working department paper economics

advertisement

MIT LIBRARIES

|5,

2406

3 9080 03130

working paper

department

of economics

COMPARATIVE STATICS UNDER UNCERTAINTY:

SINGLE CROSSING PROPERTIES AND

LOG-SUPERMODULARITY

Susan Athey

96-22

July

1996

massachusetts

institute of

technology

50 memorial drive

Cambridge, mass. 02139

f^ic^.f

COMPARATIVE STATICS UNDER UNCERTAINTY:

SINGLE CROSSING PROPERTIES AND

LOG-SUPERMODULARITY

Susan Athey

96-22

July

1996

Digitized by the Internet Archive

in

2011 with funding from

Boston Libr^y iCoii^brtium IVIember Libraries

http://www.archive.org/details/comparativestati00athe2

96-22

COMPARATIVE STATICS UNDER UNCERTAINTY:

SINGLE CROSSING PROPERTIES AND

LOG-SUPERMODULARITY

Susan Athey*

July,

1996

Department of Economics

Massachusetts Institute of Technology

E52-251B

Cambridge,

MA

02139

EMAIL: athey@mit.edu

ABSTRACT:

This paper develops necessary and sufficient conditions for monotone

comparative statics predictions in several general classes of stochastic optimization

There are two main results, where the first pertains to single crossing

problems.

properties (of marginal returns, incremental returns, and indifference curves) in stochastic

problems with a single random variable, and the second class involves logsupermodularity of fiinctions with multiple random variables (where log-supermodularity

of a density corresponds to the property affiliation from auction theory). The results are

then applied to derive comparative statics predictions in problems of investment under

uncertainty, signaling games, mechanism design, and games of incomplete information

such as pricing games and mineral rights auctions. The results are formulated so as to

highlight the tradeoffs between assumptions about payoff functions and assumptions

about probabiUty distributions; further, they apply even when the choice variables are

discrete, there are potentially multiple optima, or the objective function is not

differentiable.

KEYWORDS:

Monotone comparative

statics, single crossing, affiliation,

monotone

likelihood ratio, log-supermodularity, investment under uncertainty, risk aversion.

Milgrom and John Roberts, my dissertation advisors, for their advice and encouragement. I

Kyle Bagwell, Peter Diamond, Joshua Gans, Christian GoUier, Bengt Holmstrom, Eric

Maskin, Preston McAfee, Chris Shannon, Scott Stem, and especially Ian Jewitt for helpful discussions. Comments

from seminar participants at the Harvard/MIT Theory Workshop, University of Montreal, and Australian National

University, as well as fmancial support from the National Science Foundation, the State Farm Companies Foundation,

I

am

would

indebted to Paul

further like to thank

and a Stanford University Lieberman Fellowship, are gratefully acknowledged.

1

Introduction

1.

Since Samuelson, economists have studied and applied systematic tools for deriving comparative

Recently, this topic has received renewed attention (Topkis (1978), Milgrom and

statics predictions.

Roberts (1990a, 1990b,

(1996)), and

1994),

Milgrom and Shannon (1994), Athey, Milgrom, and Roberts

two main themes have emerged.

new

First, the

literature stresses the utility

of having

simple, general, and widely applicable theorems about comparative statics, thus providing insight into

the role of various modeling assumptions and eliminating the need to

Second,

this literature

make extraneous assumptions.

emphasizes the role of robustness of conclusions to changes in the specification

of models, searching for the weakest possible conditions which guarantee that a comparative

conclusion holds across a family of models.

many of

Athey, Milgrom, and Roberts (1996) demonstrate

the robust comparative statics results

which

properties: supermodularity,' log-supermodularity,2

In keeping with the themes of the

new

statics

arise in

economic theory

rely

that

on three main

and single crossing properties.

on comparative

literature

statics, this

paper derives

necessary and sufficient conditions for comparative statics predictions in several classes of stochastic

optimization models, focusing on single crossing properties and log-supermodularity (Athey (1995)

studies supermodularity in stochastic problems).

Further, the results apply with equal

power when

The theorems

the additional assumptions for standard implicit function

theorem analysis are

are designed to highlight the issues involved in selecting

between different assumptions about a given

satisfied.

problem, focusing on the tradeoffs between assumptions about payoff functions and probability

distributions. This

paper then applies the theorems to several economic contexts, such as problems of

investment under uncertainty and games of incomplete information, in particular the mineral rights

auction.

and

The

parallels

analysis extends the literature in these areas,

between, a number of existing

and further

clarifies the structure

behind,

results.

Stochastic optimization problems are particularly well-suited for systematic analysis with the

tools.

It

often

seems

implicit function

that

literature

methods cannot be applied,

preference arguments, and

weak

each distinct

or too strong.

becomes

it

Further,

when

has

results

its

own

specialized set of techniques.

to consider discrete choices

microeconomic analysis

(i.e.,

whether the assumptions of the model are too

difficult to assess

the choice variable

is

a parameter of a probability distribution,

between different investments.

it

is

Additionally,

we might

many

also

areas of

auction theory) require the analysis of comparative statics in stochastic

problems where an agent's objective depends on functions which

so that

When

must often be derived using lengthy revealed

concavity assumptions are often problematic (see Jewitt (1988) or Athey (1995)), and

wish

new

will

be determined

in equilibrium,

convenient to be able analyze the agent's problem without a priori restrictions (such as

quasi-concavity or differentiability) on these functions.

A

'

function on a product set is supermodular if increasing any one variable increases the returns to increasing each of

the other variables; for differentiable functions this corresponds to non-negative cross-partial derivatives between each

pair of variables. See Section 2 for formal definitions.

2

A

function

is

log-supermodular

if

the log of that function

density corresponds to affiliation of the

random

is

variables, as will

supermodular.

be discussed

Log-supermodularity of a probability

in Section 2.

This paper seeks to address these problems by deriving systematic theorems which provide

necessary and sufficient conditions for the types of comparative statics problems which arise

frequently in economic theory.

It

turns out that a

of seemingly unrelated comparative

results in the paper,

or

more choices

to

statics results

where both can be applied

maximize

few simple theorems

from

to derive

single crossing properties in

The

and

first

class of results in this paper involve single crossing properties,

which provide necessary

in

Table

u(x,0,s)f(s;9)ds

1.

.

Consider

first

is

many

a problem

In a "mineral rights" auction,

value of the object, and s

is

problems involves

results in this paper are

sufficient conditions for comparatives statics in

and f{s;d)

class of

The main

and mechanism design.

I

One

agent makes one

problems with a single random variable, and the other involves log-

supermodularity in problems with multiple random variables.

summarized

when an

statics

the expected value of a payoff function.

work behind a number

There are two main classes of

the literature.

comparative

are at

the highest signal

contexts, such as finance, auction theory,

where an agent chooses x

x represents a player's

among her opponents; u

;c

is

her signal on the

the agent's payoff function,

is

nondecreasing in her signal (which can in tum be used to establish existence

is

of a pure strategy equilibrium

uncertainty problem,

6

maximize

This paper derives conditions under

the conditional density of the opponent's signal.

which the optimal bid

bid,

to

is

when

In an investment under

players bid in discrete increments).

an investment in a risky project, whose returns are parameterized by

s,

and

affects the agent's risk preferences and/or the distribution over the returns to the investment. The

problem can also be formulated so

that the agent

chooses the distribution directly, from a class of

parameterized distributions. Both formulations are treated in this paper.

