, - U u..-c

-

*0

u a

L

.

C

E

I

- 0 C)

I

!

/

X

-o0

E

UL)

0 (9

0

ti

uJ

11

of,

D

0,

0

LU

0

-J

r-

0

rD

cx:

LU

N

JL

z

Z

w

LU

a)

LU

7

tO oU

U

LU

O

0

I

O

H

-C,

-O

LU

LU

-c

00

LL

I

I

I

0

0

I

0n

V

O

g

. 2

C) =

vEa

, _C zo

C(

C

t

L

27

(1)

many non-economic variables such as water usage

and S02 emissions

are included

in the framework

and

(2)

new technologies

The non-economic

variables

These

can be incorporated

quantities

and are summarized

are the outputs

proportional

variable)

of the model.

They are assumed

of SO 2

by the 1980 economy

to be

For example,

(or any other accessary

er dollar

ek is the SO 2 emitted

of the k-th industry.

then the total S02 emissions

1.4.

and let E = [ekl be the vector

for S02 emissions

In other words,

to as accessory

half of Fiqure

to total output of each sector.

of coefficients

output

are referred

in the bottom

let S be the total emissions

in it.

of total output.

er dollar

If X is the total output

S is the inner product

of

vector,

of X and

E or

S =

ET

X =

TE

(1.9)

Similar relationships hold for the other accessory

variables.

The boxes

in the upper half of Fioure

1.4 represent

the various means of interacting with the model. These boxes

are used to specify the alternative future being investigated.

This scenario

sition of GNP.

A final

conditions

can include

changes

in technology

and in compo-

Limited price changes can also be handled.

demand

vector is constructed

of the scenario

to represent

and the technological

the

and capital

coefficients modified to include the amount and kind of new

technology

that is specified.

the total outputs

(I - A)

1

Y.

Once these changes

(X) are calculated

The values

are made,

in the usual way: X =

of the accessory

variables

are then

obtained by simple multiplication as indicated above.

The sectors

i/ed

at

enrido

the

components

actually

his cnapter

of final demand

to provide

were chosen

used in the research

in Fiuure

in Figure

1.13.

.

are

: ;id

a

wnm~.th-

The sectors

at least the 83 order BEA aqqregation

scheme with further breakdown of major energy supplying,

energy consuming, or polluting industries.

1.2.4

Derivation of

The derivation

for a new technology

ew Technology Representations

of technological and capital coefficients

begins with

the engineering

cost study.

While coefficients derived from an engineering study of an

actual operating commercial plant are quite accurate, those

derived from a pilot plant study are subject to some uncertainty because of potential problems associated with scaling

up plant size.

Coefficients

based on costs projected

from

laboratory scale models may be quite uncertain, especially

with

to total capital

respect

Attempting

to derive

yet been proven

coefficients

feasible

lead to nonsense.

cost of buildina

for a process

in the laboratory

such a plant.

that has not

(e.g. fusion) can

There are many "cost" studies of Processes

that have never been made to work.

In addition, economic

impact projections based on laboratory feasibility studies

are unrealistic

because

of the long development

eriods

For example after

two decades, reactors still product only 1% of total ele ctric

power.

The technologies studied here fall between the 1 aborainvolved (especially in the energy field).

about

the actual numbers but sensitivity analysis can usually handle

tory and pilot

this problem.

plant

stage so there is some uncertainty

-

Another significant characteristic of new technology

engineering

studies

is that the costs are calculated

certain estimation schemes.

using

These estimates detail major cost

29

i tems

fuel or reactor

i ke

costs like overhead

cost items

vessels

or piping

and then calculate

as percentages

The result is that the larger

capital co efficients

are more accurate

While

this is a disadvantage

is an

adva

other

of the major

technical

and

than the smaller one!S.

of the overall

coefficients

it

ntage when calculating economic impacts because

the larger impacts are caused by the larger coefficients.

The technological coefficients are derived from the

engineering studies by assigning all projected operating

costs

(purchased

material

and labor) to the I/O sectors

that produced the commodity.

by the total yearly

the dollar

These figures were divided

output of the proposed

flows into new technology

plant

coefficients

to convert

7

A similar

procedure was followed for deriving the capital coefficients

from the construction cost estimates.

There were a few problems of classifi cation (i.e.

which sector produced a certain item like p iping), but these

were solved by adopting certain conventions

These conventions

will be discussed

later.

