GAO DEFENSE MANAGEMENT DOD Needs to

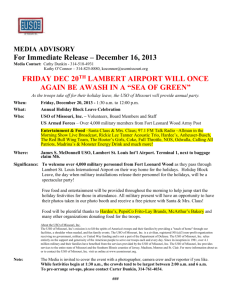

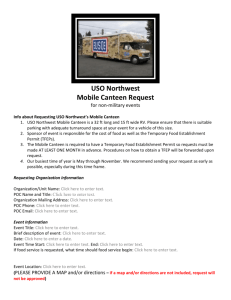

advertisement