In this

first

class of problems, the results can be succinctly

hypotheses and a conclusion.

One hypothesis concerns

summarized

in

terms of a pair of

properties of the payoff function, while the

other hypothesis concerns properties of the distribution (more general roles of the different functions

will also

be

function

treated).

The conclusion of interest

\u{x,s)fis;0)ds in (x;d): that

is,

in this class

in order to

of problems

is

(C) single crossing of the

guarantee monotone comparative statics

conclusions, the incremental returns to the choice variable (x) must change in sign only once, from

negative to positive, as a function of exogenous variable (9).

payoff function u

in s),

The hypotheses

satisfies single crossing in (x;s) (i.e., single crossing

and (H2) the density/is log-supermodular.^ The paper shows

"identified pair of sufficient conditions" relative to the conclusion C:

and further

hypothesis

if either

hypothesis

is satisfied.

fails,

of the incremental returns to x

that

is

necessary

if

HI and H2

HI and H2

the conclusion will be violated

Thus, each hypothesis

are as follows: (HI) the

are

what

I call

are sufficient for

somewhere

that the

C,

other

the conclusion is to hold everywhere

that the other hypothesis is satisfied.

The

first

class of results

characterizing single crossing

^ UJ{s;0) is

is

then extended to

problems of the form

of the x-y indifference curves, which

a parameterized density on the real

density satisfy the

treat

line,

log-supermodularity

Monotone Likelihood Ratio Property

as defined in

of/

is

is

\v(x,y,s)dF(s,6),

important for deriving

equivalent to the requirement that the

Milgrom (1981).

monotonicity conclusions in mechanism design and signaling games ."^

education signaling model, workers observe a noisy signal,

about their

the

conclusion of interest

ability,

iv{x,w(x),s)dF{s,6)

The

second

is

supermodular;

of

class

6

any wage w(x),

Firms offer wages w{x).

(x).

of x

choice

the

Then,

which

maximizes

form

U(x,Q)

6.

studied

problems,

the classic

Section

in

where each bold variable

is

the

takes

5,

numbers and

a vector of real

=

the functions

derive necessary and sufficient conditions for such objective functions to be log-

I

this

for

nondecreasing in

f

u{x,B,s)fis,B)dn(s),

JseA(x.e)

are nonnegative.

that,

is

on

(such as the results from an aptitude

6,

and then choose education investments

test)

In a variation

property

to increase in response to

is in

turn sufficient for the optimal choices of

exogenous changes

in other

some components of x and

components. Further,

in

an important class

of economic problems (those with a multiplicatively separable structure), log-supermodularity

necessary for monotone comparative statics predictions.

simplify

some

existing results

The

results

may

is

also be used to extend and

(Milgrom and Weber, 1982; Whitt (1982)) about monotonicity of

conditional expectations.

The main

result is that

identified pair

(HI) log-supermodularity of u, and (H2) log-supermodularity off, are an

of sufficient conditions

that the integral is

log-supermodular.

(in the

To

connect

incomplete information, a probability density

The

are affiUated.

result is applied to

language introduced above) relative to the conclusion

is

log-supermodular

if

and only

if the

random

variables

a Bertrand pricing game between multiple (possibly asymmetric)

firms with private information about their marginal costs. In this problem,

is

on games of

this result to the existing literature

x

is

own

a firm's

price,

9

a parameter of the firm's marginal cost, and the vector s represents the costs of each of the

opponents, which enter the firm's payoffs through the opponents' pricing strategies.

provide conditions under which each firm's price increases with

its

The

results

marginal cost parameter, which

can in turn be used to show that an equilibrium exists in a discretized game.

All of these results build

statistics literature, as

Jewitt (1987).

The

the close pairing

how

well as closely related

first

main difference

it

is

work

in

is that this

paper identifies and emphasizes the necessity of

on one of the two hypotheses lead

to

comparative

it

and further the theorems and applications are stated

wide variety of problems outside the

classic investment

In this

Second, the emphasis here

formulate the problems and select the properties to check based on the

statics,

further illustrates

changes in the other.

possible to identify the precise tradeoffs involved in modeling.

is different: I

in the

economics by Milgrom and Weber (1982) and

between single crossing properties and log-supermodularity, and

several important variations

form,

for a

on the seminal work of Karlin (1968) and Karlin and Rinott (1980)

in a

new methods

form which

under uncertainty

is

literature.

for

appropriate

The

recent

theory of comparative statics based on lattice theory motivates a closer integration of existing research

^ Athey, Milgrom, and Roberts (1996) show that a wide variety of univariate choice problems can be studied by writing

the objective in the form V(x,gix),0), and they further show that in such problems, the Spence-Mirrlees single crossing

condition (studied in Section 5.3)

variations in the function g(x).

is

the critical sufficient condition for comparative statics predictions to be robust to

in operations research

from

lattice

and

economics, and

statistics into

paper

clarifies

why

certain properties

theory arise naturally in the study of comparative statics analysis in stochastic problems.

Finally, this paper studies single crossing properties

predictions on sets of optima, or

Other authors

Diamond and

1988b,

this

who

optimum

the

have studied comparative

Stightz (1974),

1989),

when

which can be used

to derive comparative statics

not always interior.

is

problems include

statics in stochastic optimization

Eeckhoudt and Collier (1995), GolUer (1995), Jewitt (1986, 1987,

Landsberger and MeiUjson (1990), Meyer and Ormiston (1983,

1985,

1989),

Ormiston (1992), and Ormiston and Schlee (1992a, 1992b); see Scarsini (1994) for a survey of the

main

results involving risk

and

risk aversion.

Each of these papers ask questions about how an

agent's investment decisions change with the nature of the risk or uncertainty in the economic

environment, or with the characteristics of the

implicit function

methods

work

(Jewitt's

is

functions and investment or savings behavior.

from

literature

this literature in that

it

based on

is

placed on exploring properties of

Recently, Collier and Kimball (1995a, b)

develop a general approach to the study of the comparative

differs

this hterature is

an exception). The analyses generally focus on variations

of standard portfolio and investment problems; thus, emphasis

utility

Most of

function.

utility

statics associated

with

risk.

This paper

emphasizes applications outside finance, as motivated by the recent

on monotone comparative

statics,

and shows

that the

same simple theorems

many

are behind

of the existing comparative statics results.

This work

is

also related to

Athey (1995), who derives necessary and

sufficient conditions for the

property supermodularity in stochastic problems, where supermodularity

to

check in order to make comparative

statics predictions in

is

the appropriate condition

problems where the agent chooses

parameters of the probability distribution (which might interact), and each choice vanable has an

additively separable cost term.

in this

tools

In contrast to supermodularity, the single crossing properties studied

The mathematical

paper are not robust to the addition of an additively separable cost term.

used to characterize supermodularity in Athey (1995) are distinct from those

in this paper;

Athey

(1995) draws parallels between "stochastic supermodularity theorems" and stochastic dominance

theorems, basing the arguments on the linearity of the integral and

This paper

is

its

relationship to

convex

analysis.

organized as follows: Section 2 provides formal definitions of log-supermodularity

and the single crossing properties which

will

be used throughout the paper.

main single crossing theorems. Section 4 applies these theorems

to

auction

mechanism design, signaling games, and a consumption-savings problem.

theorems about problems with

game with incomplete

many random

information.

It

further

conditional expectations. Applications follow.

Section 3 proves the

theory,

finance,

Section 5 studies

variables, applying the analysis to a Bertrand pricing

shows how

these results can be used in the study of

Most of the proofs

are relegated to the appendix.

