Managerial Accounting Exam Practice Questions

advertisement

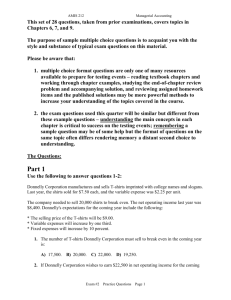

AMIS 212 Managerial Accounting This set of 36 questions, taken from prior examinations, covers topics in Chapters 5, 6, 7, and 9. The purpose of sample multiple choice questions is to acquaint you with the style and substance of typical exam questions on this material. Please be aware that: 1. multiple choice format questions are only one of many resources available to prepare for testing events – reading textbook chapters and working through chapter examples, studying the end-of-chapter review problem and accompanying solution, and reviewing assigned homework items and the published solutions may be more powerful methods to increase your understanding of the topics covered in the course. 2. the exam questions used this quarter will be similar but different from these example questions – understanding the main concepts in each chapter is critical to success on the testing events; remembering a sample question may be of some help but the format of questions on the same topic often differs rendering memory a distant second choice to understanding. The Questions: Part 1 Use the following to answer questions 1-2: Donnelly Corporation manufactures and sells T-shirts imprinted with college names and slogans. Last year, the shirts sold for $7.50 each, and the variable expense was $2.25 per unit. The company needed to sell 20,000 shirts to break even. The net operating income last year was $8,400. Donnelly's expectations for the coming year include the following: * The selling price of the T-shirts will be $9.00. * Variable expenses will increase by one third. * Fixed expenses will increase by 10 percent. 1. The number of T-shirts Donnelly Corporation must sell to break even in the coming year is: A) 17,500. B) 20,000. C) 22,000. D) 19,250. 2. If Donnelly Corporation wishes to earn $22,500 in net operating income for the coming Exam #2 Practice Questions Page 1 AMIS 212 Managerial Accounting year, the company's sales volume in dollars must be: A) $229,500. B) $213,750. C) $257,625. D) $207,000. Use the following to answer questions 3-4: Frank Company operates a cafeteria for its employees. The number of meals served each week over the last seven weeks, along with the total costs of operating the cafeteria are given below: Week Meals served Cafeteria costs 1 1,500 $4,800 2 1,600 $5,080 3 1,800 $5,280 4 1,450 $4,900 5 1,200 $4,000 6 1,650 $5,100 7 1,900 $5,400 Assume that the relevant range includes all of the activity levels mentioned in this problem. 3. Using the high-low method of analysis, the variable cost per meal served in the cafeteria would be estimated to be: A) $1.00. B) $2.80. C) $1.50. D) $2.00. 4. Assume that the cafeteria expects to serve 1,850 meals during Week 8. Using the highlow method, the expected total cost of the cafeteria would be: A) $5,300. B) $5,340. C) $4,375. D) $5,180. 5. If a company decreases the variable expense per unit while increasing the total fixed expenses, the total expense line relative to its previous position will: A) B) C) D) shift upward and have a flatter slope. shift upward and have a steeper slope. shift downward and have a flatter slope. shift downward and have a steeper slope. 7. Assume a company sells a single product. If Q equals the level of output, P is the selling price per unit, V is the variable expense per unit, and F is the fixed expense, then the break-even point in sales dollars is: A) F/[(P-V)/P]. B) F/[Q(P-V)/P]. Exam #2 C) F/(P-V). Practice Questions D) F/[Q(P-V)]. Page 2 AMIS 212 Managerial Accounting 18. The contribution margin ratio is 30% for the Honeyville Company and the break-even point in sales is $150,000. If the company's target net operating income is $60,000, sales would have to be: A) $210,000. B) $350,000. C) $250,000. D) $200,000. Use the following to answer questions 20-21: An income statement for Sam's Bookstore for the first quarter of the year is presented below: Sam's Bookstore Income Statement For Quarter Ended March 31 Sales Cost of Goods Sold Gross Margin Less Operating Expenses Selling Administration Net Operating Income $900,000 630,000 270,000 $100,000 104,000 204,000 $ 66,000 On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed. 20. The contribution margin for Sam's Bookstore for the first quarter is: A) $756,000. B) $144,000. C) $774,000. D) $180,000. 21. The cost formula for operating expenses with "X" equal to the number of books sold is: A) Y = $78,000 + $9X. B) Y = $102,000 + $7X. C) Y = $102,000 + $5X. D) Y = $78,000 + $7X. 22. Within a relevant range, the amount of variable cost per unit: A) decreases as activity increases. B) increases as activity increases. Exam #2 C) differs at each activity level. D) remains constant at each activity level. Practice Questions Page 3 AMIS 212 Managerial Accounting Use the following to answer questions 27-28: Jackson Company's operating results for last year are given below: Sales .............................. 2,400 units Selling price .................. $40 per unit Variable expense ........... $14 per unit Fixed expenses.............. $19,500 27. If the company's fixed expenses decrease by 20% next year, the break-even point will change from its previous level by: A) 150 unit increase. B) no change in the break-even point. C) 150 unit decrease. D) 360 unit decrease. 28. If the company wants to increase its total contribution margin by 40% over last year, it will need to increase its sales by: A) $26,400. B) $38,400. C) $24,960. D) $17,160. 