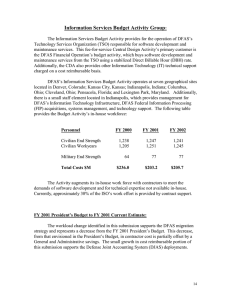

GAO FINANCIAL MANAGEMENT An Overview of

advertisement