The new technologies were incorporated

framework

using

the following

s cheme.

Suppose

nological process for sector i (e.g. natural

is represented

by the technical

coefficient

capital coefficient vector C 8.

Since

I/O tables

Next

into the I/O

the old tech-

gas production)

vector

Ai and

let the new technological

are in terms of producer

costs,

trans-

portation and trade markups must be removed from the engineering estimates before converting to coefficients.

8

Thus the whole technological coefficient matrix could be

represented

A similar

as the partitioned

partition

holds

matrix

A =[q1

for the capital

: A2 ·

coefficient

An]

matrix.

3n

process

(e.g. high BTU coal gasification)

If the new technology

is expected

be AN and Cr.

to take over a fraction

g of the total production

of sector i and a fraction

ital investment

i then the new technical

by sector

h of total cap-

coefficients

are

A

= (1-g) A

where

Ar

+

g = fraction

(1.10)

of total production

supplied

by new

technology and the new technical coefficients

are

C'

=

where

(1-h)

C

+

h

h = fraction

C

(1.11)

of total investment

made up of new

technology

These coefficient column vectors then replace the old

ones in the technical

1.3

Summary

1.3.1

and capital

coefficient

matrices.

of Results

Impacts

of Capital Spending

for New Energy

Technologies

The new technologies investigated are

(1)

High Btu coal gasification

(the Institute

of Gas

Technology electrothermal Hyoas process)

(2)

Low Btu coal gasification

(the 1980 Texaco partial

oxidation process with hot carbonate scrubbing)

and

(3)

Gas turbine

topping

cycle or combined

gas and

steam cycle electric generation plant (the 1980

United Aircraft high temperature gas turbine and

waste heat boiler steam cycle). This last technology will

be referred

to as a COGAS plant.

31

The salient

summarized

characteristics

in Figure

the new technology

1.5.

of these processes

In this and subsequent

impacts will be compared

steam electric generation plant.

are

sections

to that of a nuclear

Nuclear plants were chosen

for comparison because they represent a current new technology

that is unlikely

to change much by 1985.

readers will be familiar

and the projected

In addition,

with its capital

high growth

of nuclear

intensive

most

nature

Dower in the next

fifteen years.

This section summarizes the economic impact of capital

expenditures

will

for these new technologies.

look at impacts

The next two sections

from actual operation

of the new plants

and at price changes caused by higher priced energy.

It is only meaningful

the same output

as the nominal

capacity,

size.

to compare plants

so five trillion

This corresponds

form of energy,

five trillion

low Btu gas).

Btu/day

Consequently

10 high

Since electricity

is

40,000 MW was chosen as the appro-

priate comparison size because 40,000 M

requires

BTIU/day was selected

to approximately

Btu gas plants or 40 low Btu gas plants.

a secondary

of approximately

of COGAS plants

input energy

40,000 M

(in the form of

was also used as the

comparison size for nuclear plants.

The economic

First

the capital

impacts were calculated

coefficients

in a two step process.

of each new technology

and the

plant comparison sizes (converted to dollars) were multiplied

to obtain a vector

each new process,

(N) representing

broken

chases will be made.

the total investment

down by sectors

Second,

from which the

the investment

vector

in

ur-

(N) for some

particular technology was multiplied by the 1980 inverse coefficients

to obtain

new technology's

the vector

investment,

Xr

(I-

of total outputs

(X) caused by that

i.e.

A)

-1

N

(1.12

32

New Technoloqies Investiqated

High BTU Coal Gasification (1000 PTU/SCF)

Process:

Electrothermal

(Hyqas)

Data Source:

Electrothermal HIyga

s Process Escalated

Institute

Hydrogasi fi cation

Costs [421

of Gas Technology

Originator:

Efficiency:

71.7,7

Nominal Plant Size: 500 Million SCF/day (90%31oad factor)

Plant - $310-354 mllion

Nominal Cost:

Ptu

Gas -54.8-72.4¢/10

Low BTU Coal Gasification

(173 BTUI/SCF)

Partial Oxidation

(Hot Carbonate Scrubbing)

Process:

1980 Texaco

Data Source:

Technoloqical and Economi c Feasibility

381

of APdvanced Power Cycles

United Aircraft

Originator:

Efficiency:

87%

Nominal Plant Size: P42 million SCF'day i704 load factor)