For

readers interested mainly in applications, the most important theorems are the single crossing theorem

(Theorem

3.2, applied throughout Section 4)

Corollaries 5.2.1 and 5.2.2, and necessity in

and the log-supermodularity theorems (sufficiency

Theorem 4.3);

in

definitions are concentrated in Section 2.

2.

Definitions

2.1.

Single Crossing Properties

This

section

introduces

the

which

single crossing properties

and Comparative

Statics

of the

definitions

8(t)

arise frequently in

the study of comparative statics analysis.

We

will

be

f^,

concerned with three different kinds of single crossing

properties,

which we

SC3. To begin,

let

will refer to as

SCI, SC2, and

us define SCI, single crossing in

a single variable (where

all

^\rJ

functions are real-valued

unless otherwise noted, and italicized variables are

real numbers).^

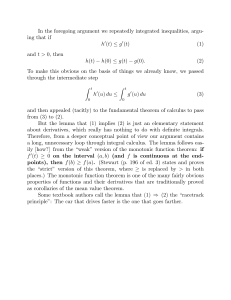

Figure

1:

g{t) satisfies

Definition 2.1 g(t) satisfies single crossing in a single variable (SCI) in

t if,

for

SCI

in

t.

all tf,>ti^,

(a) g{ti)>0 implies git„)>0, and(b) g(ti^)>0 implies g(r„)>0.

This definition simply says that

and

if g{t)

becomes

from below (Figure

if git)

strictly positive,

1).

it

becomes nonnegative as

stays strictly positive.

s increases,

Thus,

it

it

stays nonnegative;

crosses zero, at most once,

We will also be interested in weak and strict variations on SCI, as follows:

Definition 2.2 g(t) satisfies weak single crossing in a single variable

(WSCl)

in

if"P^ies S(tH) ^ 0tn > h' 8(h) >

Definition 2.3 g(t) satisfies strict single crossing in a single variable (SSCl) in

implies git„) > 0.

tn > h' g(h) ^

t

t

if,

if,

for

for

all

all

g(f)

/\z.

r^\yo

Figure

2:

g{t) satisfies

These definitions are

optimization problems:

if

h^ satisfies

increases).

SSCl

in

Further,

WSCl

in

t.

1 through 3.

SSCl arises in differentiable, univariate

an agent solves Tazxh{x,t), then h{x,t) is strictly quasi-concave if and only

illustrated in Figures

if

-x

if

(that is, the

h

is

strictly

marginal returns to x change from positive to negative as

;c

quasi-concave, then the (unique) optimal choice x\t)

is

5 Part (b) of Definition 2.1 is omitted in Karlin's (1968)

Part {b)

is

and Jewitt's (1987) work involving single crossing properties.

required for monotone comparative statics predictions

(a) allows an agent to

be indifferent between xh and

x^.

when

at r„, but the

there

agent

is

the possibility for multiple optima, since

strictly prefers

xh to x^ at

ti-

nondecreasing

below

as

t

if

and only

if h^ satisfies

SSCl

in

t

marginal returns to x cross zero from

(that is, the

increases).

Single crossing in two variables, SC2,

statics results in non-differentiable

closely related to

is

SCI;

it

is

used

= h{x„;t) - h(x^^;t)

The

definition says that if

to Xi if

increases

/

satisfies

from

to t^.

once, from below, as a function of

Milgrom and Shannon show

{x;t)

for

if,

all a;„>;c^,

SCI.

Xfj is (strictly)

ti

comparative

problems or problems which are not quasi-concave.

Definition 2.4 h{x,t) satisfies single crossing in two variables (SC2) in

g{t)

to derive

preferred to Xi for

then x^ must

ti,

still

In other words, the incremental returns to

t.

that

Note the relationship

SC2

is

be

(strictly) preferred

x cross zero

at

most

not symmetric.

is

the right condition for generalized

monotone comparative

statics analysis:

Lemma

2.1

(Milgrom and Shannon, 1994) Let

nondecreasing

If there is

in

tfor all

B

if

and only ifh

/z

:

satisfies

SR^

—> SR.

SC2

in

a unique optimum, the conclusion of this theorem

Then arg max /i(x,r)

is

monotone

{,x;t).

is

straightforward.

If there are multiple

optima, the set increases in the "strong set order," as will be formally defined in Definition 2.8;

according to this definition,

trivially

(thus,

separately

if

a maximizer does not exist, the comparative statics conclusion holds

throughout the paper, the convention of treating comparative

from existence of a maximizer

will

statics

be maintained). The theorem also holds

if

theorems

we

restrict

attention to the lowest or highest maximizers.

The comparative

This

is

is

because

SC2

statics

is

conclusion in

Lemma

2.1 involves a quantification

a requirement about every pair of choices of x

never relevant for a comparative

be necessary for comparative

statics

statics.

If the choice

statics

sets.

between two

conclusion given an objective function /, then

Many of the comparative

the quantification over constraint sets.

over constraint

SC2

jc's

cannot

theorems of this paper eliminate

Instead, the theorems requu^e the comparative statics result to

hold across a class of models, where that class

is

sufficiently rich so that a global condition is required

for a robust conclusion.

We

will introduce

SC3, single crossing of indifference curves, and other comparative

statics

theorems as they arise in the paper.

Log-Supermodularity and Related Properties

2.2.

This section introduces the definition of log-supermodularity and several related definitions from

the existing literature, highlighting the connections

detail

the different contexts in

4 of

between them.

I

discuss these definitions in

because their consequences will be exploited throughout the paper; further,

which the subsequent

the paper treat special cases of only

results

it

is

useful to

some

show

can be used. However, because Sections 3 and

one choice variable and one random variable, the

theoretic notation is not used in the text until Section 5.

lattice-

Before introducing the formal

lattice theoretic

notation and definitions, consider the special cases

of the definitions of supermodularity and log-supermodularity

way

one vector

is

greater than another if

component). Topkis (1978) proves that

if

h

vectors in the usual

-^^Kx) >

for all

(i.e.,

^j. If /i

/

cross-partial conditions

supermodular

must hold:

and only

if

is

twice differentiable, h

we

/i:??"—>SR, and

order

(weakly) larger component by

is

supermodular

if

and only

if

not suitably differentiable, then the discrete generalizations of these

is

x">xl', h{x",x_i)-h{xl-,\_i)

is

it

when

that

is,

Xj.

and only if, for all i^j, all x_,^, and all

If h is non-negative, then h is log-

supermodular.

Thus, supermodularity (respectively log-

h

is

supermodular

nondecreasing in

is

if log(/z(x)) is

if

supermodularity) can be checked pairwise, where each pair of variables must satisfy the condition that

Observe

increasing one variable increases the returns (resp. relative returns) to increasing the other.

that

it

follows from these definitions that sums of supermodular functions are supermodular, and

products of log-supermodular functions are log-supermodular.

many

Log-supermodularity arises in

consider a

demand

elasticity, £(/*)

This function

function D{P,t).

= P—^

—^—

nondecreasing in

is

,

contexts in economics.

t.

