Office for Sponsored Programs FISCAL MANAGER TRAINING February 2010

advertisement

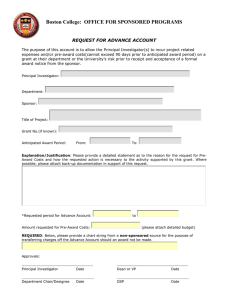

Office for Sponsored Programs FISCAL MANAGER TRAINING February 2010 OBJECTIVES Create a better understanding of: Proposal budget development Required approvals Award administration Allowable costs and documentation Sponsor Regulations and BC Policies Grant Management Resources OBJECTIVES By the end of this session, you will be able to: Identify efficiencies in managing grant budgets Identify “red flags” and problem transactions Explain the importance of following Federal regulations and BC policies Funding Actions/Expenditures – Five Year Comparison Funding Actions increased 54% since FY05 Expenditures increased 40% since FY05 $60 Millions $55 $50 $45 $40 $35 FY05 FY06 FY07 FY08 FY09 Funding Actions $38,020 $44,357 $45,167 $48,171 $58,506 Expenditures $35,808 $38,731 $43,251 $46,704 $50,297 OSP Team Structure Fred Cromp Associate Director Financial Administration and Compliance Susan Hoban Assistant Director Jean Kane Assistant Director Proposal, Award and Financial Management Proposal, Award and Financial Management Joanne Scibilia Director Joanne Bryson Administrative Assistant Sandra Baynes Anna Dore Assistant Director Andrea Morris Assistant Director Proposal, Award and Financial Management Proposal, Award and Financial Management OSP Information Systems Administrator Daniel Terminello Sheila Freedman Assistant Director Susan Comeau Assistant Director Proposal, Award and Financial Management Proposal, Award and Financial Management Diane Fabrizio Assistant Director Proposal, Award and Financial Management OSP Information Systems Analyst Shared Research Responsibilities Responsibilities for managing sponsored programs are shared among: Principal Investigators Department Staff OSP Vice Provost for Research, Deans and Department Chairs Lifecycle of a Grant Idea Funding Opportunities ? Management & Administration Proposal Application BC Approval Decline Submission Award Compliance Re-Budgeting Expenditures Time & Effort Invoicing Closeout Lifecycle of a Grant Idea Funding Opportunities ? Management & Administration Proposal Application BC Approval Decline Submission Award Compliance Re-Budgeting Expenditures Time & Effort Invoicing Closeout Guidelines Federal Regulations OMB Circular A-21, Cost Principles for Educational Institutions OMB Circular A-110 Uniform Administrative Requirements for Grants and other Agreements with Institutions of Higher Education, Hospitals and other Non-Profit Organizations OMB Circular A-133, Audits of States, Local Governments, and Non-Profit Organizations Proposal Guidelines Boston College Policies and Procedures OSP guidance Sponsor Guidelines Proposal Proposed Budget Realistic estimate of anticipated expenditures required for the project Budget period may cross BC fiscal years Key elements Direct Costs (salaries, fringe benefits, travel, etc.) Indirect Costs (F&A - Facilities and Administrative) Proposal Proposed Budget Needs of the project must be considered carefully and in advance Costs must be in accordance with: (1) sponsor guidelines (2) Boston College policies Costs must be justified: (1) how determined (2) why essential Proposal Cost Sharing Mandatory: Required contributions on the part of the University Explicitly stated in the sponsor's program announcement Identified and/or incorporated by reference in the sponsored project award document. Voluntary becomes Mandatory when: Identified in the proposal Exceeds the sponsor's stated requirements AND Incorporated by reference in the sponsored project award document Proposal Cost Sharing Example: Sponsor requires a 1:1 match and total budget may not exceed $100,000. 