ASSESSMENT REPORT BU110 – COST ACCOUNTING Prepared by Professor Kathleen Villani

advertisement

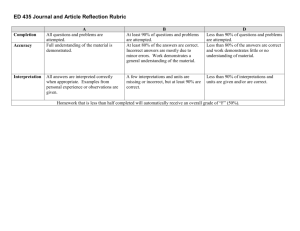

ASSESSMENT REPORT for BU110 – COST ACCOUNTING Prepared by Professor Kathleen Villani June 15, 2015 BU110 – Cost Accounting – Spring 2015 – Course and Students Assessed The Course assessed is BU110 – Cost Accounting – which is a course that normally only students enrolled in the AAS – Accounting program (BA2) will register. This course is a 4 credit, 5 hour course. In the Spring 2015 semester, two sections of BU110 were offered. The day class – Section B24, and the evening class – Section M13. Only the day class was assessed. The day class originally had 26 students enrolled of which 3 students withdrew and one student almost never attended and was given an unofficial withdrawal. Because the students withdrew at various times, all 26 students were included in the assessment but when appropriate it was noted if the student was absent or withdrew. Student Learning Outcomes BU110 Objectives: 1. Prepare a Cost of Goods Manufactured Schedule. 2. Record journal entries for a job-order cost system. 3. Prepare a cost of production report for a process cost system. 4. Prepare a flexible budget and performance report. 5. Analyze standard costs and variances, and record the appropriate journal entries. General Education Objectives: 2. Use analytical reasoning to identify issues or problems and evaluate evidence in order to make informed decisions. 3. Reason quantitatively and mathematically as required in their fields of interest and in everyday life. 6. Differentiate and make informed decisions about issues based on multiple value systems. Assessment Report – BU110 – K. Villani Page 2 of 10 Assignments for BU110 In this course, ten chapters are covered. For the lecture on each chapter, the theory is presented and explained, and then the accounting tasks are demonstrated. At the end of each chapter, Exercises and Problems are assigned to the students to do as homework. Each Exercise and Problem assigned for homework is thoroughly reviewed in class. Appendix A displays the BU110 Course Objectives, General Education Objectives, and the Assignments that relate to the Objectives. Appendix B displays sample problems. Evidence of Student Achievement Throughout the course, four exams were given. Each exam covered two or three chapters. The exam format is similar to the exercises and problems given as homework and reviewed in class. The solution for each problem on the exam is given a point value for each line of the solution for the format, the labels, the accounts, and the dollar values. On the exams are problems that cover the five BU110 Course Objectives listed above. The exam problems and the scoring on the exams are used to determine the extent to which the student learned the material and achieved the student outcome. Analysis and Summary of the Assessment Results A rubric was prepared to assess each of the exam problems that related to a course objective and hence, a student outcome. Appendix C displays the rubric. Appendix D displays the summary of the results of the rubric. Appendix E displays sample student artifacts which were used to make determinations in the rubric. Description of the Assessment Results For BU110 Course Objectives 1 – 4, the results are quite strong: 57% scored 4 and 16% scored 3 (total of 73%). Add to that the withdrawal and unofficial withdrawal (absence) which was 14% and that accounts for 87% of the students. The remaining 13% are those that scored a 2 (6%), 1 (3%) and 0 (4%). When BU110 Course Objective 5 is included, the results skew downward a bit: 51% scored 4 and 15% scored 3 (total of 66%). Add to that the withdrawal and unofficial withdrawal (absence) which was 14% and that accounts for 80% of the students. The remaining are those that scored a 2 (5%), 1(3%) and 0 (12%), a total of 20% which is a significant number of students. The downward skew is caused by the BU110 Course Objective 5 which has a total of 43% which scores a 1 (4%) and 0 (39%). This is a strong indication that this objective is not being met by enough students: 11 students out of 26 students enrolled in the course. If you analyze it in terms of students that