Document 11072547

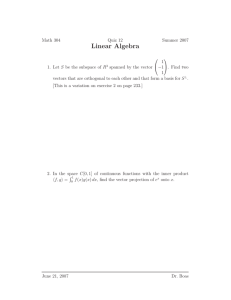

advertisement

Dewey HD28 .M414 ALFRED P. WORKING PAPER SLOAN SCHOOL OF MANAGEMENT NONLINEAR THREE STAGE LEAST SQUARES POOLING OF CROSS SECTION AND AVERAGE TIME SERIES DATA by Dale W. Jorgenson and Thomas M. Stoker WP #1293-82 ** April 1982 MASSACHUSETTS INSTITUTE OF TECHNOLOGY 50 MEMORIAL DRIVE CAMBRIDGE, MASSACHUSETTS 02139 NONLINEAR THREE STAGE LEAST SQUARES POOLING OF CROSS SECTION AND AVERAGE TIME SERIES DATA by Dale W. Jorgenson* and Thomas M. Stoker*' WP #1293-82 April 1982 Department of Economics, Harvard University Cambridge, Massachusetts 02138 Sloan School of Management, Massachusetts Institute of Technology Cambridge, Massachusetts 02139 NONLINEAR THREE STAGE LEAST SQUARES POOLING OF CROSS SECTION AND AVERAGE TIME SERIES DATA by Dale W. Jorgenson and Thomas M. Stoker Introduction 1. The purpose of this paper is to discuss the estimation of exact aggregation models by the nonlinear three stage least squares method (NL3SLS) of Amemiya (1977), Gallant (1977), Gallant and Jorgenson (1979), Jorgenson and Laffont (1974) and others. In exact aggregation models there is a unique correspondence between individual behavior and aggregate behavior. This property, known as recoverability , makes exact aggregation models appropriate for the analysis of individual data, average data or both in combination. In this paper we consider estima- tion using both cross section data on individuals and average time series data. We present the estimator, discuss its properties, demon- strate its similarity to linear pooling estimators, and indicate its computational advantages over other nonlinear estimators. The structural form of exact aggregation models for individual agents is Y ikt = X kt where k indexes agents, q dependent variables, 6 i t x^ ( V (i = 1, 6) indexes time periods, y lKt = (x^, ..., x ) , i .... = 1, q) ..., q are is a Q vector of pre- dictor variables which may vary over both agents and time, and p is a vector of variables which vary over time, but are constant across agents 074494* The Q vector of coefficients in a given time period. function of p for = 1, i & (p t> 6), is a and an L vector of structural parameters, 8' = (6 ..., Q^) All restrictions, including cross equation and exclu- ..., q. sion restrictions are embodied in the form of g^ (p 9), , i = 1, ..., q. We write the system of structural equations for each individual in vector format as: = ® (I *kt q ^ <V B (1) 6) where: = y kt b (p t e )' , (y (^ = matrix of order lkt' (p t , W' •'•' e)\ • •> (p e q t . e )')' and is the identit y x q By averaging (1) over agents for each time period, q. we obtain the structural model for averaged data as: = yt where y (I q and x ® *t } B ( V (2) e) are q and Q vectors of averages of y kJ . respec- and x fct tively. The recoverability property is reflected in the fact that (1) and (2) display the same parameter vector g (p ,6). 6 and coefficient vector Moreover, the forms (1) and (2) are necessary and sufficient of x for the recoverability property, if the population distribution kt is unrestricted (c.f. Lau (1980)). , Many examples of exact aggregation models can be found in the The simplest structural form, which underlies most discus- literature. sions of pooling time series and cross section data, 2 is the linear model. y where (1) = ikt and 8 P li t + *kt 9 (1 = l ' 2i are vectors of constant parameters. 6 and (2) consists of the elements of 8 , 9 „ i , = ••" q) The vector 1, ..., 9 of q, For illustration of more general exact aggregation structures, All examples of the we present some examples from demand analysis. Gorman Polar Form are exact aggregation models — the linear expenditure system introduced by Stone (1954) and the various S-branch utility models such as those in Brown and Helen (1972) and Blackorby, Boyce and Russell In exact aggregation form, each equation of the linear expendi- (1978). dure system appears as: = y ikt where y.. (p C it i c P " bi i \ denotes expenditure on good U> i + b \t i by family k in period t, denotes total expenditure and p' = (P lt , •••» P (common) prices at time ..., c and b , 1 ..., b , t. The vector and x' 9 ) M^ is the vector of fc consists of the parameters c, = (1, M.,.)- Of more recent interest are the AIDS system of Deaton and Muellbauer (1980) and the translog model of Jorgenson, Lau and Stoker In our format, the AIDS system appears as: (1982). = where I -~ v., lkt c., I l , i kt meters a,, ) + t The vector \t £nMkt inHr- =a o + !! a. £ + In p, it consists of the para- j l Pn M. )Mkt t in p.^. a ..., * n p.it i.i are as above, and Jn P and p M, In p n ^ it £j rc + (a ^ikt b, 1 , q .... h , and c,,, , ..., il q c , and 1 x. kt qq = (M, kt , M, kt The translog model of exact aggregation appears as: . — a y = ikt ( . + E b . . in p . > dtf^ Hb.isA R let S where D(p > = -1 + Z b D(p in p. t t t A M \t u skt ) Y lkt . ; in mp7 \t kt - \ as before, and A and p t fc gkt> i s = 1, ..., S denotes S demographic variables such as family size, age of head, etc. .... b , b* , ..., M qq M. ICC A J.KC The vector r .... bj Kt A s SKl , ). 6 consists of the parameters a-, 1 m and b , ..., b Mq , and x^ = In each of these examples, (M^, ..., M^ a , b, , q 11 in M^, the theory of consumer demand places contraints on the parameters of the model, which reduces the size of the parameter vector 6 In the next section we formally present the model and stochastic structure, as well as the assumptions required for estimation. present and characterize the NL3SLS estimator. We then We conclude with an empirical example involving substitution among different types of energy in the United States. Stochastic Structure and Instrumental Variables 2. We begin by assuming that ods under consideration, with K For each t = 1, t ..., T denotes the time peri- the size of the population at time t. and the averages we observe the vector p ?y k t = (t In addition, at time ' N < K : i.e. t o we observe t o T) 1 set of size we observe a cross section data and y, kt for k = 1, x, t kt . . . , N. o o For individual behavior, we assume that the model (1) is correct up to a stochastic component section data is then: e . The model representing the cross The model relatingb y3 for each individual. v, kt y where u = x') (I 6 (p t = L Z e. / Kl + K I v _Kl k l , k 6*) + u , K / t (t = 1, , t t to x t and pK e, . l covariance matrix ft e, . kt e. e, . k' distributed independently of v 4 t and of t, k , t , , For the moment, we assume that these and v, : kt , are independent v, is distributed with mean kt f t'. t and definite covariance matrix and positive r t' kt and positive definite is distributed with mean or e, (Stochastic Structure) 1: for k 4 k' (2*) .... T) We make the following assumption about the errors Assumption is then: t for all k' and ft ft £5 for k , 1 v . v kt is / k or t'. are known; later we replace parameters by consistent estimators. From Assumption we have immediately 1 that: E (u u;,) t =£ = and : + (ft e , ft v ) t , otherwise , = t', (3) E (e kt U o P V = % t = t . t o , (4) = We denote + n P. by ' v e fl u otherwise , . To consider estimation of the complete model, we stack the equations (1') representing the cross section as @ Y = (I where Y' (y m x) 3 y^ o , o , (p t + 9*) , e (5) , o ..., y m y , o 21t ... , , o y 2Nt .... , y o ) o is the Nq by 1 matrix of dependent variables, X is the N by Q matrix with kth row x' Kt and , c distributed is the Nq by 1 matrix of disturbances, O and covariance matrix with mean fi @) I . We represent the aggregate equations (2') as Y wnere i = 11* is the Tq by 1 x 2 8 1 (p f 2 , 8*), (9*) + u 12' (6) . * * * ' IT* 21* "**• ..., 5j, 6 1 (p T , 9*), x^ 6 disturbances, distributed with mean u ® * * * ' a1 " * " ' 2 ( P ' P ' where P = diag (1/ *^i Pl , 8*), aT ' matrix of average dependent variables, f(9)' = is the Tq x 1 matrix of structural terms, Q ?t ' (x' .... x^ 6 (p q r 8.(p., 9*), 6*)) and u is the Tq by 1 matrix of and covariance matrix 1/^). The model describing all of the data jointly is obtained by combining (5) and (6), taking into account the covariances (4). To faci- litate discussion of the pooling of time series and cross section data, it is convenient to transform (5) and (6) to eliminate heteroscedasticity over time periods and to produce zero correlation between individual and average disturbances. Heteroscedasticity is removed by transforming where P where diag = ' (I (I © (x) v P — q ..., (v^T.., P" ) 1 Y ) vIL,) (10 = by @ I P~ , standard population size correction, as in: a , (6) P" 1 ) f u has covariance matrix Q (6*) + (I u (x) ^-s P" 1 ) u (7) , I„. I The individual-aggregate correlations are removed by a nonsingular trans- formation of (5) and (7), which is equivalent to replacing y v^K , and >^K ^ -'tt'tt oooo tt oo y* o *t y* in (7) by u - Q (y t Q ( o = u* Q ( *t jP- o t x* y cs ) , *cs> ' and Jk u* tt' oo , x on where o IT t o (8) o JL - Ut o v^K , >^K o o o t ics ) . o and e x represent the cross section averages of y, x and e, , y v cs cs -'cs' and Q satisfies: Q (n u -(n/k )n t o e ) q* = n (9) u where Q can be determined uniquely from consistent estimators of £2 and After applying both corrections, we stack the individual model fi . (5) and the transformed aggregate model as; = (I X) s (p t , e*) + e , (10) y* = f* (e*) + u* , and denote the full system as; Y = f (6*) + U (11) , and covariance where U' = (e', u*'), which is distributed with mean matrix " T. = E(U'U) © h = "u © T 1 The existence of a transformation which separates cross section and average time series disturbances, such as (8), does not require the specific stochastic assumptions employed here. 3 However, on the rplfvance of the correction (8) are in order. a few remarks First, ignoring the correction (8) in the NL3SLS procedure amounts to ignoring the individualaggregate disturbance covariances, which affects only the efficiency of the estimator and not its consistency. Second, the importance of the cor- rection depends on the size of the cross section relative to population size. In many applications, will such as the example given below, N/K o be extremely small, with the correction leaving the data unaffected. Typi- cal numbers for an analysis of U.S. household demand behavior are N = 10,000 and K 70 million in 1972. Only when the cross section sample size is 10 of the same order of magnitude as the population size will the correction yield significant benefits; otherwise it can be ignored. Before presenting the additional assumptions required for esti- mation of the complete model, we introduce instrumental variables. often appropriate to treat some of the predictor variables x It is and p as endogenous for the individual observations, the aggregate observations, This can occur when the model is a simultaneous equations model or both. in exact aggregation form or part of a larger system of simultaneous equations. For example, in demand analysis the aggregate data on prices can reflect both supply and demand influences, requiring aggregate instruments, with individual total expenditure and demographic variables exogenous. Alternatively, in study of savings, errors in variables may necessitate a instruments for the individual data, while in the average data such errors may be negligible. We assume that there are s-vectors ,k=l, z, _ kt for instrumenting the individual data and s-vectors used for instrumenting the average data. with rows 1 and z, kt t I q Z z , Denote as Z respectivelv, and as Z the matrix: z ® w Z o = I q © Z . .., N used o t = 1, ..., T and Z the matrices 11 Following Gallant (1977), we make the following assumptions: Assumption The parameter space of 6, say 0, is compact, 2: with the true value an interior point. Assumption The components of , i = 1, . . , q, are twice continuously dif ferentiable in 6., j = 1, . .., L. 0) and 3: 6 . (p 9) , Fo r the next two assumptions, we use the notation &] (p , . 8. (p to refer to the vectors: 3 i 6 (p i = 6) f ( 6 3 il _ y~6~ ' 2 wnere 6. (P i y; t' " ( iQ ' 2 6. 3 P B 'fTT y ••" 39. 39 8. n 3 n •••' ' is tne mth component of 8. (p 39 n 39. ; ' 9). Assumption 4A (Cross Section). The matrix N -* n! h K F z ^ikt kt Ez kt K k N Z o 'Z o converges to a positive definite matrix as The Cesaro sums, °°. ( — - x o ( o h o x ^kt- (x o kt kt (p B i t 6))( o (p £ kt 6 o i (p e t o ^kt J o e)) t • o ». ~Kt 6 j e (p t • ° » . 9) 12 converge almost surely uniformly in =r.i :. 