To

log-supermodular

is

A marginal

often represents

wealth and s represents the return to a risky asset)

initial

—

Pratt risk aversion,

;

,

is

function U'{s-w)

nonincreasing

(i.e.,

supermodular, that

is, if

—-—

is

In their study of auctions,

will

nonincreasing in

is

log-supermodular

is

(almost

is

if

and only

nondecreasing in 6

if the

\-F{s;d)

if

its

is affiliated if

Section

5

is that

is

ratio order

6 Formally, supp[F]

is

(MLR).

more general

and only

shows

if

"

=

= {s\F{s +

is

log-

that

the joint density,

the

property

[

£)

is

s,

F

has a density/, then the

as follows:

nondecreasing in s on supp[F] for

- F( j - e) >

log-

objective functions.

Ve > o}

all

6h>9i^.

known

as

When

the

MLR requires

that

Consider a probability distribution F(s;6).

constant in ft and

nondecreasing in

l(s;e„,e^)

A

relationship to density functions, but also in the context

statics predictions for

support of F, denoted supp[F],6

the likelihood ratio

Arrow-

Milgrom and Weber

Finally, log-supermodularity is closely related to a property of probability distributions

monotone likelihood

w

related property, affiliation,

The important point

everywhere).

interesting not only in

of deriving comparative

log-supermodular in {w,s) (where

is

Milgrom and Weber (1982) define a

be discussed Sections 4.2.3 and 5.3.

supermodularity

the price

ft

(1982) showed that a vector of random variables vector s

/(s),

if

F{s;d)

1

which

and only

decreasing absolute risk aversion (DARA)).

parameterized distribution F(^s;d) has a hazard rate which

'

if

Log-supermodularity also arises commonly in the

uncertainty literature.

utility

some simple examples,

see

This

is

The

equivalent to requiring that the density/be log-supermodular.

we

s is higher,

are

more

However, we wish

likely to infer that the distribution is

F{;6„)

to define this property for a larger class

interpretation is that

relative to

when

F(;6i^)J

of distributions, perhaps distributions

with varying support and without densities (with respect to Lebesque measure) everywhere.

general,

we

can define a "carrying measure,"

C{s\d,^,6fj)

= j(Fis;6i^) + F{s;6fj)),

we

F{;6fj) and F{;6i^) are absolutely continuous with respect to Ci\6i^,6„). Then,

'

log-supermodularity of the Radon-Nikodyn derivative

In

so that both

are interested in

These constructions can be

.

dC(s;eH,6^)

used to introduce a definition of the

MLR which is slightly more general than the standard one.^

Definition 2.5 The parameter 6 indexes the distribution F{s;6) according to the

Likelihood Ratio Order (MLR)

if,

for

all

6^ >

is

0^,

Monotone

log-supermodular for C-

dC{s;e„,ei)

almost

all Sfj>s^ in SH^.

Note

that

we have

not restricted

function k{s;6) and measure

k{s;d)

It is

>

0,

fi

F

to

such that

and ^(^;0)=£_it(r,0)J//(r)

is finite

then straightforward to verify that K{s;0) satisfies

for //-almost all

where we

Sfj>Si^ in SR^.

Consider any nonnegative

be a probability distribution.

This makes

it

fairly

are interested in a general distribution

for all

(A2. 1)

s.

MLR if and

easy to

only

if

move back and

k{s;6)

forth

F, and formulations where

"density" k(s;d) directly (for example, k will be a marginal utility in

is

log-supermodular

between formulations

we

are interested in the

many of our examples,

but

it

will

also be a probability density).

Now

consider the general

lattice theoretic

definitions,

which allow

convenient analysis of multivariate log-supermodularity in Section

5.

Given a

order >, the operations "meet" (v) and "join" (a) are defined as follows: x

and

XAy

= sup|z|z <

x, z

< yj

.

In

more

for a

set

X

notationally

and a

partial

v y = inf {z|z > x, z >

EucUdean space with the usual order,

x

vy

denotes

y|

the

maximum of two vectors, while x a y denotes the componentwise minimum. With

notation, we define two very useful properties of real-valued functions (where A!" is a lattice, i.e.,

componentwise

this

an ordering and a set which

Definition 2.6

A

is

closed under meet and join):

function h.X—>Si

is

supermodular

if,

for

all

x.yeX,

hix V y) + /z(x A y) > /i(x) + /i(y).

Definition 2.7

A

non-negative function h'.X-^Si

is

log-supermodular^

if,

for

all

x.yeX,

/i(xvy)-/i(xAy)>/z(x)-My).

^ Note that the

any two-point

MLR implies First Order Stochastic Dominance (FOSD) (but not the reverse): the MLR requires that for

on K satisfies FOSD (this is further discussed in Athey (1995)).

set K, the distribution conditional

^ In particular, absolute continuity of F{;6h) with respect to F(;OJ on the region of overlap of their supports is a

consequence of the definition, not a required assumption. Further, I do not assume that F is a probability distribution.

^ Karlin and Rinott (1980) called log-supermodularity multivariate total positivity of order 2.

In the case

where

the returns

to

X is a product set, a function is supermodular if increasing one component increases

component increases

the relative

While the primary focus

how

component.

paper will be on the case where

move:

it

6.

when we

must increase

B

Sets

in the

a/\be

B.

When we

mA^^^B

equivalent

j—\-

B

*

n5^

B

Figure

4:

*

»

»

Illustrations

if,

^\

b>a then

shown

V

A(t)

is

this paper, the strong set

of

the

definition

is

A>B

aeA and bsB, if

both a,beAnB (as

in Figure 4).

If a set

nondecreasing in t in

is

lowest and highest elements of

order will be the assumed order over

not in general reflexive.

are nondecreasing. '^

set

In particular,

Observe

sets.

A>A

if

and only

that

if

on

A

is

called a sublattice:

Definition 2.9

X

an

the strong set order, then the

of the Strong Set Order on subsets of SR.

subsets of SK", the strong set order

what

line,

for every

B

this

Throughout

real

strong set order follows:

^

t

are interested in

subsets of the

A

-*

—

ratio places restrictions

in the strong set order, defined as follows.

A

.

use the usual

strong set order (SSO), written A>B,

A set-valued function A(t) is

the strong set order (SSO) iffor any Tf, > T^, A(T„)> A(T^.

Sets satisfy A>^^fjB

»

we

and

are interested in sets of optimizers of

However, monotonicity of the likelihood

Definition 2.8 A set A is greater than a set

aw be. A and

if, for any a in A and any b in B,

»

X= 9t"

We will also be interested in changes in

definition of MLR allows the support of the

For example, the

move with

the support can

in

one

they change with exogenous parameters.

distribution F{s;&) to

nondecreasing

increasing

that

also be interested in the space of subsets of SR" together with an order

the support of a distribution.

how

to every other

as (Veinott's) strong set order. This will arise

a function and

on

remms

in this

we will

component-wise order,

known

and log-supermodularity requires

every other component,

Given a

lattice X, set

AciX

is

a sublattice

if

for

all x,

y

e.

A, x

vy €A and

Ay eA.

For example, any

comparative

set [a^,a^]x[b^,b^] is a sublattice

statics (see

As discussed above,

fact

which

Lemma

10 For

will

Topkis 1978, 1979) and

the

MLR has

more discussion of

MLR,

in stochastic

implications for

be exploited in the proofs

2.2 IfF(s;d) satisfies

of 9^^

how

Sublattices arise both in the study of

monotonicity (see Whitt (1982)).

the support of the distributions

move, a

in this paper:

then supp[F(5;a)]

the strong set order, see

is

nondecreasing (SSO)

in

6.

Milgrom and Shannon (1994) or Athey, Milgrom and Roberts

(1996).

10

Single Crossing with a Single

3.

