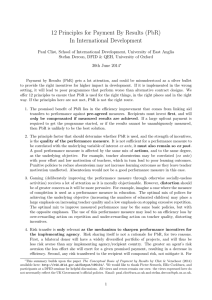

The Conceptual Basis of Payment by Results

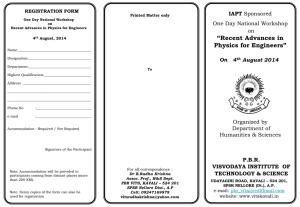

advertisement