1 = 1, ;. . . . , _ N : K z suir ~ l — .. s'k t o for all i, 9, = 1, (x kt £ £ ' o ( i e) ?t ' £ 2 = s-kt = 1, and s' (x o kt s o ( i pt B . o »l. ...,q;j, ..., where s, z £. = 1, — The matrix + », |iK t (y k\***t |^ i t Z'Z converges to a positive definite matrix The Cesaro sums, -x; it ( (p >'it-^ (x; t s. 4 Cp t B t 9)) , i <V , e)) converge almost surely in 4=1, . . . , L. The sums 6, (y ..., is the s'th component of z , Assumption AB (Time Series) 2S I ..., The sums, L. are bounded almost surely for all i = l, "_ j jt 6)) -x;B. (p t , e)) ' , for all i, j = 1, ..., q and 13 ^:sc ?s T i s (x; , p t t B))| . , t izs«p e i ' 1 u; s,t 5. " (P t , 8))L t are bounded almost surely for all = 1, and s' L Assumption - N,T « -*• (M* xo I N is ..., q j, 1=1, the s'th component :: .. z_. The matrix 5: —+— ;-- where z w I, ..., i=l, + >'*) x' ', is nonsingular, where M xo and M Assumption z kt and (Identification). 6: is identified by the instrumental variables (11) :£ are defined In equation (16) c: the next ;e: x z ; i.e. the onlv solution of the alnost sure t' o limits l2a: » N K -* as O (i = T -* <= Y l t v ^t *t (y it " 5 £ t i (p e)) t' = 1 :::- ° (i = 1, is the true value 9 . -/ ..., q) 14 Assurr-tirr. - Ass .-' linear ridels. 1 art n :- :;::; = ;-.: standard re ] and -1 -A, 5 : - : _s_al '.-- r: Jefinitiot :: i _ s titr rcdel ar i - :r _ _ er:al A5sur.rr.c- t is ar.alo- variables for lir.ear plieitly separated the ass_rrti:h5 tire series rrrel ir. se:ere:e HL3SLS estimators for e;: the :r:;s settitr. tttdel iff 11a " iirsreter a of -.on- - - 1 r a : .irerer.ts retlaie the usual large sarrle desitr !=::::: ass_rrti:rs :: lirear thetry. ;:-= : 111 vector ir. :r :r:;s =e:- the :rier t: facilitate the distussicr of cars set. the stlution :: _ A rsra eter -. is ide _ tified in the almost sure lirit the true value. Sinilarlv, is necessarily e:_a_ t: is identified tire series If it is uniquely determined ir. the E .'r . a We i:llett all rarareters idertified ir the ;r:ss settitr. ir . B art all if , all rarareters the identified renairiri tarareters ir. ir a the tine series vector '-' ir. a vector r. 3. rhe BL3SLS e;::r;::r r :: (e))' [i " l; found a; the __ V _ al-e :: - siiid miniiaizej -• = a) e : . - 1 . :: -.era © % u v> is a ;::;:;:£-: explicitly £:::r£::r ::' I as S, I 5 can B writter =:ra be ;.- S = (8) S^ + (6) S (9), 13 m. th : ~~ - a • = - -: 5 :. s( 9 ) = (y* - f* --ere clearly 5" and S section and average nodels ~Lzez z: esrirate similarly, 5 7 , f t : ~ ::"-;; t* - _ : fox the could idually I -- f* ere NL3SLS objective functions cross "- 1>« for fixed values of the regaining rararete:- could re niririzei to estiaate tara-eters could re estimated fros strair.s , (8))'[sy 7 ;- ^ ; (c : ::;: the estirated values froa cross B. data ee: sectier ar.d If 6 * 6 = minimizing f . then all 1- tire settee data :: - - -. - 16 The advantage sets to be equal, which results in efficiency gains. froir pooling lies in obtaining more efficient estimates. Note that S and the moment matrices Z 9 can be evaluated using only (6) 1 X, o and (I Z'Z o o (x) Z y~-' q ' o ) Thus for estimating Y. or other more restricted parameterizations of B(p ft 9), only one pass , through the cross section data is required to construct these moments. This is the main computational advantage provided by exact aggregation models. The estimation procedure consists of three steps: consistent estimators of and ft E ft U ; find First, second, minimize (12) to obtain 6: ' third, calculate the asymptotic covariance matrix of 9. If 9 is not empty, then we cannot improve upon previous suggestions in the lit- erature for finding consistent estimators of and ft e ft : u for example, Gallant (1977) suggests estimating each equation of the model by This involves pooling both data sources on a single equation NL2SLS. basis , forming ft as the estimated residual covariance from the cross section data, and forming ' ft u as the estimated residual covariance from the average time series data. The more usual situation is that a simpler procedure. 9 is empty, which suggests First, obtain consistent estimates of 6(p , 9) by o (linear) 2SLS estimation of each equation using the cross section data. The estimated residual covariance matrix provides a consistent esti- ft E mator of ft even if 9, is not empty. Using the consistent estimators 17 of 6(p G), , t Holding 9° solve for consistent estimates of 6°, say 6°. o fixed at estimate the remaining parameters of , 8 by applying NL2SLS to each equation of the model or NL3SLS to the system as a whole, using only the time series data. als, provides fi u a The estimated covariance matrix of the NL2SLS residu- consistent estimator of usuallv produces eood starting values for fi 6 u In addition, this procedure r . ' to use in minimizing (12). The objective function (12) can be minimized using a variety °f well known computational methods. A convenient one that illustrates pooling cross section and time series data is the Gauss-Newton process. To discuss this method we require the following notation: Let B (e) denote the matrix: o < Pol B o 1 > = (6) I where B 6 > oq J is the Q by L matrix with jth column g^ Qi (p , 6) , i 1, , o j = 1, . . . , * where i= l, ij^ (0) Let L. ty (0) denote the matrix: * (6) *q < = (e) P > is the T by L matrix with t,j element --..q, j = 1, ...,L and t = 1, ..., T. /i< x' 6^ (p , 0), for q, 18 The Gauss-Newton process is an iterative procedure for finding 9 from an initial value 6,. 9 l = 9. + A 9. by first linearizing the system (11) with is updated to 9 respect to the current value 9. At the ith iteration, 1 as: © Y - (I X) 8 (p , ~ 9.) ® (I X) pQ A9. (9.) + E , o (14) Y* - f* (9.)^ (6.) i> Ae - + u We then apply Zellner and Theil's (1962) linear three stage least squares method to the model (14), obtaining: = A 9. (M xo l 1 +K) x (M + M eo u ) (15) , where M xo M M M eo x = B (9.)' = B (9.)' >o "o i v e _1 e 1 (9\)' (ft" = (9V (n (Z o 'Z o ooo _1 X'Z © ZCZ'Z)" !') * (x) Kz'z)" _1 (Z 'Z 1 1 !') B ro (9.) (Y-(I (x) q^^ Z' X) o ) ^ (x) (fi l —' X'Z o fx) = ^ ii _1 _1 (Q Z') ) o (6 i i ) (?*-f* (0,)) . X) 6 (p^ t , 9.)) i 19 Convergence to 6 is achieved when A 6. becomes sufficiently small. In practice, however, we have found Hartley's (1961) suggestion useful, namely, we check whether S(9. + A 6.)< S(9.) by forming ment in 1 at which point a new iteration is performed, or, is found, S we shrink if not, r_. Checking continues until either improve- + A 6./2. = 9. 