Random

Variable

This section studies single crossing properties in problems where there

variable;

some of

the results are

summarized

in the first

and

third

a single random

is

rows of Table

1

investment under uncertainty, auctions, and signaling games follow in Section 4.

The

not in general extend to multidimensional integrals.

mathematical

results,

discussing their intuition and proof in

However, readers

analyzed, which are used in Section 4.

find

it

more expedient

detail.

These

results

by introducing

section begins

some

Apphcations

.

to

do

main

the

Several variations are then

interested primarily in apphcations

may

review the main ideas of Section 3.1, which are Theorem 3.1 (the main

to

and Definition

stochastic single crossing theorem)

3.1 (identified pair of sufficient conditions), and

then proceed direcdy to Section 4.

Single Crossing in Stochastic Problems

3.1.

This section studies the

first

main mathematical

sufficient conditions for a function of the

^:9l-^SR, /::9t^—>SR, and

of the paper, a result which gives necessary and

form G{d)^\ g{s)k{s,d)dii{s)

a measure).

is

/x

result

One model commonly analyzed

uncertainty literature, for example in the classic article

investor will increase his investment in a risky asset

with

initial

wealth

chooses

by Arrow (1971),

when

In that case, the function of interest for our analysis

^u'He - x)r + sx){s -

r)f{s)ds.

we

x

example,

are choosing

including ones where

are interested in

-

u{x„,s)

The

j:

is

to

the question of

We let g{s) ={s- r)f{s)

is

- x)r + sx)f{s)ds

and k{s\e) = u\{d - x)r + sx).

Many problems

^,

fit

into this

In another

framework,

we

g(s) =

a random variable, and

with the distribution over the risky parameter

s.

In this case,

and k=f.

the close pairing of assumptions

from Karhn (1968) and Jewitt (1987). Here, the

on the two functions

further, the results illustrate the tradeoffs

which

(g

arise

and

k)

which

is

results highlight

required for each result, and

between strengthening assumptions on one

function and weakening assumptions on the other. I will also study several cases where

made on

the functions

theorems, for example, where k

The assumption

paper.

when an

the first derivative with respect to x,

a fixed investment whose returns depend on

results in this section build

restrictions are

under

his wealth increases. Formally, an investor

maximize \u{x,s)f(s;0)ds.

how x changes

u{Xi^,s),

is

G (where

in

in the investment

an investment in a risky asset, to maximize \u{{6

x,

SCI

to satisfy

g and k which could

is restricted to

that k(s;d) satisfies

potentially

some

a priori

change the necessity side of the

be a probability density.

(A2.1) (from Section 2) will be maintained throughout the

An interesting case is where ^ is a

however, we will also allow

distribution;

probability density and

K is the corresponding probability

other interpretations of k.

UmK(s;6) may

In particular,

J—<»

vary with 6.

The support of

the

measure

K

is

defined in the standard

way

(see footnote 6).

Throughout the analysis of single crossing properties, the domain of it(;0) will be the

but this

is

without loss of generality since

we

functions' domains.

11

entire real line,

can simply give measure zero to regions outside the

The main

result involves

two hypotheses and a conclusion.

Theorem

3.1

hypotheses

The

(i)

(HI) g(s)

satisfies

SCI

in (s) a.e.-fl'^

(H2) kis;d) is log-supermodular

are sufficient for the conclusion,

(C) G(6)

= j g(s)kis,e)d^is)

a.e.-fl.

satisfies

SCI

in 6.

(HI) such that (C) fails.

If (H2) fails, then there exists a k which satisfies

(H2) such that (C) fails.

which

satisfies

there

exists

a

then

g

(Hi) If (HI) fails,

(ii)

Part

and

(iii)

of Theorem 3.1 states that the two hypotheses together imply the conclusion. Parts (ii)

state that neither hypothesis can be weakened without violating the conclusion somewhere

(i)

that the other hypothesis is satisfied. If

we wish

to guarantee that the conclusion holds for all

SCI, then k must be log-supermodular; likewise,

k which are log-supermodular, then g must satisfy SCI.

satisfy

if

we wish

g which

for the conclusion to hold for

Karlin (1968) discovered

the

all

sufficiency

part of this relationship in (1968) in his study of

the mathematics of "total positivity," although

he focused on a weak version of the single

crossing property. '^ Jewitt (1987)

to

was

apply this result in economics.

(1987) emphasis

is

the

first

Jewitt's

on the preservation of single

crossing properties of probability distributions

under integration, where the agent chooses a

Figure

5:

6

shifts k{s;9) so that the values

s to the right of s receive

more weight,

s and the values of s to the

;

left

of

distribution,

relative to

1^

We will say thatg(5) satisfies

all (w.r.t.

we wish

to

know how

that

choice changes with an exogenous parameter

of s receive less

which

weight, relative to s

hold for almost

and

shifts the risk aversion

of the agent's

utility function. 13

SCI almost everywhere-^

(a.e.-/i) if

the product measure on 5R^ induced by

/i)

conditions (a) and (b) of the definition of

SCI

(j^.sj pairs in SR^ such that s„>Si.

'^Karlin analyzes the case where both the payoff function and the expectation satisfy part (a) of Definition 2.1, under

the additional assumption that the distributions are absolutely continuous with respect to

related to part

(i)

of Theorem 3.1;

we

will

the payoff function in Section 3.2. In other

'3

economics problems, Milgrom and Shannon (1991) applies Karlin's

Thus, Jewitt's (1987) paper studies a slightly different problem, where

restricted to the difference

function

states

(my Section

one another, proving a

result

extend our analysis to incorporate a related notion of weak single crossing of

between two probability

distributions,

and k

is

(in

result.

our notation and assumptions), g

actually the first derivative of an agent's utility

4.2.2 analyzes Jewitt's problem exactly and describes the relationship between our results).

without proof that a result analogous to our Theorem 3.1

crossing condition on both payoff functions and objectives.

additional assumptions changes

(ii) is

We

true,

will

He

using part (a) of Definition 2.1 as his single

see in the following sections

which single crossing properties are appropriate.

12

is

how imposing

The

intuition

behind the sufficiency conditions

SCI,

function g{s) which satisfies

as

shown

in

is

(i)

According to the definition of log-

Figure 5.

in

supermodularity, an increase in 6 raises the relative likehhood that s

more probabihty weight on those values of

puts

where g

is

nonpositive.

While

will not cause the function to

The

this

s

where the g

is

Thus, an increase

high.

is

is

6

in

nonnegative relative to those values

change in 6 does not necessarily increase the expected value,

it

change in sign from positive to negative.

sufficiency arguments can be easily illustrated algebraically in the case

region where k(s;d)

Consider a payoff

straightforward.

positive that does not

depend on

implies that that die "likelihood ratio"

l{s)

=

6.

—

'—^^

is

there is a fixed

Let f be a point where g crosses zero, and

Then, pick 6h>0l-

for simplicity suppose that k{s ,&)[$ nonzero there.

where

Log-supermodularity of

nondecreasing. Thus,

we

it

have:

kis;ej

= j g(s)!^p^k(s;e,)dfiis)

lgis)kis;e„)d/2is)

= -jl\gis)\l{s)k{s;e,)d^i{s) + j}(s)l{s)k{s;e,)d^(s)

(3.1)

> -lCs)Jl\g(s)HyA)Ms) + lCs)\)(s)k(s;e,)d^i{s)

= lCs)\

The

first

Then

equality holds because

(3.1)

impUes

satisfies

SCI, while the

that, if Jg(5>t(.y;0^)JjU(.y)>(>)O,

addition, /(5) >1, then

will not

g

g{s)k{s;e,)d^i(s)

\g{s)k{s;dfj)diJ.{s)

be natural to assume

>

inequality follows

then

j g(s)k(s;e„)dfi{s)>(>)0 as well.