Plant -27.5 million

Nominal Cost:

Gas - 17.6¢/lo0Btu

Gas Turbine Topping Cvcle (Combined Gas and Steam Cycle or

COGA

)

Process:

1980 High Inlet Temperature

(28000 F)

Turbine with Waste Heat Boiler Steam

Cycle

Originator:

Efficiency:

tu Gas)

54.5%1

1000M!.I(70% load factor)

r:ominal Plant Size:

Nominal Cost:

F

1

(Usinq Low

Technoloqical and Fconomic Feasibility

of Advanced Power Cycles [381

United Aircraft

Data Source:

I

Plant - 94 million

Electricity - 5.3 mills/kwhr

G

U

R

E

1.5

Overall efficiency

Only the efficiency of the COGAS cycle.

the two efficiencies.

by multiplying

is obtained

2

3

Includes working capital.

All dollar

figures

are in 1970 dollars.

total outputs

These

ment in each technology.

impacted

by

(I-A)

1

Low

i.e.

or impacts

This latter impact

y

output

ment-related

9

investment

the outputs

1980 investment,

XI

1980

total

projected

if

caused by it are

X

to as invest-

is referred

economic

has the smallest

small investment

of the comparatively

utilizations

of

the

can take advantage

Thus to calculate

gasification,

COGAS plant

low

BTU

gas

is

in

the

this gas

10

, it must

One of the best

point.

near its manufacturing

required

Because

coal into a low grade gas.

cannot be shipped long distances very economically

be consumed

primar-

This happens

impact of any of the new technologies.

for processing

total

the

yI is

in the figure.

TU coal gasification

ily because

to the projected

and to the impact caused

of that industry

1980 total output

invest-

the maior

Figure 1.6 compares

of each new technology

industries

of

impacts

are the economic

COGAS

which

plant

of its high volume, high temperature

the probable

the two columns

should be added.

total impact

of low

flow.

TUl coal

in Figure 1.6 for it and the

The resulting

numbers

are much

closer to those for the other two technologies.

The impacts of total investment are included because most

sectors produce several kinds of products, only a few of which

and

are capital investment goods, e.g. both turboqenerators

outboard motor remote controls are made by the same sector.

Since these products often cannot be disaggrenated and since

they are usually manufactured on different machines, a better

measure of the total output of capital goods (productive capacity) is the output sold directly or indirectly to the investHence both total output and

ment component of final demand.

output are included in Finure 1.6.

investment-related

10

It is

uneconomical

to ship

for

two

reasons:

(1)

a given

diameter pipeline has only one-fifth the energy carrying capacity of natural gas (10OOBtu/SCF) when used with low tu gas

(179Btu/SCF); (2) a significant percentage of the total energy

content of low Btu gas is in the form of heat which would be

lost

in a pipeline.

^

_

_ __

_____

C)

_2

A-

,.

iS-

,

0

0

·

C\jI

E 4

I

-

C

LA

113

0

s..-

.) c(

cl

c

a0

-I

0 Ž

z ah

I

,

i

V)

cE

CZ

OD

II

!

0C

0

<-

I

4I

,

I)

.1

I,

C3~~~~~~~~~

1

I

-

_

-

C

..

C

c

:,Ž(-.

m.610

-

Cz_

!

II

01

0o

-

.

41

-

4-)

C

C,~

0c\c

-

co

L

0

0

0Ž

h -

-cl

I

v

I

'

41

cC0r-

l

0E

CŽ

"Ž1-r

cn

'I

i

CI

ICt

L)

II

C-)

.:

czŽ

L

C)C)4)

0Ž

C,

to-C

Co-

C> )CL'

>

0 - )Ol:

00

Or

I

0

I

ro o

t)

rI

r..

-1

reT

Ct C

ll

i

E 4i =

Uj

"o

i

0

a

LC

=3

C

0

C)

C:

,C

4-

4-

SF-

0oi

C)

,.a0)

3

--

Z

0C

.1

0Ž_

0r

20c

C

U

LLI 4

C')(1 h

Io

'Il

Ie ----

c0

-

1

)

-

LA

'i-

!-

Ol

-

.?

I

c')

LA

Lij

L

t-C.

4-)

-

1

C3s-- 4

4

1n~

*1

a

!

1

I

3 *

tT~44-

0

rC-

0Ž

Co I

cal

cn

c3

". : x'.

