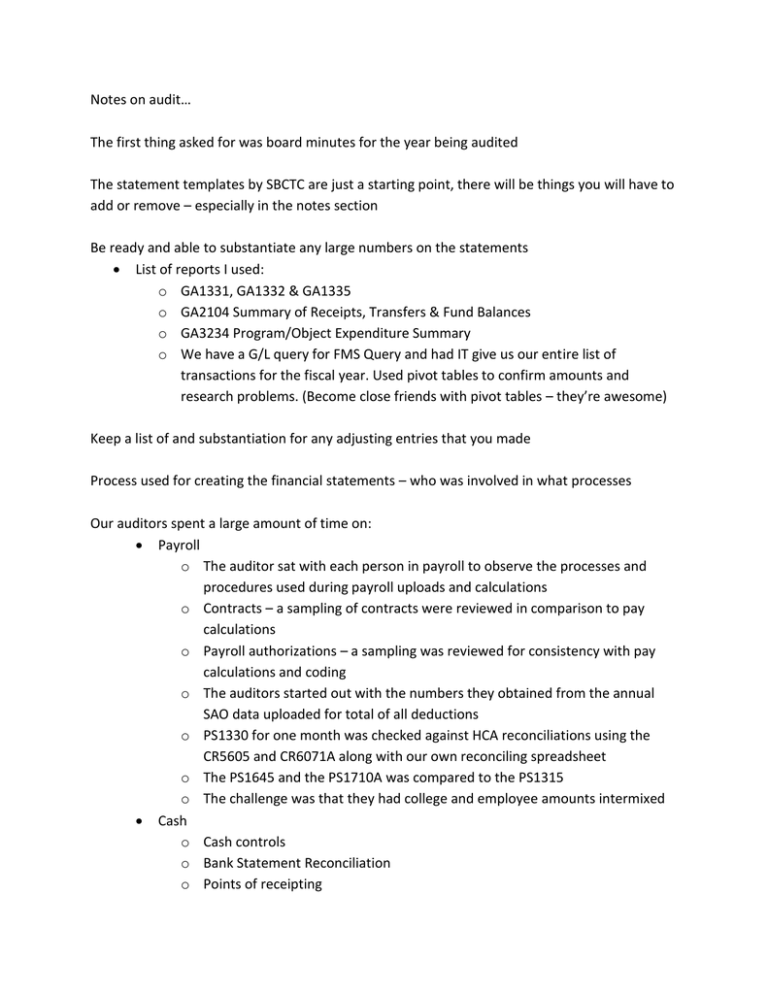

Notes on audit…

advertisement

Notes on audit… The first thing asked for was board minutes for the year being audited The statement templates by SBCTC are just a starting point, there will be things you will have to add or remove – especially in the notes section Be ready and able to substantiate any large numbers on the statements List of reports I used: o GA1331, GA1332 & GA1335 o GA2104 Summary of Receipts, Transfers & Fund Balances o GA3234 Program/Object Expenditure Summary o We have a G/L query for FMS Query and had IT give us our entire list of transactions for the fiscal year. Used pivot tables to confirm amounts and research problems. (Become close friends with pivot tables – they’re awesome) Keep a list of and substantiation for any adjusting entries that you made Process used for creating the financial statements – who was involved in what processes Our auditors spent a large amount of time on: Payroll o The auditor sat with each person in payroll to observe the processes and procedures used during payroll uploads and calculations o Contracts – a sampling of contracts were reviewed in comparison to pay calculations o Payroll authorizations – a sampling was reviewed for consistency with pay calculations and coding o The auditors started out with the numbers they obtained from the annual SAO data uploaded for total of all deductions o PS1330 for one month was checked against HCA reconciliations using the CR5605 and CR6071A along with our own reconciling spreadsheet o The PS1645 and the PS1710A was compared to the PS1315 o The challenge was that they had college and employee amounts intermixed Cash o Cash controls o Bank Statement Reconciliation o Points of receipting o processes Fixed Assets o Double check your CR2128 against the detail lists. We found that some items were dropping off o We had a challenge because there was no report that showed how much depreciation was calculated for each asset – this has been solved by the SBCTC delivering the calculation report for the CR2128 each year and should solve this issue o Substantiate Library Expenditures o Did you capitalize all the items you should have? Internal Control o Processes – who has access to what User Access and how often access is reviewed How is access granted and authorized o Reviewed a select screen from FMS and who had specific levels of authorization from SAO annual data dump Sub ledgers o Prove balance to Control Accounts Tuition Calculations o BM1741 report – unofficial enrollment report o Tuition and fees listing Grants and Contracts were reviewed to ensure that revenue and expenses were recognized appropriately They met with OAR to determine the following o How is a student's status validated? o How does admissions assure it has been accurately posted to the Student Management System (SMS)? They reviewed that GA2102 Revenue Distribution Table for a specific period Direct Loans and G5 Reconciliation Be ready to substantiate the Discounts & Allowances Worksheet amounts