In

\g{s)k{s;di^)din{s).

>1 everywhere, and thus

that l(s)

crossing but not monotonicity; however,

we

by monotonicity of

/.

in

If,

most applications, however,

it

(3.1) is useful to estabhsh single

use monotonicity in our analysis of investment under

uncertainty in Section 4.2.1.

Parts

g(s)

and

(ii)

straightforward intuition. Consider

(ii).

If

k

fails to

there exist

increasing

relative to

*H

two

When 6

negative,

increases, S^ receives

weight relative to 5^. Even though g

the integral

may

fail

is strictiy

move. The proof of Theorem

3.1

be log-supermodular, then

regions, S^ and

satisfies

proof of part

SCI,

work.

(ii)

5^.,

such

that

positive for

all

However,

SCI.

involves

some

to

the

additional

that

(as is appropriate in those

there

is

a

fixed

region

6, while Theorem 3.1 allows supp[K(s;6„)] to

that if (C) holds

13

change from positive

6

Previous analyses of closely related

problems assume

SCI

shows

to

violating

more

problems)

throughout which k{s;d)

part

6 places more weight on Si

The function illustrated in

S«.

causes G{0)

6:

first

Figure 6 satisfies SCI; but increasing

e

Figure

have

also

(iii)

whenever (HI) holds, then supp[K(s;6)]

must be increasing

6 (strong

in

set order);

then establishes through a series of counterexamples that

it

log-supermodularity oik{s;G) follows.

Now,

consider part

surrounding point

fails

(HI), then (without loss of generality) there

Sh,

while k{s;Oi) places

log-supermodular, but G{6)

is

Observe

for parts

g

But then, k{s;0) can be defined so

fi.

function

If

(ii)

fails

SCI

nonmonotonicity oig and k are

and

(iii).

If

monotonicity

is

that k{s;d„) places all

since

nondecreasing

3.1

critical to

assumed

(for

to integrate

One

by

trick

parts;

establishing the counterexamples required

example,

if

A:

is

if

for all

to think

g which

satisfy

log-supermodularity.

fail

satisfies

a probability distribution, not a

conditions can be

it

we

illustrate this

be

will

weakened using

of

all

which can sometimes be used when one of

the

technique in Section 4.2.2.

about

this result is that the set

H

of payoff functions g which satisfy

By Theorem

together with the conclusion C, identifies whether k satisfies H2.

SCI

This

Sl-

described a close relationship which two hypotheses satisfy in relationship to a

One way

conclusion.

is

of the weight on the interval

theorem break down. Thus, in individual problems,

the structure of the particular problem.

Theorem

Sh such that

g does.

necessary to re-examine the logic described above to see

is

<

of the weight on the interval surrounding point

all

that

density), then the necessity parts of the

functions

is Sl

Furthermore, these inequalities hold throughout open intervals of positive

gisi)>0, but g(s„)<0.

measure

(iii).

3.1,

SCI, then k must be log-supermodular almost everywhere;

Likewise, the class of functions k which satisfy

H2

if

G

if not,

1

satisfies

it

must

identifies whether

g

SCI.

Thus motivated,

definition will

I

define an abstract relationship between

be used to succinctly

state the

two hypotheses and a conclusion. This

remaining theorems (as well as the theorems

in

Table

1).

Definition 3.1 Two hypotheses HI and H2 are an identified pair of sufficient

conditions relative to the conclusion C if the following statements are true:

HI and H2 imply C.

(ii) If H2 fails, then C must fail somewhere that HI is satisfied.

(iii) If HI fails, then C must fail somewhere that H2 is satisfied.

(i)

few

In the next

3.1,

which

will

sections, this definition will be used to state a

be applied in Section

number of

Variations of Stochastic Single Crossing Theorems

3.2.1.

Strict

and Weak Single Crossing

in Stochastic

Problems

This section studies variations on Theorem 3.2 where h satisfies

Weak

single crossing arises in

competition or auctions.

•4 In a variation on

hixL,t) for all

x„>xj

nondecreasing in

t;

WSCl

(Figure 2) instead of

SCI

any winner-take-all pricing problem, such as Bertrand

In those problems, increasing your bid

Lemma 2.1, Milgrom

Theorem

4.

3.2.

(Figure 1).14

variations of

and Shannon (1994) show that

by a small amount

WSC2

of

h(x,t) (that is,

(or decreasing

WSCl

of /i(%,r)-

necessary and sufficient for there to exist a selection from the set of x-optimizers which

however, the set of optimizers might fail to be nondecreasing.

is

14

is

your price) has no effect when

placed a

much

turns out that your opponent has

it

much lower

higher bid or charged a

the incremental returns to increasing your bid

low or a high

and thus

go from negative (when you would have won anyway),

lost), to

zero (when you lose with

Thus, the incremental returns to increasing your bid satisfy

WSCl.

why more assumptions are required to guarantee that the expectation satisfies SCI when

satisfies only WSCl, observe that shifting weight from the region of positive returns to the

To

gis)

bid).

signal,

Thus, as the opponent's signal increases,

(when you win an auction you would have otherwise

to positive

either a

price.

drawn a favorable

see

region of zero returns

is

consistent with log-supermodularity of k, but might violate the single

G (though

crossing property of

not

weak

single crossing).

To

such cases,

rule out

we

require an

additional assumption (non-moving support):

supp[K{s;6)]

Theorem

constant in

Assume (NMS).

3.2

(HI) g(s)

satisfies

(H2) k(s;6)

form an

is

is

(NMS)

6.

Then the hypotheses

WSCl

in s a.e.-fl.

log-supermodular

a.e.-fi.

identified pair of sufficient conditions relative to the conclusion

(C) Gid)= j g(s)k{s;d)dfi(s) satisfies SCI.

Now,

strict

consider the conditions which are required for the conclusion that the expectation has the

single crossing property (SSCl).

which shows

that

SSC2

of h{x,t)

sufficient for every selection

satisfies

SSC2,

if

an agent

is

Milgrom and Shannon (1994) prove a

(that is,

SSCl of

from maxh(x,t)

indifferent

to

h{Xfj,t)-h{Xj^,t) for all Xij>x,) is

be nondecreasing in

3.2 to study

r

for

all

SSCl, we

will

on

Lemma

2.

necessary and

When

A.

between two choices of x for a low value of

increases the agent must strictly prefer the higher of the

To extend Theorem

variation

t,

then

h(x,t)

when

need to strengthen our requirements on the

function k, as follows:

Definition 3.2 A non-negative function k(s;d) is strictly log-supermodular a.e.-jX

log-supermodular a.e.-fl, and further, for all 0„>6i^ and fl-almost all (Sf/,Sj) pairs in

supp[K{s;dJ]r\supp[Kis;6„)] such thatSf,>s^, k{s^;6^)kiSfj;d„) > k{Sfj;6^)k{Sj^;dfj).

We also need one more assumption:

g{s)-k{s;6)

Theorem

3.3

on a

set

of positive /i-measure for

Assume (NMS) and

(HI) g{s)

(H2) k

9t

satisfies

is strictly

WSCl

(NZ).

all 6.