29. Korn Company sells two products, as follows: Selling price Variable expense per unit per unit Product Y $120 $ 70 Product Z 500 200 Fixed expenses total $300,000 annually. The expected sales mix in units is 60% for product Y and 40% for product Z. How much is Korn's expected break-even sales in dollars? A) $300,000 B) $475,000 C) $544,000 D) $420,000 31. At a sales level of $190,000, Bliss Company's gross margin is $15,000 less than its contribution margin, its net operating income is $30,000, and its selling and administrative expense is $70,000. At this sales level, its contribution margin would be: A) $115,000. B) $ 85,000. C) $160,000. D) $100,000. 33. Stott Company requires one dockhand for every 500 packages loaded daily. The wages for these dockhands would be classified as: A) mixed. B) variable. C) curvilinear. Exam #2 D) step-variable. Practice Questions Page 4 AMIS 212 Managerial Accounting Part 2 Use the following to answer questions 9-11: Janos Company, which has only one product, has provided the following data concerning its most recent month of operations: Selling price ............................................. $111 Units in beginning inventory ................... Units produced ......................................... Units sold ................................................. Units in ending inventory ........................ 300 2,000 2,200 100 Variable costs per unit: Direct materials..................................... Direct labor ........................................... Variable manufacturing overhead ......... Variable selling and administrative ...... $29 30 4 9 Fixed costs: Fixed manufacturing overhead ............. Fixed selling and administrative ........... $34,000 39,600 The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month. 9. What is the net operating income for the month under absorption costing? A) $12,200 B) $8,800 C) $24,800 D) $1,700 10. What is the net operating income for the month under variable costing? A) $24,800 B) $1,700 C) $12,200 D) $8,800 11. What is the unit product cost for the month under absorption costing? A) $72 B) $89 C) $80 D) $63 Exam #2 Practice Questions Page 5 AMIS 212 Managerial Accounting 18. The Jung Corporation's production budget calls for the following number of units to be produced each quarter for next year: Quarter 1 ........ Quarter 2 ........ Quarter 3 ........ Quarter 4 ........ Budgeted production 45,000 units 38,000 units 34,000 units 48,000 units Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30% of that quarter's direct material requirements. Budgeted direct materials purchases for the third quarter would be: A) 89,400 pounds. B) 114,600 pounds. C) 29,800 pounds. D) 38,200 pounds. 19. Which of the following statements is not correct? A) The sales budget generally is accompanied by a computation of expected cash receipts for the forthcoming budget period. B) The cash budget must be prepared prior to the sales budget since managers want to know the expected cash collections on sales made to customers in prior periods before projecting sales for the current period. C) The sales budget is constructed by multiplying the expected sales in units by the sales price. D) The sales budget is often the starting point in preparing the master budget. Exam #2 Practice Questions Page 6 AMIS 212 Managerial Accounting Use the following to answer questions 20-22: The Yost Company makes and sells a single product, Product A. Each unit of Product A requires 1.2 hours of labor at a labor rate of 8.40 per hour. Yost Company needs to prepare a Direct Labor Budget for the second quarter. 20. The budgeted direct labor cost per unit of Product A would be: A) $7.00. B) $9.60. C) $10.08. D) $8.40. 21. If the budgeted direct labor cost for May is $161,280, then the budgeted production of Product A for May would be: A) 19,200 units. B) 23,040 units. C) 16,800 units. D) 16,000 units. 22. The company has budgeted to produce 20,000 units of Product A in June. The finished goods inventories on June 1 and June 30 were budgeted at 400 and 600 units, respectively. Budgeted direct labor costs incurred in June would be: A) $201,600. B) $207,648. C) $199,584. D) $168,000. 23. Budgeted production needs are determined by: A) adding budgeted sales in units to the beginning inventory in units and deducting the desired ending inventory in units from this total. B) adding budgeted sales in units to the desired ending inventory in units. C) deducting the beginning inventory in units from budgeted sales in units. D) adding budgeted sales in units to the desired ending inventory in units and deducting the beginning inventory in units from this total. 28. George Company has no beginning inventory and manufactures a single product. If the number of units produced exceeds the number of units sold, then net operating income under the absorption method for the year will: A) be equal to the net operating income under variable costing less total fixed manufacturing costs. B) be greater than the net operating income under variable costing. C) be equal to the net operating income under variable costing plus total fixed manufacturing costs. D) be equal to the net operating income under variable costing. Exam #2 Practice Questions Page 7 AMIS 212 Managerial Accounting Use the following to answer questions 29-31: Last year, Krepps Company manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows: Direct materials....................................... Direct labor ............................................. Variable manufacturing overhead ........... Fixed manufacturing overhead ............... $170,000 110,000 200,000 240,000 Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost. 29. Under absorption costing, the ending inventory for the year would have a cost of: A) $180,000. B) $248,250. C) $216,000. D) $0. 