Document 11115208

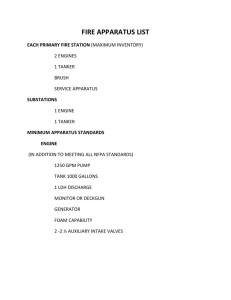

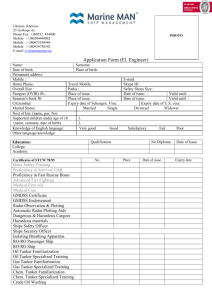

advertisement