Then the hypotheses

in s a.e.-fL

log-supermodular

a.e.-fi.

are an identified pair of sufficient conditions relative to the conclusion

(C) 0(0)= j g(s)kis;d)dn(s) satisfies

15

SSCl

in

t

two choices.

s.

(NZ)

if

it is

Allowing Both Functions

3.2.2.

There are two general

results to functions of the

to

Depend on

of sufficient conditions under which

sets

form 0(6)= j g{s;e)kis;e)d^is)

require that gis;d), in addition to satisfying

condition

is

more complicated;

where the definition

is

it

SCI

in s, is

.

The

we can

extend our single crossing

the

first is

nondecreasing in

more

6.

straightforward:

The second

we

sufficient

requires that gis;0) satisfies a variation of log-supermodularity,

extended to allow for g to take on negative values.

The following theorem considers

the first case.

Theorem 3.4 Assume (NMS) (and, respectively, (NZ)). Suppose that g(s;6) is piecewise

in 6 and nondecreasing in 6 for fi-almost all s. Then the hypotheses

continuous

(HI) g{s;G)

satisfies

WSCl

in s a.e.-^.

(H2) k(s;6) is log-supermodular (resp. strictly log-supermodular) a.e.-jL

an

identified pair of sufficient conditions relative to the conclusion

are

(C) G{e)=jg{s;e)k(^s;e)dii(s) satisfies

This result

Now

gis,0)

is

is

SCI

(resp.

SSCl)

in 6.

used to analyze the mineral rights auction in Section 4.2.3.

consider the second set of sufficient conditions for the single crossing property, where

nonmonotonic

in 6.

which does not depend on

It

turns out that

6.

Then,

we need

we have

a single crossing point for gis;6), denoted

Sq,

a well-defined extension of log-supermodularity to

functions which can attain negative values:

Definition 3.3 Consider a function g(s;d) which satisfies SSCl in s and such that the crossing

denoted Sq, is the same for all 6. This function satisfies the generalized monotone

point,

ratio property if for all 0„

>0^ and

all s"

> 5' €

{9^ \ ^q},

^^^ '^"^

gis

To

when

see

this

property might be appropriate, recall that the

investment under uncertainty problem takes the form

generalized monotone ratio property

if

and only

if the

> i^li^.

g(s ;0J

first

order conditions in Arrow's

\u'((6-x)r + sx)(s-r)f(s)ds.

g(s;9)=u\(^d-x)r + sx){s-r), then the fixed crossing point

Note

;0J

is

Sff=r,

and g{s;9)

If

we

satisfies

let

the

investor has decreasing absolute risk aversion.

we could have analyzed the problem using Theorem 3.1,

= u'{{d-x)r + sx). However, we might wish to study more

payoff function, or we might wish to analyze the problem without

that in this simple, separable case,

letting g(s)

=

f{s)is-r) and kis;6)

general functional forms for the

relying

on

first

order conditions.

Theorem 3.5 Suppose that the following conditions hold a.e.-fl: (i)for all 6, gis;G) satisfies

SSCl in s, (ii) the crossing point, denoted Sg, is the same for all d; (Hi) g satisfies the

generalized monotone ratio property, and (iv) k(s;6) is log-supermodular a.e.-fL Then,

G(d)=jgis;e)k(s;e)d^iis) satisfies

This result

on

first

is

used when

we

SCI

in 6.

study investment under uncertainty problems where analysis based

order conditions cannot be applied.

16

Comparative

4.

Single

Random

Variable

how

This section shows

conclusions in a number

the theorems of Section 3 can

of applications.

used to provide comparative

simplify and generalize

Optimization Problems with a

in Stochastic

Statics

some

statics

It is

be used to derive comparative

interesting to see

how

conclusions in a wide variety of problems.

existing results,

and provide new

statics

same simple theorems

the

The

are

applications

results in several cases.

This section begins with problems of the form \u(x,s)dF(s,d), finding necessary and sufficient

x

conditions for the choice of

problems follow

to increase

{u(x,s)dF(s,0)

how Theorem

This subsection shows

by characterizing SC2

close relationship between

the incremental returns to

3.1

can be extended to provide necessary and sufficient

x which maximizes

conditions for the choice of

section proceeds

Applications to several classes of economic

6.

in Section 4.2.

Problems of the Form

4.1.

with

\

in objectives

of the form U{x,6) = \u(x,s)dF(s,6)

SCI and SC2 from Section

x

satisfy

SCI

U{x;d) satisfies

2:

quantification over

including cases where the support might vary with 6.

were

all

Further,

the results

absolutely continuous with respect to a measure

nature of the theorems could change.

Theorem

4.1

Assume

(HI) u{x;s)

that

and only

if

It

we

assumed

/i.

that

the

we

are

Since

might imagine

that the

turns out, however, that the differences are minor, as

result:

F

is

a probability distribution.

SC2 in

satisfies MLR.

satisfies

in {x;d) if

any nonnegative function k{s;6),

maintaining slightly different assumptions than in the theorems above,

demonstrated in the following

SC2

(recall the

in 6).

The theorems developed above involved

"distributions," K{s;d),

The

u{x,s)dF(s,6) to be nondecreasing in 6.

Then the following hypotheses

(x;s).

(H2) F(s;9)

are an identified pair of sufficient conditions relative to the conclusion

(C) U{x;e)

Observe

mass

that

= ^u{x,s)dF{s,e) satisfies SC2

in (x;0).

(HI) requires SCI to hold everywhere, since the distribution can make any point a

point. Further,

that the hypothesis

we have

stated (H2) in terms of the

MLR as opposed to log-supermodularity, so

makes sense even when no absolute

continuity assumptions are maintained a

priori.

Theorem

4.1 has several consequences for the analysis of comparative statics. Consider the

solution to the following optimization problem:

X*(0,fil«,F)=argmax \u{x,s)dF(s;e)

Likewise, denote the solution to the hypothetical optimization problem under certainty (that

the agent

knows

the value ofs) as follows:

17

is,

when

x'(s, 5|w) = arg max u(x,s)

xsB

The following

4.1 for comparative statics under uncertainty (these

two consequences of Theorem

are

are stated separately because the comparative statics conclusions are slightly different in

The following two conditions are equivalent:

Corollary 4.1.1

For all u such

(i)

nondecreasing

(ii)

F

satisfies

For

(ii)

that x'(s,B\u) is nondecreasing in

sfor

X'{6,^u,F)

all B,

is

in 6.

MLR.

The following two conditions are equivalent:

Corollary 4.1.2

(i)

each case).

F

all

x'{s,B\u)

which

is

MLR, X'{6,B\u,F)

satisfy

nondecreasing

sfor

in

nondecreasing

is

6 for all

in

B.

all B.

Corollary 4.1.1 states that comparative statics results extend from the case of certainty to the case

of uncertainty

if

and only

statics conclusion,

if

the probability distribution satisfies the

X'(0,^u,F)

additional clause "for

nondecreasing in

The

B."

all

is

given a probability distribution F,

that the

comparative

can be stated with or without reference to the

6,

quantification over

MLR. Note

B

not required in the conclusion because,

is

can always choose appropriate payoff functions which make a

I

given choice of ;c optimal.

Corollary 4.1.2

that the

states

MLR

distribution with the

if

comparative

and only

result

statics

the comparative statics result holds under certainty.

if

might, however, be interested in a problem where the constraint set

over

B

in the comparative

that the quantification

result that

(i)

implies

statics statements

over

B can

(ii).