30. Under variable costing, the company's net operating income for the year would be: A) B) C) D) $60,000 lower than under absorption costing. $60,000 higher than under absorption costing. $101,250 lower than under absorption costing. $101,250 higher than under absorption costing. 31. The contribution margin per unit would be: A) $23.80. B) $25.60. C) $19.00. D) $31.00. 32. Routsong Company had the following sales and production data for the first four years of operation: Production in units ..... Sales in units .............. Year 1 Year 2 Year 3 Year 4 6,000 9,000 4,000 5,000 6,000 6,000 5,000 7,000 Selling price per unit, variable costs per unit, and total fixed costs are the same in each year. Which of the following statements is not correct? A) Under absorption costing, net operating income in Year 2 would be greater than the net operating income in Year 2 under variable costing. B) The total net operating income for all four years combined would be the same under variable and absorption costing. C) Because of the changes in production levels, under variable costing the per unit inventory cost will change each year. D) Under variable costing, net operating income for Year 1 and Year 2 would be the same. 33. Shocker Company's sales budget shows quarterly sales for the next year as follows: Exam #2 Practice Questions Page 8 AMIS 212 Quarter 1 .... Quarter 2 .... Quarter 3 .... Quarter 4 .... Managerial Accounting Unit sales 10,000 units 8,000 units 12,000 units 14,000 units Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be: A) 8,400 units. B) 8,800 units. C) 8,000 units. D) 7,200 units. 34. Shown below is the sales forecast for Cooper Inc. for the first four months of the coming year. Cash sales ........ Credit sales ...... Jan Feb Mar Apr $ 15,000 $ 24,000 $ 18,000 $ 14,000 $100,000 $120,000 $ 90,000 $ 70,000 On average, 50% of credit sales are paid for in the month of the sale, 30% in the month following sale, and the remainder is paid two months after the month of the sale. Assuming there are no bad debts, the expected cash inflow in March is: A) $122,000. B) $108,000. C) $119,000. D) $138,000. 35. Farac Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product. Production volume ..................................... 4,000 units 5,000 units Direct materials .......................................... $208,800 $261,000 Direct labor ................................................ $119,200 $149,000 Manufacturing overhead ............................ $319,200 $329,500 The best estimate of the total cost to manufacture 4,300 units is closest to: A) $695,740 B) $635,970 Exam #2 C) $665,855 D) $674,890 Practice Questions Page 9 AMIS 212 Managerial Accounting Use the following to answer questions 36, 37, 38, and 39: Kelly Company is a retail sporting goods store. Facts regarding Kelly's operations are as follows: - Sales, all on account, are budgeted at $220,000 for November and $200,000 for December. - Collections are expected to be 60% in the month of sale and 40% in the month following the sale. - The cost of goods sold is 75% of sales. - A total of 80% of the merchandise sold in a month is purchased in the month prior to the month of sale and 20% is purchased in the month of sale. Payment for purchased merchandise is made in the month following the purchase. - Other expenses [selling and administrative] to be paid in cash each month are $22,600. - Monthly depreciation is $18,000. Kelly Company Statement of Financial Position October 31 Assets Cash............................................................................... $ 22,000 ........................................... Accounts receivable Inventory ....................................................................... Property, plant and equipment (net of $680,000 accumulated depreciation)............. Total assets.................................................................... 870,000 $1,100,000 Liabilities and Stockholders’ Equity Accounts payable.......................................................... Common stock .............................................................. Retained earnings.......................................................... Total liabilities and stockholders’ equity...................... $ 160,500 800,000 139,500 $1,100,000 76,000 132,000 36. The budgeted cash collections for November are: A) $132,000 B) $212,000 C) $208,000 D) $203,600 37. The projected balance in accounts payable on November 30 is: A) $204,000 B) $153,000 C) $160,000 D) $162,000 38. The projected balance in inventory on November 30 is: A) $150,000 B) $153,000 C) $160,000 D) $120,000 39. The net income for November is: A) $14,400 B) $10,000 C) $28,000 Exam #2 D) $32,400 Practice Questions Page 10 AMIS 212 Managerial Accounting The Answers: Part 1 1. 2. 3. 4. 5. 7. 18. 20. 21. 22. 27. 28. 29. 31. 33. D D D A A A B B D D C B C A D Part 2 9. 10. 11. 18. 19. 20. 21. 22. 23. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. B C C B B C D A D B A A A C B C D C B D A Exam #2 Practice Questions Page 11