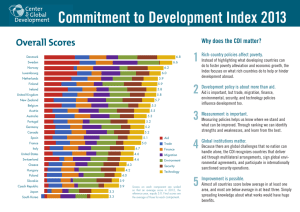

The Commitment to Development Index: 2008 Edition December 2008

advertisement