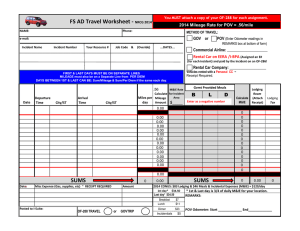

Click to fill out the interactive/auto-calculating version of this form!

advertisement

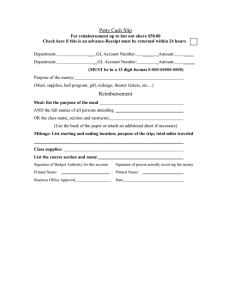

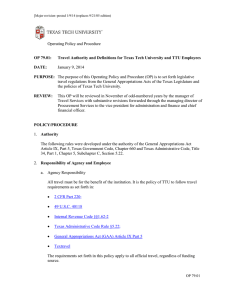

Click to fill out the interactive/auto-calculating version of this form! https://share.stlucie.k12.fl.us/forms/_layouts/FormServer.aspx?XsnLocation=/forms/DistrictForms/FIN0023.xsn St. Lucie Public Schools Out of District Travel Expense Report Read Instructions Before Completing Form Purpose of Trip Traveler's Name Home Address School/Dept. Name (Approved leave Form Covering entire period of absence including after work, weekends and holidays is required) Incomplete or improperly completed forms will be returned without being processed. Did you remember to attach your agenda and your hotel bill? Is the cost strip complete and correct? Did your administrator sign the approval? **Social Security # Method of Travel Personal Vehicle District Vehicle Car Pool Driver of Vehicle ~ ~ ~ AM PM Time of Departure Mileage shall be paid at the rate of 54.0 cents per mile based on IRS guidelines. Time of Return Expenses ~ ~ ~ ~ Date Rental Vehicle Bus Private Plane Airplane Itinerary City Arrived At City Left From Number of Miles Vicinity Mileage Indicate Date Day Per Diem ($80.00) *Lodging (1) Breakfast ($6.00) Lunch ($11.00) Dinner ($19.00) *Registration Fee *Communication Expense *Tolls *Parking Fees *Taxi Sun Mon Tue Wed Thu Fri Sat Total $ I certify that the above as true and correct statement of travel expenses incurred in the conduct of School District business for a public purpose authorized by law. Signature of Traveler Date Fund Administrative Approval/Principal/Director Function Object Center Project Program Date **Social security numbers are collected, and will only be used, in order to conduct background checks, and, once hired, to process payroll/personnel action, employment benefits, and retirement benefits. FIN0023 Rev. 01/16 Page 1 of 2 INSTRUCTIONS Please refer to St. Lucie County Public Schools Policy 7.52 for more on Travel Expense Reimbursement 1. In-State and Out- of-State Travel for employees and authorized persons: At the option of the Traveler: $80.00 per diem: OR lodging at a single occupancy rate plus meal allowance as provided in paragraph 3. All overnight travel shall be supported by a lodging receipt, regardless of the payment method. 2. 3. PER DIEM shall be equally prorated for partial periods of time on a quarter day basis beginning with the hour of midnight (e.g. 1/4 day X $80.00 = $20.00). When out of the District on official business, but not overnight, the traveler may be allowed meals subsistence as provided in paragraph 3. Meal Allowances in or out of state A. Breakfast $6.00 When travel begins before 6:00 A.M. and extends beyond 8:00 A.M. B. Lunch $11.00 When travel begins before 12:00 P.M. and extends beyond 2:00 P.M. C. Dinner $19.00 When travel begins before 6:00 P.M. and extends beyond 8:00 P.M. 4. Mileage Allowance for use of a privately owned vehicle is a fixed rate of 54.0 cents per mile. All mileage shall be shown from point of origin to point of destination. Mileage is paid based on the Florida Department of Transportation’s Official Mileage (City to City). Vicinity mileage necessary for conduct of official business is allowable, but must be shown with exact address as a separate item on the expense report. 5. All Conference, convention, and Workshop travel shall be supported by a copy of the agenda or program and registration form. All out-of-state travel shall be supported by a copy of the approved Board agenda item. 6. The cost of meals and lodging included in registration fees, or made available to the traveler either through the conference or hotel, shall be deducted from the per diem or meal allowance at the rates cited in paragraph 3. 7. Written receipts for actual costs of lodging, parking, transportation, registration, rental car, commercial carrier, tolls, or other services are required. Photo copies will not be accepted. All signatures must be in ink. 8. Complete all information on Travel Expense Report and forward “Administrator Approved” reports to Accounts Payable. INCORRECTLY PREPARED REPORTS WILL BE RETURNED. Page 2 of 2