50% from sponsor; 50% cost sharing from BC BC cost share may include salary, fringe benefits, equipment, related F&A, etc. Source of BC cost share must be identified and approved in advance Cost Sharing Approval Flowchart BC Approval Proposal Transmittal Form Purpose Identify - proposed cost sharing - faculty buyout - space requirements - sub-recipients Obtain necessary internal approvals (Page 3 of PTF) Allow departments/schools to maintain proposal data Maintain database of submitted proposals with OSP Submit to OSP five (5) days in advance BC Approval Lifecycle of a Grant Idea Funding Opportunities ? Management & Administration Proposal Application BC Approval Decline Submission Award Compliance Re-Budgeting Expenditures Time & Effort Invoicing Closeout Award Negotiations may be required (could take from 1 to 30 days) Pre-award costs may be allowed OSP keeps PI informed OSP Receives Award OSP notifies PI OSP Reviews Award OSP Signs Award OSP logs award for budget setup Set up can take 1 to 5 days from log in date. OSP Sets Up Budget OSP Sends Notification Budget access available OSP notifies PI, department administrator, etc. Award Award Guidelines Federal Regulations OMB Circular A-21, Cost Principles for Educational Institutions OMB Circular A-110, Uniform Administrative Requirements for Grants and other Agreements with Institutions of Higher Education, Hospitals and other Non-Profit Organizations OMB Circular A-133, Audits of States, Local Governments, and Non-Profit Organizations Award Award Guidelines Boston College Policies and Procedures OSP guidance Sponsor Guidelines Terms and Conditions Approved budget Budget period Restrictions Award Re-Budgeting Definition Transfer of funds from one budget category or account code to another Restrictions Sponsor requirements OMB Circular A-21 Prior approval, Expanded Authorities Re-Budgeting Re-Budgeting Process Email request to OSP Project ID, account codes, and amount of transfer Brief justification Sponsor approval, if required OR, OSP budget transfer form Tips Think ahead Consider allocations Re-Budgeting Allowable Costs and Documentation Reasonable Allocable Allowable Timely Consistent Original, itemized receipts or invoices Purpose of expenditure (benefit to the project) Appropriate signatures Date Document exceptions Expenditures Service Agreements For consultant or professional services Less than $5,000 Approved in sponsored project budget Standard Service Agreement Non-negotiable $5,000 or greater University bid process Procurement Services Expenditures Faculty Buyouts For faculty work during the academic year 1/6th Rule Faculty contract = 6 units Teaching, service, research Minimum course buyout = 1 unit Approval at proposal stage Tips Department standards Coordinate ECR with Provost’s Office Expenditures Faculty Buyouts Example Dr. X Academic Year Salary = $90,000 1 course = 1/6 or 16.67% = $15,000 What if . . . Proposal requires 25% time commitment? Team teaches with Dr. Y? Administrative faculty? Expenditures Summer Salary For faculty work during June, July and August Monthly rate calculation 1/9 of academic salary Previous academic year’s salary Tips “Job 2”, New Hire Coordinate ECR with Provost’s Office Sponsor restrictions Expenditures Time & Effort Certification Required under Federal regulations Quarterly review of salary charges and effort Principal Investigator or responsible official Significant changes Tips Payroll distribution vs. percent effort Timeliness Time & Effort Time & Effort Certification Example – Dr. X Proposed 1 course buyout, 1 month summer salary ($15,000 buyout, $10,000 summer) Monthly pay rate = $7,500 ($90,000/12) Buyout Monthly buyout rate = $1,667 ($15,000/9) Effort ≈ 17% (1/6), Payroll Percent ≈ 22% ($1,667/$7,500) Summer Effort = 100%, Payroll Percent ≈ 57% ($10,000/$17,500) Time & Effort Lifecycle of a Grant Idea Funding Opportunities ? Management & Administration Proposal Application BC Approval Decline Submission Award Compliance Re-Budgeting Expenditures Time & Effort Invoicing Closeout RED FLAGS Frequent problem areas Subject to extra testing during Audits Could result in cost disallowance Requires careful review by departments Red Flags Travel Especially foreign travel on federal projects Must use US flag air carrier Must document currency conversion rate Alcohol and entertainment costs unallowable Travel Advances, must check budget and chart string Use correct account codes 68901 Travel Consulting, non BC employees