completed Assessment Report – BU110 – K. Villani Page 3 of 10 the course, it is 11 out of 22 students which are 50% of the students that completed the course but were not successful in learning BU110 Course Objective 5. As previously stated, this course is taken by students majoring in accounting. They have successfully completed BU101 and BU102, Principles of Accounting Parts I and II. They may also have taken or are currently enrolled in BU103 or BU104, Intermediate Accounting Parts I and II. These courses – BU101, 102, 103, 104 – are courses in Financial Accounting. BU110 is a course in Managerial Accounting. Emphasis in this course is on the managerial concepts not the financial concepts. This course is dedicated to teaching and illustrating the new managerial concepts presented in this course which the students did not experience in Financial Accounting. The rubric indicates that this is successful for BU110 Course Objectives 1 – 4 but not for BU110 Course Objective 5. The recommendation is for more time to be spent on Standard Cost Accounting – about close to two full weeks of the semester. This should be made up by spending slightly less time on BU110 Course Objectives 2 (Job Order Cost), 3 (Process Cost) and 4 (Budget and Performance Report) where well over half of the students score a 4 in the rubric. Assessment Report – BU110 – K. Villani Page 4 of 10 APPENDIX A – BU110 COURSE OBJECTIVES, GENERAL EDUCATION OBJECTIVES, AND ASSIGNMENTS BU110 Course Objective General Education Objective Assignments Exercises Problems 1. Prepare a Cost of Goods Manufactured Schedule. 2, 3 1-7 1-4 2. Record journal entries for a joborder cost system. 2, 3 1-10, 1-11 1-7 3. Prepare a production report, and record journal entries for a process cost system. 2, 3 5-11 6-1, 6-2 5-1, 5-2, 5-3, 5-7, 5-10 6-1, 6-8 4. Prepare a flexible budget and performance report. 2, 3, 6 7-8, 7-9, 7-10 5. Analyze standard costs and variances, and record the appropriate journal entries. 2, 3, 6 8-1, 8-2, 8-10, 8-15, 8-18 Assessment Report – BU110 – K. Villani Page 5 of 10 APPENDIX B – SAMPLE ASSIGNMENTS P1-4 Statement of cost of goods manufactured; income statement; balance sheet The adjusted trial balance for Kokomo Furniture Company on November 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were $33,000. c. Direct labor cost was $18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of November. th Appendix B Sample Assignments copied from Principles of Cost Accounting,16 ed, VanDerbeck, 2013 South-Western Cengage Learning Assessment Report – BU110 – K. Villani Page 6 of 10 APPENDIX B – SAMPLE ASSIGNMENTS – continued P1-7 Journal entries; account analysis Selected account balances and transactions of Vista Manufacturing Co. follow: Raw materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Factory supplies. . . . . . . . . . . . . . . . . . . . . . . . . . . . . Work in process . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Finished goods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Beginning Bal May 1 Ending Bal May 31 $ 6,000 $ 5,500 800 900 3,500 6,500 12,000 13,200 May Transactions: a. Purchased raw materials and factory supplies on account at costs of $45,000 and $10,000, respectively. (One inventory account is maintained.) b. Incurred wages during the month of $65,000 ($15,000 was for indirect labor). c. Incurred factory overhead costs in the amount of $42,000 on account. d. Made adjusting entries to record $10,000 of factory overhead for items such as depreciation (credit Various Credits). Factory overhead was closed to Work in Process.jobs were transferred to Finished Goods, and the cost of jobs sold was charged to Cost of Goods Sold. Required: Prepare journal entries for the following: 1. The purchase of raw materials and factory supplies. 2. The issuance of raw materials and supplies into production. (Hint: Be certain to consider the beginning and ending balances of raw materials and supplies as well as the amount of the purchases.) 3. The recording of the payroll. 4. The distribution of the payroll. 5. The payment of the payroll. 6. The recording of factory overhead incurred. 7. The adjusting entry for factory overhead. 8. The entry to transfer factory overhead costs to Work in Process. 