However,

might be a value ofx, denoted

u{x,s) for any value of s.

u{x',s),

and thus

With

x',

required for

is

we would not be

and

(i)

able to

(ii)

(ii) if

implies

(ii)

which maximizes U{x,6)

In such cases,

is fixed,

for

we

(i)

some

would not place any

It

turns out

are only concerned with the

because, given

6,

We

so that the quantification

of Corollary 4.1.2 would be unnecessary.

be omitted from both

it

under uncertainty for any

holds

F

and

u, there

but which does not maximize

restrictions

on the behavior of

draw conclusions about the behavior of U{x\6).

additional restrictions, however, Corollary 4.1.2 can be modified:

Corollary 4.1.3 (Ormiston and Schlee, 1993) Assume that U(x,d) and u(x,s) are strictly

quasi-concave and differentiable in x and that the optimum is interior. Then the following two

conditions are equivalent:

(i)

(ii)

For

all

F

x'(s,^u)

The assumption

which

is

satisfy

MLR, X'(6,B\u,F)

nondecreasing

in

with

(ii),

implies that u satisfies

statics

optimum allows us

conclusion because

comer

One example

is

solution. In another

ante assumptions

in 6.

the standard portfolio

to

strict

SC2; we can then apply Theorem

restrictions required in order to apply Corollary 4.1.3

problems.

nondecreasing

s.

that there is a unique, interior

over the constraint set in the comparative

is

remove

quasi-concavity, together

3.1.

that the

problem

18

However,

the extra

eliminate a variety of interesting economic

problem where the problem under

example, in the auctions application of Section 4.2.3,

which guarantee

the quantification

is strictly

we

certainty has a

cannot make ex

quasi-concave because the opponents'

strategies are

and

finally, the

42.

we might wish

endogenous;

problem has a

structure

to restrict the

problem

to permit only discrete bidding units;

where 6 enters the payoff function.

Applications

This section contains a number of appUcations of the theorems from Section

applications unify and extend

some

The

first

two

under uncertainty Uterature. The

classic results in the investment

new

3.

third application is

somewhat complicated, but

how, when bidding

units are discrete, existence (or non-existence) of pure strategy equilibrium in first

provides

it

results in auction theory:

it

shows

price "mineral rights" auctions can be derived with minimal assumptions.

4.2.1.

Investment Under Uncertainty:

How Much

to Invest in

A Specified Project

This section provides the formal analysis of a general investment under uncertainty problem.

Suppose

that

an agent's problem

Thus,

denoted x'(6,B).

and the

K

is

as follows:

\

u(k(x,s), 6)f{s,6)dn(s) and the solution set

,

represents a general retum function

of the world,

amount,

x,

well as

some exogenous parameter

state

max

The agent's

s.

6,

utility

which depends on

depends on the returns

which might represent

initial

is

the investment

to the project as

wealth or some other factor

relating to risk aversion.

When this objective function is differentiable

and quasi-concave, the optimum

the first order conditions, given as follows:

simplicity, the

theorem

is stated

is

characterized

For notational

lu^(7t{x,s),6)7:^(x,s)f(s,6)dfj.(s).

under the assumption

utility

function

is

differentiable in

its

argument, but neither this nor any other regularity assumptions are required for the following

The following assumptions

concave, and further

are

=

7t{x,s)

made

in the existing literature: the

z+x-s, or at best, 7t(x,s)

= h(x)s

the latter case; the former case has been widely analyzed).

The

problem

(see

is

differentiable

Milgrom 1995

Tt

first

result.

and quasi-

for an analysis of

generalization provided

especially useful if the function ;ris endogenous, so that regularity properties of

by

below

will

be

cannot be assumed

without loss of generality.

Proposition 4.2 In the problem

max

xeB

nondecreasing

(HI)

in

y and

\u{n{x,s),6)f{s,0)dii{s) (assuming that u{y,d)

7t(x,s) is

nondecreasing

SC2

in (x;s) a.e.-fi.

7r{x,s) satisfies

(H2) u^{y,d)f{s,6)

is

is

J

log-supermodular

in s), the

hypotheses

in is,y,G) a.e.-jx.^^

are sufficient for the conclusion that

(C) The solution x*(6,B)

is

1

5 If u is not

everywhere differentiable

[u(y„,6)-u{yL,6)]J[s;6)

is

in 9 for all B.

and quasi-concave, HI and H2 are an

nondecreasing

Further, if the problem is differentiable

sufficient conditions relative to C.

in its first

log-supermodular

identified pair

of

argument, the corresponding hypothesis can be stated as follows:

in (yi.,yH,6,s) for all

19

yL<yH-

The proof of this

from Section

"for

5).

result reUes

the case

(C),

where the analysis cannot

and the

rely

on

some

(as well as

results about log-supermodularity

and quasi-concave

If the objective function is differentiable

B" can be removed from

all

on Theorem 3.5

from Theorem

result follows easily

first

order conditions

is

in x, the quantification

Necessity in

3.1.

more cumbersome, and

omitted

is

here.

Hypothesis (H2)

is satisfied if (a)

6 decreases the investor's absolute

risk aversion,

and (b)/is

This result provides a general statement of two basic results in the theory of

log-supermodular.

investment under uncertainty, illustrating that log-supermodularity

is

behind the seemingly unrelated

conditions on the distribution and the investor's risk aversion.

important to note, however, that the necessity of HI depends on the fact that

It is

any nonnegative value, and

to restrict attention to the case

Uke

u^f can be non-monotonic

in particular

where the agent

risk aversion.

I

will

now show

that their analysis

For simplicity, consider the case where 6

Arrow model, a

Conditions:

/

\

can be generalized.

affects only the distribution,

function

by

comparative

and the problem

is

A stronger hypothesis about 7t is required: tt^^ (which is satisfied

We study the First Order

exploited by Eeckhoudt and GoUier).

fact

u'{7t{x,s))K^(x,s)f(s;6)dii(s). Monotonicity of u implies that log-supermodularity of

not necessary, and the following arguments demonstrate

is

the assumption of

and quasi-concave.

differentiable

in the

on

Eeckhoudt and Collier (1995)

= z+xs, under

analyze the special case of this model which corresponds to 7tix,s)

take

However, we often would

in s.

risk averse.

is

«,/can

parts to

statics.

show

that log-supermodularity

Eeckhoudt and GoUier (1995)

how we

can integrate our objective

of the distribution F(s;6)

call this

kind of

is

sufficient for

shift in the probability distribution

"Monotone Probability Ratio" shift. Since F(s •,6fj)=F(s •,6^=l (where s is the supremum of both

supports and s is the infimum), log-supermodularity of F implies that F(s;dfj)<F(s;di) for all s (i.e..

a

First

Order Stochastic Dominance). As a simple consequence of the analysis of Section

that log-supermodularity

of

/

generalization of Eeckhoudt and Gollier's

Proposition 4.3

max

and

is

Assume

will see

The

(apply Corollary 5.2.2).

result is then given as follows:

that the objective

is

quasi-concave and differentiable

in

x

an interior optimum. Further assume u'>0 and «"<0, and that the expected

value of the project, JK(x,s)f{s;d)ds,

(HI)

main

we

Consider the investment under uncertainty problem

^u{K{x,s))f{s,6)dn{s).

that there

F

implies log-supermodularity of

5,

7C{x,s) is

supermodular

is