Document 11163155

advertisement

Digitized by the Internet Archive

in

2011 with funding from

Boston Library Consortium IVIember Libraries

http://www.archive.org/details/panamericantouniOOfish

DEC

working paper

department

of economics

PAN AMERICAN TO UNITED:

THE PACIFIC DIVISION TRANSFER CASE

Franklin M. Fisher

Number 420

May 1986

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

4

1986

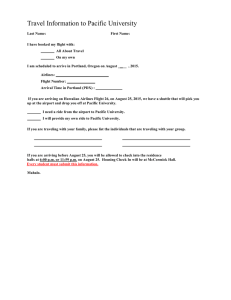

<PAN AMERICAN TO UNITED:

THE PACIFIC DIVISION TRANSFER CASE

Franklin M. Fisher

Number 420

May 1986

5/26/86

Franklin M. Fisher

Massachusetts Institute of Technology

United Airlines recent acquisition of Pan American's Pacific

Division will greatly increase concentration,

-

Japan service

—

an important market

Price competition will disappear.

ket

combining

its

with high entry barriers.

United will dominate the mar-

use of its computer reservation

biased

by

less

and

by

Ameri-

Without the acqui-

the resulting efficiencies could have been achieved in a

restrictive

way with three carriers competing

efficient service.

narrow

system

own giant domestic feeder system with Pan

can's Tokyo hub, both legacies of regulation.

sition,

especially in U.S.

to

The Department of Transportation took

view of its post-deregulation responsibilities in

ving the acquisition.

provide

a

very

appro-

DEC 3

1986

f

Franklin M. Fisher

Massachusetts Institute of Technology

success

The

substitution

of

competition

substitution

in

turn

particularly

in

the

deregulation

airline

of

direct

for

requires serious

transition

the

on

That

regulation.

enforcement,

antitrust

a

free

danger

that

regulated

from a

Without such enforcement,

environment.

depends

there is

a

to

airlines

that

were specially favored during the regulatory

will

able

to combine and parlay those

be

advantages

era

into

an

avoidance of market discipline.

April,

In

United

1985,

Airlines and Pan

announced an agreement whereby United would acquire

Airways

American's International Pacific Division.

American

$750

million,

craft and other assets.

while Pan American was to

along with

and 401(h)

408

to

air-

The two airlines applied to

Department of Transportation for approval pursuant

amended,

tive

transfer

An agreement involving employment of Pan

American employees was also reached.

tions

Pan

United was to pay Pan

its underlying Pacific route authority,

United

the

World

American

of the Federal Aviation Act

of

sec-

to

1958,

as

and, after an evidentiary hearing before an Administra-

Law Judge (who,

however,

wrote no opinion).

Secretary of

Transportation Elizabeth Dole approved the transaction at the end

of October.

The

One,

issues involved in the proceeding fell into two

parts.

with which this paper will not be concerned, had to do with

.

the various labor provisions of the agreement.

of this paper,

subject

dealt with the possible effects

nautics Board (CAB)

(DOT)

,

and this was the first

The competitive issues were

major case to come before it.

in testimony offered by the two applicants,

partment

and by American,

of Justice,

Airlines.

I

was

the

of

the task of dealing with that issue devolved

,

on the Department of Transportation

sidered

the

With the demise of the Civil Aero-

on competition.

acquisition

The second,

a

Eastern,

witness for Northwest,

con-

De-

by the

and

and this

Northwest

paper

is

largely based on my testimony.

Merger and acquisition cases are remarkable even among antitrust cases for the extent to which they tend to focus on

issues

of market definition and the measurement of concentration.

focus is an unfortunate one.

While market definition and concen-

measurement are not irrelevant,

tration

they at best provide

guide to the competitive issues involved.

crude

That

a

In particular,

market definition is only a way of organizing the data, while too

little is known about oligopoly behavior for measures of

tration such as the Hirschman-Herf indahl Index (HHI)

concen-

to give more

than a very rough indication of the likelihood of non-competitive

Consideration of such matters is entirely appropriate

behavior.

as

a

screening device,

Guidelines.

will

center

serious

as in the Department of Justice's Merger

The danger in actual proceedings is that discussion

on such threshold issues to the exclusion

and detailed analysis.

of

This is particularly likely

more

in

the case of the HHI where the natural desire of attorneys to find

a

bright line leads a numerical index to be taken over-seriously

.

The EM£lii£^QiyisiQn^ll£&nsl3£^£&SS was no exception. Indeed,

the applicants,

correctly foreseeing that the Department of Jus-

(and possibly others)

tice

presentations

on

were ready with obviously pre-prepared rebuttal

HHIs,

involving

would rely heavily

testimony directed solely at the question of whether anything can

be

concluded from examination of raw HHI statistics in

airline "markets".

tional

As a result,

Secretary Dole's opinion,

cially,

interna-

the debate and,

espe-

was misdirected, giving rela-

tively little attention to the interesting and substantive compe-

titive issues.

market definition and concentration

Nevertheless,

ment are important threshold issues to discuss,

and

measurebegin with

I

them.

anti-trust

Market definition is only the starting point for

defining

analysis,

analysis

market

will

the universe of discourse within which

take place.

Hence,

to be useful,

definition must include all those

'

noncompetitive behavior in the proposed market.

can

proposed

products,

firms,

and

constraints

that are likely to provide substantial

services

a

that

Such constraints

come either through substitution in demand or through

ready

substitution in supply (which shades over into ease of entry)

In

gers,

previous cases involving post-deregulation airline

the

CAB

wisely

declined to look only

on

at

2

mer-

concentration

statistics constructed for narrowly defined markets consisting of

individual

possibility

city

pairs.

The CAB reasoned

correctly

that

the

of entry by other carriers into serving a particular

wider market definition was

city

pair meant that

even

though it was not always clear just what that wider defini-

tion should be.

a

called

3

market

SMSl^iQ^'QA^lsl&B^TXMnsfSl^QMSM presents no such

The

for,

concentration

the message of the

definition

problems.

statistics

(whatever that is worth)

First,

any

reasonable market definition.

tant)

,

is

essentially the same

Second (and far more

for

impor-

air transportation in the Pacific does not take place in a

deregulated environment, and problems of entry are severe indeed.