9. The entry to transfer the cost of completed work to Finished Goods. (Hint: Be sure to consider the beginning and ending balances of Work in Process as well as the costs added to Work in Process this period.) 10. The entry to record the cost of goods sold. (Hint: Be sure to consider the beginning and ending balances of Finished Goods as well as the cost of the goods finished during the month.) th Appendix B Sample Assignments copied from Principles of Cost Accounting,16 ed, VanDerbeck, 2013 South-Western Cengage Learning Assessment Plan – BU110 – K. Villani Page 7 of 10 APPENDIX C – RUBRIC FOR BU110 – COST ACCOUNTING General Education Objective BU110 Objective 4 3 2 1 0 90-100% format of schedule correct; and labels/names correct; and dollar values correct 80-89% format of schedule mostly correct; and labels/names mostly correct; and dollar values mostly correct 70-79% many errors in format of schedule; or labels/names; or dollar amounts 60-69% format of schedule mostly incorrect; and labels/names mostly incorrect; and dollar values mostly incorrect 0-59% all incorrect or did not do the problem 2, 3 1. Prepare a Cost of Goods Manufactured Schedule. 2, 3 2. Record journal entries for a job-order cost system. debit account correct; and credit account correct; and dollar value correct most debit accounts correct; and most credit accounts correct; and most dollar values correct many errors in debit account; or credit account; or dollar values debits accounts mostly incorrect; and credit accounts mostly incorrect; and dollar values mostly incorrect all incorrect or did not do the problem 2, 3 3. Prepare a cost of production report for a process cost system. format of cost of production report correct; and labels/names correct; and dollar values correct format of cost of production report mostly correct; and labels/names mostly correct; and dollar values mostly correct many errors in format of cost of production report; or labels/names; or dollar amounts format of cost of production report mostly incorrect; and labels/names mostly incorrect; and dollar values mostly incorrect all incorrect or did not do the problem 2, 3 4. Prepare a flexible budget and performance report. format of budget and performance report correct; and labels/names correct; and dollar values correct format of budget and performance report mostly correct; and labels/names mostly correct; and dollar values mostly correct many errors in format of budget and performance report; or labels/names; or dollar amounts format of budget and performance report mostly incorrect; and labels/names mostly incorrect; and dollar values mostly incorrect all incorrect or did not do the problem 2, 3, 6 5. Analyze standard costs and variances, and record the journal entries. computations of variances correct; and journal entries correct most computations of variances correct; and most journal entries correct many errors in variances computations; many errors in journal entries computations of variances mostly incorrect; and journal entries mostly incorrect all incorrect or did not do the problem Assessment Plan – BU110 – K. Villani Page 8 of 10 APPENDIX D – SUMMARY OF THE RESULTS FOR THE RUBRIC FOR BU110 – COST ACCOUNTING General Education Objective 2, 3 2, 3 2, 3 2, 3 BU110 Objective 1. 2. 3. 4. Prepare a Cost of Goods Manufactured Schedule. Record journal entries for a job-order cost system. Prepare a cost of production report for a process cost system. Prepare a flexible budget and performance report. SUBTOTAL 2, 3, 6 5. Analyze standard costs and variances, and record the journal entries. TOTAL 4 3 2 1 0 ABS (WU) W TOTALS COUNT 12 8 1 0 2 2 1 26 PERCENTAGE 46% 30% 4% 0% 8% 8% 4% 100% COUNT 17 2 1 2 1 2 1 26 PERCENTAGE 64% 8% 4% 8% 4% 8% 4% 100% COUNT 15 4 2 0 1 1 3 26 PERCENTAGE 58% 15% 8% 0% 4% 4% 11% 100% COUNT 15 3 2 1 1 1 3 26 PERCENTAGE 58% 11% 8% 4% 4% 4% 11% 100% COUNT 59 17 6 3 5 6 8 104 PERCENTAGE 57% 16% 6% 3% 4% 6% 8% 100% COUNT 7 3 1 1 10 1 3 26 PERCENTAGE 27% 11% 4% 4% 39% 4% 11% 100% COUNT 66 20 7 4 15 7 11 130 PERCENTAGE 51% 15% 5% 3% 12% 5% 9% 100% Assessment Plan – BU110 – K. Villani Page 9 of 10 APPENDIX E – SAMPLE ARTIFACTS Assessment Plan – BU110 – K. Villani Page 10 of 10 APPENDIX E – SAMPLE ARTIFACTS - continued