9 ; if the current increment falls below a convergence criterion, 9=6.. we have found l Under our assumptions the NL3SLS estimator T * 9* as N, <=, 5 is consistent for and asymptotically normal with asymptotic covariance matrix: AVAR = (6) (M* xo + M*)" 1 x (16) , where the *'s indicate (15) evaluated with the true values H (c.f. Gallant (1977)). and .". The precise form of the limiting normal distri- bution depends on the way that N and T approach infinity; however, a + M )~ consistent estimator of AVAR (6) is (M in any case, so this problem is of secondary concern. Several points of interest arise from a closer inspection of (15). if 6° = First, the relation to linear pooling estimators is apparent; for example, 9 = 9, then: A 6. = (M xo l where A 6. l )~ x (M + r. M v-1 x' and A 9. are the l xo A 6" l + M Gauss-Newton x A 6.) 1 , increments from minimizing :: = . .- : ; = '- i I - . I ' - . i 'IT :.~r V - -_- --- - --------- ------ --z . - ' - \ . - ,_--: - OTU 0* - - --------- - -------- - '), - i I' Z* U '- u :.:::- r-= ilch satisfies g(e = t 1 ::=::::.:£: ::r i_. . _- tions ; r .: - (p) = (Y - *(g(c and ;;::£-;- = - r 1 : ? •-- .- ---..-- og —Ls. . ' - - - - - - - - : " ; --:er :'- = -.'-'. - - - :: ' 5_ . r-it£ :£5t statistic . - :;:-.:; : Gallant ::~ )CL Ls : :; : 5 | £ ~ f. .1 of S sis to : -T£; aE is r -1 pro tiod idek : is - r. analogous the to ~;-i~~ as t r i c e = :r;~ r. ~ = ;: 22 of S Z can be used in evaluating (17), the desirable monotonicity condition (p) - S(5) both S r will be guaranteed if the same > and S. is used to evaluate I the original consistent estimates Thus, and ft e in estimating 9 ft u used should be used in finding estimators for restricted ver- sions of the model. The final topic we consider is the estimation of 9* subject to inequality restrictions. For example, in demand analysis, an integrable demand system must obey the condition that the Slutsky matrix of compensated price derivatives is nonpositive definite. 9 The unconstrained estimator need not obey such restrictions for finite samples: thus, it may be desirable to impose them. We represent such restrictions for- mally as * m (6) > — where we assume ponent of <£ m m , = 1, .... M' (19) , dif ferentiable in each comto be twice continuously J 9. The inequality constrained estimator the constraints (19). 9 minimizes S(9) subject to This estimator corresponds to a saddlepoint of the Laeraneian function: f, = where X S(9) + A'<J> is a vector of M' constraint functions. (20) , Lagrange multipliers and e £ = v is the M' vector of The Kuhn- Tucker (1951) conditions for a saddle- point of this Lagrangian are: V $ S(9) + V ($(9)) = , 23 and the complementary slackness condition: = X'<$> X , >_ , - r where *(8) is the M' byL matrix with i, : . . 1 ; To obtain the estimator in (14). we begin by linearizing the model as E Next, we linearize the constraints as c(e. where . - .~ element j +1 ) = i (e.) i + a i (5.) i , is the current iteration value of the unknown Darameters. 6 He i then apply Liew's (1976) inequality constrained linear three s:age lea; squares method to the linear model, obtaining: = a"e i &Vl + Cm x: _1 + m x x* (e.)' i ) i , where & 0. is giver, by (15) and \* is the solution of the linear complc mentarity problem i (5.) (M l x: + M _1 x) i (9.)* X l + f & 6 B - - (9 i ) - > — , where i (e\) 1 [m XO * S r1 X' i 5.) 1 f x + [i a x &e ] X > x t (e )]' x • = :. 24 Given + 6. A 9. i i m that satisfies the constraints (19), we update to 6 = 1, and check that both S(e...) l+l ..., M'. < S (6,), and that l <j> 6 = > m (6.,,) i+i — 0,' If not, we shrink the increment vector as before, until either improvement is found or the increment values fall in absolute value below a convergence criterion. the NL3SLS estimator. This concludes our discussion of 25 Example: 4. Household Energy Consumption The purpose of the model we employ to illustrate the nonlinear three stage least squares estimator is to characterize household demand The basic assumption of this model is that each household for energy. First, total expenditures are performs a two stage budgeting process: allocated among all other goods and an energy aggregate; second, total expenditures on energy are allocated among four individual components; electricity, natural gas, gasoline and all other fuels. Since the rela- tive prices of the components under consideration are not constant over time, the existence of an energy price aggregate for each household requires homothetic separability of the four types of energy and other , goods. 9 As is now standard in demand analysis, we begin with the indirect (dual) subutility function corresponding to the four types of energy: P/ Pi V V —— f-=^ (21) ) denotes total expenditures on energy for family k in year where M the p. = , i = 1, ..., A, t and denote the prices of the four energy components. We assume that all relevant differences among households can be parametrized by a vector of characterisitcs A^ , so that (21) can be rewritten as: 26 V = (—,... V kc )T ^ where V types ::" as c:~« is , a. ) (22) , Kt .-•- to all househrlcs. The relative demands for all four energy are found by an abdication of Rcy's (1943) Identity : •• :_ a . ** v .--. ikt P^/H^ In : I 3ln 1 Pqt /\ t (i = 1, •--.are ponent, i = A) , (23) the share of energv expenditure allocated to the ith con- 15 -"_... ..., 1, . . . 4. , To make the above model operational, we postulate a translog form for the function V: p. 4 = it a, Z + L- rr^- 4 = p 4 X J b, "« i=l j=l let , in "" — - it "kt p. r it *n "" "kt (24) + _ b , 1=1 s=_ . is As.-;t . I = -1 a, : , i=l : i=i b A 1S = o = b — tz M. „ let The required homogeneity of degree -1 of i=l in . , *. irt:.ies ; = 1, ..-, 4, 1J (25) s = l, ..., s. 27 The system of demand functions (23) can be generated by atilit maximization under symmetry, that Is, b. — monotonicity « b. . i,j = 1, ., Symmetry can be imposed directly, while mono- tonicity restrictions take the form of inequalities: factorized as B = LDL' ..., 4, ..., , nst for all positive share values the matrix B = (b..) be nonnegative definite. D = diag (5 ...,£, and where L is a unit lower triangular matrix , B is nonnegative definite if 6. ). £ Let B be Cholesky where from (25), at least one '£ is zero. . 0, i £ = 1, i-pose all of the "<.