Table

travel

shows that the largest segment of U.S. -Far East

1

is

between

mainland and the

the U.S.

Far

East.

Hawaii-Far East and Guam-Far East segments predominantly

of low-fare,

Japan-originating tour group travel.

segments (as opposed to Japan-mainland travel)

posed

primarily

reign

flag carriers.

tings.

Trip

[TABLES

travel

this?

for example,

rouadd

1

So far as the U.S.

I

concentrate

AND

2

market

definition

4

HERE]

be interested in a narrower

is concerned,

fo-

U.S. -Far

non-stop

In what follows,

on Mainland U.S. -Far East air travel.

than

com-

hours to what would otherwise be a

4

5200 mile, 10 hour non-stop trip.

one

to be

suggestion reinforced by the

a

routings via Honolulu to Japan,

approximately 1000 miles and

Should

shows

This suggests treating Mainland

that most of the passengers involved prefer

fact

2

of foreign nationals travelling largely by

East travel as a separate market,

The

consist

Table

these

air

part of Mainland-Far

the answer is negative.

East

Surveys of

air

U.S.

resident air travelers going to the Far East show that only about

32

percent of them live in one of the gateway

Mew York, San Francisco, and Seattle).

Los Angeles,

adjusting

cities

(Chicago,

5

Even after

for the fact that travelers residing near but not in a

gateway city also use that city's airport as their home

it

considerably more than half of all

is clear that

travelling

dents

to

the Far East do not begin

airport,

U.S.

resi-

end

their

and

Such travellers are likely to be indifferent

travel at gateways.

as to which gateway they pass through, making their choice on the

basis of schedule convenience and price.

Similarly, many passen-

gers originating in the Orient are unlikely to have strong prefeas to the choice of an American gateway through which

rences

or end their visits.

begin

definition

involving

They

narrow.

also

These facts suggest that

to

market

a

only single American cities would

be

too

competed

show that Pan American and United

with each other before the acquisition despite the fact that they

served different gateways.

A

similar

statement does not apply to

concentrating on particular Asian cities,

for

lar,

reasons

of geography,

market

definitions

In particu-

however.

the importance of Japan

as

a

tourist attraction, and the overwhelming importance of its economy in that of Asia,

play

a

the Japanese airports,

particularly

Tokyo,

vital special role in trans-Pacific travel.

Indeed, not only does more than half of trans-Pacific travel

originate

or terminate in Japan

(Table

remaining traffic passes through Tokyo.

1)

,

but also much of the

While it is possible to

compete for such traffic using other hubs (Seoul,

the

for

example),

fact that such a large part of the traffic stops,

lays over

,

or originates in Tokyo necessarily places the use of such

natives at

the

a

disadvantage.

In terms of demand substitutability

of those alternatives places only

availability

alter-

weak

con-

stemming from supply substitutability are

also

a

straint on the pricing of Japan-U.S mainland travel.

Constraints

relatively weak, for there are serious barriers to entry into the

provision of U.S. -Japan air transportation.

air transportation mergers,

domestic

deregulation makes for

dealing with

a

Unlike the case

where ease of entry

Bermuda-1

barrier

of

deregulated environment.

a

type bilateral agreement

conduct show,

Indeed,

neither U.S.

formidable

a

As over thirty years

freely

or Japanese carriers can

Japan

the last several years,

in

signed in 1952, is

presenting

to entry into U.S. -Japan service.

enter.

after

wider market definition, we are not here

The U.S. -Japan Civil Aviation Agreement,

a

in

favored

has

scrapping

the existing route description negotiated in the

agreement

in favor of an agreement v;hich,

1952

changes,

among other

would limit or do away with the existing valuable "beyond" rights

carriers to carry traffic beyond Tokyo).

(the right of U.S.

agreement of April 30,

permit

provide

a

1985,

The

which amends the 1952 agreement to

somewhat limited increase in Japan-U.S. service does not

a

corresponding increase in beyond rights

Indeed,

the

Japanese resisted the transfer of Pan American's beyond rights to

United,

asking

for

concessions from United

States,

and

only

backing down under heavy pressure from the U.S. government.

In

addition

to the reluctance of the

Japanese

to

permit

that can provide full-fledged competition,

entry

limitations

severe

on the use of Tokyo's

similar problems at Osaka,

and environmental factors,

airport

(and

Japan's secondary international faci-

(A

airlines serving Narita may toge-

only 270 movements per day during

provide

1985-86

and limits on terminal parking stands

As a consequence,

and gates.

hour permitted between 6:00 A.M.

There

movements

winter

are

of

Ope-

with only 26 movements per

and 8:00 P.M.,

fewer from 8:00

and none at all between 11:00 P.M. and 6:00

to 11:00 P.M.,

A.M..

the

takeoff and landing constitute two movements.).

rations per hour are also restricted,

P.M.

Narita

These include operational restrictions, political, legal,

lity).

ther

there are also

further

constraints on the total

in consecutive three hour periods.

number

Particularly

cause flights to or from the United States must use certain

of

betime

periods to enable passengers to make sensible connections without

arriving or departing at ungodly hours of the night,

period

constraints

As

one.

a

these time-

daily

are far more binding than the overall

result,

there is no serious prospect for a sizeable

expansion of operations in the near future.

These barriers are high, but they will become even higher as

a

result of the acquisition.

give the post-acquisition United an unfair

that

will

over

existing

strain

sitioned

The same factors described

competitors will even more certainly act

further entry.

United itself was the airline

to overcome the existing barriers;

later

advantage

to

re-

best

po-

it is hard to envi-

sion any other airline entering in a major way after the acquisition.

The presence of such barriers to entry and, indeed, the fact

Japan-U.S.

that

important

Mainland traffic can be taken to constitute

separate

market

is

reflected in the

United-Pan American transaction itself.

price

The principal

being acquired by United from Pan American are

assets

of

an

the

tangible

aircraft,

Indeed, a news report

but these are obsolescent and inefficient.

o

about the President of United states:

"Mr. Ferris of United has conceded that the transaction

Mr.

poses aircraft problems.

Ferris says that ^we're not

overjoyed about the airplanes United is getting, particular."

ly the L-lOll's

.

What

for

.

.

