The Photovoltaic Market Analysis Program:

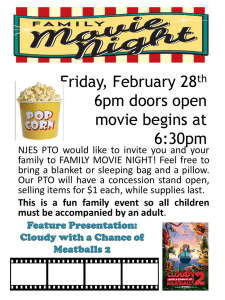

advertisement