£ homogeneity and symmetry restrictions at the outset and impose the monotonicity restrictions if they are required. Application of Rcy's Identity (23) to the translog form (24) yields share equations of the forn " V ikt = a XV + ± + In P 3t "is s ;, A skt . these are the structural equations of the model; we add term E *. . lkt =. -. ** (26) stocbastic : 4 -w., lkt = a. l + S + £n o. it J b.. I . liJ . j=l = We assume that the vector e* kt zero and covariance matrix 7i* £ holds. (i - 1. Ve treat M. and A, , s b". I , s=l is A . skt + s*. lkt . (27) is distributed normallv with ~ea~ (e* ) lkt and uncorrelated over time and over house- as exogenous; therefore, 28 with E* we assume that these variables are uncorrected t . Notice that of the indivican be interpreted as representing omitted attributes e* kt included attributes dual household which are uncorrected with the A^. squares estimator We can apply the nonlinear three stage least of the model to the individual and aggregate versions (27), noting two required for this differences between our formal development and that can be replaced First, average budget shares in the population example. aggregation of (27), using by market budget shares, defined by weighted total energy expenditures: ^ ZM^ w 7 M. W w _ , . it" S uA + 4 ikt = a + x jV ^ isT s=l . A b. xi I . j=1 skt Z , (28) la p, t It \t (£ ikt EM*t + v lkt > ?* as before. where we have added the stochastic term kt J v kt = \ l v The vector with mean zero and is assumed to be normally distributed * 1 ikt J covariance matrix fl*, and uncorrelated over households. the error correcThe aggregate form (28) necessitates altering tion transformations (7) and (8) of Section 2. It is easily seen that -homoscedastic if each equation at the aggregate share errors will be time t is multiplied by /iT (previously S%~) (I . t ~ V 2 , where 2 (29) 29 Removing the individual-aggregate error correlations is a more difficult Unfortunately, the correct transformation (previously (8)) problem. utilizes the precise distribution of K, in each cross section data base. An alternative procedure, which sacrifices a slight amount of efficiency, is to use as aggregate data the market shares of all individuals not observed in the cross section in each year. However, as indicated earlier, our cross section observations represent such a minute proportion of the total population that the aggregate data would be unaffected by removing Consequently, we ignore the individual-aggregate corre- them. lations. The second difference between the models (27) and (28) and (1') and (2') arises from the fact that both the individual budget shares w., and market shares w. that e lkt add to unity, i = 1, it kt and v matrices. kt .... 4. have singular distributions, with Q e and This implies singular fi v We remove this problem by omitting one equation from the model for estimation (setting q = 3) ; we can solve for estimates of the para- meters of the omitted equation from the estimates for the first three equations. 12 ' The error vectors of the system of three equations are assumed to satisfy Assumption We are now in in detail. a 1. position to discuss the empirical application As indicated above, our objective is to analyze the alloca- tion of total expenditure on energy among four types of energy. The basic consumer units are households; we differentiate households amons five demographic characteristics and type of residence. — family size, age of head, region, race, 30 We have represented these characteristics in the attribute vector A^ as qualitative or dummy variables. represented by family size White and urban residence. 1, The base case household is age of head 15-24, region Northeast, race This type of household has shares given by the constant terras. For the estimation of the model, we utilize five cross section data sets: the 1960-61, 1972 and 1973 Consumer Expenditure Surveys (CES) of the Bureau of Labor Statistics, and the 1973 and 1975 Lifestyle and Energy Use surveys performed by the Washington Center for Metropolitan Studies (WCMS). Data on the four energy categories are quite compatible across these surveys. 13 " There are 13,098 observations in the 1960-61 CES, 8879 in the 1972 CES, 8898 in the 1973 CES, 579 in the 1973 WCMS and 2970 in the 1975 WCMS, making a total of 34,424 cross section obser- vations. The aggregate price and quantity series are obtained annually from the National Income and Product Accounts, for the years 1946 to 1978. The quantity series are taken as the corresponding components of personal consumption expenditures in constant dollar form, with the price series the associated implicit deflators. The statistics IMA/EM in (28) are shares of energy expenditures for each demographic group. These are constructed on an annual basis following the technique of Stoker (1979) which utilizes income distribution data obtained from the Current Population Reports, Series P-60. 31 Since we view the demographic variables as exogenous, we require no instruments for the cross section data (setting Z = X respec- tively for each cross section), and utilize OLS on each equation for getting starting values and consistent estimates of 14 fi . In addition, in order to compensate for slight differences among data sets, we utilize only within-sample deviation from means moments and pool the various data sets, weighting by the within sample covariance matrix estimates, again sacrificing a slight amount of efficiency. The aggregate price data are viewed as endogenous, and so we utilize fourteen additional variables as well as the attribute-expenditure statistics as instruments. consistent estimates of 0. u We obtain both starting values and via the technique described above — a estimat- ing the demographic coefficients with cross section data and while holding them constant, estimating the price coefficients with the time series data. Results of the pooled estimation are presented in Table 1. The estimates were obtained by fitting the equations for electricity, natural gas and other fuels; estimates for the gasoline equation derived from homogeneity and symmetry restrictions. We see that most price coefficients are estimated precisely, except for the coefficients of the price of gaso- line and the own-price coefficients of natural gas. This leads us to test the hypothesis that gasoline and the other fuels are separable. Also, it is easily seen that the inequality restrictions required for monotonicity hold, so they need not be imposed. :-: Notation 1: IABLE -=re-de-: Variables . . , lze f 5: V ....