9080 02617 6898 3 MIT LIBRARIES ,.;.:

advertisement

MIT LIBRARIES

3 9080 02617 6898

Bf. ,.;.:

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/threestrikesyourOOcaba

;l

W^

OH"

Massachusetts Institute of Technology

Department of Economics

Working Paper Series

Three Strikes and You're Out:

Reply to Cooper & Willis

Ricardo

J.

Caballero

Eduardo M.R.A. Engel

Working Paper 04-10

March 2004

Room

E52-251

50 Memorial Drive

Cambridge,

This

MA 02142

paper can be downloaded without charge from the

Paper Collection at

Social Science Research Network

http://ssm.com/abstract=5 2602

1

iMASSACHUSETTS INSTITUTE

C'i^ TECHNOLOGY

1

MAR

1

1

200^

Three Strikes and You're Out:

Reply

By Ricardo

J.

to

Cooper and Willis

Caballero and Eduardo M.R.A. EngeP

March, 2004

Abstract

Cooper and Willis (2003)

is

the latest in a sequence of criticisms of our methodology for

estimating aggregate nonlinearities

when microeconomic adjustment

based on "reproducing" our main findings using

artificial

microeconomic agents face quadratic adjustment

costs.

sults

lumpy. Their case

That

Their mistakes range from misinterpreting their

is

data generated by a model where

is,

they supposedly find our re-

where they should not be found. The three claims on which they base

incorrect.

to

is

own

their case are

simulation results to failing

understand the context in which our procedures should be applied. They also claim that

our approach assumes that employment decisions depend on the gap between the target and

current level of

unemployment. This

is

incorrect as well, since the 'gap approach' has been

derived formally from at least as sophisticated microeconomic models as the one they present.

On

a

more

positive note, the correct interpretation of

Cooper and

Willis's results

shows

our procedures are surprisingly robust to significant departures from the assumptions

that

made

in

our original derivations.

JEL Codes:

Keywords:

C22, C43, D2, E2, E5.

Adjustment hazard, aggregate nonlinearities, lumpy adjustment, observed and

unobserved gaps, quadratic adjustment.

*Caballero: Department of Economics, Massachusetts Institute of Teclmology, 50

MA

Memorial Drive, Cambridge,

02142, and National Bureau of Economic Research (e-mail: caball@MIT.EDU); Engel: Department of Eco-

nomics, Yale University, P.O.Box 208268,

mail: eduardo.engel@yale.edu).

New

Haven,

CT

06520, and National Bureau of Economic Research

(e-

Summary

1

of the case

Cooper and Willis (2003), henceforth CW,

is

Labor Adjustment: Mind the Gap." In

comment

this

"The Economics of

the third version of the authors'

CW argue that our finding (in Caballero and

Engel (1993), henceforth CE, and Caballero, Engel and Haltiwanger (1997), henceforth

lumpy microeconomic adjustment matters

They base

their case

for aggregate

on "reproducing" our main findings using

where microeconomic agents face quadratic adjustment

we show

In this reply

that the three claims

mistakes range from misinterpreting their

own

on which they base

is,

model

they supposedly find our

employment decisions depend on the gap between

is

the target

incorrect as well, since the 'gap approach' has

phisticated

CW's

results

partures from the assumptions

CE

Throughout,

microeconomic

distribution of

and

CEH

shows

made

and current

On

more

a

microeconomic gaps are

CE and CEH

=

(first

other studies that at the

is:

'kMi^^+yMi^\

(1)

Ad^'^ is

and desired employment

the equation above simplifies to a linear

on aggregates

at least as so-

explaining aggregate employment fluctuations.

the cross section distribution of gaps between actual

variable depends only

of unemployment.

positive note, the correct

many

represents the rate of growth of aggregate employment, and

0,

level

and examine whether the implied features of the

usefiil in

A£',

and y =

approach assumes that

in our original derivations.

level adjustments are lumpy,*

When A, >

Their

that our procedures are surprisingly robust to significant de-

take as an assumption validated in

Specifically, the basic regression in

AE

that our

been derived formally from

microeconomic models as the one they present.

interpretation of

their case are incorrect.

simulation results to failing to understand the con-

which our procedures should be applied. They also claim

text in

where

That

not warranted.