foreign and domestic 68902 Travel Domestic, all BC employees traveling in the US 68903 Travel Foreign, all BC employees traveling outside of the US Is this allowable? Dr. Yes has an NSF grant which is funding an international conference in Ireland. Scientists from all over the world have been invited to participate and their travel will be reimbursed by the NSF grant. One of the participants used Aer Lingus to fly from Boston because it was cheaper and more convenient. Red Flags Equipment Must be approved by funding agency Special purpose equipment is allowable Examples include: research, scientific, and medical equipment. General purpose equipment is unallowable Examples include: office equipment, furniture, IT equipment and systems, printing equipment Supplies Research and scientific supplies are allowable Examples include chemicals and lab supplies General purpose supplies are unallowable Examples include paper, pens, pencils Are any of these allowable? Dr. X just received funding to do field work in Alaska. He would like to charge the following to his new award: Laptop computer to take with him to do field work. A bookcase to match his desk for his office at Boston College. A cell phone (and related plans) so he can keep in touch with his project staff back at his institution. What should you do? Professor Jones would like to purchase a piece of equipment that he feels will greatly benefit his project. However, this item is not in his approved budget. What should you do? Professor Smith is currently the Principal Investigator for several federal grants. He wants to evenly charge his lab supplies across all of his grants. Red Flags Consultants Things to consider Process IRS Guidelines Is the nature of the work performed unique Is the individual and work controlled Is the work performed for a sustained period of time Guidance provided by HR. Service Agreement found on OSP website Use correct account code 68390 required account code for all consultants What should you do? One of your PIs comes to you and gives you an invoice payable to a relative for some data entry work performed during the semester break. Red Flags Cost Transfers Purpose Reallocate misapplied charges Remove unallowable expenses Correct clerical errors Process Cost Transfer Form Justification, documentation 90 days What should you do? Upon reviewing his expenditures for the prior month, Professor Jones noticed that some lab supplies had been charged to his NSF budget that should have been charged to his NIH budget. What should you do? Professor Jones has overspent the approved budget on his NSF grant. What should be done to correct the negative balance? Grant Management Resources List of Queries QUERIES Query Name BC_GM_BUD_ACCTD_GRANTS Navigation Description When to Use ■ Reporting Tools ► Query ► Query Viewer BC_GM_BUD_ACCTD_GRANTS ▪ Provides a high level view of all accounts in your project in Commitment Control ▪ Can download and analyze in Excel ▪ Real-time ▪ To verify balance available before processing transactions (expense reports, reqs, vouchers, payroll) ▪ Provides you a list of all projects that you are a team member of. ▪ Provides a view of overall budget of your projects from Project Resources ▪ Can download and analyze in Excel ▪ To view all projects you’re a team member of. ▪ To view other grant specific information such as account status, sponsor name, PI and project type Note: Must enter chartfield strings BC_GM_PROJ_SUMMARY ■ Reporting Tools ► Query ► Query Viewer BC_GM_PROJ_SUMMARY List of Queries (Cont.) QUERIES Query Name BC_GM_PROJ_ACCT_SUMMARY Navigation ■ Reporting Tools ► Query ► Query Viewer BC_GM_PROJ_ACCT_SUMMARY Note: Must Enter Business Unit & Project ID BC_PO_GRANTS_REQ_PROMPT ■ Reporting Tools ► Query ► Query Viewer BC_PO_GRANTS_REQ_PROMPT Note: Must Enter Req ID BC_PO_GRANTS_PO_PROMPT ■ Reporting Tools ► Query ► Query Viewer BC_PO_GRANTS_PO_PROMPT Note: Must Enter PO ID Description When to Use ▪ Provides a high level view of parent accounts in your project from Project Resources ▪ Can download and analyze in Excel ▪ To view other grant