•

is paying three quarters of a billion

United

is rather Pan American's route system and rights.

dollars

part

In

because United already serves Seoul and Hong Kong, this means the

valuable rights to carry traffic beyond Tokyo.

paid

being

associated

merely reflects the scarcity rents

those rights or whether

assessment

Whether the price

(as I believe)

it also includes

United

that Japan-U.S.

Mainland air transportation is

Certainly,

to consider.

a

it is clear

sensible market

no sensible analysis of the effects of

pos-

acquisition on competition in trans-Pacific travel can

sibly

fail

to

's

from

of the supra-competitive profits to be achieved

the avoidance of price competition in serving Japan,

the

with

pay primary

attention

to

Japan-U.S.

Mainland

service.

Whether

travel

one defines the market as all Mainland-Far East air

or restricts attention to Japan,

drawn

about concentration are the same.

quite

concentrated

the conclusions

The market is

to

be

already

and that the acquisition will increase

that

,

concentration significantly.

Table

shows pre-acquisition market shares for

3

overly-broad U.S.

same.

In

the

Mainland-Far East market and the narrower U.S.

Mainland-Japan market.

the

both

In either case,

the general conclusion is

terms of the Herf indahl-Hirschman

concentration in the provision of U.S.

Index

(HHI)

Mainland-Far East service

will

go from 1782 before the acquisition to 2052 after

U.S.

Mainland-Japan service,

In

it.

the HHI will go from 2542 to 2812.

Either case would certainly cause concern in terms of the Justice

Merger

Department's

Guidelines.

9

In either

case

already

an

highly concentrated market will become significantly more concenThat

trated.

conclusion

is reinforced by the

that,

fact

as

discussed in the Appendix, the non-Japanese foreign flag carriers

are unlikely to be able to expand their shares of U.S. -Japan

air

Hence the

service to take advantage of supra-competitive prices.

HHI which counts those shares understates the effective degree of

concentration

and the increase that will be caused by the acqui-

sition.

[TABLE

As already remarked,

perly

treated

problems.

tacit

provide

3

HERE]

however, concentration statistics proonly a general

indication

of

possible

We believe that oligopolistic self-restraint (or less

forms of collusion)

are more likely when numbers are small

and concentration high, but we totally lack any precise theory as

to the concentration levels involved.

HHI

Accordingly,

statistics may be suitable for guidelines but

reliance on

cannot

avoid

the necessity for further, detailed analysis.

principal reason for concern is,

The

of course,

fear

the

that

the increase in concentration brought about by the acquisi-

tion

will

lead to an avoidance

international

no longer are)

price

wish

domestic fares

(as

It is interesting that the answer

of

affirmative,

the Japanese government to

despite

regulate.

particularly interesting to note that United has been

active

Since

the question naturally arises of whether there is

,

the case of Pacific air travel is

obvious

competition.

air fares are heavily regulated

any competition to be avoided.

in

of

It

is

especially

such competition as it has attempted to expand

in

the

using

its Seattle gateway.

The

first form that such price competition

takes

involves

the combination of a trans-Pacific and an internal U.S.

journey.

While

the fare between Japan and a U.S.

gateway city is subject

to international tariff filing requirements,

U.S.

As a result,

is not.

a U.S.

airline, particularly United

with its immense domestic route system,

price

the fare within the

can effectively cut

offered to a Japanese (or other Asian) visitor by offering

extremely low prices on the segment of the trip that takes

within the U.S.,

gers

the

place

Such price cutting even applies to some passen-

travelling only to U.S.

gateways.

A passenger travelling

from Tokyo to New York, for example, could take advantage of such

price cuts by travelling via Seattle instead of directly.

When

1983,

its

United

first entered the U.S. -Japan market

it offered "Visit U.S.A."

on-line

passengers,

(VUSA)

fares,

April

available only to

enabling them to fly on

10

in

its

domestic

In so doing, United did not merely follow

systerr for a flat fee.

it offered a pass that significantly

the

competition,

the

VUSA fares already being offered by other

(responding to

the CAB

a

undercut

airlines.

After

complaint by JAL) declared VUSA fares to

be international fares subject to Japanese tariff filing require-

United introduced a different price cut

ments.

passengers.

on-line

for its

In November 1983 it, began offering so-called YROPAC

involving low "add-ons" for the domestic portion of trans-

fares

When, in May 1985, DOT (again respon-

Pacific travel on United.

to a complaint by JAL)

ding

filed

international tariffs or be discontinued.

in

ready with a third version.

must

held that these fares also

United

be

was

It introduced so-called COMPO fares

allowing

international

segments

for a low add-on price

passengers to fly up

domestic

four

to

(two hundred dollars for

travel

within

the western United States)

rently

has arrangements with certain Orient travel agencies per-

.

In addition.

United

appa-

mitting them not to remit the COMPO fare add-on collected.

The second form of price competition involves travel agents.

Airlines

regularly

agents.

Since

such

compete on the commissions

paid

business,

agents book the lion's share of

particularly for international travel,

travel

to

such competition is quite

important.

Here again United is particularly well placed.

control

the Apollo computer reservations

below)

of

enables

it

efficiently to monitor

system

and

(discussed

reward

bookings in terms of its own share of those bookings.

Its

agents'

United has

actively competed on price using this technique.

Of course, price competition in commissions to travel agents

need not always result in lower prices to travellers.

11

Whether it

so depends on the state of competition among travel

does

At least in large cities, however, one would expect

themselves.

commissions to be passed on in some

increased

agents

either

form,

as

lower prices or as improved service.

In

least one segment of the market,

clear

it is

that

commissions to travel agents do result in lower prices to

higher

the

at

travelling public.

This is the so-called

"ethnic"

market

segment where, for example, American travellers of Chinese origin

purchase tickets in Chinese neighborhoods.

fic,

In serving such traf-

it is common for airlines to sell through "consolidators"

brokers

major

These consolidators

who sell many tickets.

given substantial "commission overrides" which are partly

—

are

passed

on by them to their own customers such as travel agencies located

in ethnic neighborhoods.

Those agencies in turn pass on part of

commissions to individuals in those neighborhoods who mar-

their

ket the tickets to the travelling public.

This system of

competition in the ethnic market segment in the U.S.

more

price

has an even

active parallel abroad where airline tickets can

regularly

be bought at a discount on the streets of Hong Kong or Taipei.

before

Thus,

competition.