data generated by a

artificial

costs.

is

where they should not be found.

results

This

employment dynamics,

CEH) that

moments of the

the i-th

moment of

at the firm level.

model where the

left

hand

side

cross section distribution of gaps). This

case can be obtained either from a microeconomic model where agents adjust infrequently but with

a probability that

is

independent of their gap (the constant hazard model of Calvo, 1983) or from a

model where agents face quadratic adjustment

When Y >

'CW

0,

in favor

and adjust

all

the time (Sargent, 1978).^

on the other hand, higher moments of the cross-section

(2003) seem to agree with

evidence"

costs

this

assumption,

in particular, in their

distribution of gaps matter

conclusion they refer to "overwhelming

of it.

"See Rotemberg (1987) for a formal proof of the aggregate equivalence of Calvo 's lumpy adjustment model and

the quadratic adjustment cost model.

1

from a scenario where microeconomic adjust-

for aggregate dynamics.^ This case can be obtained

ment is lumpy and the probabiUty of such adjustment is increasing

model of CE). There

it

is

ample microeconomic evidence

matters for aggregate adjustment.

very significant y

>

and a

We

find that

it

in the

gap (the increasing hazard

for this behavior, the question is

whether

does, since our aggregate regressions

large contribution of yvW/

to aggregate

CW's critique has changed over time, but as of today,

it

can be

employment

show

a

fluctuations.

claims, all of them

split into three

based on applying our procedures to data generated with a model with smooth microeconomic

adjustment:

When our measure

• Claim 1:

of microeconomic gaps are computed from

there exist parameter configurations for

there

the

•

is

Claim

which estimates of y are similar to

no microeconomic lumpiness or

common denominator in

nonlinearities. This has

microeconomic

been

ours, even

their

though

main claim, and

CW (2001, 2002, 2003).

When the microeconomic gaps

2:

their artificial data,

are not directly observed but can be estimated with

used in

data, the procedures

CEH

give nonsensical results

when

applied to

their data.

When

• Claim 3:

only aggregate data are used, coupled with the Kolmogorov equations

quired to keep track of the simulated cross section distribution of gaps, as in CE, our

mates can be found even when their

Not only

are these claims incorrect, as

we will

argue below, but they also reflect a fundamental

We developed a methodology to study whether lumpy

microeconomic adjustment has aggregate implications, not

In section

incorrect.

microeconomic adjustments

II

we show

In section III

that

we

should not be used

if

to infer

from aggregate data whether

are lumpy.

due to a basic interpretation error of

their

argue that since the identification strategy

gaps with microeconomic data

is

built

on the observation

that

own

we

results,

Claim

1

is

adopt for estimating

microeconomic data are lumpy,

microeconomic data are not lumpy. Therefore Claim 2

Furthermore, the fact that

esti-

(linear) data are used.

misunderstanding of the point of our papers.

the underlying

re-

is

it

not surprising.

CW find nonsensical results while we find meaningful and statistically

significant results, indicates that our findings

do not

arise

when microeconomic adjustments

are

smooth.

^The higher moment

it

is

that matters in specification (1)

simple and shows up often both

in

our

work and

in

is

the third

CW's

moment.

critique.

We

focus on this specification because

Yet there are other specifications

our work that involve higher moments different from the third moment, which explains

'higher moments'.

why we

in their

and

generically refer to

IV we show

In section

that

Claim 3 has nothing

to

nomic adjustment. Their finding comes from relaxing

do with lumpy

to

what we found with

to

Somewhat

to departures

paradoxically, the

non-lumpy microeoco-

an extreme the maintained assumption of

our analysis that the driving forces are random walks."* This result

comparable

vs.

is

neither

new nor quantitatively

actual data.

CW

work of

can be used to show that our approach

from the random walk assumption. In

is

robust

nothing can be found with the serial

fact,

CW (2002), and (almost) nothing with the low serial correlation of 0.47

CW (2003) dropped further to 0.28, and even then the gain in R^ from

correlation of 0.81 used in

assumed

in

CW (2001).

adding higher moments

it

is

substantially less than half of what

we

found. Section

V concludes.

