GAO DOD FINANCIAL MANAGEMENT Improvement Needed

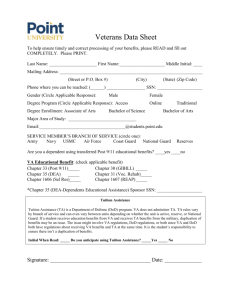

advertisement