Document 11052216

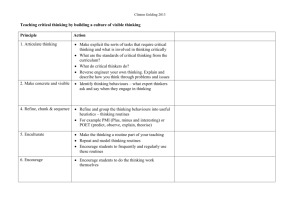

advertisement