In

the acquisition,

particular,

there was substantial price

United,

which had

a

foothold

such

serving Japan and was particularly well placed to engage in

competition

flights

others.

was very active in doing so.

between

It fought to fill its

Seattle and Japan and to attract

from

traffic

It also invested in a competing hub at Seoul and fought

to attract traffic there.

have

in

eventually

permitted

Whether such price competition

United to overcome the

12

would

barriers

to

into Japan is

entry

a

close question,

and

I

discuss

later.

it

What is certain, however, is that the acquisition removed much of

the

motive

for engaging in it.

With Pan American's Tokyo

other Pacific service added to its immense domestic route

with

(and

below)

,

Apollo computer

its

United can expect to attract

without competing on price.

Angeles-Tokyo

and

increase

would

reservations

a

Pan

system

discussed

system

large share of the traffic

Indeed, United forecast that its Los

San Francisco-Tokyo

over

and

on-board

American's

by

average

and

14.9%

fares

13.3%,

respectively.

At

the same time.

Pan American was taken out of the fight.

Its Pacific Division was profitable and,

the

shortly before

indeed,

acquisition Pan American had announced and

published

dules for a major expansion of its Pacific service.

sche-

The acquisi-

tion ended that.

Thus,

there

when

appears

one looks behind the concentration

statistics,

ample reason for concern over the effect

of

the

acquisition on competition.

There is more to the matter than this, however.

doubt

that the post-acquisition United will be

titor than the pre-acquisition Pan American.

stronger compe-

In particular,

provide single-line service between interior points in

will

United

with

a

There is no

States and points beyond Tokyo

a

—

something Pan

very poor domestic route system did not

do

it

the

American

effectively.

This will be a benefit to the travelling public.

Will the provision of that benefit more than offset the loss

13

of price competition?

In this connection,

it is noteworthy that

the

acquisition was opposed by Northwest Airlines,

U.S.

flag carrier in the Pacific as well as by Eastern and Ameri-

can

Airlines,

competitors

V7here

suspect

that

competition.

oppose

a

merger,

If one looks no further,

routes.

ordinarily

one is

they fear a net increase,

Pacific

not a net

led

to

decrease

in

this suggests that compe-

by single-line service will be worth more to the

tition

ling

of which hoped to acquire

both

largest

the

travel-

public than the price competition that would have continued

in the absence of the acquisition.

In fact,

such a conclusion is quite superficial.

for believing that the public and

reasons

will both suffer as

competitors

result of the acquisition.

is booked through travel agents.

Far

the

Since the middle

1970s,

agent bookings have been predominantly made by the use

tavel

computer

provide

seat

's

far the largest part of travel to

By

^^^k^SQllQ^

East

a

United

There are

reservations

systems (CRSs)

Such systems

.

up-to-date schedule information,

availability

at different fare

only

not

they also inform as to

levels,

airline computers to book reservations,

of

communicate

with

print tickets, and faci-

litate land arrangements.

With one relatively minor exception,

airlines,

system,

and

the two airlines with the largest domestic

American and United,

of their systems

all CRSs are owned

(named,

by

route

have by far the largest placements

respectively, "Sabre" and "Apollo") with

agents.

This is not an accident.

In responding to a travel agent's

inquiry, not all possible flights and routings can be given equal

14

prominence in the computer display.

possibilities

Generally, there are so many

they cannot all be displayed

that

once,

at

and

is a natural tendency for agents to choose from the alter-

there

natives

on

the first screen presented and even from

line or two on that screen.

importance

to

13

first

the

It is thus a matter of considerable

airlines how the software

involved

chooses

the

order in which flights are displayed, and there is a great incen-

Indeed,

tive for an airline CRS vendor to favor its own flights.

the

money

make

to be made from so doing is large enough to

it

profitable for an airline to offer its CRS to travel agents below

cost or even to pay them for taking it.

Both

United

and American were quick to take

opportunity,

this

was happening,

(still pending)

of

biased

After it became plain that

this produced two private

antitrust

suits

and an investigation by the Deparment of Justice.

investigation

That

advantage

first providing relatively openly

at

displays favoring their own flights.

this

14

in

turn led to proceedings before

the

CAB

which, in the fall of 1984, adopted the suggestion of the Justice

Department and began regulating the way in which CRS displays are

determined.

I

use the phrase "began regulating" deliberately,

lation in this area is likely to be

a

for regu-

never-ending task with

vendors always one step ahead of the regulators.

the

For example, in

its initial regulations, the CAB required that the primary screen

displayed

United

be "unbiased" but permitted

a

biased secondary screen.

and American took full advantage of this

loophole,

providing incentives to travel agencies to lock in the

15

even

secondary

screen so that individual agents had to begin with it rather than

the

unbiased "primary" one.

That practice was abandoned

after

Congressional hearings in March 1985.

more subtle example involves trans-Pacific travel

A second,

United's

directly.

Apollo system (unlike other CRSs) does

connecting flights where the carrier involved has no autho-

list

rity to carry merely local traffic.

agents

This means that Apollo-using

to Osaka

booking passengers travelling from the U.S.

Northwest

in Tokyo.

or

connection

Okinawa cannot discover that there is an easy on-line

on

not

Instead they find connections to

JAL.

Not surprisingly, many of those connections involve United trans-

Pacific flights even though the usual considerations of passenger

on-line

convenience used in the Apollo algorithm would place the

connection first. 15

Northwest

There are many other examples

of

the anticompetitive use of Apollo in the Pacific.

examples

Such

are only the tip of the

potential

iceberg.

regu-

They represent abuses already located but not yet cured by

illustrate the enormous difficulty

(indeed,

the

impossibility) of curing the CRS problem through regulation.

The

They

lation.

algorithms

complex

so

(necessarily)

that the effort to regulate is likely to lead

and continual series of hearings with regulation

so

ways

and the opportunities for misuse of them in subtle

varied

endless

used to determine display order are

to

an

always

struggling to catch up. 17

So

far

as

trans-Pacific service

is

concerned,

willingness to use Apollo to divert traffic from its

is

competitors

limited directly to passengers booking in the United

That is not the end of the story,

16

however,

United's

States.

for travel agents in

8

Japan also use

a

biased CRS, the JAL controlled JALCOM III.

system,

not subject to U.S.

showing

only JAL flights.