- f rr lighting, «3for sraft'ssar— - —niS^« " W3AS: electricity ::~:; " ; water, and heating, cooking, heating —^ « - ._ :: plu5 all . la-o -overs aeration of autonobiles, and so on. vehicles, --"V heating, use of aopliance Predictor Variables P trice of electricity , price of natural gas . E and others, price of fuel oil - P SOL price of gasoline constant (a^ . , ' F4, 73, F6, 77 - J F2 rz » F3, ' /^-n, e - or riore ' -:, A70 ,30, A40, A50, ..„ m 6, « 2 e effects «ft«c for sizes 2, 3, 4, 5, s size . £« w f 25-34, 35-44, ts for age classes effects headrffec ^^ rtl =en«al - region effects fcr , Bonvhites, race effect for . rural residence residence effect for weighted f ur. cci o r. 5 — ., s squared residuals: . -1- =f the ^"^ ; : TABLE 1 Five Cross Sections* . r GAS 'SOL PGASO c . m WE -. 12551 (.0150) .16616 (.0300) -.05383 (.0182) -.05383 (.0182) .02768 (.0189) .04653 (.0101) -.12651 (.0150) .04653 (.0101) .10882 (.0188) .01418 (.0268) -.02038 (.0178) -.02884 (.0136) -.19601 (.0063) -.05782 (.0055) -.17469 (.0051) .00579 (.0026) F2 .00876 (.0038) .01163 (.0034 F3 .0169S (.0045) .00605 (.0041] -.01072 (.0031) F4 .00510 (.0049) -.00069 (.0044] -.00272 (.0033) F5 .00114 (.0058) -.00940 (.0052) -.01298 (.0039) F6 .02739 (.0072) .00184 (.0065) -.02756 (.0049) n .01866 (.0076) .01868 (.0068) -.03521 (.0051) -.04522 (.0056) -.03043 (.0051 -.:.-'': A30 A40 -.03068 (.0061) -.05099 (.0054] -.02067 (.0041) A50 -.03498 (.0057) -.0435S (.0051) -.03410 (.0039) A60 -.02949 (.0057) -.05042 (.0051) -.05426 (.0039) A70 -.06150 (.0056) -.:£:": -.10285 (.0038] EJC .00845 (.0039) -.07266 (.0035) .09626 (.2026) BS -.04511 (.0039) -.03367 (.0035) .11663 (.0026) RV .00627 (.0041) -.05039 (.0037) .10528 (.0027) BLK -.01643 (.0045) -.08812 (.0040) .00493 (.0038) .01289 (.0036) .11150 (.0032) -.11125 (.0024) EL'S. .:::: Asymptotic standard errors ir. parenthesis Convergence After 3 Iterations * -- :::s * . - - JAT .01418 34 Turning to the demographic coefficients, we see that all are significant at the one percent level except for family sizes 4, 2, 5, family North Central and West regions in the electricity equation, sizes 3 through 7 or more in the natural gas equation, family sizes 2 and 7 sizes 4, and 4 and Nonwhite the fuel oil equation, and family more in the gasoline equation. 6 or The lack of significance of these coeffi- indicates no differcients is not a problem for our model, since this the base case family ence between households of each of these types and of size one, residence. and urban age of head 15-24, region Northeast, race White standard Moreover, for all the demographic coefficients the coefficient actually errors are quite small, so that an insignificant represents a precisely estimated small effect. Table The price effects implied by the estimates in easily interpreted in elasticity form. elasticities for each type of household. 1 are most There are different sets of price A complete display of all own vector would require comand cross price elasticities for a given price types of families. putation of elasticities for each of the 672 different in Tables Since this would be very cumbersome, we present 2 A-E own-price demographic characelasticities for all four energy types, varying each teristic while holding prices at 1972 values. In interpreting the own- represent elasticities price elasticities one must bear in mind that they expenditure constant. of the energy types holding total energy For example, on a given family's conthe effect of an increase in the price of energy our elasticities, which sumption will only be partially represented by 35 TABLE 2 Own Price Elasticities A. Varying Family Size 3 2 7 A oi llectricity -1.732991 -1.762442 -1.7Q2333 -1.740P47 -1. 736699 -1.833738 -I. latural Gas -1.254490 -1.284875 -1.269492 -1.252834 -1.234197 -1.7SP799 -1. "uel Oil & -1.557023 -1.574029 -1.52804* -1.549385 -1.522322 -1.4««157 Other -1.074701 lasoline -1.0707S4 -1.0727*7 -1.074433 -1.071243 -1.074437 -1. B. 25-34 15-24 electricity latural Gas ?uel Oil & Other Jasoline Varying Age of Head 45-54 35-44 55-64 -1.419793 -1.374565 -1.579846 -1.537328 -1.522322 -1.490*83 -1.084232 -1.116745 -1.063697 -1.076230 -1.078243 -1.080090 N.E. N.C. Varying Region S W Electricity -1.736*99 -1.765390 -1.613920 -1.757778 Natural Gas -1.234197 -1.145039 -1.182277 -1.164196 -1.522322 -1.970945 -2.186580 -2.055859 Fuel Oil & Other -1.078743 -1.073018 -1.072146 -1.068844 Gasoline Varying Race Nonwhite White D. Varying Type of Residence Rural Urban -1.736699 -1.686668 -1.736699 -1.781366 Electricity -1.234197 -1.134174 -1.234197 -5.125896 Natural Gas -1.522322 -1.534976 -1.522322 -1.340497 -1.078243 -1.100625 -1.078243 -1.076013 Gasoline 65 or more -1.740575 -1.64PU4 -1.8526*7 -1.692060 -1.736699 -1.722308 -1.249*60 -1.235326 -1.181041 -1. 411*47 -1.283502 -1.234197 C. Fuel Oil & -1 Other 36 reflect substitution among energy types, but not substitution between energy and other goods. In general our results indicate that families are very sensitive to energy price changes, given the level of total energy expenditures. To illustrate tests of hypotheses about household demand for energy using the model (27) and (28), we test the hypothesis that gasoline is separable from the other energy components. This hypothesis arises naturally since energy is used primarily for two purposes: trans- portation and household operation (heating, lighting and running appliances). Under separability, the total expenditure allocation process for each family can be broken down into three stages: first, the allo- cation of expenditure between other goods and the energy aggregate; second, the allocation of energy expenditures to gasoline and a "house- hold operation" aggregate; and, finally, the allocation of household operation funds to electricity, natural gas and other fuels. Separability of gasoline allows the function (22) to be written in the form: T v kt " where the index 4 p 1r p 2t p 3t <VhT TT TT • refers to gasoline. p 4t • \,> • ITT • \t> Within the context of the trans- log function (24), necessary and sufficient conditions for this structure are: <30) 37 3 41 = B. = (i = 1, , 4 ... (31) 4) which comprise two independent restrictions given homogeneity and sym- metry conditions. Within the context of the exact aggregation model, failure to reject separability implies that each household's utility func- tion displays separability of gasoline from the other fuels. This implies that a "household operation" aggregate price and quantity could be constructed for each family. However, the appearance of demographic differences in the estimated equations implies that the aggregate price of "household operations" will vary from household to household. The restrictions implying a common aggregate price are much stronger, requiring all demographic effects to vanish from the electricity, natural gas and fuel oil and other equations; these restrictions are certainly in conflict with the significance of the demographic coefficients noted above. We perform the test of separability, as indicated in Section by first estimating the model subject to the restrictions (31), and then comparing S (p) - S (6) to x 2 (2) critical values, where the restricted objective function value. Table estimates constrained to obey separability. 3 S (p) is contains the NL3SLS In comparison to Table 1, we see that virtually all demographic coefficients are identical. For the price coefficients, we see that those in the electricity equation 3, 38 Table 3 Pooled Estimation Results With Separability Imposed P E 39 increase somewhat in absolute value, with the remaining (unconstrained) coefficients declining in absolute value. The test of separability is performed as follows: S (p) = 85375.61, S(9) = 85366. 44, so that S (p) - S(6) = 9.17. The one percent 2 critical level for a x (2) is 9.21, so we fail to reject separability at the one percent level of significance. With the amount of data employed, a one percent level of significance is reasonable; if anything, it may be insufficiently stringent. Further evidence of the acceptabil- ity of separability is given by Tables lated from the estimates of Table 3. 4 A-E, where elasticities calcu- A comparison with Tables 2 A-E indicate that the two sets of elasticities are almost identical, even with the gasoline elasticities constrained to -1.00 under separability. TABLE 4 40 Own Price Elasticities A. Varying Family Size Electricity Natural Gas Fuel Oil & Other Gasoline : .,:«»» -...»»« ,«.77,-».77.2»> T,....n.i .,',,,4., -,.2412,2 ./„„„ - -..«"" B. Fuel Oil & Other Gasoline — 8 - 1 ' ,98iM , - 21 " 69 "'•"' -oooooo -uoooooo -..oooooo-..^ Varying Age of Head 55-64 45-54. 35-A4 25-34 15-24 Natural Gas 2 or mc -,.3,2047 -,.32,-74 ...31, .,.3.7,12 -1.355744 -..17,444 .,.000000 ./.oooooo -..oooooo Electricity 1 - —— 7 A 3 65 or more -l..«7.. -,.752905 -7.7J7M4 -1.758255 -,.2,1226 -1.199952 -,.154*0, .1 353070 -,.242272 -,.,9855, -,.330557 -1.303042 -,.257755 ...39,625 M.3,2624 -1.352047 -.oooooo -l.oooooo -t.oooooo .,.oo„ooo -i.oooooo ...oooooo -,.«W77 -K7U307 C. N.E. Varying Region N.C. §_ W -1.775003 -1.75290b -1.782*53 -1.629211 -1.139611 .1.19B551 -1-123388 -1.1"l« -1.715932 -1.352047 -1.657726 -1.80619* -i.oooono -l.oooooo -i.oooooo -i.oooooo Electricity Natural Gas Fuel Oil & Other Gasoline Varying Race Nonwhite White D. E. Varying Type of Residence Rural U r b an -1.752905 Electricity -1.702878 -1.797952 -1.752905 -1.198551 Natural Gas -1.114202 -4.113869 -1.198551 -1.229052 -1.352047 -1.360708 -1.352047 Fuel Oil & Other -1.000000 -1.000000 -1.000000 -1.000000 Gasoline 41 Footnotes 1. An entirely different motivation for an exact aggregation procedure is obtained by making assumptions on the distribution of x for each kt Namely, one can assume that (2) is the correct macro model, t. and that x is a sufficient statistic for the underlying distribution. Then, cross section regressions (as in the pooling procedure) consistently estimate the first derivatives of the macro function, i.e. 3(p , 6). See Stoker (1981) for the justification of this approach. 2. There is a large literature on pooling time series and cross section data in a linear format and Nerlove (1966). others. — the classic paper is Balestra See also Maddala (1971) and Mundlak (1978), among In fact, our procedure can be viewed as a full pooling estima- tor, with missing cross section data for certain time periods. Stoker (1978) for an exposition of this point. See Also it should be noted that most discussions of pooling time series and cross-section data are concerned with stochastic structure and not the structural model given here. Issues regarding fixed and random effects as well as heterosced- asticity problems (see for example, Amemiya (1978)) can be studied within the framework of this paper although we do not explicitly treat them. 3. For any nonsingular error structure there always exists a diagonalizing transformation; however, the transformations of greatest practical interest do not Involve the distribution of x across the popu- lation and allow the error structure of the model to be analyzed using either the cross section or time series data base individually. Stoker 42 (1978) gives an example where individual errors are serieally correlated but a simple transformation allows the correlation to be studied using only the average data. In the exposition we assume that the variance of the dis- A. conditional on the instrumental variables is constant for turbance both cross-section and average time series models. is relaxed, If this assumption efficiency gains are possible by adjusting the weighting matrix of equations 12 and 13. See White (1980a, 1980b, 1982) and Hansen (1982) for details. 5. An exposition of the Gauss-Newton method for single equations can be found in Draper and Smith (1966); this method is discussed for sys- tems of nonlinear regression equations by Malinvaud (1980). 6. If the correction (8) is applied x* should replace x o o here. 7. Learner (1976) 8. Matrix weighted averages are discussed in Chamberlain and and Mundlak (1978), among others. The model, data and results are discussed in much greater detail in Jorgenson, Lau and Stoker (1981). 9. The theory of multi-stage budgeting is reviewed in Black- orby, Primont and Russell (1978). 10. For these restrictions see Jorgenson and Lau (1975). 11. In our previous notation, p prices and x tics at time is the vector of component refers to the constant and attribute-expenditure statist. 