Their main critique

2

In the

main part of their critique,

CW compute from their artificial data the cross-sectional moments

of static gaps and esfimate an equation analogous to

(1):

A£P^ = ;iywJ')'^^ + YyW;^)-^^,

where A£'^^ and

M^')'*^^ stand for the rate

(2)

of growth of aggregate employment and the

/th

moment

of the cross section distribution of static gaps respectively, when the underlying data are generated

with

CW's

quadratic adjustment cost model.

Their main finding

ent from the one

is

that they estimate a positive

and

statistically significant y,

we find using actual data. Cooper and Willis then argue that this is evidence that a

researcher testing for aggregate nonlinearities on their data

are important for aggregate dynamics.

our results

may

not very differ-

It

would conclude, erroneously,

follows, they argue, that our

methodology

is

that these

flawed and

well be due to misspecification error.

However, finding similar values of y does not mean that a researcher will conclude that the

nonlinear term

to also look at

cases.

It

is

equally important for aggregate dynamics in the two cases. For

whether the regressor that

turns out that

much smaller

it

is

one needs

multiplied by y has similar variability in the two

does not: The variability of M^^^ in

than that of the corresponding

this,

moment when

CW's

quadratic adjustment

model

is

micro-adjustments are lumpy. Thus,

''in our derivations, and as is standard in much of the (5,5)-literature, we assumed that the driving forces follow a

random walk, an assumption that cannot be easily rejected in the data. In this case, one can show that the static gap (the

difference between cuiTent employment and the optimal level of employment if there are no adjustment costs) is equal

gap (the difference between current employment and the optimal level of employment if adjustment

removed only today) plus a constant that depends on the drift. This is a very usefiil result since the static gap

to the frictionless

costs are

is

straightforward to calculate while

its

frictionless counterpart involves

more complex dynamic

calculations.

the contribution of yM^^^

simulated data, while

is

it

minuscule in explaining aggregate employment

is

large

and economically

reported values of neither R^ nor

A,

The

first

column

in Table

1

when

table that the R'^ reported

is

and R^

falls

based on Table la in

estimating (2)

is

the

CW

(2003).

the second

By

column of Table

here, the

moment of

y,

even though

statistically

less than

0.013 over the

CEH,

reported in

R^ increases by 0.15 when adding a non-linear parameter

and the variation of the speed of adjustment over the relevant range

as that in

CW's comment,

the third

same with or without

contrast, in the corresponding exercise in Table 3 of

1

put, the

apparent from their

It is

economically irrelevant, as the adjustment speed varies by

relevant range of gaps.^

in

CW's

rises).

gaps: 0.90. Similarly, the estimated value of the non-hnear parameter

significant,^ is

Simply

significant in our findings.

change when adding the nonlinear term

while they change substantially in our setting (k

volatility in

is

more than

ten times as large

CW's model.

The economic

striking in the

irrelevance of the non-linearities estimated

by Cooper and

2002 version of their comment, where they used a more

Willis

is

even more

realistic value for the first

order correlation of productivity shocks (0.81 at an annual level). ^ There they report an I^ of 0.97,

both for the model with and without the non-linear parameter,^ and the adjustment speed implied

by

their non-linear

^The

model

statistical significance

their simulations,

^Where

varies only

by 0.005 over the relevant range of values taken by the gap.

they find possibly reflects the fact that they use time series with 1000 observations in

while CEH's estimates are based on 35 observations.

the 'relevant range'

is

defined as

the cross-section of static gaps, respectively.

^q ± 2<3a, with //q and Oq denoting the mean and standard deviation of

A tedious but straightforward calculation from first principles shows that

_ StgOfi

2

2

with:

Gk

"-^o-^'

where

G=

( 1

A+

p-

p^

— 5)/(l — 5pj, X denotes the speed of adjustment in the partial adjustment representation of the quadratic

adjustment cost model, 5 denotes the discount rate that results

target as a present value of future static targets,

in this

model when calculating

the (con-ect)

dynamic

Og denotes the standard deviation of firm-specific productivity shocks

CW

a is defined on p. 23 in

(2002).