That

regulation, provides a first screen

It

is

conceivable that United

could

trade JAL special status on Apollo in return for favorable treat-

ment

JALCOM III

on

—

an arrangement not available to

current American trans-Pacific competitors.

already

been

hansa.)

In

United

similar deal

(A

struck in the Atlantic between American and

this way.

United could extend its

biased

's

has

Luftuse

of

traffic through the provision

of

Apollo to involve Japan-originating traffic.

Obviously,

diversion

of

biased or incomplete information is destructive of competition on

Moreover,

merits.

the

even if regulation keeps

moving target,

perpetually

catching

the harm will be done.

its

Because

of

existing competition, operating margins are thin on trans-Pacific

diverted

so that relatively little traffic needs to be

flights,

to United for other airlines to find such service unprofitable.

Without

a

trans-Pacific service while pursuing

does

United

problem.

not

high-fare policy

a

is

position

to be able to use Apollo to attain a commanding

likely

in

resolution of the difficult CRS

1

merely reflect the additional benefits of its

that

on-line

service.

Even apart from the

^-i^S'ii^^SiiPXtrXJJe^L^a^sy^pf^Eeaai^iifiD^

CRS

problem,

potential

service

Those

the

however,

are reasons to believe

there

benefits of the acquisition in

will not,

reasons

eventual

in the long run,

providing

be passed on to

that

single-line

consumers.

have to do with the impact of the acquisition

structure

of the

17

market

for

the

trans-Pacific

on

air

.

travel

As

result of half a century of airline

a

both

and Pan American possessed certain advantages over

United

when deregulation began.

airlines

system

the United States,

in

favored U.S.

single

other

United had the largest route

while

Pan

American,

often

the

flag airline, had a large Pacific system, including

beyond-Tokyo rights.

a

regulation,

airline,

Had those advantages both been possessed by

airline would doubtless

that

totally

have

dominated Pacific air travel.

That domination did not occur,

west in particular

not shared.

—

Before the acquisition. United had excellent domes-

develop its Pacific routes.

an

It v/as striving

expanded from nothing in pre-deregulation days,

the acquisition of National Airlines.

provided partly by JAL,

largely

flag carriers to a limited extent

service

through

Competition in the Pacific

Japanese

the airline of choice for

nationals but without any internal U.S.

of all, by Northwest.

to

Pan American, on the other hand, had

excellent hub at Tokyo but very poor domestic feeder

was

North-

could compete because those advantages were

service but poor service beyond Tokyo.

tic

—

and other airlines

routes, by other foreign

(see the Appendix)

,

and,

most

Northwest, in particular, had moved in the

post-deregulation period to build its hub at Tokyo and expand its

domestic

system,

but,

by

1985 had not come close to having

domestic feeder service that matched United

a

's.

Had the acquisition not been approved. United would have had

to

continue to fight to expand its Asian service.

time.

Northwest

At the

would have expanded its domestic route

If both airlines had been successful,

18

same

system.

the result in five to

ten

time would have been competition by two powerful

years

carriers

providing on-line service from points inside the United States to

many points in Asia.

without

Further,

the acquisition,

Pan American would have

had to do something else with its Pacific Division.

mentioned,

Division was profitable,

that

already

As

and Pan American

announced plans for expansion of service in the Pacific,

already

active

so one possibility would have been for it to remain as an

competitor,

run

long

striving for greater efficiency.

as a major player,

To succeed in the

it would have had to

its domestic operations.

expand

had

continue

have

it could

Alternatively,

some or all of the Division to another domestic carrier

sold

carriers.

Unless

that carrier were American Airlines

tion

of the Pacific Division by whom would present many

same

problems

as acquisition by United)

,

such

a

to

or

(acquisithe

of

sale would

be

pro-competitive.

Thus,

run

had the acquisition not taken place, the likely long-

result would have involved at least two and

probably

three

American flag carriers providing on-line service on both sides of

the Pacific and competing to do so.

That competition would have

resulted in the benefits of superior on-line service being passed

on

to

the travelling public rather than being retained

airlines in the form of higher prices.

tion would have continued as United,

by

the

Certainly, price competiPan American, and Northwest

all fought to gain adequate systems on both sides of the Pacific.

The

acquisition changed that picture drastically.

It

re-

moved Pan American as an active force and, at one stroke, allowed

19

to inherit not only its own legacy of regulation but also

United

that of Pan American.

it

much

likely that Northwest

less

receive

could

previously noted,

sufficient

on-line

to grow internally into a second full

traffic

As

This gives it an immense headstart, making

carrier.

it does not take much diversion of traffic

on Pacific routes to turn profit into loss.

Similarly, U.S. flag carriers that did not provide U.S. -Asia

before the acquisition are unlikely to

service

constraints

competitive

April

United.

The

agreement

frequency of service and hence the capacity

the

of

Furthermore, the new U. S. carriers will only have rights

1986.

not beyond.

Tokyo,

19

Had the acquisition not been

approved,

the

new carriers would have fought to expand their service,

the

U.S.

exchange

that

might well have pressed for beyond rights (perhaps

for parallel concessions to

United

rights at

from

a

has

carriers)

however,

and

and

in

Now

.

beyond

the pressure of competition

the new carriers who lack such advantages is likely

approved

the

Japanese

acquired Pan American's Tokyo hub

single stroke,

relatively low.

is

the

newly able to provide trans-Pacific service starting in

carriers

to

post-acquisition

1985 amendment to the U.S. -Japan bilateral

30,

limits

on the

serious

impose

to

be

The Japanese government, having just reluctantly

the transfer of Pan American's beyond rights to

likely strongly to resist granting new ones.

new carriers to grow gradually at

best,

United

This will force

sinking

resources

into rent-seeking activity and perceiving that United can use its

CRS

and superior on-line service to discipline them at any time.

Can

competition

be preserved in

the

Pacific?

The

most

likely source of such competition remains Northwest, but here the

20

acquisition

As already discussed.

consequences.

advantages

too

are

been

The alternative

Northwest would itself seek

that

United

continue

Pacific,

the

competing

providing

a

merger partner as a means

Northwest announcing

A major reason for that merger is Republic's fleet of

It

non-merger means.