,--.~

0ŽC'-)

U-,

Z5

<31

OTH

0Ž -

D

c.

.

I

z -I

rj

C

-C

.

'

G

in

i

(I

N-

-

I-

O

~r

-

I

I -

U3D

kz

0.-4

Ln A e

-I5- *

0

-3

IJ

.

\

*U

L)

04- i

C)

U

>-

CŽ

,

c

U-

v

(--

rI

*I

0

4C

-I

Ln

ICN-

C Z

C", vD

C

II

Cj

l

C\i

v

>-

C

L

U,

1

IZ

r

.4t a)

C:)

4 C)

-C 0

0,

0~.

CC

4-)

4-C)-i

4'-'

a

CO

_-

IF-

CD

CJ I

.'

) Cij

L)

-

I

Or-!

'C3

C

cr)

C\j

1.0

C

1k0

I

-

-

0Ž

mn

I

0

0

-

C

S- c

- 70

.3

c oŽ-

,

.- - l0)

c'

n

oa

mi__

,-0a'

0

U-

-:

0

00

-,

4C0

4-

-i

0l-

U,C)

,'

-;l

0 ._4

O

-I.J

*x5 )=

U,

1,

(L)

- 10

1

to c

I

O

I)

4

~&(A )

1

c"

c

4-

QIQ r 0

a)

V)

-V)

C

C- u >, r_

o ,*C ) . EI Q a)

E

*,

'2 C :.

i_

L

0

-lw-

.F-

(L

r)

E

C cr

l

,I

V)

-

C D- 01 a

i

aI

*-.1

o o. o")

Vc

I

o- I

NV

(

)

:

(U

35

The numbers

in Fioure 1.6 represent the mini-

presented

mum probable impact of these technoloqies because they do not

take into account any expansion of the transportation

(pipe-

lines), distribution, Ior administration

Nor do they include the effects of increased manufac-

lines or transmission

systems.

turing capaci ty required

technologies.

indicated

to supply

the equiDiment for the new

This investment would be over and above that

in Figure

1.6.

the boiler-makers

In particular,

and turbogene rator manufacturers would have to expand siqnificantly

from their

demands.

How much

1980 levels

they would

to meet

actually

upon whether the new technolony

placement

of old technology

the niew technoloqy

have to expand depends

represents

or new markets.

discussed further in the section

e volution

and re-

This will be

on the integrated

1985 pro-

jecti ons.

1.3.2

Impacts of Operating

the New Technologies

Opera ting impacts were calculated

for the three new

techno!

logies , and nuclear plants were again used as the reference

The three new technologies were:

(1)

high Btu coal gasification

(2)

low Btu coal gasification

(3)

combined

and

COGAS and low Btu goal gasification

plant.

This last combination was chosen because it represents

the most likely utilization of both processes.

Impacts

are again

defined

as the industrial

outputs

required to support the direct and indirect requirements of

five trillion Btu/day operation of each new technology.

Figure

1.7 summarizes

the projected

the major impacts

1980 total output

As would

be expected

the coal mining industry.

largest other

and compares

them to

of each sector.

the most significant impact

What may be surprising

impact of the two new technologies

is on

is that the

i s less than

36

F I G U R

MAJOR

INDUSTRIAL

1.7

OUTPUTS

REQUIRED

TO SUPPORT

5 TRILLION BTU/PAY2 OPERATION OF

EACH NEW TECHNOLOGY3

Projected

Total 1980

Outputs

Sector

Coal Mining

Low Btu

Coal

Hi h Btu

Coal

N!uclear

COGAS

Gasi ficat i on Gas ification

Steam

Generation

4329

321

374

386

9

34030

16

13

18

985

35137

33

33

136

193

7798

13

13

14

2

3839

25

1

2

5

Sanitary

Services

6928

20

9

15

6

Mineral

Mininq

2205

1

1

Industrial

Chemicals

(Nuclear Fuel

Reprocessing)

Maintenance

Repair Construction

Construction &

Mining Equipment (conveyors

& grinders)

Stone & Clay

Mining

Water &

1

36

11 Outputs in millions of 1958 dollars, calculated

All

x N: (I-A) 1

YN where

YN is the vector

of energy

from

purchases.

25 trillion

Btu/day

is the equivalent

of 10 500 million SCF/day

high Btu gas plants or 10 100,000 bbl/day oil refineries

or 40

1000 M

3

See

electric generation

Figure

1.5 for

plants.

definitions

of processes.