specific information such as account status, sponsor name, PI and project type ▪ Shows Req ID, Req Date, Req Status, Budget Status, Requester, Project/Grant, Amount and other information. ▪ Can download and analyze in Excel ▪ To look up status of Req ▪ Shows PO ID, PO Date, Entered by, Entered On, PO Status, Project/Grant, Amount and other information. ▪ Can download and analyze in Excel ▪ To look up status of PO List of Queries (Cont.) QUERIES Query Name BC_AP_GRANTS_VCHRS_BY_PROMPT Navigation ■ Reporting Tools ► Query ► Query Viewer BC_AP_GRANTS_VCHRS_BY_PROMPT Note: Must Enter Voucher ID BC_EX_GRANTS_EXP_RPTS_PROMPT ■ Reporting Tools ► Query ► Query Viewer BC_EX_GRANTS_EXP_RPTS_PROMPT Note: Must Enter Expense Report ID Description When to Use ▪ Shows Voucher ID, Invoice Number, Invoice Date, Budget Status, WF Audit, Project/Grant, Total Amount and other information. ▪ Can download and analyze in Excel ▪ To look up status of Voucher ▪ Shows Report ID, Entered by, Creation Date, Status, Budget Status, Payee, Project/Grant, Total Amount and other information. ▪ Can download and analyze in Excel ▪ To look up status of Expense Report List of Reports ON-LINE REPORTS Report Name Description Navigation ACR Grant ▪ Summary by account from Project Resources ▪ Enter Project ID and Date To ▪ Select Unix for the Server ▪ Ad Hoc BC Reports ► Projects and Grants ► ACR for Project/Grants TDR Grant ▪ Detailed transactions by account from Project Resources ▪ Select NT for the Server ▪ Enter Project ID, From and To Dates ▪ Ad Hoc BC Reports ► Projects and Grants ► TDR for Project/Grants Grant Balance Available Summary ▪ Shows available budget with subtotals and totals ▪ Ran from KK – (Commitment Control) ▪ Select NT for the Server ▪ Enter Project ID ▪ Ad Hoc BC Reports ► Projects and Grants ► Grant Balance Summary Report List of Reports (Cont.) REPORTS Report Name Description Navigation ACR Grant ▪ ▪ ▪ ▪ Electronic version of end of month reports Summary by account from Project Resources Can download to PDF Monthly https://myreports.bc.edu TDR Grant ▪ Electronic version of end of month reports ▪ Detailed transactions by account from Project Resources ▪ Can download to PDF ▪ Monthly https://myreports.bc.edu Time and Effort Report ▪ Reflects all labor charges for employees paid from grants ▪ Quarterly OSP emails the Time and Effort reports for certification. List of Reports (Cont.) REPORTS Report Name Description Navigation Grant Cost Sharing Status Summary ▪ ▪ ▪ ▪ ▪ Summary to date of Total Costs Provides % of Cost Sharing Obligation Met Enter Project ID Select NT for the Server Ad Hoc BC Reports ► Projects and Grants ► Grants Cost Sharing Status Rpt Grant Cost Sharing Salary Summary ▪ ▪ ▪ ▪ Summary to date of employees paid on Fund 120 Enter Project ID Select NT for the Server Ad Hoc BC Reports ► Projects and Grants ► Grants Cost Sharing Salary Summ Inquiries INQUIRIES Report Name Description Navigation TDI ▪ TDI allows you to view transactions by budget on one page. This data is as of previous day and is refreshed nightly at 6:00 p.m. ▪ Can download to Excel ▪ Ad hoc BC Reports ► Commitment Control ► TDI – PG Commitment Control ▪ Allows you to view budget information such as available balance, pre-encumbrance and encumbrance. You can also drill into the budget, pre-encumbrance and encumbrance to get transaction information. ▪ Can download to Excel ▪ Ad hoc Commitment Control ►Review Budget Activities ►Budget Inquiry ► Budget Details Other Resources Office for Sponsored Programs: http://www.bc.edu/research/osp.html Frequently Asked Questions: http://www.bc.edu/research/osp/faqs.html Federal Regulations (OMB A-21, A-110, A-133): http://www.bc.edu/research/osp/govreg.html Financial Oversight of Sponsored Projects: http://www.bc.edu/research/osp/assistdoc.html Boston College Research and Project Policy: http://www.bc.edu/research/osp/policies/principles.html CONCLUSION Create a better understanding of: Proposal budget development Required approvals Award administration Allowable costs and documentation Sponsor Regulations and BC Policies Grant Management Resources