Airlines.

short-haul

If the

a

feeder system,

by

Northwest-Republic meger is consummated

and Northwest is able to redeploy the acquired aircraft,

person-

and other facilities greatly to expand its route structure,

nel,

there is at least

effectively

the

in

would take several years for Northwest to acquire

crucial to the development of

such a fleet,

of

That oc-

1986 that it had arranged to acquire Republic

aircraft.

very

(predicted in my testimony) was

curred as this paper was being written,

January

would

it

acquiring a substantial domestic feed system.

quickly

of

post-acquisition

's

Had it attempted to do so,

forced to retrench in

limited service.

chain

(and predicted)

great for Northwest to

internal growth.

through

have

set off a predictable

has

a

chance that Northwest can continue to compete

in the Pacific.

Northwest-Republic

What other effects on

acquisition

may or may not

competition

have

is

a

matter beyond the scope of this paper.

Such matters are not outside the scope of the Department

Transportation, however.

of

Indeed, one would expect the Department

to take a broad view of transportation policy. Quite the contrary

was

of

the case,

with the Department taking a very fragmented view

its responsibilities.

merely

That fragmented view was evident

not

in DOT's refusal to take seriously the prospect that

the

21

.

.

acquisition would lead to further mergers but, more surprisingly,

in

the way in which it dealt

rather,

(or,

failed to deal) with

the question of United's post-acquisition advantages.

DOT appears never to have seriously considered the

cular,

tion

In parti-

whether the efficiencies achievable by the

of

ques-

acquisition

could also be achieved in a way less likely to be destructive

of

competition

the first of United's post-acquisition

discussed above,

As

advantages

is the possession and use of the Apollo

CRS

Given

fact that the CRS problem remains under

review

the

litigation)

,

expanding

its

one

might

have

consequences in

expected DOT to

a

major way.

hesitate

This was

system.

(and

before

not

the

case, Secretary Dole's opinion brushing aside the matter with the

comment

that it was premature to conclude that the existing

CRS

rules are inadequate.

The

Department took

In

a

the

substantial financial commitment in order to

so doing,

nouncement

similarly narrow view of

larger

It accepted Pan American's contention that the airline

picture.

required

a

expand.

it passed over Pan American's pre-acquisition

of increased service.

21

an-

Even if that conclusion were

correct, however, it would not follow that the acquisition should

have

been approved.

The Department failed to consider

whether

the

required financial commitment could have been obtained in

way

less

destructive

of competition

(sale to

an

airline

a

not

already competing in the Pacific, for example)

The

question

similar treatment.

of

United's ability to expand

was

given

a

The Department recognized the entry barriers

22

involved and concluded that United would not be able to

so that substitution of a strong United for a weak

unaided,

thein

Pan American would increase competition.

In one sense,

had

United

this is

a

close call.

Before the acquisition.

the willingness of the Japanese government to

—

rights

Tokyo

and its service into

beyond rights,

no

22

was

To an extent, therefore, further expansion was subject

limited.

to

overcome

further

grant

something it would certainly not do easily.

There are, however, three reasons for thinking that approval

the acquisition was not necessary for such expansion and that

of

the same ends could have been achieved in a less restrictive way.

of all U.

First,

S.

airlines, United was probably the best siIndeed, it had already begun development

tuated to bypass Japan.

an alternative hub at Seoul.

of

By approving the

acquisition,

removed the incentive for that development which would

DOT

have

provided at least some competition to America-Japan service.

the history of U.

Second,

reflects

tion

slow.

The

involved

-Japan negotiations over avia-

although the progress has

expansion of Northwest in the Pacific,

been

often

for example,

continual pressure by the American government for

ther rights.

sition,

progress,

S.

it

fur-

Had the American government not approved the acqui-

could have made further rights for United its

priority in negotiations with Japan.

If,

first

indeed, it turned out

that Pan American had to retrench, there would have been a strong

argument for gradual,

to United.

a

in

piecemeal transfer of unused beyond rights

Moreover, a fully pro-competitive policy

would offer

Japanese carrier the right to carry passengers beyond

gateways

exchange for rights beyond Tokyo for United (and other U.

23

S.

—

carriers)

flag

government

an offer that the Japanese

would

certainly have to think about.

rights for United would have to

have

DOT could itself

have

United could provide increased trans-Pacific

ser-

while

Third,

beyond

been the subject of further negotiations,

that

assured

The agreement of April,

vice.

up

1985 provided for the addition of

three additional routes for American

to

providing

carriers

Depart-

It was totally in the control of the

service to Japan.

Transportation to assure that United received

ment

of

more)

of those routes.

one

(or

This would have ensured that United kept

fighting to fill its trans-Pacific planes and would have enhanced

the

argument

that

required

additional beyond rights were

for

efficient service.

DOT did not do this.

ensuring that the U,

thereby

would

routes

have

acquisition

United,

expansion.

In

cursory

that

Instead it approved the

on

flag carriers awarded the

to deal with the

immensely

a

new

post-

powerful

discouraging them from more than

so doing,

connection

S.

acquisition,

limited

it failed to make more than the

between the decision on the acquisition

the new routes,

stating only that the

result

of

most

and

any

by United in the Japan route case "cannot be predic-

application

ted here."^^

This

is

considering

a

very blinkered view of DOT's

airline mergers.

responsibility

It made sense temporarily to give

DOT the post-deregulation responsibility for approval of

mergers

in

airline

DOT only because that department can take an overview of

transportation

policy.

Without that,

24

it would have been

more

immediately to entrust such responsibility directly

sensible

the

courts

matters)

trust

the

But

.

consideration

particular

means.

refused

of

a

in

anti-

primary point of such an overview must be

whether the efficiencies

promised

transaction can be achieved through less

by

a

restrictive

In the P^sifif^Diyi^iPE 1l^n§i^X^£MS^^ the Department of

Transportation

and

perhaps to those agencies more skilled

(or

to

simply

failed

to^

consider

to step outside the confines of the

such

questions.

instant

proceeding

consider even closely related matters plainly under its

control.

In so refusing,

lities.

That

is

a

It

own

it failed to live up to its responsibi-

cause for concern however one

thinks

2M£iilQ^Qi^i§lQB^TXMDS£sx^£^SM should have been decided.