^As we pointed out the en-ors in the first and second versions of CW's

and

critique, they reacted

by looking for a new

parameter configurations and new model specifications that might help their case. Their lack of success, despite two

major revisions of their original comment, possibly

^This

is

for the

reported for R^ are

is

benchmark with high adjustment

1

.00.

the best evidence of the robustness of our findings.

costs.

For the benchmark with low adjustment

costs, both values

Estimating unobserved gaps with microeconomic data

3

The second and

third points of

CW's

critique

stem from the

fact that in practice the

gaps are not

observed and hence neither are the cross-sectional distributions of these gaps. They argue that

our procedures to estimate these gaps and moments introduce

positives

and nonsensical

tion), since

Cooper and

claims 2 and

In

(in this section)

distinction

and

between the procedure

that in Caballero

Willis' specific critique differs

Engel

in Caballero,

and Engel (1993)

(in the

next sec-

between these cases (corresponding

to their

observe the microeconomic data but have no direct observation of the gaps. In

order to construct the microeconomic gaps,

when hours exceed

are

certain

normal

below normal.

we

relies heavily

context, the relationship

The

use information on hours.

level, there is a shortage

idea being that

of labor while the opposite

true

is

one needs to estimate the mapping from the hours-gap

Still,

the employment-gap, and the equation that does this suffers

Our way out

to false

3, respectively).

CEH we

when hours

which can lead

errors

Again, Cooper and Willis are mistaken.

results.

To explain why, we begin by making a

and Haltiwanger (1997)

new

on our observation

that

from

to

classic simultaneity problems.

microeconomic adjustment

is

between hours and employment gaps can be estimated

lumpy. In

if

this

one only uses

observations where large adjustments took place; the basic logic behind this procedure being that

during these episodes the variability of the regressor

regression. Yet if one

and

Willis' data,

knows

that

swamps the

variability

microeconomic data are not lumpy, as

of the error term in that

is

the case with

no sensible researcher would use our procedure. Cooper and Willis make the

mistake of not understanding that the microeconomic estimation procedure in

on the observation

reality,

4

Cooper

that

microeconomic behavior

a fact explicitly acknowledged

is

CEH is

lumpy. Fortunately for us, the

conditional

latter

holds in

by CW.^

Estimating unobserved gaps using only aggregate data

In Caballero and Engel (1993)

cross-sectional

we do

moments from an

not observe microeconomic data and hence generate the

internally consistent model. This

tablished fact that microeconomic adjustment

Kolmogorov/Markov functional equation

sponding to a given

^"[There

Conclusion.

is]

set

is

model

starts

from the well

es-

lumpy, and uses this information to construct the

for the evolution of the cross-section distribution corre-

of parameters. Cooper and Willis apply our procedure to data generated by

ovei-whelming evidence that plant level adjustment

is

nonlinear",

CW (2003),

first

paragraph

in the

adjustment cost model, and find evidence that y in equation (2)

their quadratic

is

when

positive

it

should be zero.

Here

CW

fail

assumed

correlation

we assumed

that the driving forces follow a

the Introduction, in this case the static gap

longer

and

within the {S,s) literature that

is

now depends on

gap

They then drop the

is

if the

equal to the frictionless gap plus a constant.

random walk assumption

The

the state.

serial correlation

step in

first

serial

with a quadratic adjustment cost model.

It is

But

results qualitatively similar to ours.

CW

in

well

gap no

between

static

to rediscover this result."^

is

around 0.28 (we report

to

to generate

microeconomic data

only then that they find, under some circumstances,

new (we

this is neither

random walk assumption

go on

It is

relaxed, the static

is

of the driving forces from one

correlation coefficients at annualized rates) and

departures from the

low

random walk. As mentioned

a sufficient statistic for the probability of adjustment, so that the difference

frictionless

all serial

the very

is

in their driving processes.

In our derivations

known

which

to identify the real reason behind their finding,

and

static

knew

already

frictionless

that for very large

gaps could not be exchanged)

nor quantitatively comparable to our findings.

Paradoxically, the findings in

the serial correlation

is

CW are encouraging for the gap approach, since

dropped to very low

the values of serial correlation used in

levels that things start breaking

CW (2001),

which

we found

CE

it is

only

down. In

when

fact, for

would be no

are already low," there

significant false positive finding.

