Independent eva luat ion

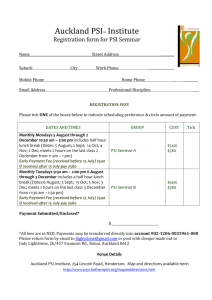

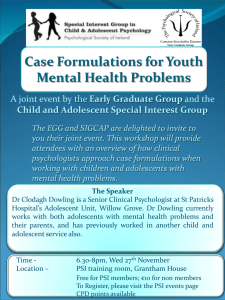

advertisement