25

the

presence of the secondary Asian foregin

The

carriers

flag

(China Airlines, Korean Air, C.A.A.C, Thai Airv/ays International,

Singapore Airlines, and Phillipine Airlines)

for

is

already accounted

the concentration statistice given in the

in

statistics

show

a

high degree

of

concentration

Those

text.

substantially

Such statistice, moreover, under-

increased by the acquisition.

whose

the importance of the secondary Asian flag carriers

state

ability to impose constraints on the behavior of the major market

Those secondary carriers are

is severely limited.

participants

unlikely to expand much beyond the position they now occupy.

Secondary Asian flag carriers have substantial advantages in

their own countries.

serving

countries

those

carriers

are more likely to fly on

than on foreign ones.

passengers

from

Japan

passengers

All else equal,

(A

their

from

national

own

similar statement holds

or the United

for

National

States.)

flag

carriers enjoy the benefits of greater visibility at home, established

relationships with local organizations,

intra-country

traffic.

They

also enjoy the

and control over

benefits

the

of

active governmental support that can take the form of restrictive

regulation

of competitors,

capital and operating subsidies,

or

informal pressure on nationals to use their own flag carrier.

On

the other hand,

such carriers have much less of

sence outside their own countries.

As a result,

a

pre-

much of the U.

S.-Asia air traffic served by such carriers is made up of passengers originating in their home countries.

It is far from

clear

that they can expand much beyond this.

In

many

instances,

the level of traffic on the

26

secondary

Asian flag carriers reflects explicit agreements on capacity

Through various agreements,

price.

service

vide

many of these carriers pro-

(especially between Tokyo and other Asian

under either capacity or pooling agreements.

cities)

A capacity

agree-

airplane size, and other aspects

ment controls flight frequency,

In a pooling agreement,

of service.

and

the pooling carriers agree

as to the sharing of revenues derived from the joint operation of

an air routs.

They also agree to restrict capacity.

Many of the

secondary Asian flag carriers have pooling or capacity agreements

Those agreements serve to protect the positions of the

with JAL.

participating

carriers

and help them to maintain

control

over

lucrative traffic between their home countries. 23

immense importance of U.S. -Japan traffic in Pacific air

The

travel would force any secondary Asian flag carrier aspiring to a

significant

truly

through

Japan

role

in the broader market

to the U.S..

enjoy fifth-freedom rights

of

those

carrier

rights.

would

presently

While such carriers

in carrying passengers

it is hard to envisage much expansion

An aggressive expansion attempt

doubtless be resisted by the Japanese

if a secondary Asian flag carrier were to

doubtful

Moreover,

expanded

obtain

Certainly,

it is

from

that it could also obtain the beyond-Tokyo rights

nations

such

needed to establish an efficient

carriers

hub

at

Tokyo.

could not provide service within

27

a

government

in carrying passengers between Japan and the U.S.,

rights

other

such

by

and might even jeopardize existing pooling agreements.

even

do

(the right to carry passengers between

two countries both foreign to the carrier)

through Tokyo to the U.S.,

rights

seek

to

the

United States.

Such

carriers would thus,

find it extremely

in any event,

difficult

to expand and play a major role in

They

continue to lack both hubs at Tokyo and U.S.

v^ill

the

post-acqusition United that has both.

unlikely to play

travel.

domestic

Thus handicapped, they will now have to contend

feeder systems.

with

U.S. -Asia

a

They

major pro-competitive role in the

sition world.

28

are

thus

post-acqui-

,

paper is largely based on my testimony on

*This

Airlines Inc.

Northwest

in the

of

2S£lii£^^iylSlQn^Tl^n§iSI^£M^S

Department of Transportation Docket 43065,

are to this case unless otherwise specified.

1985.

I

All references

am indebted to J.

George Hall, Kevin Neels, Sheldon L. Pine, Barry S.

Campion,

W.

behalf

Spector, Peter Ward, and especially Ronald D. Eastman and William

Kutzke for assistance and discussion but retain responsibility

A.

for

The views expressed are my own and not

error.

necessarily

those of Northwest Airlines.

1.

Exhibit JA-RT-2, Rebuttal testimony of Dennis W. Carlton,

William M. Landes, and Sam Peltzman.

2.

For

a

definition,

IS£I

detailed discussion of economic analysis and market

see P.M.

(Cambridge,

MA:

Fisher,

J.J.

McGowan, and J.E. Greenwood

MIT Press), 1983, Chapter 3. In effect, the

Department of Justice now takes this view of market definition as

a

summary of constraints.

ter,

Vol.

minimal

49,

1984,

Its l^sZQSX^Sii-l^MlinSM

26,284)

define

a

(Federal Regis-

"market" in terms as the

collection of firms that could sustain

a

price

rise

of

stated size for a given period of time.

3.

the

D.

Aviation

S.

Sibley, S. B. Jollie, gi^^I "Antitrust Policy in

Industry,"

Washington:

£iyli^^xeD^JJii£^^BfiS£^ ^

1982, pp. 109-113.

3.

traffic

The

is

conclusions

included.

are

no different if

Hawaii-Far East service

concentrated.

29

Hawaii-Far

is

also

East

quite

For example, U.S. Travel and Tourism Administration "Sur-

4.

of International Air Travelers,

vey

December,

pp. yOSOS4-l - YOSOS4-6.

1983,

yield consistent results.

to

In-Flight Survey," OctoberOther similar surveys

Surveys of residence are more

likely

be accurate on the question of how much travel originates

terminates

in

gateway city than are direct ticketing

travelers to the Far East buy separate

many

since

a

or

counts,

tickets

for

travel between their residence and a gateway city.

It

5.

traffic

United's

non-negligible

portion

of

through Seattle to Japan originates at one

of

even the case that

is

the two California gateways.

a

See Exhibit DOJ-R-1, Rebuttal Tes-

timony of Gloria J. Hurdle, Table R-2.

6.

In January 1986,

Pan American provided non-stop service

between Tokyo and Los Angeles, New York, and San Francisco, while

United had non-stop flights between Tokyo and Seattle.