Table 2 reports the gains in R^ that

the (absolute) gap, versus those that

in

from adding a hazard term increasing

would be obtained from doing the

degrees of serial correlation in the driving processes.'^ Clearly, there

of finding an increasing hazard when there

(i.e.,

assumed random walk.

then the gain in

"'Although they

the difference

fit

was

fail to

none)

CW exercise with different

is

no

risk

if serial correlation is

of false positives

not too far from the

CW had to stretch things a lot to find parameters similar to ours, and even

less than half

of the gain

we

found.

highlight the connection between their sharp departure from the

between both gap measures. Also, beginning

claiming that our approach assumes

CW, 2003)

is

in

tliat

in their abstract,

the optimal policy depends

random walk assumption and

by repeatedly

they mislead their readers

on the gap.

In the final sentence of Section

they finally acknowledge that the "gap approach" can be derived from optimizing behavior

follow a random walk, yet credit a previous version of their

comment

for this well

known

II

(in

when shocks

result (see, for example,

Nickell, 1985).

"The

aimualized serial correlation they use in

driving force

we

RBC

(see, e.g.,

models

'"We

used

replicate

in

Cooley andPrescott, 1995)

CW's

CW

Caballero and Engel (1993)

is

is

(2001)

is

close to 0.50.

above 0.80. Also note

CE

for this

model

procedure and use 1000 observations as they

(0.75).

serial correlation in the actual

used

to calibrate

0.81.

aggregate shock in order to calibrate the R^ of the constant-hazard

in

The

that the standard value

/

did.

We

also add

i.i.d.

quadratic adjustment cost

nonnal noise

model

to

match

to the

the R'-

Final

5

The

first

Remarks

paragraph in the conclusion of

CW

illustrates the

flawed logic of their approach.

concludes that "despite the overwhelming evidence that plant-level adjustment

is

It

nonlinear, the

question of whether this matters for aggregate employment dynamics remains an open issue."

But

if the

goal

is

to

show whether

clearly established microeconomic lumpiness matters at the

aggregate level, then the natural approach

to start fi"om a

is

and determine whether aggregation removes

what our methodology

is

all

when

that satisfy the

little

at all,

we

have made an

wrong, or

irrelevant, or driven

test

is

is

precisely

with simulated data that

whether a procedure designed to

test

false positives

twisted logic at best.

effort to take their claims seriously.

than can be rescued from the sequel of

either

and

start

microeconomic lumpiness condition provides

applied to their counterfactual data. This

In our reply, however,

of micro nonlinearities, which

designed to do. Instead, Cooper and Willis

does not resemble actual microeconomic data

competing hypotheses

traces

model with microeconomic lumpiness

CW's

attempts.

by an extraneous

The

But there

is

very

results they claim to find are

ingredient. Let us recap

what they did and

the conclusions they should have drawn:

1

CW relax both of our maintained assumptions — that microeconomic adjustments are lumpy

and

that driving forces follow a

random walk

lumpy microeconomic adjustment

it

in

first

an extreme fashion. The evidence on

overwhelming, even Cooper and Willis acknowledge

and our assumption of a random walk

at times,

assumption of an annual

2.

is

—

is

definitely closer to reality than their

order correlation as low as 0.28.

Correctly interpreted, their main result implies the exact opposite of their Claim

microeconomic gaps are observed, our methodology does not detect

ities

when

When

the

nomic

data,

microeconomic gaps are not observed but need

one should not use our

identification strategy

is

know

to

be estimated from microeco-

(which

sharp contrast with those

when only

we found with actual

relies

to be smooth. In

rameter estimates they find with their counterfactual data are not

Finally,

significant nonlinear-

CW.

lumpiness) with their data, where adjustment

4.

When the

applied to data generated even with the major departures from our assumptions

considered by

3.

1.

on microeconomic

any event, the pa-

statistically significant, in

data.

aggregate data are available and the path of the cross-sectional

distri-

bution needs to be simulated, the assumptions about the serial correlation of the driving

processes

become more

important. This

is

not new. The surprising feature of

CW's

results

is

that

even

after

sion of their

is less

dropping the

serial correlation as

as they

do in the most recent ver-

comment, the explanatory power of the nonlinear terms

than half of what

we found

in the data. If one adopts

the persistence of the driving processes,

essentially

much

no

realistic

and uses the values assumed

no gain from adding higher moments

their claim, there is

more

false positive finding

in their

to their regressions.

in

experiments

assumptions on

CW (2002), there

is

Again, and contrary to

even when applying our methodology

to highly

unrealistic data.