37

1% of the total outputs of the affected industry

tries not shown in the figure,

Obvi ous ly COGAS electricity

are relati

i solated

vely

For indus-

the impacts were even

generation

less.

and coal gasification

sectors of the economy.

influence arises from their huge investment

described in the last section.

Their major

requ irements

as

For nuclear generation, the major affected industry is

nuclear fuel reprocessing, which resides in the Industrial

Chemicals

R:ector (BEA 27.01).

The fact that nuclear

fuel

reprocessing must be treated like the typical Industrial

Chemical product causes a problem because it has considerably

different input requirements from the typical industrial chemical.

However,

industry,

sector,

it could not be broken

since

out as a separate

it had to be as signed to the Industrial Chemical

and treated

as a typical

chemical.

It could not be

broken out because it is not a standard sub-industry and

separate technical coefficients for it are not available.

This assignment

results

i n such obvious

anomalies

as nuclear

steam generation having a large impact on mineral mining.

While part of this impact represents leaitimate purchases of

uranium

ore, most of thes e purchases

are the result of treating

nuclear fuel reprocessinq like a typical industrial

This illustrates

the need for care in interpreting

chemical.

the results

of an I/O simulation.

1.3.3

Price Changes

It is quite

easy

change, e.g. doubling

in

the

economy

if it

to

calculate how some particular price

the price of oil, will affect other prices

is

as sumed

passed onto the customer.

that such price changes

This theory was derived

are

in section

competitive situation, e.q. between

plastics, fiberglass, and aluminium. such price increases may

1.2.

However,

in a highly

38

be absorbed

there

because

of fear of losing market

share.

Also

is no data on the time it takes such price changes

propagate

through

the economy,

to assume

the changes will be complete

to

so the best that can be done is

within

two or three

years.

The most important criticism of possible price change

calculations

is that there is no data indicating

how any sectors

other than Households (personal consumption expenditures)

respond to such price changes. 11 Without this information

the price change calculation is almost useless.

ation

that would

be required

of the long term effects

matrix

for each sector

for a complete

The inform-

characterization

of any price chances would be a

that described

coefficients

for that sector would

in the price

of any commodity

how the technological

be modified

by a change

(both elasticities

and cross-

elasticities would be needed for each sector for each product

and between

products).

This is an impossible

task but, if

the more restrictive question of how industries would respond

to fuel price

derived

changes

(assuming

is asked,

then some answers could be

that the data is available).

It should

be

possible to obtain elasticities and cross-elasticities for

fuels

for each sector

that would

allow one to predict

how the

technological coefficient would change with different fuel

pri ces.

Since

total fuel costs make up only a few percent

of the

selling price of the average good sales of most products other

than fuels would

prices.

be only slightly

affected

by changes

in fuel

Those few sectors, like basic metals and perhaps

plastics, that are fuel price sensitive could be investigated

A Cornell Study [ 81 does have time responses and an

industrial price elasticity for fuel price changes but the

aggregation level (i.e. all industries lumped together) is

too great for their results to be useful in this study.

39

further.

This procedure would result in an adequate repres-

entation of industrial fuel-price elastic effects.

ately

Unfortun-

this data is not now available.

However, because Households consume large

oil, gas, and electricity,

it is useful

q uantities

of

to calcul ate how these

purchases might change with fuel price inc reases.

Therefore

the price changes resulting from doubling the value addedl2

of each of the fou r energy sectors was calculated. Next,

using the Universi ty of Maryland's

icities

fo)r Househ old purchases

2 1 long term price elast-

of these energy

sectors,

the

long term declines in Household consumption were calculated.

Figure

1.8 summari zes these results.

NIote that each rov in

the figure was cal culated separately from all others.

long term price

discussion

4,

el asticities

8,

12,

they indicate

are important

how effective

curtailing growth in energy demand.

becomes

available,

of much

34]

These elasticities

because

are still the subject

The

for poli cy purposes

price uses are for

When bette r data

this type of research

may he more fruit-

ful.