43 12. Nonlinear three stage least squares estimates are invari- ant to the choice of omitted equation. 13. Expenditures on all four components are observed in each data set except the 1960-61 CES, where electricity and natural gas are combined. Utilizing this data requires only a trivial modification in the construction of the appropriate moments of M and M . See Jorgenson, Lau and Stoker (1981) for details. 14. More formally, the model in each cross section is a multi- variate linear regression model with respect to the coefficients 6(p , 8). Best linear unbiased estimation of such a model is equivalent to OLS applied to each equation. 15. We list these instruments in the Appendix. 16. The existence of demographic effects contradicts the existence of a common aggregate price of energy for all households. 44 References Amemiya, T. (1977), "The Maximum Likelihood and Nonlinear Three-Stage Least Squares Estimator in the General Nonlinear Simultaneous Equations Model," Econometrica 45, 955-968. (1978), "A Note on a Random Coefficients Model," International Economic Review Vol. 19, pp. 793-796. , Balestra, P. and M. Nerlove (1976), "Pooling Cross Section and Time Series Data in the Estimation of a Dynamic Model: The Demand for Natural Gas," Econometrica 34, 585-612. Blackorby, Boyce, R. and R.R. Russell (1978), "Estimation of Demand C. Systems Generated by the Gorman Polar Form; A Generalization of the S-Branch Utility Tree," Econometrica 46, 345-364. Blackorby, C, Primont, D. and R.R. Russell (1975), "Budgeting, Decentralization and Aggregation," Annals of Social and Economic Measurement 4, 49-101. , , Brown, M. and D. Heien (1972), "The S-Branch Utility Tree: A Generalization of the Linear Expenditure System," Econometrica 40, 737-747. Chamberlain, G. and E. Learner (1976), "Matrix Weighted Averages and Posterior Bounds," Journal of the Royal Statistical Society, B , 38, 73-84. Deaton, A. and J. Muellbauer (1980), "An Almost Ideal Demand System," American Economic Review 70. , Draper, N.R. and H. Smith (1966), Applied Regression Analysis New York. , Wiley, Gallant, R. (1977), "Three-Stage Least-Squares Estimation for a System of Simultaneous, Nonlinear, Implicit Equations," Journal of Econometrics , 5, 71-88. Gallant, and D.W. Jorgenson (1979), "Statistical Inference for a System of Simultaneous, Nonlinear, Implicit Equations in the Context of Instrumental Variable Estimation," Journal of Econometrics 11, 275-302. R. , Hansen, L.P. (1982), "Large Sample Properties of Generalized Methods of Moments Estimators," Econometrica , forthcoming. (1961), "The Modified Gauss-Newton Method for the Fitting of Non-Linear Regression Functions by Least Squares," Techno- Hartley, H.O. metrics, 3, 269-280. 45 Jorgenson, D.W. and J. Laffont (1974), "Efficient Estimation of Nonlinear Simultaneous Equations with Additive Disturbances," Annals of Economic and Social Measurement 3, 615-640. , Jorgenson, D.W. and L.J. Lau (1975), "The Structure of Consumer Preferences," Annals of Social and Economic Measurement 4, 49-101. , Jorgenson, D.W. L.J. Lau, and T. Stoker (1981), "Modeling Energy Expenditures Through Exact Aggregation," Einal Report to the Electric p ower Research Institue, Inc., RF-1428-1. , no«2\ "T*e T*\insvendonta1 , _______ an-' Logarithmic Model of Aggregate Consumer Behavior," in R. Basm.inn and 0. Rhodes, eds., Advances in Econometrics Vol. 1, Greenwich, JAI Press, pp. 97-238. , Kuhn, H.W. and A.W. Tucker (1951), "Nonlinear Programming," in J. Neyman, Proceedings of the Second Berkeley Symposium on Matheed. Berkeley, University of mat icnT St at is t les n m\ Probnhi 1 ty 1Pre ss 48 4 9 California , 2 , i , Lau, L.J. "Existence Conditions for Aggregate Demand Functions," Econometrica , forthcoming. Liew, C.K. (1976), "A Two-Stage Least Squares Estimator with Inequality Restrictions on Parameters," Review of Economics and Statistics , 58, 234-238. (198 ), Maddala, G.S. (1971), "The Likelihood Approaches to Pooling Cross Section and Time Series Data," Econometrica 39, 939-954. , Malinvaud, E. 1980, Statistical Methods of Econometrics Amsterdam, North-Holland. , 3rd. ed., Mundlak, Y. (1978), "On the Pooling of Time Series and Cross Section Data," Econometrica , 46. Roy, R. (1943), De 1' Utilitie: Paris; Herman. Stoker, T. Contribution a la Theorie des Choix , (1978), "The Pooling of Cross Section and Average Time Series Data," draft, Harvard University. (1979), Aggregation over Individuals and Demand Analysis , unpublished doctoral dissertation, Harvard University. (1981), "The Use of Cross Section Data to Characterize Macro Functions," forthcoming in Journal of the American Statistical Association. 46 White, H. (1980a), "Nonlinear Regression on Cross-Section Data," Econometrica, Vol. 48, pp. 721-746. (1980b), "A Heteroscedasicity-Consistent Covariance Matrix Estimator with a Direct Test for Heteroscedasticity ," Econometrica Vol. 48, pp. 817-838. , (1982), "Instrumental Variables Regression with Independent Observations," Econometrica Vol. 50, pp. 483-500. , Zellner, A. and H. Theil (1962), "Three-Stage Least Squares: Simultaneous Estimation of Simultaneous Equations," Econometrica 30, 54-78. , APPENDIX TABLE AGGREGATE INSTRUMENTAL VARIABLES The variables used as instruments for the aggregate time series portion of the model are as follows: 11 Constant 12 TL 13 14 15 16 17 — effective tax rate, labor services TCR — effective tax rate, noncompetitive imports LH — time available for labor services p — u.S. population, millions of individuals PL — implicit deflator, supply of labor service PLG — implicit deflator, government purchases of labor services 18 19 — which equals governexogenous income EL-HR-RT ment transfers to persons (excepting social insurance) less personal transfers to foreigners and personal nontax payments to government — W(-l) , private national wealth, lagged one period T — potential time for labor services; of Harrod neutral change 110 LH- (1+H) 111 Total imports 112 PCR 113 PL/(1+H) 114 T — — H implicit deflator, noncompetitive imports T — corrected deflator for labor services time, set to in 1972 — rate v -i f KAS^Vi'te Du WV29 1E9& Lib-26-67 no 1293- 82 Jorgenson, Dal/Nonlinear three Stage q H028M414 D*BKS 744949 ' 111 3 1 .P.P. -34.P. J IF" TOSO DOS 013 537