Northwest

provided non-stop service between Tokyo and all five gateways and

Japan

Air

gateway

stop

Lines

(JAL)

had such flights between Tokyo and

except Chicago.

every

non-

Other foreign flag carriers flew

between Tokyo and the two California

cities.

were

There

somewhat different patterns .for other Asian destinations (but, as

seen in Table

1

and discussed below, Japan-U.S. traffic is by far

the most important piece of U.S-Asia air travel).

7.

8.

W^ll^S^LSM^^^mxn&l

,

April 29, 1985, p.

The Guidelines characterize

trated" if the HHI is at least 1800.

that

produces

a

a

6.

concen-

market as "highly

They suggest that

"highly concentrated" market will

a

merger

usually

be

challenged if it results in an increase in the HHI of at least 50

points.

The increase involved here (on either definition)

30

is

270

points.

For a somewhat more extended discussion of what follows,

9.

see Exhibit NW-T-780,

"Pacific Pricing."

Exhibit NW-R-734.

10.

11. For an estimate of the way the public values single-line

service in the context of

a

domestic merger case,

ton, W.M. Landes, and R.A. Posner

A

Mergers:

Case

(1980), pp. 65-83.

to

that

suppose

Study,"

,

see D.W. Carl-

"Benefits and Costs of Airline

B^ii^JpyxD^l^pi

SQQnQml£3

,

Vol.

At least in the short run, there is no reason

United will be more

cost-efficient

than

it plans to continue to use the same obsolescent

American;

11

Pan

air-

craft.

almost

first

American Airlines study in December 1981 found that

An

12.

of all sales made on its CRS

92%

screen

(Sabre)

came

first

line.

and more than 53% from the

from

(U.

the

S.

Department of Justice, "Comments and Proposed Rules," Civil Aeronautics Board, Docket 41686 (1983), p. 81.)

13.

In one case. United offered to recompense a travel agent

converting to its CRS (Apollo) with $500,000 cash, a 10% override

on all transportation sold on Apollo,

of

and five years of free use

the system including absorption by United of all telecommuni-

cations line charges.

("Statement of Northwest Airlines, Inc.,"

Committee on Commerce,

Science and Transportation,

on Aviation,

1985,

p.

Hearings,

Subcommittee

Computer Reservation Systems,

March 19,

64.)

14. The loss in passenger convenience involved here is large

as

anyone

who looks at the schedules involved

31

or

has

changed

.

terminals at Narita will quickly realize.

15. See Exhibit NW-T-765.

16.

numerous

recent

A

report

of the Department of

examples of complaints about

]/^iiPfl^Si:Si^Ei^lD^i}^i£^

f

bias

1985, pp. 33-40)

Justice

cites

{i^<85^EfiPfiXi^e£^ii)^

and states

(p.

39):

Whether a specific algorithm

violates the antibias rule can be a difficult and highly fact-bound

issue.

The issue would not be adequately resolved by more rules,

however.

It can only be addressed on a case-by-case basis.

.

.

.

17. For example. Northwest's profit margin in the Pacific in

Pan American's was 7.5%.

1984 was only 5.8% of revenues.

bit N^V-R-18)

.

(Exhi-

Such low margins imply that much of the price paid

by United to Pan American is for future supra-competitive profits

rather

than for the scarcity rents involved in competitive

ser-

vice to Japan.

18.

Similarly,

a

new Japanese carrier will not be able

to

acquire a U.S. feeder system.

19.

Eln^l^QElnlQn^sn^^Qi^sx

pp.

,

50-51.

QslniQD^&B^^Ql^MI is equally terse on this subject

20. lln^l^QsiBlQB^^n^^Qx^SI

,

pp.

21. lin^l^QslnlQn^Mn^^Qx^si

r

p.

22.

23.

Zln^l^QelnlQB^MB^^Qx^SI

See Exhibit NW-T-790.

32

,

p.

3

5-36.

39.

38.

The

2'^ai^iizs

(p. 35)

.

TABLE

Number of Passengers

1

(Thousands)

on Scheduled Service

between the U.S. and the Far East, 1984

Bs^nM^n/M^

TPi^2

Total

6

,372

2

,128

551

3

,693

Japan

4

,253

1

,516

498

2

,239

557

526

352

330

140

182

102

1

99

70

35

55

Hong Kong

Korea

Taiwan

Phillipines

India

Singapore

P.R.C.

Thailand

Pakistan

Malaysia

EQBQlUla

9

1

Source: Northwest Airlines

a.

91

182

—

Qi^sm

4

15

33

—

MsiulSD^

371

423

246

115

140

44

70

35

9

1

(from INS Form 92)

Including Okinawa (total of eight thousand passengers).

TABLE

Number of Passengers

2

(Thousands)

on Scheduled and Charter

Service between the U.S. and Japan

Japan

Between

4,404

Guam

Percent

521

Honolulu

Percent

1,631

Mainland

Percent

2,252

Source:

a.

1984

Foreign

U.S.

Foreign

1,357

3,047

2,122

2,282

31

69

48

52

43

478

215

9

91

41

306

59

I

Total

Percent

,

1

U.S.

228

1,403

86

611

37

1,020

14

1,086

1,166

1,296

48

52

58

956

42

63

Northwest Airlines (from DOT U^S^^In^MI.n^^lQBMl^hl£.

Including Okinawa.

TABLE

1984 Market Shares

(Per Cents)

3

in Trans-Pacific Air Travel^

ShMi^A<^Mlnl^n^-l&£^^M§^

£M^£is£

BMxsA^Minl^n§z2^p^n

Northwest

27.5

31.3

JAL

21.9

33.5

Pan American

18.5

19.3

Korean Air

9.3

0.0

United

7.3

7.0

China Airlines

6.8

1.4

Singapore Airlines

2.9

3.1

Thai International

Airways

2.2

1.9

CAAC

1.6

Phillipine Airlines

1.3

1.4

Varig

0.6

1.0

1782

2542

HHI

a.

Market

Immigration

and Naturalization Service

shares are for total number of passengers

figures

each

Source:

on total passengers carried by U.S.

gateway

were allocated to

Northwest,

United using ER586 service segment data.

flag

Pan

(INS).

carried.

INS

carriers

via

American,

and

953 073

W

Date Due

FES 2

1990

"on

to 2

^26 '§0

;^Y 1

EG ^S

\c

^S Q

Lib-26-67

3

TDflO

DD4 ^E^ B3