1.3.3

1985 Projections

The final exercise

projected

a series

of five alternative

1985 futures involving various energy use growth rates, both

with

and without

new technologies.

as the Low, Medium,

plus Gas Turbine

12

Value

High, High plus Hygas,

futures,

Added

taxes, and profits

cedure of doubling

These will be referred

is

to

and Hiih plus Hyqas

and are defined below.

defined

as

the

labor, depreciation, business

The seemingly strange proof each sector.

value added was c hosen because pollution

controls typically affect labor and capital (depreciation)

charges, not material requirements. Thus it makes most sense

to double these quantities and test the price sensitivity

the fuel sectors to this change.

of

40

F

EFFECTS

OF

I

G

U

R

VALUF

DOU:LI'":'

ON PERSONAL

E

1.8

ADDED

CONSUMPTION

Modi

fi

Energy P

Sector

Coal

ReI a tti eee

e

eRelRiv

Ln-eChange

L on q - te rm

Lonter

ice 2

Price

Increase Elasticity

INDUSTRIFS

ErIEPGY

OF FUELS

1 Personal

Lonq-term

in

Personal

_____

Moife

ed

FOP

3

Consumption

of Percentage

Consumption

of Total

Consu4

Consumption

of Fuel

of Fuel

71.3,%

-. 222

-15.8%

Oil

28.9%

-.094

- 2.7%

40.2%

Natural Gas

60.7%

0.0

0.0%

25.4%

Electricity

78/6%

-.214

-16.85

25.9%

Refined

! ..

.

.

2.3%

_~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~,

Each row is associated with a different case that entails

doubling the value added of the indicated industry only.

2 This

number multiplied

by the actual dollar

nrice of the

energy source gives it new dollar price increase.

3 Calculated

using

the I'niversity of

aryland's

long-term

for each fuel.

personal-consumption price-elasticities

4

Indus try (includinq electric uti lities and commercial establishments) and government are th e other consuming sectors

besides households (personal con sumption).

5

If Hal

vorsen 's [22] residential price elasticity (-1.1) is

used, this number becomes -89.4%

qi ves similar results.

The Cornell

renort

8 1

41

used the 1980 technical

All of the projections

coeffi-

cient matrix with some modifications of the energy sectors.

The investment component of final demand was recalculated for

each projection using the 1975 Battelle capital matrix modified

projection

for each alternative

of oil, natural

differed

gas, and electricity

The medium energy

use

final demand

The initial

for the new technologies.

slightly

only in the amount

purchases.

rowth rate future assumes

continuation of the 1970-80 final demand growth patterns

no change

in industrial

The high energy

demand

(than the Medium

tricity

technology

and

from 1980.

use future reflects

future)

a

a 4

for oil, natural

hiaher

final

gas, and elec

and increased industrial consumption (reflected in sli ght

increases

in the energy

matrix).

The se changes assume

and electric

rows of the technical

increased

coefficient

air conditioning

heat, worse gasoline mileage and longer yearly

driving distances.

will not be a supply

All of these projections

limitation

on natural

assume

that there

gas and that the

same domestic to foreign crude and natural gas ratios apply

in 1985 that held in 1980.

The low energy

demand

(than the Medium

use future involved

6% lower final

future) for oil, natural

gas, and

electricity and better conversion efficiency for electricity

conversion and transportation.

assumptions.

Figure 1.9 summarizes these

Two alternative high energy growth futures

were also investigated.

the introduction

The High plus Hyqas future

of high BTU coal gasification

the High plus Hyqas plus Gas Turbine

the gas turbine topping

gasification).

in Figure

1.10.

cycle

future

included

(Hynas) while

included

Hygas and

(supported by low BTU coal

These technology modifications are described

3

42

L

C

r

O

--

>

4L

c'u

,C)

)

. -C

0

*

v,

N> 0t U -6-1

4 4'-.-

C

(0 )

DO

4> >

cr,

c Cc

C

O-D (D

_a).C

U

L

C

r

a) C

L'

L

* C

41

0Uc

re

O 4

c-

4 C--

OC)

E

CC3

L L

.-

O V1

l

'O

0C

a1

U

a)

L

· r UD

CI c- C,

I

-

>

0

F: 4.

C) E

cc

aD

a)

C

C

C

4J^

C4 4-

a)

L

o

a)

L

a)

1

41

A'

c

O

E

*,

C)

vi

U

E

.r

LC)

·.

W

L

O

4,

o

C L

.

44-

.

E

J

G'L

:--u-- "CLC4C

4U

X"

,-C

S-

r.

4D

o

a

>

·

4-

3

C

C

a