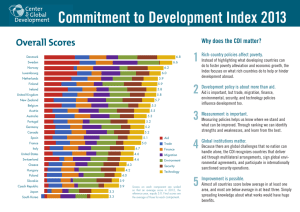

The Commitment to Development Index: 2006 Edition David Roodman

advertisement