The other two paragraphs

proach"

First,

is

voodoo-economics and

what they

us from

in their conclusion carry the implicit

call "the

that they are

messages

ready to deliver a superior gap-free alternative.

microeconomic models

as the

one they present

extensive literature on the optimality of {S,s) models).'^ Second, and perhaps

in published

from dynamic optimization

work. In

gap ap-

gap approach" has been derived formally by us and many others before

at least as sophisticated

the methods derived

that "the

fact, the difficulties in

that

(for this, see the

more

importantly,

do not "rely on gap measures" already

exist

measuring gaps was our own motivation for Caballero

and Engel (1994, 1999).'^

To end on a more positive

note,

CW's approach contrasts with more constructive and interesting

recent developments in the literature on the

adjustments. For example,

RBC model,

macroeconomic implications of lumpy microeconomic

Kahn and Thomas (2003) conclude

matter for actual investment. But this

gate data generated

is

fixed costs if the interest rate

is

be modified for

first

invest-

as a demonstration that fixed costs

do not

And

it

among

they also

show

that the aggre-

features of actual aggregate data, such as the

such spikes can be generated by microeconomic

and

fruitful area

of research:

to capture the nonlinearites that are

this

proof of optimality of (S,s) policies

discussed in this reply see,

that

fact,

not endogenized (confirming the results in Caballero and Engel,

Let us hope that energy will be spent on

'^The

on aggregate

not what they did. In

999). This finding points to an interesting

to

many

by such a model misses important

skewness caused by investment spikes.

need

an otherwise standard

fixed costs of adjusting caphal do not have a significant impact

ment.'^ This finding has been misinterpreted by

1

that within

is

How does the RBC model

observed in aggregate investment?

type of question.

in

Scarf (1960). For important extensions, relevant to the models

others, Harrison, Sellke

and Taylor (1983), Grossman and Laroque (1990), and the

pedagogical survey in Dixit (1993).

'"'in

these papers

we extended the

(S,s) literature to incorporate stochastic adjustment costs

model via maximum likelihood.

'^See Veracierto (2002) for a similar conclusion in a model of iiTeversible investment.

and estimate a

structural

REFERENCES

Caballero, Ricardo

J.

and Engel, Eduardo M.R.A. "Microeconomic Adjustment Hazards and

Aggregate Dynamics", Quarterly Journal ofEconomics,

"Explaining Investment Dynamics in

.

proach," National Bureau of

US

May

1993, 108(2), pp. 359-383.

Manufacturing:

Economic Research (Cambridge,

A

Generalized {S,s) Ap-

MA)

Working Paper No.

4887, October 1994.

"Explaining Investment Dynamics in

.

US

Manufacturing:

A

Generalized {S,s) Ap-

proach," Econometrica, July 1999, (57(4), pp. 741-782.

and Haltiwanger, John C. "Aggregate Employment Dynamics: Building from Microe-

conomic Evidence", American Economic Review, March 1997, 57(1), pp.

1

15-137.

Calvo, Guillermo, "Staggered Prices in a Utility-Maximizing Framework," Journal of Monetary

Economics, September 1983, 72(3), pp. 383-398.

Cooley,

Thomas

Thomas

F.

F.

and Prescott, Edward C. "Economic Growth and Business

Cycles," in

Cooley, ed.. Frontiers of Business Cycle Research. Princeton: Princeton Uni-

versity Press, 1995, pp. 1-38.

Cooper, Russell and WUlis, Johnathan. "The Economics of Labor Adjustment: Mind the Gap,"

National Bureau of Economic Research (Cambridge,

MA) Working Paper No.

8527, October

2001.

.

"The Economics of Labor Adjustment: Mind the Gap." Federal Reserve Bank of Min-

neapolis Research Department Staff Paper 310, August 2002.

.

