Using the Implicit Function Theorem 1 The Theorem

advertisement

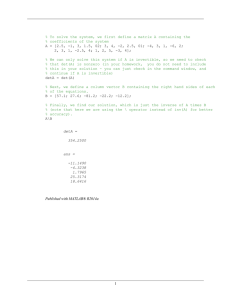

Using the Implicit Function Theorem 1 The Theorem n m m ~ Suppose F : R → R is a differentiable function, and let k ∈ R . Suppose a1 .. ~a = . ∈ Rn is a solution to F (~x) = ~k. Write JFI for the matrix formed an from the first n−m columns of the Jacobian JF , and JFD for the matrix formed from the last m columns of JF . If the m × m matrix JFD (~a) is invertible, then a1 n−m there is an open set U ⊂ R containing ~b = ... and a function an−m f : U → Rm so that an−m+1 ~x .. ~ f (b) = . and F = ~k for ~x ∈ U . f (~x) am The Jacobian of f is −1 ~x ~x D I Jf (~x) = − JF JF f (~x) f (~x) In particular, Jf (~b) = −(JFD (~a))−1 JFI (~a). 1 for ~x ∈ U . 2 Two Examples First Example. Let F : R4 → R be given by F (~x) = x1 x2 − x3 x4 , and consider the solution 1 2 ~a = −1 5 to the equation F (~x) = 7. Can we regard x4 as a function of x1 , x2 , x3 near this point? In this case JFD is the scalar ∂F = −x3 , ∂x4 so JFD (~a) = 1 and indeed x4 is an implicit function of x1 , x2 , x3 near ~a. The Jacobian of x4 = f (x1 , x2 , x3 ) is ∂x4 ∂x4 ∂x4 1 x x −x = 2 1 4 ∂x1 ∂x2 ∂x3 x3 near this point; in particular, at ~a it is −2 −1 5 . Second Example. Let G : R3 → R2 be given by 2 x 2 x + xyz + y G y = , x2 + y 2 − z 2 z 0 1 and consider the solution ~a = 1 to the equation G(~x) = . Are y, z −3 2 functions of x near ~a? Here 2x + yz xz + 2y xy xz + 2y xy D JG = and JG = 2x 2y −2z 2y −2z so that JGD (~a) 2 0 = . 2 −4 This matrix has determinant −8, and so is invertible. Thus y, z indeed are functions of x near ~a, and their derivatives at x = 0 are −1 1 dy −2 0 2 2 0 −1 I dx = − JG (~a) = = . 1 1 dz 2 −4 −4 4 0 − 21 dx 2 Hence if x increases by 0.2, then y must decrease by about 0.2 and z must decrease by about 0.1. 3 An Economic Model What follows is an economic model known as the “IS-LM” model; it was developed in 1936 by John R. Hicks to represent ideas of John Maynard Keynes. Let Y be the national income, C national consumption, I national investment, G government expenditure, M the demand for money, M s the money supply, T taxation, r the interest rate. We assume that C = f (Y −T ), I = I(r) and M = M (Y, r) where 0 < f 0 (x) < 1 (1) (an increase in the excess of income over tax increases consumption); I 0 (r) < 0 (2) (an increase in the interest rate decreases investment); and ∂M ∂M > 0, <0 (3) ∂Y ∂r (monetary demand increases with higher income and decreases with higher interest). In addition, it is assumed that Y = C + I + G and M s = M (4) (income is the sum of consumption, investment and government expenditure, and the money supply equals the demand for money). Thus, if we define G M s Y − C − I − G F , T = M − Ms Y r 0 then we are looking for solutions of F = . Now we ask whether Y, r are 0 functions of G, M s , T subject to the conditions (4). The Jacobian of F is −1 0 f 0 (Y − T ) 1 − f 0 (Y − T ) −I 0 (r) JF = ∂M ∂M 0 −1 0 ∂Y ∂r 3 so JFD = 1 − f 0 (Y − T ) −I 0 (r) ∂M ∂Y ∂M ∂r with determinant det JFD = (1 − f 0 (Y − T )) ∂M ∂M + I 0 (r) . ∂r ∂Y Then the assumptions (1,2,3) imply that both terms are negative, so det JFD 6= 0. So Y, r can be thought of as functions of G, M s , T , and ∂Y ∂Y ∂Y ∂M −1 −1 0 f 0 (Y − T ) I 0 (r) ∂G ∂M s ∂T ∂r = ∂r ∂r ∂r 0 −1 0 1 − f 0 (Y − T ) det JFD − ∂M ∂G ∂M s ∂T ∂Y ∂M ∂M 0 −1 − ∂r −I 0 (r) f (Y − T ) ∂r = . ∂M 0 ∂M 0 D (Y − T ) − 1 − f f (Y − T ) det JF ∂Y ∂Y Thus, for example, ∂Y ∂M = −P > 0, ∂G ∂r where P is the positive quantity det−1J D . F 4 Exercises x1 −2x21 x2 + x3 + x24 x2 4 2 . For each 1. Let H : R → R be defined by H = x1 x3 x4 − x2 x3 x4 of the following points ~a, determine whether x3 , x4 subject to the condition ∂x3 ∂x3 1 ∂x1 ∂x2 H(~x) = are functions of x1 , x2 near ~a. If they are, find ∂x4 ∂x at ~a. 4 0 ∂x1 ∂x2 1 2 a. ~a = 1 2 1 0 b. ~a = 1 0 1 0 c. ~a = 0 1 2. In the IS-LM model above, what can you say about 4 0 0 d. ~a = 0 . −1 ∂Y ∂M s and ∂Y ∂T ?