Document 11164274

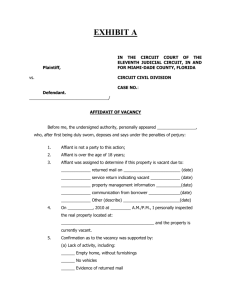

advertisement