"The Economics of Labor Adjustment: Mind the Gap." Federal Reserve Bank of Kansas

Research Working Paper 03-05, July 2003.

Dixit, Avinash.

"A Simplified Treatment of the Theory of Optimal Control of Brownian Motion",

Journal ofEconomic Dynamics and Control, October 1991, 75(4), pp. 657-673.

Grossman, Sanford

J.

and Laroque, Guy. "Asset Pricing and Optimal

Portfolio Choice in the

Presence of Illiquid Durable Consumption Goods," Econometrica, January 1990, 55(1), pp.

25-51.

Harrison,

J.

Michael; Sellke,

Thomas

L.

and Taylor, Allison

J.

"Impulse Control of Brownian

Motion," Mathematics of Operations Research, August 1983, 5(3), pp. 454-466.

Khan, Aubin and Thomas,

Do

Cycle Models:

Julia K.

"Nonconvex Factor Adjustments

in Equilibrium Business

Nonlinearities Matter?", Journal of Monetary Economics,

March 2003,

50(2), pp. 331-360.

Nickell, Stephen.

Oxford Bulletin of Economics and Statistics,

Rotemberg, Julio

An

"Error Correction, Partial Adjustment and All That:

J.

"The

May

1985,

47 {2),

New Keynesian Microfoundations," in

ley Fischer, eds.. National

pp.

1

19-29.

Olivier

Bureau of Economics (Cambridge,

Expository Note,"

MA)

J.

Blanchard and Stan-

Macroeconomics An-

nual, 1987, pp. 69-104.

Scarf,

Herbert E. "The Optimality of {S,s)

Policies

n the Dynamic Inventory Problem,"

in

Ken-

neth Arrow, Samuel Karlin, Patrick Suppes, eds.. Mathematical Methods in Social Sciences,

Stanford University Press: Stanford,

CA, 1960, 196-202.

Veracierto, Marcelo. "Plant Level Irreversible Investment and Equilibrium Business Cycles",

American Economic Review, 92{\), March 2002,

10

pp. 181-197.

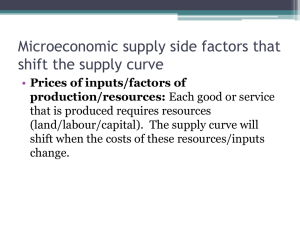

Table

1:

ESTIMATION WITH STATIC Gap

CW (quadr. adj

.)

CEH

(lumpy

R- without non-linear parameter

0.90

0.65

R^ with non-linear parameter:

0.90

0.79

Increase in R^ after adding non-linear parameter:

0.00

0.14

Minimum adjustment speed (non-linear model):

Maximum adjustment speed (non-linear model):

0.19

0.31

0.20

0.46

Range of adjustment speeds (non-linear model);

0.01

0.15

adj .)

CW column based on Table la in CW (2004). CEH based on Table 3 in CEH (1997). Maximum,

minimum and range of adjustment speeds are calculated considering adjustment hazards in the range

jjG ± 2aa, where /jq and Oa denote the mean and standard deviation of the cross-section of static

gaps for the model under consideration.

11

Table

2:

Estimation with Inferred Static Gap: Macroeconomic Data

Data

Driving force p (annual)

BLS, as

in

CE

Increase in R-

OTS

(1993)

Sim. Quadr. Adj.

1.00

0.00

Sim. Quadr. Adj.,

0.75"

0.01

0.47

0.03

028

0.05

CW (2001)

Sim. Quadr. Adj., as in CW (2004)

Sim. Quadr. Adj. as in

'Increase in Br' denotes the difference between the R- obtained

constant hazard and the E}

when imposing

a constant hazard, in

when

estimating a

model with a non-

both cases using the methodology in

CE

(1993). 'Sim. Quadr. Adj.' stands for 'Simulated Quadratic Adjustment'.

This

value of p

calibrating

RBC

somewhat below both the value in the driving force used

models (see Cooley and Prescott, 1995).

is

3837 023

12

in

CE

and the values used when

MIT LIBRARIES

3 9080 02617 6898

i!;:iijii;i;ii!;;:ii;/i;iiiil;ii;iiil:l!i!i;iiiIU;miiiiijMl!i!iii;!:iiii