a GAO DOD TRAVEL CARDS Control Weaknesses

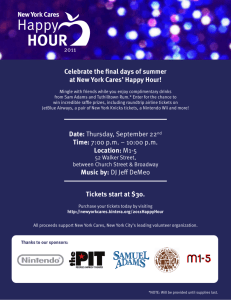

advertisement